By going through these Maharashtra State Board Class 12 Economics Notes Chapter 9 Money Market and Capital Market in India students can recall all the concepts quickly.

Maharashtra State Board Class 12 Economics Notes Chapter 9 Money Market and Capital Market in India

Financial Markets:

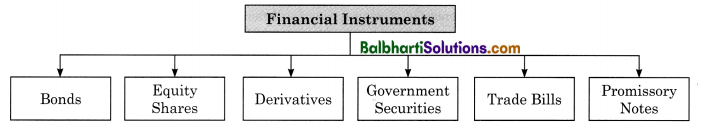

Financial Markets refers to market where sale and purchase of financial assets such as bonds, stock, derivatives, government securities, foreign currency, etc. takes place.

Financial market operates through banks, non-banking financial institutions, brokers, mutual funds, discount houses, etc.

Financial Markets include two distinct markets i.e. Money market and Capital market.

MONEY MARKET IN INDIA

Money Market:

Money Market is a market for short terms funds. It deals in funds up to one-year maturity.

It is market for ‘near money’ i.e. short term instruments such as trade bills, government securities, promissory notes, etc.

Such instruments are highly liquids in nature, less risky and easily marketable.

![]()

Structure of Indian Money Market:

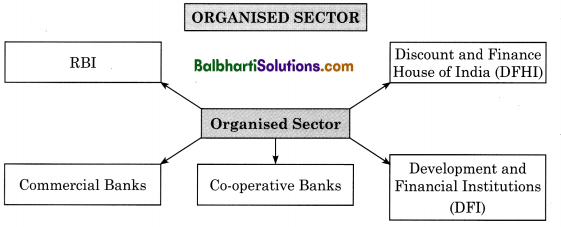

The Indian money market consist of 2 segments namely organised sector and unorganised sector. Main money marketplace in India are located at Mumbai, Delhi and Kolkata.

Mumbai is the most active money market centre in India.

Central Bank of India (Reserve Bank of India):

Central Bank is the apex or the supreme monetary banking authority and occupies an important position in the monetary and banking structure of the country.

→ The central bank aims at promoting the financial and economic stability of the country.

→ It is a reservoir of credit and a lender of the last resort.

→ RBI was set up on the basis of the recommendation of Hilton Young Commission.

→ RBI commenced its operations on 1st April, 1935 as a private shareholder’s bank.

→ RBI was nationalised on 1st January 1949.

→ It is the most important constituent of the money market.

→ In different countries, the central banks are known by different names, for instance in U.S.A. it is known as Federal Reserve System, in UK it is called as Bank of England.

Definition:

→ According to M.H. de Kock “A central bank is one which constitutes the apex of the monetary and banking structure of its country, and which performs as best as it can in the national interest, certain functions such as note issue, banker to the government, banker to the banks and custodian of country’s foreign exchange resources.”

→ According to Prof. W. A. Shaw “A central bank is a bank which controls credit. ” From the above definitions, it is clear that the central bank is the supreme monetary and banking authority and occupies a pivotal position in the monetary and banking structure of the country.

![]()

Functions of Central Bank:

The functions of central bank differ from country to country in accordance with the prevailing economic conditions. But some functions which are commonly performed by the central banks in all the countries are :

→ Issue of Currency Notes: The central bank has been authorised to print and issue currency notes. The RBI enjoys the monopoly of note issue of all denominations except one rupee note. The one rupee note and coins are issued by the Ministry of Finance of the Government of India but their distribution is undertaken by RBI.

→ Banker to the Government: The central bank acts as (A) a banker, (B) an advisor, and (C) an agent to the government. It performs all those functions which commercial banks perform for their customers.

It act as a friend, philosopher and guide to the government.

→ Bankers’ Bank: The central bank is the apex body of the banking system. It supervises, coordinates and controls the operations and activities of the commercial banks. As their bank it undertakes following functions:

(A) acts as a custodian of Cash Reserve

(B) acts as a lender of last resort

(C) acts as a clearinghouse

→ Controller of Credit / Money Supply: To overcome inflation, it restricts the supply of credit and to prevent depression and deflation, it expands credit. There are various methods through which central bank controls the supply of credit in the economy. They are –

(A) Quantitative Methods or General Measures

(B) Qualitative Methods or Selective Measures

→ Custodian of Foreign Exchange Reserve of the Country: The central bank is a custodian of country’s gold and major foreign currencies like US dollar, Euro the British Pound, etc. which are obtained by government from international trade. An important function of central bank is to maintain the exchange rate of national currency.

→ Developmental and Promotional Functions: In developing countries like India, a very important function of central bank is to promote, economic development.

- To promote banking habit among the people.

- To provide agriculture finance through NABARD and to promote rural and agriculture development.

- To provide Industrial Finance through IDBI, IFCI and SFC and to boost the growth of industrial sectors of India.

- To provide Export-Import Finance through EXIM Bank.

- To encourage small savings by providing opportunities of investment and better returns for small savers.

→ To collect data and publish through monthly bulletins like RBI Bulletin, RBI Journals, etc.

Commercial Bank:

A bank is a dealer in credit. Commercial bank performs all the functions for earning profit. Commercial banks play an important role in mobilizing savings and allocating them to various sectors of the economy. It includes both scheduled commercial bank and non scheduled commercial bank.

Scheduled commercial banks are those included in the second schedule of the Reserve Bank of India Act 1934. In terms of ownership and function commercial bank in India can be classified into 4 categories Public Sector banks, Private Sector banks, Regional Rural banks, Foreign banks.

Definition:

Banking Regulation Act 1949 defines – “Banking means the accepting for the purpose of lending or investment of deposits of money from public, repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise. ”

![]()

Functions of a Commercial Bank:

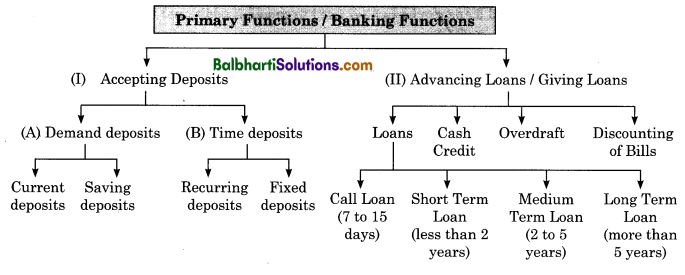

Primary Functions / Banking Functions :

→ Accepting Deposits: Commercial bank accepts the following types of deposits :

(a) Demand Deposits and

(b) Time Deposits

(a) Demand Deposits: are of two types –

- Current Account Deposits

- Saving Account Deposits

(b) Time Deposits: are of two types –

- Recurring Deposits

- Fixed Deposits

→ Advancing / Granting Loans: Commercial banks grant loans and advances to the borrowers in the following forms :

- Loans

- Cash Credit

- Overdraft facility

- Discounting of bills

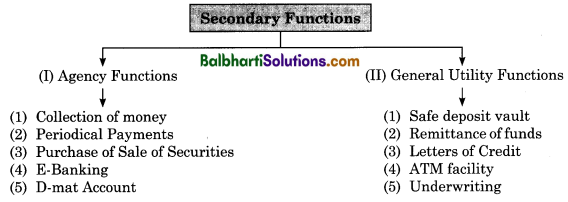

Ancillary, Secondary or Non-Banking or Subsidiary Functions:

![]()

Multiple Credit Creating Process of Commercial Banks:

Commercial banks accept deposits called primary deposits from the public. These deposits form the basis of all credit creation activities. A part of these deposits are kept as reserve by the bank to meet the demand for cash by the depositor. This is termed as minimum cash reserve.

The balance over the minimum cash reserve which is used by the banks to create credit by way of providing loans is known as derivative deposits. When a bank grants loan to a borrower, bank opens a deposit account in the name of the borrower and credit the loan amount in this account. This is called derivative deposit. Borrower can withdraw money from this account by means of cheque.

When the borrower withdraws money from his loan account by a cheque, it is deposited by the payee in some other bank. These banks again create credit on the basis of fresh deposits received after keeping the required reserves. In this way commercial bank creates credit money which is the part of total money supply. So commercial banks are also known as manufacturers of money. The amount from repaid loans can be further used to sanction additional loans. This process is called as multiple credit creation.

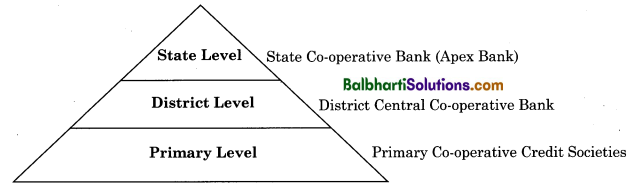

Co-operative Banks:

Co-operative Credit Societies is Act of 1904 led to formation of co-operative banks. Presently registered under Co-operative Society Act, 1965. Their main function is to get the deposits from members and public and grant loans to farmers (even farmers who is not a member) and small industrialist in both rural and urban area.

The co-operative credit sector comprises of co-operative credit institutions such as primary co-operative credit societies, district central co-operative bank and state co-operative banks.

![]()

Development Financial Institutions (DFI’S): Development financial institutions are agencies that provides medium and long term financial assistance and are engaged in promotion and development of industry, agriculture and other key sectors.

Industrial Finance Corporation of India (IFCI) was the first development financial institution to be established in 1948. Following are the types of financial institutions in India :

- Term lending eg. IFCI, IDBI, ICICI, EXIM

- Refinance Institutions

- Investment Institutions

- State level Institution

Industrial Credit and Investment Corporation of India (ICICI) has become a universal bank by a reverse merger with its subsidiary ICICI Bank.

Discount and Finance House of India (DFHI):

DFHI was incorporated in March 1988 on recommendation of the Vaghul Committee. It commenced its operation in April 1988. It is jointly owned by the RBI, public sector banks and financial institutions. The main function of this money market institution is to discount, re-discount, purchase and sell treasury bills, trade bills, commercial bills and commercial papers.

![]()

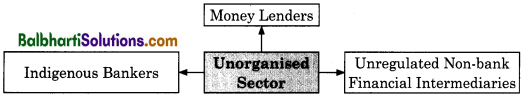

Unorganised Sector

Unorganised money market generally operates in urban centres, but their actual activities are largely confined to rural sector. This market is unorganised because its activities are not coordinated by the RBI.

Indigenous Bankers:

They are financial intermediaries which operates on similar line to banks. They deal in short term credit instruments like hundi (Indigenous bill of exchange). The rate of interest differ from one market to another and from one bank to another. They do not depend on deposits entirely, they may also use their own funds.

They provide loans directly to trade and industry and to agriculturists through money lenders and traders.

They are the important source of fund due to inadequate banking facilities, simple and flexible nature of their operations, their informal approach and personal contacts, prompt services and availability of timely funds.

Money Lenders:

Moneylenders are predominant in villages. However, they are also found in urban areas. Interest rates are generally high. Large amount of loans are given for unproductive purposes. The operation of money lenders are prompt, informal and flexible. The borrowers are generally agricultural labourers, marginal and small farmers, artisans, factory workers, small traders, etc. Due to exploitative nature of money lenders, their activities are presently restricted by RBI.

Unregulated Non-bank Financial Intermediaries:

It consist of Chit funds, Nidhis, Loan Companies and others.

→ Chit funds: They are saving institutions. The members make regular contributions to the fund. The collected fund is given to some member based on previously agreed criterion (by bids or by draws). Chit funds are more famous in Kerala and Tamilnadu.

→ Nidhis: The deposits from the members are the major source of funds and they make loans to members at reasonable rate of interest for the purpose of construction of house, repairs, etc. They are highly localized to South India.

→ Loan Companies: They are called finance companies. Their total capital consists of borrowings, deposits and owned funds. They offer high rate of interest along with other incentives to attract deposits. A part is invested in banks in the form of fixed deposits and the rest is used to grant loans. Their activities are mainly confined to traders, small scale industries and self-employed person. Loans are given at a very high rate of interest.

![]()

Money Market Instruments:

The following instruments are traded in the money market – Call or Notice Money, Treasury Bills, Commercial Papers, Certificate of Deposits and Commercial Bills.

Role of Money Market in India:

- To fulfil short-term requirements of borrowers.

- To provide better liquidity management.

- To provide portfolio management.

- To establish equilibrium between the demand for and supply of short-term funds.

- To fulfil financial requirements of the Government.

- To implement monetary policies announced by the central bank.

- To economize the use of cash.

- To ensure growth of commerce, industry and trade.

Problems of the Indian Money Market:

Indian Money Market is relatively underdeveloped when compared to advanced markets like London and New York Money Markets.

Its main weaknesses are given as below :

- Existence of Unorganised Money Market

- Multiplicity in Interest Rates

- Shortages of Funds

- Seasonal Diversity of Money Market

- Absence of Well Organized Banking Sector

- Delays in technological up-gradation

Reforms Introduced in the Money Market:

- Introduction of New Money Market Instruments

- Liquidity Adjustment Facility (LAF)

- Deregulation of Interest Rates

- National Electronic Fund Transfer (NEFT) and Real-Time Gross Settlement (RTGS)

CAPITAL MARKET IN INDIA

Capital Market:

Capital market is the market for long term funds. It refers to all the facilities and the institutional arrangements for borrowing and lending funds (Medium-term and long term funds). The demand for long-term funds comes mainly from industry, trade, agriculture and governments. The supply of funds comes largely from individual savers, corporate savings, bank, insurance companies, specialized financial institutions and government.

![]()

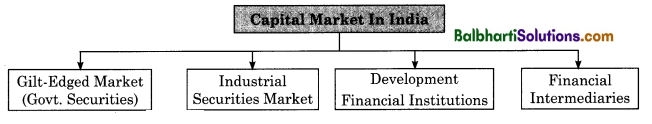

Structure of Capital Market in India:

The Capital Market, like any market, is composed of those who demand funds (i.e. borrower) and those who supply funds (i.e. lenders).

Indian Capital Market is broadly composed of

- Gilt-Edged (i.e. Govt. Securities Market)

- Industrial Securities Market

- Development Financial Institutions

- Financial Intermediaries.

→ Gilt Edged Market: It deals in government and semi-government securities. These securities carry fixed interest rates. The investors in government securities are mainly financial institution like Commercial banks, LIC and Provident fund. RBI plays a very important role in this market through open market operation.

→ Industrial Securities Market: It deals with shares and debentures of old and new companies. This market is further divided into new issue market i.e. Primary Market and old issue market i.e. Secondary Market.

The primary market helps to raise new capital through share and debentures. The secondary market deals with securities already issued by the companies. The primary market operates through the companies, while the secondary market operates through stock exchange. BSE and NSE are the premier stock exchanges in the country.

→ Development Financial Institution: They provide medium-term and long term financial assistance to the private sector. They include Industrial Finance Corporation of India 1948 (IFCI), the Industrial Credit and Investment Corporation of India (ICICI), the Industrial Development Bank of India (IDBI), Industrial Reconstruction Bank of India (IRBI) in 1971, which was renamed as Industrial Investment Bank of India Ltd., (IIBL) in 1995, the Export and Import Bank of India (EXIM Bank) in 1982 and so on.

→ Financial Intermediaries: They consist of merchant banks, mutual funds, leasing companies, venture capital companies and others. They help in mobilising savings and supplying funds to the capital market.

Role of Capital Market in India:

- To mobilise long term savings from various section of the population through sale of securities.

- To provide equity capital to business organisations for purchase of assets.

- To encourage public to invest in industrial securities.

- To help to achieve operational efficiency in the organisation.

- To determine fair and quick value of equity shares and debt instruments.

- To bring integration among various sectors of the economy.

![]()

Problems of the Capital Market:

- Irreparable loss to capital market, due to increasing number of scams and frauds.

- Loss of public trust and confidence among the investors.

- Problem of insider trading and price manipulation affecting smooth functioning of capital market.

- Lack of trading in debt instruments like bonds, debentures, etc.

- Decline in volume of trade as investors preferred to trade in premier stock exchanges like BSE and NSE.

- Lack of efficient information as compared to advanced countries.

Reforms in Capital Market:

- Establishment of Securities Exchange Board of India (SEBI) in 1988.

- Establishment of National Stock Exchange (NSE) in 1992.

- Introduction of Computerised Screen-Based Trading System (SBTS).

- Introduction of Demat Accounting system in 1996.

- Increased access to global funds by Indian companies through ADRs and GDRs.

- Establishment of Investor Education and Protection Fund (IEPF) in 2001.

- Introduction of automated complaint handling system.