By going through these Maharashtra State Board Class 12 Economics Notes Chapter 7 National Income can recall all the concepts quickly.

Maharashtra State Board Class 12 Economics Notes Chapter 7 National Income

Meaning:

In general sense of the term ‘National Income’ refers to the total money value of all final goods and services produced in the country during a period, usually one year. It includes net income from abroad. But does not include depreciation.

Definitions:

→ Prof. AC. Pigou: ‘The national dividend is that part of the objective income of the community including of course income derived from abroad, which can be measured in money.”

→ Prof. Irving Fisher: “National dividend or income consists solely of services as received by ultimate consumers whether from their material or from their human environments.”

→ National Income Committee: “A National Income estimate measures the volume of commodities and services turned out during a given period counted without duplication.” Here, the National Income is calculated without double counting.

Features of National Income:

→ Macro-Economic Concept: National Income is a macro-economic concept as it is the aggregate income of the country. It includes the value of goods and services produced in the different sectors of the economy.

→ Flow Concept: National Income is the flow óf goods and services produced in the economy during a year. The flow of goods takes place when there is production activity in the economy. It generates flow of income in the form of rent, wages, interest and profit.

→ Money Value: National Income is Money valuation of Goods and Services only. National Income is always expressed in terms of money. Only those goods and services which are exchanged for money are included. Unpaid services like the service of housewife should not be included.

→ Avoid Double Counting: While estimating National Income we include only the value of final goods and services and not the value of intermediate goods or raw materials to avoid double counting.

→ Net Income from Abroad : While estimating National Income net income from abroad i.e. difference between exports and imports (X – M) as well as net income from foreign investment should be included (R – P).

→ Net Aggregate Value : National Income includes net value of goods and services produced. It does not include depreciation cost. Depreciation is wear and tear of capital goods due to their continuous use in production.

→ National Income is calculated at Current and Constant price: National Income when cakulated at the prevailing market price it is called National Income at current price and when it is calculated at the base year price; it is called National Income at constant price.

→ National Income is calculated for one year : National Income is always expressed with reference to a period i.e. generally one financial year from 1st April to 31st March of every year.

![]()

Circular Flow of National Income:

The circular flow of National Income and expenditure refer to the process whereby the National

Income and expenditure of an economy flow in a circular manner continuously through time.

The national income is circulated in the economy based on one’s expenditure is another’s income.

→ Two sector economy : In this economy money flows between households and firms.

Y=C+I

→ Three sector economy: In this economy money flows between households, business firms and

government. Y = C + I + G

→ Four sector economy : In this economy money flows among households, sectors, business firms,

government and foreign sectors. Y = C + I + G + (X — M)

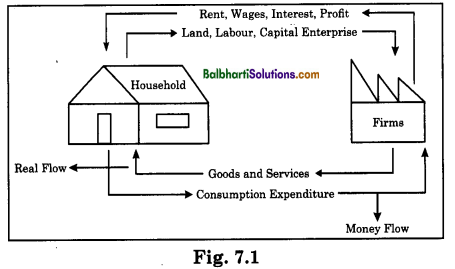

Circular Flow of National Income in Simple Economy: It is a two-sector hypothetical model. It consists of (a) household sector (b) firm or business sector.

This model represents a closed economy where there is no foreign sector. There is no government interference.

→ Household Sector: The household are assumed to possess certain specific features:

- Households are the owners of all factors of production land, labour, capital and entrepreneur.

- Their total income consists of returns on their factors of production – rent, wages, interest and profits.

- They are the consumers of consumer goods and services.

- They spend their total income on goods and services produced by the firms.

→ Business Firms: The business firms are assumed to have the following features and functions.

- The firms hire the factors of productions – land, labour and capital – from the household.

- They use the factors of production to produce and sell goods and services to the households.

The working of a two-sector economy and the circular flow of income and expenditure are illustrated in the diagram below.

In every economy there is the household sector on one hand and business firm on the other hand.

→ Household is the basic consuming unit. It centres around a family. Its main function is to consume goods and services. Business firm is the basic producing unit. Its main function is to produce goods and services with the aim of maximising profits. When the household supplies factor services (land, labour, capital, enterprise) to business firms, business firms supply goods and services to the household. This is known as real flow.

→ In a money economy when the household supplies factor services, there is a flow of income from the business firm to the household in form of rent, wages, interest and profit. This income comes from the firms to the household sector. The household sector uses this income to satisfy the wants.

→ Therefore, there is a flow of consumption expenditure from the household to the business firm. The flow of factor payments from business sector to household sector and corresponding flow of consumption expenditure from household sector to business firms. This is known as money flow.

→ Both the money flow and real flow should balance for the smooth functioning of the economy. If the money flow is greater than real flow, there would be inflation and if the money flow is less than the real flow there would be deflation.

→ In the above diagram, the inner circle represents the Real flow and the outer circle represents the Money flow. There is circular and continuous flow of money income as production is a continuous activity due to never-ending human wants. The circular flow shows interdependence in the economy.

![]()

Different Concepts of National Income:

→ Gross Domestic Product (GDP): It is the gross market value of all final goods and services produced within the domestic territory of a country in a year.

GDP=C+I+G+(X-M)

C – Private sector consumption expenditure

I – Private sector investment expenditure

G – Government consumption and Investment expenditure

X – M (Net export value)

→ Gross National Product (GNP): It means the gross value of final goods and services produced annually in a country, which is estimated according to the price prevailing in the market.

GNP=C+I+G+(X-M)+(R–P)

R – Receipts from abroad

P – Payment made abroad.

→ Net Domestic Product (NDP): It is the net market value of all final goods and services produced, within the territorial boundaries of a country in a year.

NDP = GDP- Depreciation

→ Net National Product (NNP): It is the net market value of all final goods and services produced by the residents of a country in a year.

NNP GNP – Depreciation

Concept of Green GNP:

The Green GNP is the measurement of the national income adjusted for degradation of environment. E.g. The national income for a current year is 8,000 units and the degradation of environment is 500 units, so Green GNP is 8000- 500 = 7500 units.

The Green GNP considers the environmental degradation or resource depletion. It is defined as “Green GNP is an indicator of sustainable use of natural environment and equitable distribution of benefits of development.”

![]()

Features of Green GNP:

- There should be sustainable economic development, i.e. economic development should be such that it does not create environmental pollution and degradation.

- The benefits of sustainable economic development should be equally distributed.

- In the long period of time it helps to promote economic welfare.

- It can be measured as follow: Green GNP = GNP – (Net fall in stock of natural capital + pollution load)

Methods of Measuring of National Income (N.I.):

There are three methods of measuring National Income.

(A) Product Method or Output Method.

(B) Factor Cost Method or Income Method.

(C) Expenditure Method or Total Outlay Method.

Any of the three methods can be adopted to measure National Income of a country because National Income can be viewed from three angles viz : from production side, distribution or income side and expenditure side.

i.e. NI = NP = ND = NE.

NP National Product

ND = National Dividend I Income

NE = National Expenditure

In India, National Income accounting is done through a combination of output and income method.

![]()

Product Method or Output Method:

This method is also called as Inventory Method.

According to this method economy is divided into various sectors like agriculture, mining,

manufacturing, small enterprises, commerce, transport, communication, etc.

National income by this method can be calculated by either valuing all final goods and services produced during a year at their market price or by adding up all values at each higher stage of production, until these products are turned into final products.

In output method there are two approaches to measure national income.

(1) Final goods approach (2) Value added approach

→ Final Goods Approach Final Product Approach : According to this approach, value of all final goods and services produced in primary, secondary and tertiary sector are included and the value of all intermediate transactions are ignored.

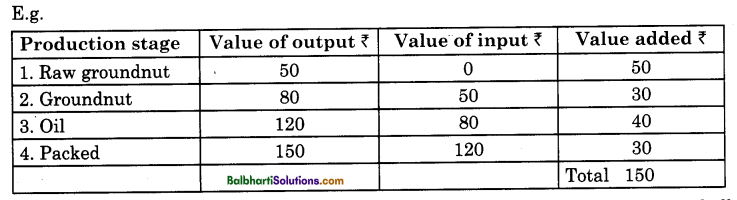

→ Value Added Approach I Value Added Method: To avoid double-counting, the value-added approach is used to estimate the National Income. According to this method, it is necessary to obtain the total of value-added at each stage in the manufacture of a commodity to arrive at Gross National Product. The value-added method can be explained by means of a simple example.

→ In the above example, value of groundnut with shell is ₹ 50, after removing shells value of groundnut is 80, after crushing groundnut the value is ₹ 120 and when oil is packed in the packets its value is ₹ 150.

→ So, the value added at each stage is, raw groundnut ( ₹ 50), groundnut ( ₹ 30), Oil ( ₹ 40), packed oil (₹ 30) so total value added is 150.

To avoid double-counting either the value of final output or the value – added should be taken in estimation of National Income.

The output method is widely used in the underdeveloped countries. In India, this method is applied in agriculture, mining and manufacturing sector.

Precautions:

→ Avoid Double Counting: The value of only final goods and services must be considered and not the value of raw – materials or intermediary goods, etc.

→ Self Consumption Goods: Goods used for self-consumption by farmers should be included in National Income.

→ Price Level Changes to be considered: The values of national output must be expressed in terms of prices in some base year to know the national output in real terms i.e. N.I. at constant price.

→ Net Income from Abroad: Care should be taken to include net income from abroad in National Income.

→ Depreciation: Depreciation of capital assets should be deducted from the value of gross investment during the year.

→ Indirect Taxes and Subsidies: To get National Income, deduct the indirect tax from the market price and add subsidies.

→ Second-Hand Goods: Sale and purchase of second-hand goods should be ignored as it is not a part of current production.

![]()

Income Method or Factor Cost Method:

In this method the National Income is treated to be equal to all the incomes accruing to the basic factors of production used in producing the national products. The factors of production are categorised as land, labour, capital and organisation. Accordingly, National Income is treated as the sum of factor payments viz; Rent, Wages, Interest, Profits, Mixed-Income respectively.

Here we look at National Income from distribution side. Information regarding incomes are obtained from income-tax returns, books of accounts, departmental records and reports.

The various incomes that are included in this method are:

NI = R + W + I + P + MI + (X – M)

NI = Rent + Wages + Interest + Profit + Mixed Income + Net Income from Abroad.

Precautions:

→ Exclude Unpaid Services: Only the services which are paid should be included in National Income estimate – unpaid service like service of a housewife should be ignored.

→ Transfer payments not to be included: Transfer payments like gifts, pension, unemployment allowances, lottery prize, etc., should not be included as these incomes are not earned by rendering productive services. Undistributed profits of companies, income from government property, profits from public enterprise should be included.

→ Income from sale of second-hand goods to be excluded: Financial transactions and sale proceeds of second-hand properties and goods are to be excluded since they are not part of current year’s production.

→ Exclude Direct Taxes and Subsidies: Revenue earned through direct tax by the government should be excluded as they are only transfer incomes.

→ Rental value of self-owned houses to be included: The rental value of owner-occupied houses should be included in National Income.

→ Net foreign income should be included: Net income from abroad should be included in National Income estimate i.e. (X -M) and (R – P). In India, the National Income Committee of the CSO uses the income method for estimating the income from service sector like trade, transport, profession and liberal arts, etc.

Expenditure Method or Outlay Method:

National Income can also be calculated by adding up the expenditure incurred on purchase of final goods and services. We can get National Income by summing up all consumption expenditure.

“ investment expenditure made by all individuals, firms as well as the government of a country during a year.

NI=C+I+G+(X-M)+(R-P) ,

→ Consumption Expenditure (C): It includes all expenditure incurred on durable and non-durable goods, and services which are consumed by the consumers. E.g. food, medical care, clothing, car, computer and services, etc.

→ Investment Expenditure (I): It refers to the investment made by private businessmen on capital goods like machinery, plants, factories, warehouses, etc.

→ Government Expenditure (G): It refers to expenditure on consumption and investment –

- Consumption expenditure: are incurred on various administrative services like law and order, defence education, generation and distribution of electricity.

- Investment expenditure: refers to expenditure incurred by government on construction of roads, railways, dams, canals, etc.

→ Net Exports (X – M): It refers to difference between exports and imports of the country. If the exports are more than imports then net exports will be positive, it is called Trade Surplus, and if imports are greater than exports, then net exports will be negative, it is called as Trade Deficit.

→ Net Receipts (R- P): It is the difference between expenditure incurred by foreigners in the country (R) and expenditure incurred abroad by Nationals (P). Net Receipts can also be Positive or Negative.

Precautions:

- To avoid double-counting only those expenditures are to be counted which are incurred on final goods and services.

- Government Expenditure on Transfer payments like unemployment allowance, old age pension, are to be excluded.

- Expenditure on second-hand goods like furniture, house, land, etc. should be excluded.

- Expenditure incurred on purchase of financial assets such as shares, bonds, etc. to be excluded.

- Indirect Tax should be deducted and subsidies should be added.

Out of these methods, the output method and income method are extensively used. Expenditure method is rarely used because of practical difficulties.

In India, the Central Statistical Organisation (CSO) adopts a combination of Output method and Income method to estimate N.I. of India.

![]()

Difficulties in the Measurement of National Income:

(A) Theoretical Difficulties:

→ Transfer payment: Transfer payments like pension, unemployment allowance is ignored from national income. If they are included there will be overestimation of national income because these are just an income transferred from the government to people.

→ Unpaid services: Unpaid services like service of housewives are not included due to practical problem of getting exact value. But same work when done by a paid maidservant is included in national income.

→ Illegal income: The income earn from illegal activities is never disclosed by anyone. So, it is very difficult to get data of illegal income, that’s why it is not included in National income, e.g. income from black marketing, smuggling, gambling, etc.

→ Production for self-consumption: It is very difficult to get data and value of goods kept for self-consumption as they do not enter market.

→ Income of foreign firms: Income of foreign firm should be included in the national income of the country where the firm undertakes production work. But the profit earn by these firms are transferred to their home / own country.

→ Valuation of government services: The government is providing various services like education, health, law and order, defence, etc. It is difficult to get exact value of these services. E.g. chest X-ray in private hospital – 500 and same X-ray in government hospital ₹5O.

→ Changing price level: Due to changes in price level it is difficult to get exact value of national income. During the inflation, national income will be much more than actual.

(B) Practical Difficulties or Statistical Difficulties:

→ Problem of double counting: In case of certain goods it is difficult to distinguish properly between final goods and intermediate goods. That’s why problem of double counting arises e.g. flour is final goods for housewife, but it is intermediate goods for the bakery.

→ Existence of non-monetised sector: In India large non-monetised sector exists in rural area specially in agriculture. In agriculture, many places goods and services are exchanged with goods that’s why it is difficult to count in national income.

→ Inadequate and unreliable data: Because of illiteracy it is difficult to get adequate and reliable data from unorganised sector, small enterprises, agriculture, etc.

→ Depreciation: Its difficult to measure exact value of depreciation. There are no uniform common accepted standard rates of depreciation applicable to the various capital assets.

→ Capital gain or loss: Due to capital gain there is overestimation and due to capital loss there is underestimation of national income.

→ Illiteracy and ignorance: Majority of small producer in developing counties are illiterate and ignorant and are not able to keep accounts of their productive activities.

→ Lack of systematic, occupational classification: There is lack of systematic occupational classification, which makes the calculation of national income difficult. Especially in rural areas where many villagers work on farms for some time and also take some other job during off season.

→ Untrained and incompetent staff: Due to untrained and incompetent staff, accurate and timely, information cannot be obtained.

![]()

Importance of National Income (NI):

→ For the economÿ: National income data are particularly important for macroeconomic analysis and performance of the economy.

→ National policies: National income gives the data of aggregate economic activities in an economy. So, it is very useful to formulate national policies like employment policy, industrial policy, agricultural policy, export promotion policy, etc.

→ Economic planning: The data of national income is very important tools for long term and short-term economic planning, e.g. planning for aggregate saving, investment, output, etc.

→ Economic research: The data of national income is very useful to the research students to study in detail how income is produced, how it is distributed, how much is spent, saved or taxed.

→ Comparison of standard of living: Because of national income it is possible to do comparison between the standard of living of the people of different countries and home country.

→ Distribution of income: The data of national income is very important to understand the disparities in the income of different sections of the society and to make the policies to reduce the disparities in income.

→ Speed of economic growth: Because of national income it is possible to know the trends or speed of economic growth of our country in relation to previous years.