By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 1 Introduction to Book Keeping and Accountancy students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 1 Introduction to Book Keeping and Accountancy

Introduction-

In the ancient days, in order to satisfy wants, commodities and services were directly exchanged against A other commodities and services. After the introduction of money as a medium of exchange commodities and services were purchased and sold directly for money or money’s worth. Along with civilisation, growth and development of economy, business activities also increased. Later on it became difficult for businessman to remember all the business transactions of the day. Thus, a need was felt to record (i.e. to write) business dealings in a systematic way. This very job of recording or writing the business transactions in a separate book is known as “Book-Keeping”. Book-Keeping records are useful for taking important decisions as to whether the business activities are feasible, profitable and to be continued further or not. The detail information of business and other organisations is also required by the proprietors, managers and other stakeholders like government, customers, employees, researchers, investors to fulfill their different objectives.

Evolution of Accounting:

The system of book keeping was in operation in India, since the time of Chandragupta Maurya. During his regime his minister Kautilya wrote a book called ‘Arthashastra’ in which some references were given regarding the way of recording and maintaining accounting records. This system of recording business transactions in the separate book was known as Deshi Nama.

The person who records the business transactions in the books of accounts is called an ‘Accountant’. In the earlier times of civilisation, accountants were appointed by the wealthy people to keep detailed information of their properties. Accountants used to prepare accounts periodically for the owners of the property. The double entry system of book-keeping was first originated in Italy and developed by Luca De Bargo Pacioli in 1494.

Industrial revolution took place in 18th and 19th century which gave birth to the large scale business organisations such as Partnership firm, Joint stock companies, Cooperative societies, etc. In the large scale business organisations, due to separation of ownership from the management, the need was felt to develop comprehensive accounting information system to provide detail information about the business to the shareholders (owners) and investors.

In the 20th century, a separate branch of accounting called Management Accounting system is discovered and developed to analyses financial information and to provide financial information to the management for decision making.

In the 21st century due to the vast and rapid growth and development in the business activities and business organisations, the individual centric accounting system gradually developed into Social Responsibility Accounting. Thus, in the modern world of business, accounting become the most important aspect of every business organisation.

![]()

Meaning And Definition OF Book-Keeping-

(A) Meaning : Book-keeping is an art or system of keeping or maintaining a record of business transactions in a regular and systematic manner. According to R. N. Carter, “Book-keeping is a science and an art of correctly recording in the books of accounts, all those business transactions that result in transfer of money or money’s worth.” In other words, Book-keeping is a science as well as an art of recording pecuniary i.e. financial transactions systematically and in chronological order in a separate set of books.

Book-keeping is a science, because in book-keeping there are a number of well defined rules and principles which we use and follow while recording business transactions. It is a social science because, in book-keeping, we study human behaviour with respect to his earning of money and wealth and spending to satisfy the numerous human wants.

Book-keeping is also considered as an art of recording business transactions, because the writing of accounts in a specific style and format requires education, knowledge, training, skill and experience.

From another point of view, Book-keeping is a continuous process of collecting, analysing, classifying, summarising and recording the different types of business transactions. In brief, book keeping may be defined as “A science as well as an art of collecting, analysing, classifying, summarising and recording all types of business transactions in a significant manner and in terms of money in a separate set of books.

Definition:

- “Book-keeping is a Scientific Method of recording day to day business transactions in words and figures in the books of Accounts so as to show correctly and clearly the financial position of a business.”

- According to J.R. Batliboi, “Book-keeping is an art of recording business dealing in a set of books.”

- Finney and Miller : “Book-keeping is the process of analyzing, classifying and recording transactions in accordance with preconceived plans.”

- L. C. Cropper : “Book-keeping is the art of recording in a suitable form a person’s business dealings, so that, at any time, their nature and effect may be clearly seen.”

Thus, book-keeping involves the following :

- Recording financial business transactions in the main book of accounts called Journal.

- Preparing different accounts in another book of accounts called Ledger. – –

- At the end of the accounting year, balancing all accounts opened and operated in the ledger.

- On the basis of the balance extracted from different accounts, preparing a trial balance for various purposes.

Features of Book-Keeping:

The main features of book-keeping are explained below :

- Book-keeping is process or method of recording business transactions.

- Book-Keeping is a science. This is because the book of accounts is prepared on the basis of some well defined principles and conventions.

- Book-keeping is an art. This is because the preparation of accounts in a specific style and format calls for skill, experience, knowledge and judgement.

- In book keeping only records of monetary (financial) transactions are prepared and maintained.

- Various books of accounts such as journal, subsidiary books, ledger, registers, etc. are prepared to record business transactions.

- The records of business transactions are prepared for specific period of time say one year.

- The records are maintained and preserved for a long period of time. .

- The result of business activities is ascertained on the basis of book-keeping records.

Objectives of Book-Keeping:

The different objectives of book-keeping are given below :

- To keep a complete and accurate records of all financial transactions in a systematic, orderly and logical s, manner.

- To maintain date wise and account wise permanent, correct and complete records of the business transactions . for various purposes.

- Book-Keeping enables the businessman to make permanent record of financial transactions of business

organisation. This records can be produced in the court of law as an evidence in settlement of any claim or disputes. - To ascertain the profit earned or loss sustained in the business.

- To know the financial position of the business i.e. capital invested in the business, assets accumulated and acquired and liabilities owed, etc. .

- To know the exact amount due from debtors and the exact amount payable to creditors.

- To know the exact amount of taxes payable to the Government and to do tax planning for the business ventures.

- To detect and prevent errors and frauds committed by others in the business.

- To provide valuable business information to various groups of users.

- To take decisions on significant business matters.

- To know the progress made by the business and to measure the efficiency of business.

- Various laws such as Income Tax, Companies Act, Co-operative Societies Act, Charitable Trust Act, etc. make it mandatory to prepare and maintain books of accounts.

Importance of Book-Keeping :

The importance of book-keeping is explained as follows :

- Record: In this present dynamic world, every day a businessman enters into a number of business transactions with different customers and the nature of each of those transaction is different. It is not possible for a businessman to remember all such transactions, and therefore it is necessary to record these transactions.

- Financial Information: Book-keeping provides valuable and much needed information on profit earned or loss sufferred, balance of assets and liabilities, stock, investments, capital balance, etc.

- Decision making: Owner or top management get valuable information from book keeping records for decision making in the business.

- Controlling: Information obtained from book keeping help the businessman to apply control and check on the expenses and to increase the profitability of the business. Information provided by the accounting system are also of great importance in avoiding wastage and unnecessary expenses. It is also helpful to achieve success in business ventures.

- Evidence: Information recorded in the books of accounts are considered by the court of law as an evidence in settlement of any disputes.

- Comparison: By comparing the financial statements of the past years with the current year and with the financial statements of similar other firms, managements or owners of the business can judge whether the business is making progress or not and accordingly introduce changes in the business planning to increase his profitability.

- Tax Liability: Government authorities can collect taxes like sales tax, income tax and revenue collecting departments can accurately impose and collect taxes from the business firm on the basis of information provided by the books of accounts.

![]()

Utility of Book-Keeping :

Utility means usefulness. The utility of book-keeping to different persons and entities is explained as follows : ‘

(1) Businessman or Owner: The businessman or owner who invests his money and assets into his business must know the profitability, financial stability, and solvency of his business concern. This can be ascertained only from the books of accounts. It would not be possible for a businessman to carry-out the business without a systematic record of the business transactions. A businessman can take business decisions more realistically on the basis of the information provided by the books of accounts.

(2) Management: From the Book Keeping records, a manager can provide timely information to the different parties to gain their confidence. Besides this, book keeping records help the management in planning, decision making, controlling and managing the business activities.

(3) Government: On the basis of information provided by the accountant, various departments of the Government will be able to calculate and collect sales tax, income tax and revenues due from business organisations.

(4) Prospective Investors: After studying the book-keeping information, the prospective investors such as

shareholders, debentureholders, creditors, partners can decide whether to invest money into the business or not.

(5) Customers: Book keeping records provide information on the financial capacity and profitability of the business organisations.. This in turn help the customers to find out whether they are being exploited by the businessmen or not.

(6) Creditors & Lenders: Book-keeping has a great utility to creditors and lenders. The creditors get valuable and correct financial informations from the different financial statements published by the business concern. On the basis of such information, they can decide whether to invest further or to extend the credit period or

to recover the amount due from business.

(7) Development: With the help of accounting, businessman can avoid wastages, losses and control the .

expenditure. As a result profitability and revenue earning capacity of the business organisation increase which in turn help the organisation to expand and develop its business.

Difference Between Book-Keeping And Accountancy-

The difference between Book-Keeping and Accountancy is explained as under :

- Meaning: Book keeping refers to the process of recording business transactions in the book of accounts.

Accountancy refers to the process of summarising and analysing the business transactions and interpreting the effects of those transactions on the business activities. - Stage: Book-keeping is a first stage of accounting as it involves preliminary work of accountancy. Its work starts immediately after completion of transactions. The work of accountancy starts after the completion of Book Keeping work. Thus accountancy is the next stage of book-keeping.

- Objectives: The main aim of book-keeping is to provide primary information while the main aim of

accountancy is to process and interpret profits & losses from the data available in the book-keeping. - Responsibility: Junior staff or newly recruited staff is responsible for keeping records of business

transactions. Senior staff is responsible for maintaining accounting records. - Outcomes: Book-Keeping ultimately results in Journal and Ledger. Accountancy ultimately result in

preparation of Trading A/c, Profit and Loss A/c and Balance Sheet. . - Period: Book keeping discloses the day to day details of business transactions whereas accounting gives yearly details of business transactions.

- Scope: Book-keeping is a part and parcel of accountancy and it has a limited and narrow scope whereas accountancy has a vast and unlimited scope.

- Procedure: In book keeping entries for day to day transactions are recorded by following basic principles and rules of double entry book keeping. In accountancy, book keeping information are classified, analysed and summarised to prepare financial statements, reports, ratios etc.

- Principles: To record preliminary information in journal, ledger and subsidiary books elementary knowledge of journalising and posting are required. To prepare accounting statements, reports, final accounts, ratios etc., knowledge of all accounting concepts, principles and conventions are required.

Meaning And Definition Of Accountancy:

Accounting is a broader concept than the concept of Book-Keeping. It refers to the process of summarising and analysing the business transactions and interpreting the effects of those transactions on the business. The definition of accounting as given by American Accounting Association is stated as follows, “Accounting _ refers to the process of identifying, measuring and communicating economic information to permit informed judgements and decision by the user of accounts.

Kohler’s definition of Accountancy is stated as follows: “Accountancy refers to the entire body of the ‘ theory and process of accounting.”

In brief accounting is a process of recording, classifying, summarising, analysing and interpreting the financial transactions and communicating the results thereof to the users of such information.

Basis (Methods) of Accounting System :

Accounts are recorded and maintained on various basis.

(1) Cash basis: Under this system income is recorded as and when cash is actually received and expenses are

recorded when they are actually paid in cash or by cheque.

Every transaction in which cash comes into the business or cash goes out of the business is recorded with v its specific purpose. Under this system only cash transactions are recorded. Credit transactions as well as barter transactions are not recorded. This method of accounting system is usually followed (Adopted) by the professionals like Doctors, Lawyers, Chartered Accountant, Actors, etc.

(2) Accrual Basis/Mercantile Basis: Under accrual basis or mercantile basis of accounting system, incomes are recorded as and when they accrues or earned and expenses are recorded as and when they are due or become payable. Under this system both the types of transactions viz. cash transactions and credit transactions are recorded. This system records incomes and expenses in the books of accounts as and when they are earned and incurred and not when they are actually received and paid. This system is also called Mercantile basis of accounting.

Example: Professional fees amounted to ₹ 3,000 is due to Chartered Accounting firm as on 31st March 2019, but received by the firm on 1st May, 2019. The accounting year of the firm ends on 31st March every year. As per cash basis, the Chartered Accountant Firm would record professional fees received in the accounting year 2019-20.

As per accrual basis, the Chartered Accountant Firm would record professional fees received in the accounting year 2018-19.

(3) Mixed or Hybrid basis: Under Mixed or Hybrid basis of accounting the principles of both cash basis and accrual basis are followed in recording business transactions. Under this method of accounting system revenues and assets are usually recorded on cash basis and expenses are generally recorded on accrual basis. In brief it is a mixture (combination) of cash basis and accrual basis of accounting. The laws in India do not permit the organisations to use this method of accounting system.

![]()

Qualitative Characteristics of Accounting Information –

Qualitative characteristics of Accounting information are explained as follows :

(1) Reliability of Accounting information : The information provided in the financial statements must be reliable. These information must be free from material errors and bias. The information must be presented in good faith. The reliability of the financial statement is dependent on the following points:

- Completeness or verifiability: The information provided in the financial statements is said to be reliable when it is complete within the limits of materiality and cost. Any omission may cause information to be false or misleading on unreliable in terms of its relevance.

- Neutrality: The information given in the financial statements must be neutral in all respect. Such statements or information are not neutral if by selective presentation of information, may affect the decision making power of the users.

- Faithfulness: The transactions and the other events must be represented faithfully in the information. Many times the financial information provided is subject to some risks and they are not faithfully represented.

(2) Relevance of Accounting information: The information given in the financial statements must be relevant to the decision making requirements of the users. The information provided in the financial statements shoqld have quality of relevance when it creates favourable impact on the decision making power of users by helping them to evaluate past, present or future events. The productive and confirm roles of information are related to each other.

The relevance of information is affected by its nature and materiality. Accounting information is said to be material, if its omission from the financial statement affect the decision making for its users.

(3) Understandability of Accounting information : One of the important qualitative characteristics of Accounting information is that the information given in the financial statements should be readily understandable by the users. The information provided should be as simple as possible. It is assumed that the users are having reasonable knowledge of the business and its accounting activities. It is also assumed that the users are having willingness to study the information given in the financial statements. However, information of complex matters should not be excluded simply on the grounds that they are very difficult for certain users to understand.

(4) Comparability of Accounting information: Every user should have enough knowledge and capability to compare the financial statements to identify trends (ups and down) in the financial position and performance of the business unit over the number of years and also of different business units. This is to evaluate their relative financial position, performance and changes in financial position. This qualitative characteristic requires that there should be consistency in choosing accounting policies. Lack of consistency may not allow the early comparability of the financial statements of different periods and different enterprises.

Basic Accounting Terminologies :

(1) Transaction : In common parlance, transaction is a dealing between two or more persons, in which one person gives something to the other and in exchange of that receives something from the other. It is an exchange of goods and services either for cash or for any other goods or services. In other words, it is a business activity which interprets in money terms what business gives and what business receives in that exchange. To complete the transaction at least two persons are required. Purchase of goods, sale of goods, receipt and payment of cash, borrowing and lending, depositing cash into the bank, withdrawal of cash from the bank, etc. are the examples of business transactions.

Business transactions are broadly classified into two categories viz. (a) Monetary transactions and (b) Non¬monetary transactions.

(a) Monetary transactions : The business transactions in which goods and services are directly

or indirectly exchanged for money or money’s worth are called monetary transactions. Business organisations record only monetary transactions in their books of accounts. Monetary transactions “”v are further classified as (i) Cash transactions and (ii) Credit transactions. ,,

(i) Cash transactions: In cash transaction, goods or services are directly exchanged for cash. When

goods or services are purchased for immediate cash payment, it is known as cash transaction, e.g.

goods purchased against immediate cash payment.

(ii) Credit transactions: In credit transaction, goods or services are exchanged for a certain value to be ,

received or paid in the future. In a credit transaction, goods or services are purchased, but payment is

postponed to a future date e.g. Mr. ‘A’ has purchased goods for ₹ 500/- and agrees to pay the amount after a month. It is a credit transaction.

(b) Non-monetary transactions : The business transactions in which goods and services are directly

exchanged for other goods and services are called non-monetary transactions. In this type of transaction,

money does not play any role e.g. purchase of 5 kgs rice in exchange of 1 metre cloth is a non-monetary transaction. It is also called as barter transaction or money less transaction.

(2) Entry : Recording the summary of business transactions in the form of debit and credit in the journal and

in proper form in subsidiary books and ledger is called an entry.

(3) Narration : A brief or short explanation of an entry written just below the entry in a bracket in the

particulars column of journal is called narration. It is started with a word ‘Being’. Narration should be as

short as possible. It should be easy to understand.

(4) Goods : Any commodity or article which is produced or purchased for sale by a trader is called goods. In

other words, any commodity or article in which a trader regularly deals or carries on trade is called goods

for that business or trader.

Goods have the following features, viz.

- Goods may be any commodity or article which has exchange value.

- Goods must be manufactured or purchased by a trader for sale.

- Goods must be stored and exhibited for sale and not for use. For instance, books and literature are goods for publishers or book sellers. Similarly, clothes are goods for a cloth merchant and different kinds of grains stored or kept for sale are goods for a grocer.

- Goods which are stored and not yet sold are the property of the trader.

![]()

(5) Capital and Drawings :

(a) Capital: Total amount of cash, goods, assets, etc. invested by the proprietor into his business from

time to time is called capital. In accounting sense, excess of business assets over business liabilities

is described as capital. It is an asset for a proprietor and long term liabilities for the business. It is

received back by the proprietor only on the dissolution of his business. In the form of equation.

Capital = Business Assets – Business Liabilities

Investments into the business, profit earning capacity, withdrawals from the business by the proprietor for

self use, etc. are the main determinants of capital. The amount of capital may be calculated as follows:

(1) Mr. Kamalakar started business with Cash ₹ 1,50,000, Goods worth ₹ 1,40,000. Building valued at

₹ 4,00,000 and Furniture costing ₹ 45,000. Here Mr. Kamalakar’s capital arrived ₹ 7,35,000/-.

(2) Business information of Mr. Ravikant Sharma shows that his business assets are valued at ₹ 15,00,000

and business liabilities are estimated at ₹ 5,00,000. Here Ravikant Sharma’s capital is computed at

₹ 10,00,000/-. [i.e. ₹ 15,00,000-₹ 5,00,000]

(b) Drawings: Word ‘drawings’ is just the opposite to the word ‘capital’ in meaning. Drawings refer to total amount of cash and/or goods withdrawn by the proprietor from the business from time to time for self (personal) use or family use. Drawings are always adjusted with capital. Heavy withdrawals made by a businessman for self use reduces capital in the business. If the businessman controls his drawings, business can be developed further due to less loss of capital. Withdrawals made by a businessman for business purpose is not treated as drawings.

For example, Mr. Ramesh, a cloth merchant, took away 15 metres of cloth for family use on the occasion of the Diwali Festival without paying any thing to the business. The price of cloth per metre is ₹ 250/-. Here, drawings of Ramesh are computed at ₹ 3,750/-.

[i.e. 250 x 15 mts.].

(6) Debtors and Creditors :

(a) Debtors: Debtor refers to a person br an entity from whom money or money’s worth is receivable to a business enterprise. Debt is a total sum of money due from a person with whom the business has dealings. Accordingly, a person from whom such debt is due to a business, is called the debtor. In other words, the debtor is a person who has already taken a loan or services or goods from the business for which he has not yet paid for. A debtor is always under obligation to make payment to a business or a creditor. The following example will make the above ideas clear. Mr. Ashok sold goods worth ₹ 10,000 to Mr. Kishor on the condition that Mr. Kishor will pay that amount of ₹ 10,000 to Mr. Ashok after 2 months. Here, Mr. Kishor is a debtor to Mr. Ashok till he pays the entire amount to Mr. Ashok.

(b) Creditors: A creditor is a person or an entity to whom the business is under obligation to pay a certain

amount of cash. In other words, a person to whom the business owes or is required to pay some amount of cash is called creditor. A creditor is a person who has given a loan or goods or services to the business and for which he has not yet received any amount of cash, or reward. The business is under obligation to pay money to its creditor. For example, Mr. Anil, a businessman borrows money from the Bank of India for one year period for business purpose. Here the Bank of India is a creditor to Mr. Anil, till Mr. Anil clears his loan. .

(c) Bad debts: A sum of money due from other person is called debts. The debts which cannot he recovered from debtors inspite of repeated efforts are called ‘Bad debts’. It is a revenue loss to the business.

(7) Expenditure : An amount spent or incurred by the business organisation on the purchase of goods and

services or for any other consideration received by the business is called expenditure.; e.g. amount spent on purchase of raw material, electricity bill paid, etc.

Business expenditures are classified as (i) Capital expenditure, (ii) Revenue expenditure and (iii) Deferred

Revenue expenditure.

(a) Capital Expenditure: The expenditures which are incurred (1) on acquisition of an asset (2) in putting a new asset in working condition and (3) for acquiring benefits which will last for a long time are called capital expenditures, e.g. purchase of plant and machinery, wages paid for installation or erection charges of machinery, advertisement paid at a stretch for four years, octroi, freight paid on assets, over-hauling charges, etc. are categorised into the capital expenditure.

(b) Revenue Expenditure: The expenditures which are incurred to acquire the benefits which will last for a short period, are called revenue expenditures. It is normal day to day expenditure which do not

. increase profit earning capacity of an organisation, e.g. salaries, rent, interest paid, repairs and renewals, etc. are the examples of revenue expenditures.

(c) Deferred Revenue Expenditure: Heavy expenditure which is incurred in the current year, but benefit of which may be received or accrued to the business in the following two or more years, is called deferred revenue expenditure, e.g. Heavy amount spent on advertisement and publicity is a deferred revenue expenditure.

(8) Cash Discount and Trade Discount:

(a) Discount: An allowance, benefit or reduction in payment in monetary terms given by the trader to buyer or by a creditor to a debtor at the time of sale or repayment is known as discount, e.g. goods costing ₹ 15,000/- sold by a trader to the buyer and accepts ₹ 14,700 in full settlement. Here the difference of t 300 is considered as discount. Discount may be classified into two categories, viz. (a) Trade discount and (b) Cash discount.

(b) Trade Discount: Discount given by the seller to the buyer to increase sales turnover and to enable the buyer to earn a reasonable profit on resale is called Trade discount. It may be given by a manufacturer to a wholesaler or by a wholesaler to a retailer on bulk purchases. Trade discount is calculated on the catalogue price or list price of the goods. Amount of trade discount is deducted from invoice price. It is not shown in the books of accounts.

For instance if goods of ₹ 5,000 are purchased @5% Trade Discount, the value of goods that will be

recorded will be ₹ 4,750. Here Trade Discount = 5000 x \(\frac{5}{100}\) = ₹ 250

Net value of Goods = Catalogue price – Trade discount

= 5,000 – 250 = ₹ 4,750.

(c) Cash Discount: Discount given by the creditor to the debtor on payment of cash is called cash discount. It is the concession given to encourage prompt payment. It is always recorded in the books of accounts, as it is gain to the buyer and loss to the seller.

(9) Solvent and Insolvent:

(a) Solvent: A person who is capable of paying his past and present debts fully from his business and personal property is known as solvent. His financial condition is sound to pay his business debts. Solvency of the businessman increases the goodwill of the business. A solvent person’s property always A exceeds his business debts.

Example: On revaluation of assets and liabilities, it is found that total assets of Sudhakar, a proprietor is ₹ 9,50,000 and his total obligations (debts) are ₹ 2,50,000. Here financial position of Sudhakar is sound as he can easily pay off his total obligations (debts). He is therefore called solvent person.

![]()

(b) Insolvent: A person who is unable to pay his debts, is called insolvent. An insolvent person does not

have sufficient assets to pay his debts. His business debts are much larger than his business and personal

assets. He cannot settle the dues of his creditors fully. Insolvency leads to compulsory dissolution of

the business. . .

Example: Total Assets of the proprietor ‘X’ in the business are worth ₹ 2,00,000 whereas his total , liabilities (obligations) are ₹ 3,50,000 and he does not have any personal property to set off business debts. Here in this case ‘X’ is called insolvent, because he cannot pay off all the liabilities of his business.

If the court is satisfied that he cannot pay debts of the business even from his personal property, he will be declared as insolvent by the court of law.

(10) Accounting year : A period of 12 months is called a year. A year which begins with 1st January and ends with 31st December is called the calendar year. Accounts of the business enterprises are usually prepared

for a period of 12 months i.e. one complete year. The year for which the accounts of the business enterprises are prepared is called the accounting year. In India business enterprises may select one of the following periods as its financial year:

- From 1st January to 31st December.

- From 1st April of one year to 31st March of the next year.

- From 1st July of one year to 30th June of the next year.

- From 1st October of one year to 30th September of next year.

Now for Income Tax purpose an accounting year starts on 1st April and end on 31st March of next year.

(11) Trading concern and Not for Profit concern :

(a) Trading Concern: The enterprises which undertake business activities for earning profit are called

trading concerns. They are also called business organisations. They either manufacture or purchase the

goods for resale for a profit. They may be classified as sole trading concern, partnership organisation, company organisation, state enterprises, co-operative societies, etc.

(b) Not for Profit Concerns / Non-trading Concern: The enterprise which undertakes activities

not for earning profit but to provide services to its members or public at large is called ‘Not for profit

concerns’ or ‘Non-profit organisation’, Cricket Club of India, Mahalaxmi Charitable Trust, Educational Institution, etc. Thebe enterprises prepare income and expenditure account to find out whether income

is just sufficient to meet their expenses.

(12) Goodwill: Money value of a business reputation earned by the business over a number of past few years

is called goodwill. It is nothing but the reputation or name established in the market by the business organisation. It is an extra value attached to the business over and above its value. It is an intangible asset of the business.

(13) Profit or Loss ; Income and Revenue :

(a) Profit: Profit means a gain earned by the businessman by undertaking ventures or risks. In accounting terminology, excess of sales revenue over the expenses is called profit.

Symbolically, Profit = Revenue – Expenses.

If a firm sold goods for ₹ 50,000 and all related expenses incurred by the firm during the said period is ₹ 41,000.

Here, in this case profit earned by the firm is arrived at₹ 9,000.

It is calculated as follow:

Sales revenue = ₹ 50,000 and total expenses = ₹ 41,000

Profit = Sales Revenue – Expenses

= 50,000 – 41,000 = ₹ 9,000

(b) Loss: Excess of expenses or expenditures over revenue or income is called loss. Businessmen incur losses on account of several factors like misuse of resources, abnormal wastage, negligence of proprietor, improper planning, competition, lack of innovation, unfavourable policy of the government, etc. Recurring losses lead to compulsory dissolution of the business.

Symbolically, Loss = Expenses – Revenues

If a firm sold goods for ₹ 30,000 and all related expenses incurred by the firm during the said period is ₹ 36,000.

Here, in this case firm incurs the loss of ₹ 6,000.

It is calculated as follow:

Expenses = ₹ 36,000 and Revenue = ₹ 30,000 ,

Loss = Expenses — Revenue

= 36,000 – 30,000 = ₹ 6,000

(c) Income: Revenue received by the business organisation after rendering services or subletting assets is called income. Symbolically:

Income = Amount received after rendering services or renting owned property. If auditorium of the college is subletted to the Bank for ₹ 45,000 per month, the total rent ₹ 5,40,000 in a year becomes an income of the college authorities

(d) Revenue: Income received by the business organisation from its normal business activities especially from the sale of goods and services to the customers is called Revenue.

(14) Assets, Liabilities and Net Worth :

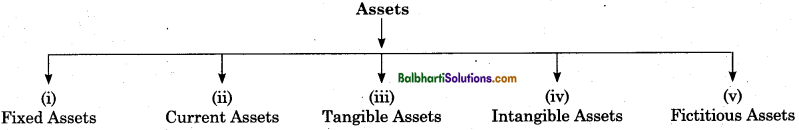

(a) Assets: Property-of any type or description owned and possessed by a person is known as an asset. Assets are not stored for sale but they are kept for the use of the owner. In other words, economic resources which provide benefits to the enterprise are called assets, e.g. furniture, goods, etc.

Assets possess the following features, viz.

- Assets is a property of any type or economic resource which has an exchange value,

- It is belonged to a person or a user,

- It is always stored for use and not for sale.

For example, land and building, furniture and fixtures, bank balance, unsold goods, cash in hand, etc. are called assets. The classification of assets is shown below:

- Fixed Assets are those assets which are held in the business for a long period of time and are generally used for manufacturing goods and services. For example land & building, plant & machinery, motor vehicles, etc. are the fixed assets of an enterprise.

- Current Assets are those assets which are held in the business for a very short period and they are used for maintaining the liquidity of the business. For example, cash in hand, bank balance, stock of goods in hand, amount receivable from debtors, etc. are current assets of the business enterprise.

- Assets like cash, machinery, stock of goods, furniture, etc. are called tangible assets as they can»be seen, touched and felt.

- Assets which cannot be seen, touched and felt, but can be sold and converted into cash are called intangible assets. Use of intangible assets enables its owner to earn income in the form of royalty. For example goodwill, copy rights, patents, trade marks, services of doctors, teachers, bankers, etc. are called intangible assets.

- Assets which neither represent any tangible thing in existence nor have realisable value in the market are called fictitious asset, e.g. preliminary expenses, discount on issue of shares, etc.

(b) Liabilities: Liabilities refer to the total amount of debts or obligations that a business has to pay or fulfill, in future. In other words ‘liabilities’ mean total amount owed by the business to other persons. In short, liabilities represent the total amount payable to outside parties at different dates. For example, bank overdraft, bank loan, sundry creditors, bills payable, capital, loan taken from financial institution, etc. are called business liabilities. Liabilities may be classified as Fixed Liabilities and Current Liabilities.

(i) Fixed Liabilities: Liabilities which are settled or paid only on winding up or dissolution of the organisation are called fixed liabilities. It may be in the form of owner’s capital, share capital, secured loans like debentures, bonds, loans from banks, loans from financial institutions, etc. Fixed liabilities are refunded only after a long period of time. Fixed liabilities constitute long term sources of finance.

(ii) Current Liabilities: Liabilities which are payable within a year are called current liabilities. Short term obligations or debts which are matured within a year or within a operating cycles are called current liabilities. Current liabilities constitute short term sources of finance. They arise in the regular course of business operations. They are usually unsecured. Bank overdraft, Sundry Creditors, Bills Payable, Outstanding expenses payable are considered as current liabilities.

(c) Net Worth: Worth means value or price. Accordingly, net worth refers to the net value of the business enterprise in terms of its assets and liabilities. It implies the excess of assets over liabilities as disclosed by a firm’s balance sheet, i.e. capital owned by a business. In other words, net worth refers to the value of a business enterprise when its liabilities have been deducted from the value of its assets. In terms, of equation,

Net Worth = Market value of total assets shown in the balance sheet – Current liabilities

Example: Suppose, the total assets of the business is ₹ 7,50,000 whereas the total liabilities of the business is ₹ 3,65,000.

Here, net worth of th business is calculated as follows:

Net Worth = Value of Total Assets — Value of Total Liabilities

= 7,50,000 – 3,65,000 = ₹ 3,85,000

![]()

(15) Contingent Liabilities : The contingent liabilities are the liabilities whose occurrence depends upon the happening of a certain events which may or may not take place. Such liabilities may or may not occur in the future. These liabilities are shown in the balance sheet on the liabilities side only in the inner column and their description is written in the foot note. These liabilities are not taken in the balance sheet total. They are considered as probable losses of the business enterprise. E.g. demand of worker for compensation of ₹ 20,000 pending before the court of law.

Accounting Principles-

The basic aims of book-keeping and accountancy are to record the business transactions in a summarised form, systematically and in chronological order in the books of accounts and to prepare various accounting statements and report periodically to communicate the result and financial position of the business to the stakeholders or concerned parties. To achieve these aims, accounting is based on universally accepted and scientifically laid down principles. The basic fundamental truth of accounting or rules of conducts or procedures which are universally accepted and followed by the accountants every where without unreasonable likes or dislikes to record business transactions and to prepare accounts are called accounting principles. Through usage, necessity and experience, these accounting principles are gradually developed over a long period of time.

According to the Institute of Chartered Accountants of India (ICAI), accounting conventions, accounting concepts, accounting principles, accounting postulates, etc. are the basic points of agreement on which financial accounting theory and practice are founded.

Accounting principles are also considered as general laws or precedents for taking decisions and actions in the field of business.

Accounting Concepts-

Concept means the general idea which conveys certain meanings. Accordingly accounting concepts imply general notion or abstract ideas on which accounting is based.

Accounting is the language of the business with the help of which financial information are transmitted to the concerned parties of the business. In order to communicate the business information exactly with the same meaning to all interested parties related to the business, accountants have discovered a number of accounting concepts. Accounting concepts are general guidelines for sound accounting practices.

The different accounting concepts are discussed as follows :

(1) Business entity concept : The business entity concept suggests that a business has a separate entity and has an independent legal existence distinct from the person who owns it. Although a business has no body, soul, life and existence, still the law recognises it as a legal person. This accounting concept enables the accountants to record the transactions of the owner or proprietor separately from the transactions of the business. In the absence of such distinction the private affairs of the proprietor would have mixed up with the affairs of the business. As a result, the true and clear picture of the state of affairs of the business would not have been made available. The concept of business entity is applicable to all forms of business organisations such as sole trader, partnership, joint stock companies, co-operative societies, etc.

Illustration: A proprietor Mr. Ashok has spent ₹ 13,000 from business funds on Travelling and Conveyance. This includes a bill for the amount of ₹ 4,500 spent on personal and family travelling. In this case only ₹ 8,500 should be charged to Profit and Loss Account under the heading of Travelling and Conveyapce and ₹ 4,500 should be considered as drawings and each amount of drawings should be deducted from capital of the proprietor.

(2) Money measurement concept: This accounting concept states that in the books of accounts, accountant records only those business transactions which are financial in nature and capable to be expressed in monetary terms. It means the qualitative and quantitative aspects which can not be measured in terms of money, are not recorded in the books of accounts.

In India all the accountants records business transactions in Indian Currency i.e. Rupee (₹).

Illustration: A businessman invested the following properties (Assets) into the business: Building with 5 rooms at the cost of ₹ 40,00,000, Cash ₹ 5,00,000 Furniture costing ₹ 40,000 and raw materials 2 tonnes at the cost of ₹ 80,000. Here the total assets of the business is 40,00,000 + 5,00,000 + 40,000 + 80,000 = ₹ 46,20,000. In the books of accounts, the accountant records assets of ₹ 46,20,000 and Capital at ₹ 46,20,000.

(3) Cost concept: According to this accounting concept, an asset of the business is recorded in the books of account at the price paid to acquire or produce it, i.e. at its cost and not at its current market value. The cost at which assets are acquired and recorded, provides the base for the subsequent accounting for that asset. E.g. if a plot of land is bought for ₹ 2,50,000 by a business, it will be recorded in the books of accounts at ₹ 2,50,000 for further accounting. A year later if its market value increases to ₹ 4,00,000 or even more, then no change will be made in the books of account so to reflect this increase in its value. This concept enables the accountant to depreciate assets correctly and show their correct value in the books of accounts. This concept prevents arbitrary value being put on the assets purchased.

(4) Consistency concept : This accounting convention states that once a particular accounting practice, method or policy is adopted to prepare accounts, statements and reports, it should be continued for years together and should not be changed unless unavoidable circumstances force the enterprise to change it. If the change is unavoidable, the change and its effects should be stated clearly. If consistency is maintained in the accounting practice or procedures over many years, a comparison of two different accounting periods may be made easily to draw meaningful conclusions.

Illustration: It would be improper to depreciate the machinery according to one method of depreciation in one year and to switch over to another method in the next year.

(5) Conservatism : This accounting concept suggests that while preparing accounting statements, planning, policies, strategies and budgets, all possible or anticipated losses must be taken into consideration while unrealised, prospective or anticipated profit should be ignored. This is also known as “the policy of playing a safe game.” It is also called “Principle of prudence.” According to this accounting concept, closing stock is valued at the market price or cost price whichever is lower. Similarly, provision for bad and doubtful debts is also permitted and made every year. If this accounting convention is not applied or followed continuously, it may result into an understatement of incomes, assets and overstatement of liabilities and provisions. Illustration: The closing stock of a factory is valued at cost price ₹ 80,000. However, its market value determined at ₹ 86,000. According to conservatism concept, here closing stock is to be valued at ₹ 80,000 which is lower than it market value ₹ 86,000.

(6) Going concern concept: According to this concept, it is assumed that business will be carried out indefinitely for a long period of time in the future and accordingly business transactions are undertaken and recorded. Hence in this concept it is assumed that the business will continue for a long time. It has continuity of life. It is not to be closed at the end of each year. It is assumed that business is permanent. This Concept is also called continuity concept or permanency concept. Fixed assets like plant and machinery, furniture and fixture, land and building, motor vehicles, etc. are purchased on the assumption that a business is a going concern. This accounting concept enables the accountants to make distinction between the capital expenditure and revenue expenditure. Managerial functions like planning, financing, organising, controlling, etc. are performed in every organisation on the basic assumption that the business is a going concern.

(7) Realisation concept: This accounting concept explains that sale is supposed to be completed when the title and possession of goods are passed from the seller to the buyer and in exchange the payment is received by the seller from the buyer. Revenue or income is considered to be earned on the date on which its actual payment is received. In other words, income realised by selling goods or by rendering services during the accounting year should be considered in the income statement of that accounting year. Since accounting is the historical records of transactions, it records what is actually received and paid. In the case of installment sale or hire purchases, the sales are treated to have been completed only to the extent to which the installment are received. Similarly, in the case of contract account, profit is calculated on the basis of work certified.

Illustration: In business there may be a building whose purchase price i.e. cost is shown at ₹ 2,00,000. Now the market price of that building may be ₹ 10,00,000/-. It does not mean that the profit of ₹ 8,00,000 is realised. Such profit should not be recorded in the books of accounts.

(8) Accrual concept: This accounting concept states that revenue is recognised when they are earned and not when they are received. Similarly-, costs are recognised as soon as they are incurred and not when they are paid. This accounting concept enables the accountants to measure the income for a particular period by calculating the difference between the revenue recognised in that period and expenses incurred to earn that revenue. Accrual accounting is a basic accounting concept used in preparation of Trading Account, Profit and Loss Account and the Balance Sheet.

Illustration: A firm has deposited ₹ 5,00,000 with the Bank in Fixed deposit carrying interest @ 12% p.a. on 1st July, 2010 for 5 years. Bank is required to pay interest on maturity along with principal amount, i.e. on 30th June, 2015.

![]()

As per the principle of accrual, interest for 9 months i.e. from 1st July 2010 to 31st March, 2011 of ₹ 45,000 is to be shown as “interest accrued” on the credit side of Profit and Loss A/c as on 31st March, 2011. i.e. in the accounting year 2010-11, although interest is not received in cash.

Dual aspect concept: This accounting concept explains that every business transaction has two aspects viz. (i) acquisition or increase in asset of the business and (ii) creation or increase in claims against business. Assets refer to the valuable things owned by the business. Capital refers to the proprietor’s contribution to the business to provide fund to undertake activities. Capital is the owner’s claim against the business, e.g. a capital of ₹ 5,00,000 received in cash by the business from the proprietor has dual aspects viz. business has cash i.e. asset of ₹ 5,00,000 and the proprietor has a claim of ₹ 5,00,000 against the business entity called capital. If you put the same idea in the form of equation, we can state,

Capital (₹ 5,00,000) = Assets (₹ 5,00,000)

A month later, the business has borrowed ₹ 2,00,000 from the bank to meet its increasing requirement. Now, the asset of the business has increased by ₹ 2,00,000 on the one hand and a claim against the business has also increased by ₹ 2,00,000. We can state the above situation in an equation form as follows:

Capital (₹ 5,00,000) + Liabilities (Bank Loan ₹ 2,00,000)

= Assets 7,00,000 (₹ 5,00,000 + ₹ 2,00,000)

The above equation can be restated by interchanging the terms as follows:

Capital (₹ 5,00,000) = Assets (₹ 7,00,000) – Liabilities (₹ 2,00,000)

OR

Liabilities (₹ 2,00,000) = Assets (₹ 7,00,000) – Capital (₹ 5,00,000)

Thus, the accounting system called double entry book-keeping system is set up to record dual aspects of every business transaction in the books of accounts.

(10) Disclosure : According to concept of full disclosure, accounting must disclose all the material facts and information so that interested parties after reading such accounting report can get a clear view of the state of affairs of the business. Accounting statements must be prepared honestly and they should be free from any bias or prejudice. The statements of accounts so prepared by the accountants must neither hide any material information nor exaggerate any facts. Disclosure does not mean leaking out the business secrecy, but to disclose all the significant information and fact keeping in view various accounting assumptions. This accounting concept is more relevant to the joint stock company where there is a divorce between ownership and management. The management of the company must prepare financial statements and reports of the functioning of the company periodically and these statements must disclose the true and fair view of the state of affairs of the company.

(11) Materiality : The term ‘material’ means ‘relatively important’. Accounting information is said to be material, if its omission from the financial statement affects the decision making for its users. According to convention of materiality, accountants must disclose all material facts and information which highlights the financial position and profitability of the business organisation. However, materiality will differ or change with nature, size and tradition of the business. What is material for one organisation may be immaterial

for another organisation.

(12) Matching Cost Concept : This concept suggests that while determining the exact or accurate profit or income, we have to compare or match the revenue of the business with the cost that is incurred to earn that revenue. In other words, only relevant cost or expenses of the period are required to be deducted from the relevant revenue of that year. For instance if in the accounting year 2011-12, the revenue of ₹ 18,00,000 is earned, by way of sales, this entire revenue is not the profit. In order to calculate the profit, we have to deduct cost of goods sold from the sales revenue. In the above example, if the cost of goods sold is ₹ 15,00,000, then the gross profit would be ₹ 3,00,000. The gross profit here is ascertained by comparing and matching the sales revenue with the cost of goods sold.

Importance of Accounting Concepts :

- With the help of accounting concepts accountant can easily prepare reliable financial statements such as cash flow statement, fund flow statement, trading A/c, profit and loss A/c etc. They add the reliability to the financial statements.

- Accounting statements are helpful to keep and maintain uniformity in presentation of financial statement. Uniformity is helpful for comparison of financial statements of two or more business entries and also different periods.

- Accounting concepts provide acceptable basis of measurement.

- They are helpful to provide proper information ahout the business to various interested parties.

- They provide valid and appropriate assumptions for preparation of financial statements and reports.

Accounting Standards (AS) and International Financial Reporting Standard (IFRS)-

(A) Accounting Standards:

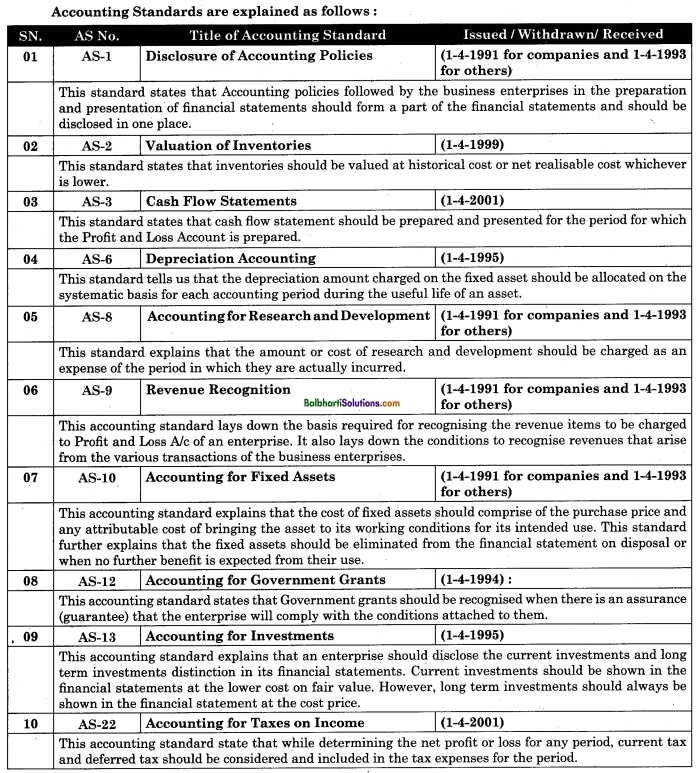

(1) Meaning: Accounting standards may be defined as, “Codified Generally Accepted Accounting Principles (GAAP), uniform accounting rules and guidelines to prepare financial statements of different business units in a uniform manner for easy comparison and disclosures of business information to the users.” Standard of Accounting are recommended by the Institute of Chartered Accountants of India (ICAI) and prescribed by the Central Government in consultation with the National Advisory Committee on Accounting Standards (NACAS). Accounting Standards are written policy document covering the different aspects such as recognition, measurement, treatment and presentation.

Kohler States, “Accounting Standards are codes of conduct imposed by customs, law or professional bodies for the benefit of public accountants and accountants generally.”

(2) Need for accounting standards:

- To promote better understanding of financial statements. Accounting standards reduce confusion about the accounting treatments used to prepare financial statements.

- To facilitate accountants to follow uniform procedures and practices.

- To enable or help the organisation to make meaningful comparison of financial statements of different companies situated at different places.

- To standardise the diverse accounting policies and practices with a view to eliminate the non-comparability of financial statements and add the reliability to the financial statements.

- To fulfil and complete the legal requirements more effectively.

(B) International Financial Reporting Standards (IFRS):

International Financial Reporting Standards (IFRS) are prepared and issued by the International Accounting Standard Board (IASB). IFRS is a set of International Accounting Standards which explain and show how different types of financial transactions and other events should be shown or reported in the financial statements. IFRS are prepared and issued to develop Accounting Standards that would be acceptable world wide and to improve financial reporting internationally.

![]()

(C) Accounting Standards in India :

In India, the Council of Institute of Chartered Accountants of India (ICAI) has issued accounting standards. Accounting Standards Board (ASB) was constituted by ICAI on 218t April 1977. ASB recognised the need for Accounting Standards in India and by considering the applicable laws, custom, usage, business environment and International Accounting Standards,framed Accounting Standards to be followed in India. The council of Institute of Chartered Accountants of India has so far issued 31 Accounting Standards. Some of those