By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 2 Meaning and Fundamentals of Double Entry Book-Keeping students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 2 Meaning and Fundamentals of Double Entry Book-Keeping

Meaning and Definition of Double Entry Book-Keeping System-

Meaning:

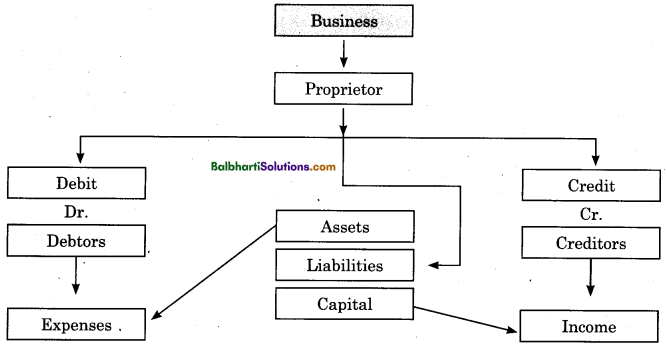

The Double Entry Book keeping system is scientific, perfect and a complete method of recording business information in the books of accounts. Usually, in every business transaction, we find two accounts, out of which one account is given debit effect and other account is given credit effect. In this system for every debit, there is a corresponding credit and in money term all debits are equal to all credits. If any thing comes into business, an account of that item is to be debited and if any thing goes out from business, an account of that item is to be credited in the books of account, e.g. Ashok purchases goods worth ₹ 5,000 from Kishor by paying cash. Here, Ashok gets goods of ₹ 5,000 and parts with cash of ₹ 5,000. In the books of Ashok, Goods A/c. will be given debit effect to extent of ₹ 5,000 and Cash A/c will be given credit effect to extent of ₹ 5,000. Thus, every business transaction is split up into two parts or two aspects, i.e. debit aspect and credit aspect. Debit effect is posted to the debit side of one Ledger A/c. and credit effect is recorded on the credit side of the other Ledger A/c.

![]()

It means every business transaction is recorded in two different accounts at two different places. In this manner, in double entry book keeping system, completed business transactions are first recorded in journal and then in ledgers. At the end of the accounting year, all ledger accounts are closed and balanced. The balance shown by each ledger account is then recorded on a separate sheet in order of debit and credit. This is known as trial balance. When this process is over, the debit column and credit column of trial balance are totalled. The total of debit side always agrees or equals with the total of credit side. It means every debit is given equivalent credit under the double entry book-keeping system.

Thus, double entry book-keeping system seeks to record every business transaction in money or money’s worth in its double aspects viz. debit and credit.

Definition of Double Entry Book Keeping System:

(1) J. R. Batliboi : “Every business transaction has a two fold effect and that it affects two accounts in opposite directions and if a complete record is to be made of each such transaction it would been necessary to debit one account and credit another account. It is this recording of two fold effect of every transaction that has given rise to term Double Entry. ”

(2) William Pickles : “The Double Entry System seeks to record every transaction in Money or Money’s worth in its double aspect – the receipt of a benefit by one account and the surrender of a like benefit by another account, the former entry being to the debit of the account receiving and the later to the credit of the account surrendering.’’

Methods of Recording Accounting Information-

Book keeping system is classified as (i) Indian system of recording accounting information and (ii) English system of recording accounting information.

(i) Indian System : Traditional method of recording and keeping the records of accounts in any one of Indian languages like Marathi, Hindi, Gujarati, Urdu, etc. is called the Indian accounting system. It is also called Mahajani / Deshi Nama system. Under this system, transactions are recorded in long books known as Kird or Bahi Khata and it is not based on Double Entry book-keeping system. This system does not have scientific base. This system is still used in India by small business organisations.

(ii) English System: When business informations are recorded in the books of accounts in English language as per modern (advanced) method, it is called. English accounting system. Now-a-days, English accounting system is more advanced and popular and universally followed all over the world. In India, in many large scale business organisations, English system of recording accounting is followed. English accounting system is sub classified as (i) Single entry book-keeping system and (ii) Double entry book-keeping system.

Single Entry Book-Keeping System :

A book-keeping system in which only one aspect of business transaction is considered and systematically recorded in the books of accounts and other aspect is completely ignored is called single entry book-keeping system. Under this system of book keeping only Cash Book and personal accounts are prepared and maintained. It is incomplete and unscientific method of book-keeping. It cannot provide accurate information about the profitability and financial position of the business. It has several drawbacks and defects. It is not as popular as double entry book-keeping system. It is rarely used in the modern business world. This system is suitable for small business organisations.

Double Entry Book-Keeping System :

A book-keeping system in which double or two fold effects of each transaction is recorded systematically is called double entry book-keeping system. In this system one account is debited and another account is credited with equal amount. It is scientific method of recording all business transactions in the books of accounts.

The main principles of double entry system are stated as follows :

In every business transaction minimum two interested parties are involved.

Every business transaction has minimum two aspects or effects viz. one receiving benefit and another giving benefit.

Two aspects or effects of every business transaction are recorded in the books of accounts.

In monetary term every debit has equal credit. It means every debit has corresponding credit of equal amount. Two fold effects of every business transaction are recorded by debiting one account and crediting another account.

![]()

Advantages of Double Entry Book – Keeping System-

- Recording double aspects of each transaction in the books of accounts, ensures an arithmetical accuracy of accounts.

- This system is helpful to detect, prevent and reduce the frauds.

- If at all any mistake occurs, it can be easily detected and rectified.

- Exact amount due to us from customers/debtors and other parties, and exact amount payable to creditors/ suppliers by us can be known easily from the records maintained as per this system.

- This accounting system keeps complete, accurate and perfect records of business transactions.

- This accounting system is suitable for all types of business organisations i.e. small scale, medium scale and large scale, public and private business organisations, etc.

- This accounting system is helpful to prepare trial balance and final accounts of the business at the end of the accounting year.

- With the help of this system income statements of the current year can be compared with the income statements of previous years and on the basis of that comparison a businessman gets information about the variations in incomes and expenses. To control expenses, a businessman can adopt different measures.

- As all accounts are prepared independently under this accounting system, item wise detail information can be known easily, e.g. value of assets, amount of expenses, amount payable to other parties, etc.

Conventional System of Accounting-

Conventional system of accounting is an old and traditional method of recording business transactions in the books of accounts. Indian accounting system is one of the finest example of conventional system of accounting. Under this system accounting information are recorded in any one of the Indian languages such as Marathi, Gujarati, Hindi, Marwadi, Urdu, etc.

It is a system of accounting in which businessman or accountant (in local language called ‘munimjV) prepares conventional cash book, Journal i.e. Rojmel and Ledger i.e. Khatavahi to record business transactions. Conventional system of accounting is more suitable and useful for those businessmen whose turnover is small and number of business activities is limited. Even today this accounting system is adopted by many professionals and businessmen.

Left hand side of every ledger account is called Debit i.e. ‘Jama’ and right hand side is called Credit i.e. ‘Udhar’ or ‘Nave’. This system suffers from many drawbacks. It is incomplete system of maintaining accounting records. It is not recognised by law as an accounting system.

Classifications of Accounts-

(i) Account:

(A) Meaning: An account is a list of business transactions falling under the same description for a given period of time. A systematic and summarised record of business transactions with respect to person, property, loss, gain, income or expense is known as account. An account is generally prepared for one complete year. The word ‘Account’ in abbreviation can be written as ‘A/c.’ Accounts are prepared and maintained in the Ledger. Separate Ledger sheet or page is used for one specific account.

According to J. R. Batliboi, “An account is summarised record of transactions affecting one person, one kind of property or one class of gain or loss. ”

An account is divided into two equal parts, viz. left hand side called debit side and right hand side called credit side.

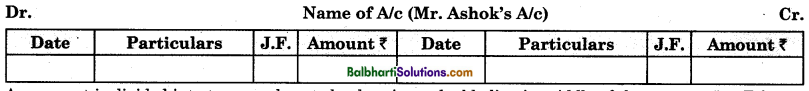

(B) Specimen of an account: The specimen form of an account is given below:

An account is divided into two equal parts by drawing a double line in middle of the account (i.e. T form). The left hand side is called debit side (Debit record) and right hand side is called credit side (Credit record).

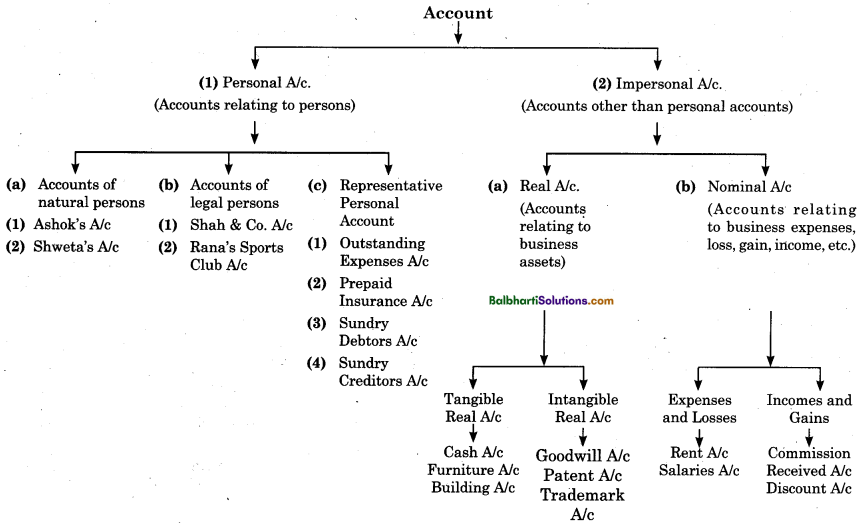

(ii) Classification of Accounts :

Classification of accounts means dividing or grouping different accounts into certain well defined classes with certain objectives.

Accounts are classified into two main groups as (i) Personal Account, and (ii) Impersonal Account.

(1) Personal A/c : Account of person or account relating to person with whom a business keeps dealing is called Personal A/c. Therefore, an account of an individual, partnership firm, company, club, institution, local authority, association, State Government and Central Government with which business keeps dealings is called a personal account. From the view point of law, persons are classified as (a) natural or living persons,(b) legal or artificial persons and (c) Representative Persons. The term natural person implies individuals human beings, e.g. Ashok’s A/c, Kishor’s A/c etc. A legal person does not have life, body and soul, but the law recognises it as a person because all business transactions are done in its name.

For instance Bank of India’s A/c is a personal account as Bank of India is a financial institution which deals in money. It is a legal person. Under the title of legal person the following institutions and legal bodies are included, viz. partnership firm, joint stock company, association, clubs, legal, medical, financial, educational and charitable institutions, gram panchayat, district body, State Government, Central Government, etc. Account of Debtor, Account of Creditor, Bank A/c, College’s A/c, Hospital’s A/c, Club’s A/c and Partnership Firm A/c. are called Personal A/cs.

![]()

Representative Personal Account represents an account of a group of certain persons with whom business keeps dealings e.g. Sundry Debtors A/c, Prepaid Insurance A/c, Outstanding Salaries A/c , etc.

(2) Impersonal Account : All accounts other than personal accounts are known as impersonal accounts. In other words, all accounts which are not personal accounts are grouped under impersonal account. For instance Cash A/c, Rent A/c, Wages A/c and Furniture A/c. are impersonal accounts. Impersonal accounts are classified as (a) Real A/c. and (b) Nominal A/c.

(a) Real A/c : An account of tangible as well as intangible property or any thing owned and possessed by a business is called Real A/c. In other words Real A/c is that account which relates to tangible as well.as intangible assets, objects, etc. of the business. For example Cash A/c, Furniture A/c, Land and Building A/c, Goods A/C, Goodwill A/c, Patent A/c, Plant and Machinery A/c. are called Real A/c. as they relate to the property of the business. Real A/c is further divided into Tangible Real A/c and Intangible Real , A/c.

Tangible Real assets are those which can be seen, touched, felt and measured. It has physical existence. Accounts of Tangible assets are called Tangible Real A/c. E.g. Cash A/c, Goods A/c etc. Intangible Real assets are those which cannot be seen or touched, but it can be measured in terms of money. Accounts of intangible assets are called Intangible Real A/c., e.g. Goodwill A/c, Patent A/c, Trademark A/c, Copy right A/c etc.

(b) Nominal Account: An account relating to business expense, income, gain and loss is called Nominal account. In other words, an account of business expense, business income, business loss or business gain is called Nominal A/c. For instance Rent A/c. is a Nominal A/c, as rent is an expense if it is paid by business and it is an income if it is received by business. Similarly, Salaries A/c, Interest A/c, CQmmission A/c, Discount A/c., etc are Nominal A/c. Nominal A/c is also called as Fictitious A/c. In the ledger, separate account is prepared and maintained for each head of business expenses, losses, incomes and gains. Nominal A/c represents business incomes, gains, expenses and losses. Thus, a classification of accounts is shown in summarised form as below.

![]()

(iii)List of Legal Persons Are Given Below:

Legal Persons:

- Partnership Firm

- Hindu Undivided Family

- joint Stock Company (a) Private Limited Company, (b) Public Limited Company,

- Co-operative Societies,

- Institutions (a) Financial Institutions, (b) Educational Institutions, (c) Medical Institutions, (d) Legal Institutions, (e) Charitable or Welfare Institutions,

- Associations

- Clubs,

- Government Authorities (a) Local-grampanchayat, different kinds of district authorities or bodies, Municipalities (b) State Government, (c) Central Government (d) Government Department.

(iv) Illustrations on Different types of Accounts :

- Anand Agrawal’s A/c.: Mr. Anand Agrawal with whom business deals is a living person. Hence, Mr. Anand Agrawal’s A/c is a Personal A/c..

- Audit Fees A/c.: Audit means to check or to verify an account. The qualified person who does this work of checking is called the auditor. Fees charged by the auditor is called as audit fees. It is an income for auditor and expense for the business. It is a Nominal A/c.

- Bad Debts A/c.: ‘Bad debts’ is a loss that business suffers on account of irrecoverable debts from insolvent debtor. It is an account relating to business loss, hence it is a Nominal A/c. If it is recovered in subsequent accounting year it is termed as Bad Debt Recovery A/c. The same is also included in Nominal A/c. as there is a gain on recovery of bad debts.

- Bank Charges A/c.: Bank charges are the expense for the business and income for the bank, therefore, Bank Charges A/c. is a Nominal A/c.

- Bank of India’s A/c.: Bank of India is a financial institution dealing in money. It is a legal person and so Bank of India’s A/c. is a Personal A/c.

- Mumbai English School A/c.: Mumbai English School is an educational institution. It is a legal person and hence Mumbai English School A/c. is a Personal A/c.

- Building A/c.: Building is an asset of the business. Account of business asset is known as Real A/c. Therefore, Building A/c. is a Real A/c.

- Cash A/c.: Cash in Hand is a business asset and hence Cash A/c. is a Real A/c.

- Carriage A/c.: Expenses incurred to carry goods or raw materials are known as carriage. Carriage is a business expense and hence it is a Nominal A/c.

- Commission A/c.: Commission if received by business, is a business income and if it is paid by business it is a business expense. Commission A/c. thus relates to income or expense of the business, hence it is a Nominal A/c.

- Copy Right A/c.: Copy right is the right given to author by law, in respect of sales of book written by him. Copy right is an asset of author. It is, therefore, a Real A/c.

- Capital A/c.: Capital is provided by proprietor. Proprietor is a living person. Hence, Capital A/c. is a Personal A/c.

- Debtor’s A/c.: Debtor is a person from whom money or money’s worth is receivable by business. Debtor may be natural or legal person. Therefore, Debtor’s A/c. is a Personal A/c.

- Depreciation A/c.: Depreciation is a reduction in value of the fixed asset of the business due to its use, wear and tear or any other similar causes. It is a business expense or notional loss. So Depreciation A/c. is a Nominal A/c.

- Discount A/c.: Discount is an allowance or concession, in money terms received or given by the business. If it is allowed by business it is an expense and if it is received by business it is an income. Hence, Discount A/c is a Nominal A/c.

- Dividend A/c.: Returns on share investment paid by company to shareholders are known as Dividend. Many times, a business invest the surplus money in the shares of company. Thus, dividend is a business income, and hence included in the classification of Nominal A/c.

- Drawings A/c.: Withdrawal in cash or in kind made by a businessman from time to time from business for self use or family’s use is known as drawings. It is an account of proprietor, a living person. Therefore, Drawing A/c is a Personal A/c.

- Freehold Premises A/c.: Premises means building and surrounding area or land attached to it. Premises which is not leased or hired is called ‘Freehold premises’. Freehold premises are an asset of the business and they are covered in Real A/c.

- Furniture A/c.: Furniture of business is a business asset and therefore, Furniture A/c. is a Real A/c.

- Goods A/c.: Goods exhibited or remained in the stock are business assets. So Goods A/c. is a Real A/c.

- Goodwill A/c.: Goodwill is a money value of business reputation earned by business over number of years. It is an intangible asset of the business. It is a Real A/c.

- Investment A/c.: Investment made by the business is a business asset and therefore, Investment A/c. is a Real A/c.

- Interest A/c.: Interest A/c. is an account of expense when it is due or paid by business on debt. Interest is an income if it is received or earned on investment, by business. Thus interest A/c. is a Nominal A/c.

- Insurance Premium A/c.: If business property is insured with insurance against risk of fire or theft, the business has to pay a stipulated amount decided by the insurance company at a regular interval to the insurance company. Such payment is called the insurance premium. It is a business expense. Thus, Insurance Premium A/c. is a Nominal A/c. ‘

- Live Stock A/c.: Stock or collection of animal kept for sale by the business is called Live Stock. It is an asset of the business. It is a Real A/c.

- Loan A/c.: Loan is given by business to debtor or it is taken by business from creditor. Debtor and creditor are persons. Therefore, Loan A/c. is a Personal A/c.

- Loss by Fire A/c.: Loss by fire is a business loss and so it is a Nominal A/c.

- Machinery A/c.: Machinery of business is a business asset and hence Machinery A/c. is a Real A/c.

- Motor Vehicles A/c.: Motor vehicles of business are business assets, so Motor Vehicles A/c. is a Real A/c.

- Patent A/c.: Patent refers to right of manufacturer or business to produce and sell goods or services. It is a business asset and therefore, Patent A/c. is a Real A/c.

- Printing and Stationery A/c.: Amount spent by business on printing and stationery is business expense and so Printing and Stationery A/c. is a Nominal A/c. x

- Prepaid Rent A/c.: Rent which is paid in advance by the business for period yet to exist is called prepaid rent. It is an asset of proprietor. Thus, Prepaid Rent A/c. is a Personal A/c.

(Note: Outstanding and Prepaid expenses are Personal A/c. e.g. outstanding wages, prepaid insurance premium, outstanding salaries, etc. are Personal A/c.) - Royalty A/c.: The amount paid to the owner of a copy right or patent right for making use of trade mark of their product is called Royalty. Royalty is a business expense. It is a direct expense of the business. So Royalty Account is a Nominal Account.

- Stock of Goods A/c. or Stock of Stationery A/c.: Total unsold goods or total goods remaining in the godown of the business is called stock of goods. Stationery remaining or unused in the office for daily correspondence is called stock of stationery. Both Stock of Goods A/c and Stock of Stationery A/c. are Real A/cs. as they are the assets of the business.

- Shiv Vaibhav Co-operative Stores A/c: Shiv Vaibhav Co-operative Stores is a legal person (it is recognised by law as person) and hence Shiv Vaibhav Co-operative Stores A/c is a Personal A/c.

- Shares A/c.: Amount invested by business in the company in the form of shares is called as investment in shares. It is an asset of business. Therefore, Shares A/c. is a Real A/c.

- Loose Tools A/c.: Different types of equipments and instruments used by business in manufacturing goods and services are together known as loose tools. It is a Real A/c.

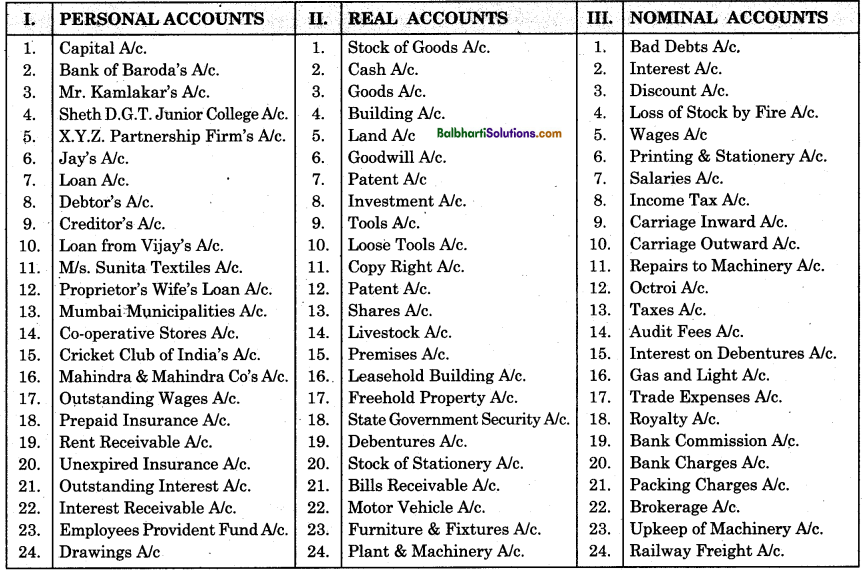

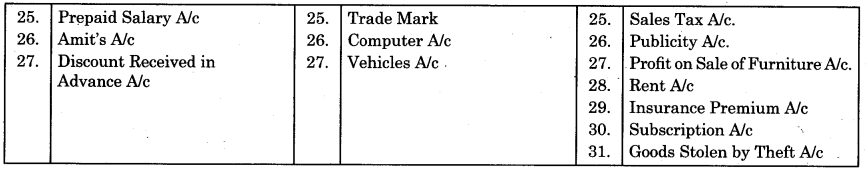

(v) Table Showing Classification of Accounts Into Personal Accounts, Real Accounts & Nominal Accounts :

(vi) Meaning of Debit and Credit:

- Debit: To debit an account means to enter the entry or to write on the left hand side of an account.

- Credit: To credit an account means to enter the entry or to write on the right hand side of an account.

Examples :

(1) Paid ₹ 10,000 to Seema.

In this transaction since Seema is receiver of cash, her account is to be debited i.e. we have to enter this transaction on the debit side of Seema’s A/c. On the other hand as cash goes out from the business, Cash A/c is to be credited i.e. we have to enter the transaction on the credit side of Cash A/c.

(2) Received ₹ 6,000 from Sameer.

In this transaction since cash comes into the business, Cash A/c is to be debited i.e. we have to enter the transaction on the debit side of Cash A/c. On the other hand Sameer is the giver of cash and hence his account is to be credited i.e. we have to enter this transaction on the credit side of Sameer’s A/c.

Rules For Journalisation : (Golden Rules of Accountancy) (Traditional Approach)-

(a) Personal A/c.: Personal A/c. relates to persons with whom a business keeps dealings. A person may be a natural person or a legal person. If a person receives anything from the business, he is called receiver and his account is to be debited in the books of the business. If person gives anything to the business, he is called a giver and his account is to be credited in the books of the business.

Principle of Personal A/c. states that:

![]()

Debtt the Receiver of The BenefiT Credit the Giver of the Benefit:

E.g.

- Goods worth ₹ 1,000 sold to Ramesh. In this transaction, Ramesh is the receiver of goods, he is called receiver and his A/c is to be debited in the books of the business.

- Purchased goods worth ₹ 500/- from Kiran. In this transaction, Kiran is the giver of the goods to the business. He is giver and his A/c. is to be credited in the books of the business.

- Paid cash ₹ 500 to Sanjay. In this transaction Sanjay is the receiver. Hence, Sanjay’s A/c is to be debited.

(b) Real A/c.: Real A/c relates to property which may either come into the business or go from the business. If any property or ‘goods’ comes into the business, account of that property or goods is to be debited in the books of the business. If any property or ‘goods’ goes out from the business, account of that property or goods is to be credited in the books of the business. Principle of Real A/c states that:

Debit What Comes in Credit What Goes Out:

E.g. Goods sold on cash for ₹ 1,500/-. In this transaction cash, an asset comes into the business on sale of goods, and therefore Cash A/c is to be debited in the books of business. On the other hand, goods, an asset of the business goes out of the business on sale and therefore Goods A/c. is to be credited in the books of the business.

(c) Nominal A/c.: Nominal account is an account that relates to business expenses, loss, income and gain. If business incurs expense to manage and run business, account of that expense is to be debited in the books of business. When a business earns income by rendering services or hiring business assets, an account of that income is to be credited in the books of business. In the transaction of sale or purchase of goods or assets, if any loss is incurred by the business, account of that loss is to be debited in the books of the business. If in the transaction of sale of goods or asset any profit is earned by the business, then account of that profit is to be credited in the books of the business.

Principle of Nominal A/c. states that:

Debit All The Expenses or Losses

Credit All Incomes, Gains or Profits

E.g.

- Paid ₹ 50/- as commission to our agent.

- Received ₹ 100/- as interest on our fixed deposit.

- Sold old furniture costing ₹ 5,000/- for ₹ 4,000/- and incurred a loss of ₹ 1,000/-.

In the first transaction, commission which is paid to an agent is business expense and it is to be debited in the books of the business. In the second transaction interest which is received is business income and therefore it is to be credited in the books of the business. In the third transaction, the business has incurred a loss of ₹ 1,000/- on account of sale of furniture. The account of loss is to be debited in the books of the business.

Activity II (Given in the Text book to solve)

(I) From the following transactions find out

(1) Two Aspects (2) Two Accounts (3) Classify the Accounts

(i) Started business with Cash ₹ 50,000.

(ii) Purchased Machinery on credit from Avinash ₹ 20,000.

(iii) Purchased goods ₹ 5,000 from Rahul on cash.

Solution :

(1) Two Aspects

| Aspect I | Aspect II |

| Cash comes in | Proprietor is giver |

| Machinery comes in | Avinash is giver |

| Purchases is an expense | Cash goes out |

| Aniket is the receiver | Sales is an income |

| Salaries is an expense | Cash goes out |

| Cash comes in | Furniture goes out |

(2) Two Aspects and Two Accounts :

| Two Aspects | Two Accounts | |

| Cash comes in Proprietor is giver | Cash A/c ……………………. | ……………………. Capital A/c |

| Machinery comes in Avinash is giver | Machinery A/c, ……………………. | ……………………. Avinash’s A/c |

| Purchases is an expense Cash goes out | Purchases A/c ……………………. | ……………………. Cash A/c |

| Aniket is the receiver Sales is an income | Aniket’s A/c ……………………. | ……………………. Sales |

| Salaries is an expense Cash goes out | Salaries A/c ……………………. | ……………………. Cash A/c |

| Cash comes in Furniture goes out | Cash A/c ……………………. | ……………………. Furniture A/c |

(3) Two Aspects, Two Accounts and Classify the Accounts :

| Two Aspects | Two Accounts | Classification |

| Cash comes in Proprietor (Capital) is giver | Cash A/c Capital A/c | Real A/c Personal A/c |

| Machinery comes in Avinash is giver | Machinery A/c Avinash A/c | Real A/c Personal A/c |

| Purchases is an expense Cash goes out | Purchases A/c Cash A/c | Nominal A/c Real A/c |

| Aniket is the receiver Sales is an income | Aniket’s A/c Sales A/c | Personal A/c Nominal A/c |

| Salaries is an expense Cash goes out | Salaries A/c Cash A/c | Nominal A/c Real A/c |

| Cash comes in Furniture goes out | Cash A/c Furniture A/c | Real A/c Real A/c |

Analysis of transaction by applying rules of Debit and Credit

(Traditional Approach)

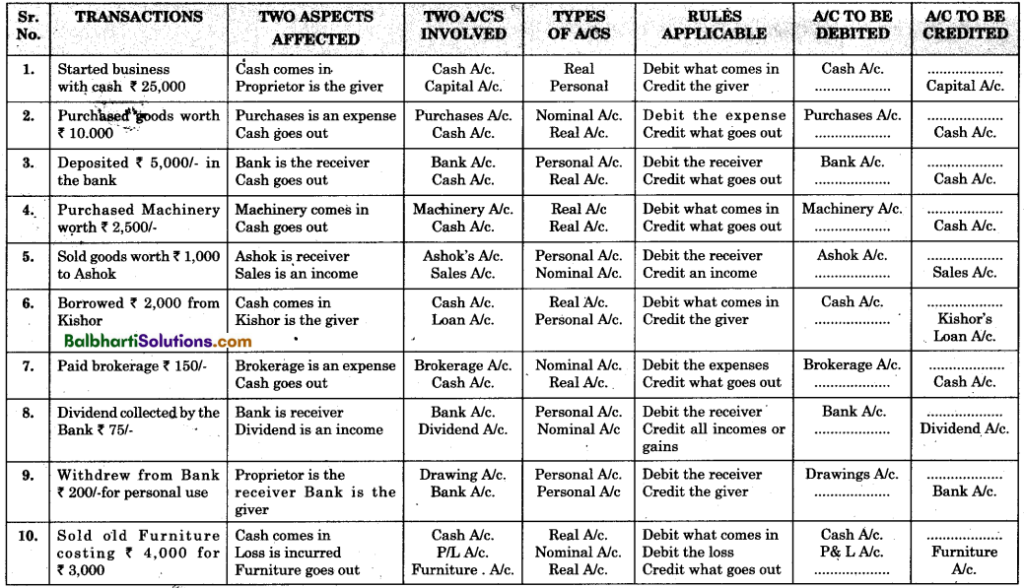

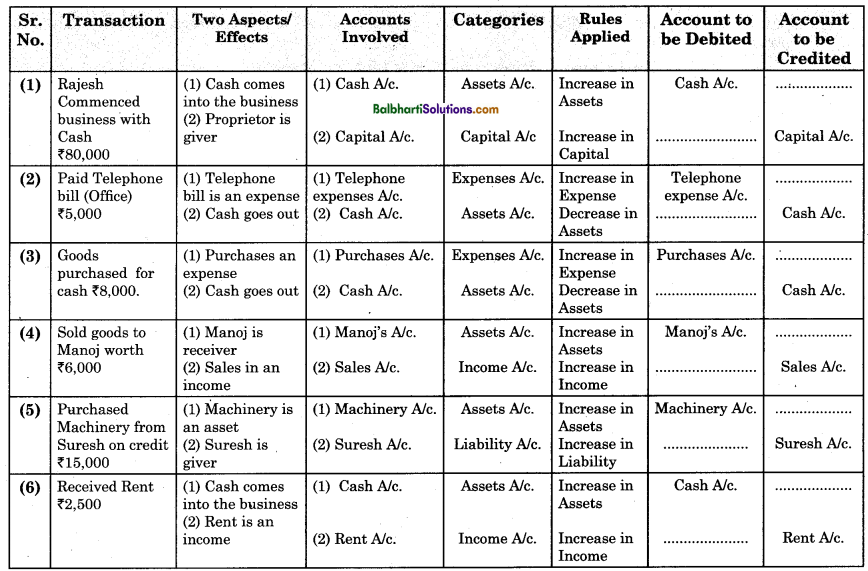

Table showing various business transactions, two aspects affected, two accounts involved, classification of accounts, rules applicable, account to be debited and account to be credited is given below.

Activity: 02 (Given in Textbook to Solve)

Fill the following table.

Analysis of transaction by applying rules of Debit and Credit

(Traditional Approach)

![]()

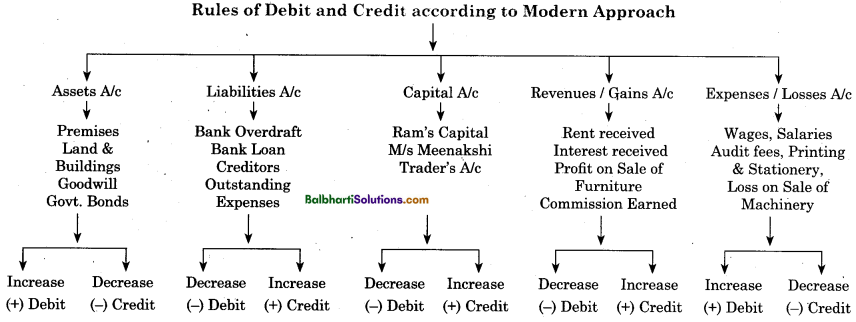

Rules For Debit And Credit: (Modern approach) :

The chart showing the rules of debit and credit as per modern approach is given below.

Two fundamental rules are followed to record the changes in the accounts are stated below:

(1) For changes in Assets / Expenses.

- Increase (↑) in assets is debited and

Decrease (↓) in asset side is credited - Increase (↑) in expenses / losses is debited and

Decrease (↓) in expenses / losses is credited.

(2) For changes in Liabilities / Revenues (Gains)

- Increase (↑) in Liabilities is credited and

Decrease (↓) in Liabilities is debited. - Increase (↑) in Revenues (Gains) is credited

Decrease (↓) in Revenues (Gains) is debited. - Increase (↑) in Capital is credited and

Decrease (↓) in Capital is debited.

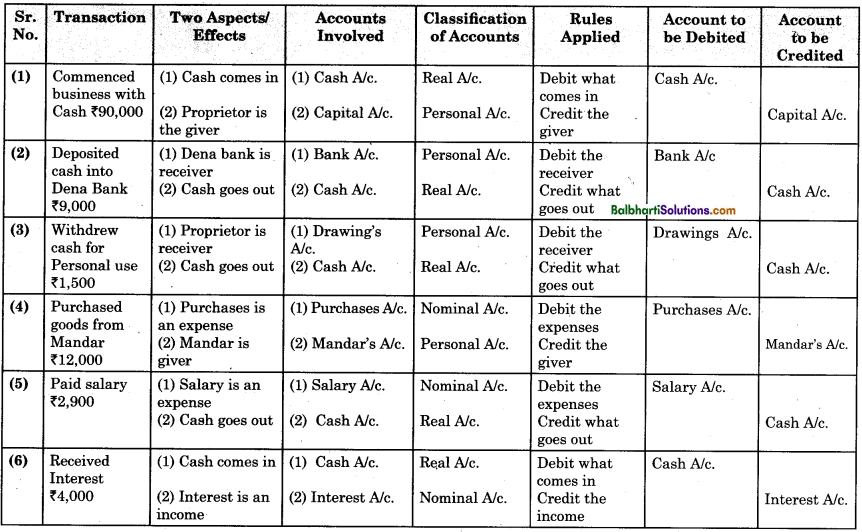

Activity: 03 : Fill the following table.

Analysis of transaction by applying rules of Debit and Credit (Modern Approach)

Analysis of the Following Transactions and Finding Out Their Effects-

(1) Started business with cash ₹ 50,000.

In this transaction cash comes in and increases (↑) Capital by ₹ 50,000. Hence, Cash A/c is debited by ₹ 50,000. On the other hand Liability of the business viz. Capital is created and increased (t). Hence, Capital A/c is credited by ₹ 50,000.

(2) Deposited ₹ 40,000 into the bank.

In this transaction after depositing Cash ₹ 40,000 into the bank, Bank balance increases (↑) and hence Bank A/c is debited by ₹ 40,000. On the other hand cash balance decreases (4) and hence, Cash A/c is credited by ₹ 10,000.

(3) Purchased goods worth ₹ 6,500 from Sameer on credit.

In this transaction Goods worth ₹.6,500 comes into the business after purchases. Purchases is our expense and it increases (↑). Hence, Purchases A/c is debited by ₹ 6,500. On the other hand Sameer is our Creditor and Liability towards creditor increases (↑). Hence, Sameer’s A/c is credited by ₹ 6,500.

(4) Sold goods worth ₹ 4,000 to Mr. Sawant on Credit.

In this transaction after sale of goods of ₹ 4,000, our revenue increases (↑) by ₹ 4,000. Hence, Sales A/c is credited. Mr. Sawant is our debtor and our assets in the form of cash receivable from debtors increases (↑). Hence, Mr. Sawant’s A/c is debited.

(5) Purchased Furniture for ₹ 25,000 for office use and amount paid by cheque.

In this transaction value of furniture i.e. assets increases (↑) and hence, Furniture A/c is debited by ₹ 25,000. After payment, bank balance i.e. our assets decreased (↓) and hence, Bank A/c is credited by ₹ 25,000.

(6) Received cash ₹ 2,000 from Mr. Sawant.

In this transaction cash comes in and cash balance i.e. assets increases (↑). Hence, Cash A/c is debited by ? 2,000. Amount receivable from Mr. Sawant i.e. debtor (asset) decreases (↓). Hence, Mr. Sawant’s A/c is credited by ₹ 2,000.

![]()

(7) Paid cash ₹ 1,500 to Sameer.

In this transaction, Sameer is our creditor and amount payable to Sameer i.e. Liability decreases. Hence, Sameer’s A/c is debited by ₹ 1,500. Cash goes out and cash balance i.e. asset decreases. Hence, Cash A/c is credited by ₹ 1,500.

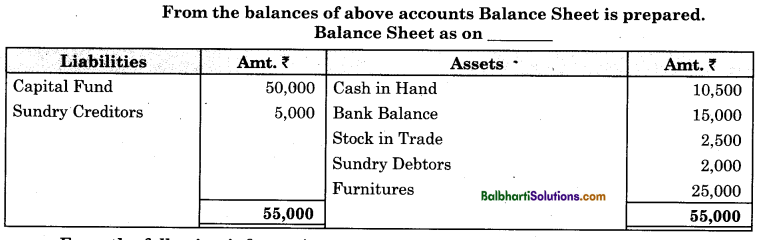

From the following information prepare a chart showing assets, liabilities, incomes, expenses and capital.

(1) Furnitures and Fixtures

(2) Commission Received

(3) Machinery

(4) Sundry Creditors

(5) Bills Payable

(6) Discount Allowed

(7) Sundry Debtors

(8) Patents

(9) Royalty

(10) Discount Earned

(11) Bills Receivable

(12) Drawings

(13) Capital

(14) Bank Loan

(15) Bank Balance

(16) Cash in Hand

(17) Salaries Paid

(18) Travelling Expenses

(19) Repairs and Renewals

(20) Goodwill

(21) Depreciation

(22) Bank Overdraft

(23) Prepaid Insurance

(24) Outstanding Salary

(25) Wages

(26) Carriage

(27) Premises

(28) Dividend Received.

Answer:

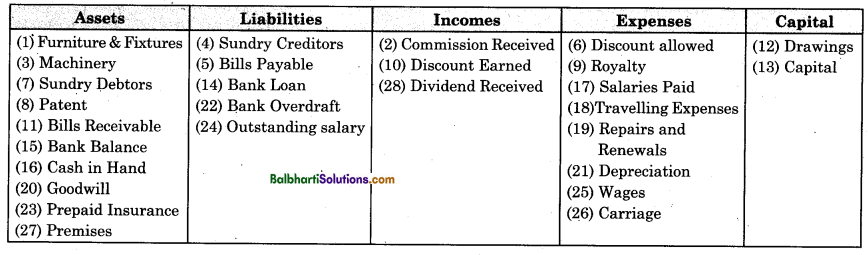

Accounting Equations :

Accounting equation implies that the total assets of a business are always equal to the total liabilities of a business plus capital i.e. Owner’s equity.

This equation is symbolically expressed as follows:

Assets = Liabilities + Capital OR

A = L + C

Other equations are stated below:

Capital = Total Assets – External Liabilities Total Assets = Total Liabilities Assets = External Liabilities + Capital Assets = Equities

Above fundamental equations provide foundation to Double Entry Book-keeping System.

![]()

Equities: The properties owned and possessed by the business are called as Assets. The rights to the properties are called equities. Equities may be sub-divided into two categories viz. the right to creditors and the right to the owners. The equity of creditors represents debts of the business. It is called liabilities. The equity of owner is called as Capital. Proprietor is the debtor of all his expenses and creditor for all his incomes. This relationship is shown in the following diagram.