By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 6 Dissolution of Partnership Firm students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 6 Dissolution of Partnership Firm

Introduction, Meaning and Definition of Dissolution of Partnership Firm-

Introduction : The term ‘dissolve’ means ‘to come to an end or bring to an end.’ Accordingly ‘dissolution’ means termination of a formal or legal relationship such as a business, marriage, etc. There is a difference between the dissolution of partnership and dissolution of partnership firm. Dissolution of partnership refers to severing or discontinuing the relation or connection by one or more partners with other partners without breaking or putting an end to business activities of the partnership firm. In this case, business activities of the firm are continued by remaining partners. Dissolution of partnership firm implies complete closure or breakdown of relations among all the partners and stoppage of all business or trading activities of the firm. Dissolution of partnership firm is a broader concept which also includes dissolution of partnership. Dissolution of partnership is a narrow concept. It does not include dissolution of partnership firm.

Meaning and Definitipn of Dissolution of Partnership Firm : Dissolution of a partnership firm is the end or closure or termination of the firm by break-up of the relation among the partners. In such a case, there is a stoppage of all trading activities. Dissolution has broader meaning in legal terms. A word ‘DISSOLUTION’ comes from the Latin word ‘DISSOLUTION’. According to the provisions of the Partnership Act, 1932, (Section 39) “the dissolution of partnership between all the partners of a firm is called the dissolution of the firm”.

![]()

In other words, dissolution of a partnership firm means complete closure of relation among all the partners. In such a case the firm ceases to exist.

Circumstances / Reasons for Dissolution of Partnership Firm –

A partnership firm may be dissolved in various ways. They are as follows :

(A) Dissolution of partnership without court order : A partnership firm may be dissolved :

- When all partners or all partners except one decide to dissolve the firm, or the firm may be dissolved in accordance with an agreement signed previously or initially by all the partners.

- When the period for which the partnership was formed has come to an end.

- When the specific venture or object for which partnership was formed is completed.

- When all partners or all the partners except one are declared insolvent.

- When the business of the firm is declared as illegal or unlawful.

- When the partnership is at will and one of the partners has given a 14 days’ notice in writing to all other partners to dissolve the firm.

(B) Dissolution by court order : The partnership firm will be dissolved by the court if any one of the

partners files a suit i.e. legal application in the court of law. Under the following circumstances the court orders to dissolve the partnership firm :

- When a partner becomes unsound mind / insane or permanently incapable of performing his

duties. - When a partner is guilty of misconduct which affects the business of the firm.

- When a partner frequently breaks or violates the partnership agreement.

- Where a partner transfers his interest in the firm to an outsider without obtaining consent of other partners.

- When the business- of the firm cannot be carried on except at a loss.

- Any other reason considered by court as just and equitable.

Difference between Dissolution of Partnership and Dissolution of Firm-

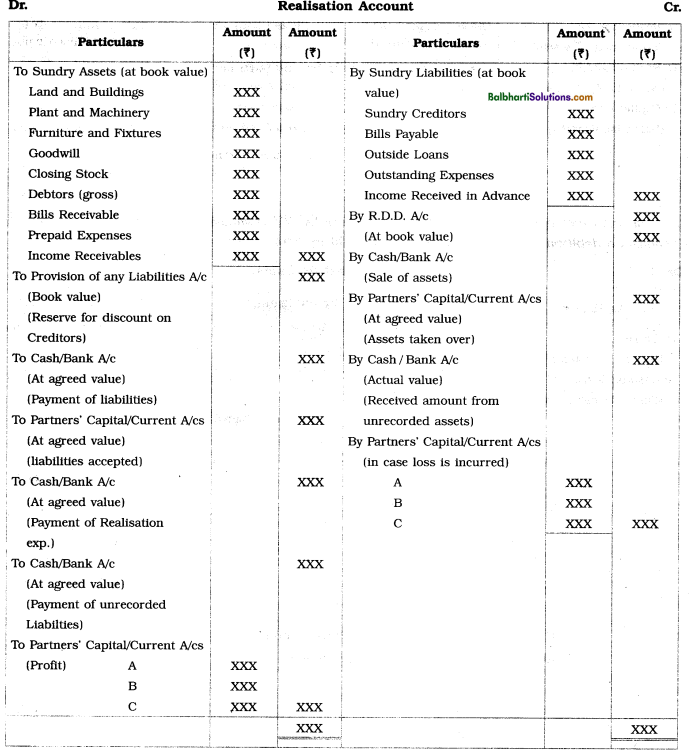

| Base of Comparision | Dissolution of Partnership | Dissolution of Firm |

| Meaning | Complete dissolution may or may not imply. | Complete dissolution of partnership is implied. |

| Nature | Nature of dissolution of partnership is not compulsory. | Nature & dissolution of firm is voluntary or not compulsory. |

| Continuation of Business | Business activities may continue and reconstitution of partnership takes place. | Business activities completely stopped/ discontinued. |

| Requirement | Revaluation of assets and liabilities takes place for the further procedure of reconstituion of partnership. | Realisation of assets and Liabilities takes place as no question of any reconstitution of partnership. |

| Final Closure of books | Final closure of books in not mandatory. | Final closure of books is mandatory. |

| Court order | Dissolution of partnership may not affected by court order. | A court order can affect dissolution of firm. |

![]()

Effects of Dissolution of Partnership Firm –

The effects of dissolution of partnership firm are stated as follows :

- All trading or business activities are closed down.

- All assets of the firm are sold out.

- All liabilities of the firm are paid off or discharged according to the preference of payment.

- If any surplus left, it will be divided among the partners in their profit sharing ratio.

Accounting treatment / Settlement of accounts on Dissolution of Firm –

In order to meet outside liabilities, the partnership firm raises funds by selling its assets. According to the provisions made under Section 48 of Partnership Act, 1932, the liabilities are paid as per the order given below:

- Payment of realisation expenses incurred while selling various assets.

- Repayment of loans and payment to creditors, outstanding expenses, Bank overdraft, Bills payable, Bank loans, Loans from other financial institutions, etc.

- Repayment of loans obtained from partners.

- Repayment of capital balances of partners to the extent possible.

- If any surplus left, it will be divided among the partners in their profit sharing ratio.

Accounting Procedure –

The accounting procedure adopted for dissolution of partnership may be

classified under the following two types :

(A) Simple Dissolution and (B) Dissolution Under Insolvency Situation.

(A) Simple Dissolution : When all partners remain solvent and firm is dissolved due to any reason it is called simple dissolution. On dissolution of the firm the following ledger accounts are opened to record various transactions, viz. (a) Realisation A/c (b) Partners’ Capital A/cs (c) Partners’ Current A/cs (under fixed capital method) (d) Cash or Bank A/c.

(a) Realisation Account : An account which is opened and operated at the time of dissolution by the partnership firm to record the entries of taking over and sale of assets and taking over and payment of liabilities of the firm and to find out profit or loss on realisation of assets and liabilities is called Realisation A/c. After recording all the entries relating realisation of assets and liabilities, this account is closed and balanced. The debit balance of Realisation A/c indicates loss incurred on realisation of assets and liabilities. The credit balance on Realisation A/c shows profit earned on realisation of assets and liabilities. The balance shown by Realisation A/c is transferred to all partners’ Capital Accounts or Current Accounts.

(b) Partners’ Capital Accounts : Capital balances of all partners shown in the last Balance Sheet are transferred to Capital Account of each partner on credit side as ”By Balance b/d”. Usually Partners’ Capital Account show debit balances.

(c) Partners’ Current Accounts : If fixed capital method is followed by the firm, along with Capital Account a Current Account for each partner is opened. Current Account may either show debit balance or credit balance. Entries relating to taken over of assets, payment of liabilities, transfer of Profit and Loss A/c balance, transfer realisation profit or loss, etc. are passed through Current Accounts. At the end, Current Accounts are closed and balances appearing in those accounts are transferred to respective Partners’ Capital Accounts.

(d) Partner’s Loan Account : When partner Loan Account has credit balance, it is not transferred to Credit side of Realisation Account but amount is paid off after paying all third parties due. If Partner Loan Account has debit balance, Partner’s Loan should be debited to Partners’ Capital / Current Account directly.

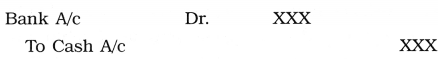

(e) Cash Account or Bank Account : On the dissolution of partnership firm, Cash A/c or Bank A/c is opened and balance of cash or bank shown in the last Balance Sheet is transferred to this account on debit side as “To Balance b/d.” In case of Bank Overdraft, the balance is shown on the credit side of Bank A/c as “By Balance b/d”, if Bank A/c is opened and operated. In that case cash balance is transferred to Bank A/c on debit side by passing the entry :

All the receipts and payments are recorded in this Account. At the end this Account gets automatically closed.

Accounting entries to close : Under simple dissolution, the accounting procedure may be divided into three stages viz. (A) Transfer Stage, (B) Realisation or Disposal Stage and (C) Distribution Stage.

(A) Transfer Stage : In this stage all the assets except cash balance, bank balance and Profit and Loss A/c (debit) balance, are transferred at book value to debit side of Realisation A/c and all the liabilities except partner’s loan, capitals, reserves, Profit and Loss A/c (Credit) balance are transferred at book value to credit side of Realisation A/c.

![]()

Pro forma journal entries :

(1) Transfer of assets : (except cash and bank balance and Profit and Loss A/c debit balance) :

(Being the assets transferred at book values)

(2) Transfer of third party liabilities :

(Being third party liabilities transferred at book values)

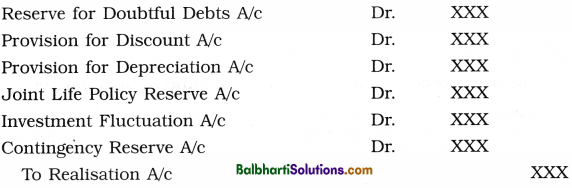

(3) Transfer of provisions against assets :

(Being various provisions made to assets transferred to Realisation A/c)

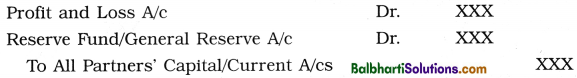

(4) Transfer of accumulated profit and reserves :

(Being accumulated loss and deferred expenses not yet written off transferred to all Partners’ Capital/Current A/cs in their profit sharing ratio)

(5) Transfer of accumulated loss appearing on the assets side of Balance Sheet:

Note : (i) Balance of Cash A/c and Bank A/c and Partner’s Loan A/c should not be transferred to Realisation A/c. In such cases separate A/c for Cash or Bank and Partner’s Loan should be opened and balance shown in the last balance sheet should be transferred to those accounts, (ii) In case of sundry debtors, gross amount of debtors before deducting R.D.D. should be transferred to debit side of Realisation A/c and R.D.D. amount should be transferred to credit side of Realisation A/c.

(B) Realisation or Disposal Stage : In this stage all assets including unrecorded assets are sold out i.e. realised into cash. Assets may be taken over by any partner after adjusting the agreed amount to its Capital/Current A/c. From the collected sales proceeds (cash) liabilities and dissolution expenses are paid. Partner’s loan is also paid off in this stage.

Pro forma journal entries :

(1) Sale of recorded/unrecorded assets :

(Being assets sold and cash received)

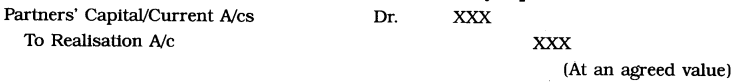

(2) Taken over or recorded as well as unrecorded assets by a partner :

(Being assets taken over by a partner)

Note: Against the due amount to creditor, when asset is taken over by a creditor in part or in full payment due, due amount is to be decreased to that extent and balance amount will be paid to him. Here entry for the net payment is mandatory while entry for asset taken over by the creditor is not required.

(3) (a) Payment of recorded as well as unrecorded liabilities by the firm :

(b) Payment of recorded and unrecorded liabilities by a partner :

Note : If nothing is mentioned about the payment of liability, then it is paid at book value.

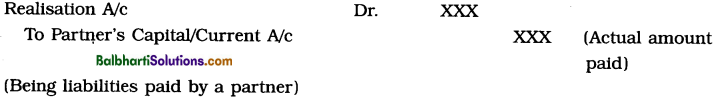

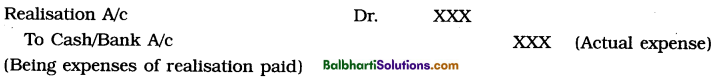

(4) (a) Payment of realisation expenses :

(b) Payment of realisation expenses by a partner :

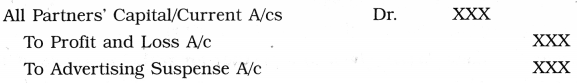

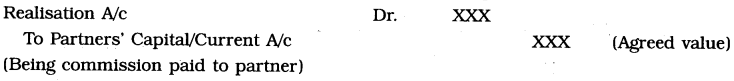

(5) Payment of commission given to a partner for realising assets of the firm :

![]()

(6) Payment of contingent liability by a firm :

(7) Payment of partners’ loan :

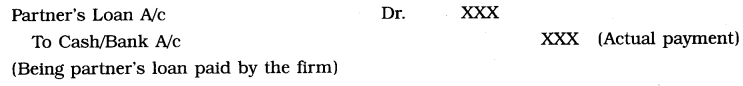

(C) Distribution Stage : In this stage Realisation A/c is closed and balanced. The debit balance i.e. loss or credit balance i.e. profit is transferred to Partners’ Capital or Current Accounts in their profit sharing ratio. Then Current Accounts of the partners are closed and balance appearing thereon is transferred to Capital Accounts of the partners. At the end Capital Accounts of all partners are closed by making payments to or receiving cash from the partners.

Pro forma journal entries :

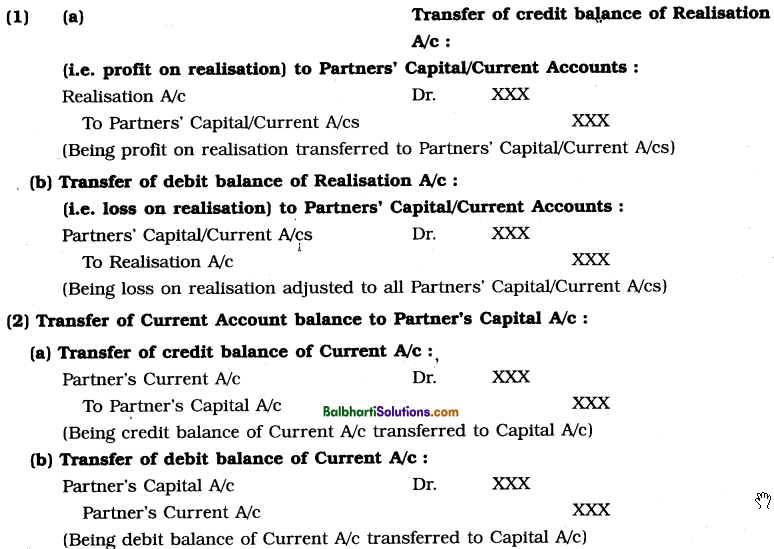

Treatment of unrecorded (undisclosed) assets and liabilities : On the date of dissolution in the books of accounts, some assets and liabilities are not recorded, so entries of like this assets and liabiliies are not transferred to Realisation account. But entries for like this unrecorded assets and liabilities are recorded in the books when they are realised or paid. Related entries are as follow:

Treatment of Goodwill on Dissolution : When goodwill appears in the books, like other assets, it will be transferred to debit side of Realisation A/c, like all other assets. If goodwill is not appear in the books, wheatever sale amount is received, it will be debited to Cash / Bank A/c and credited to Realisation A/c.

(1) When Goodwill Account appears in the Balance Sheet:

(i) Transfer of Goodwill to Realisation Account:

(ii) When Goodwill is realised on dissolution:

(2) When Goodwill Account does not appear in the Balance Sheet:

Here, no entry for transfer of goodwill require.

(i) When Goodwill is realised on dissolution :

(ii) When partner purchases Goodwill:

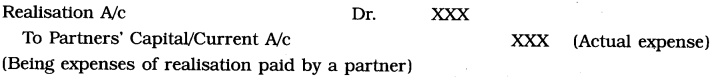

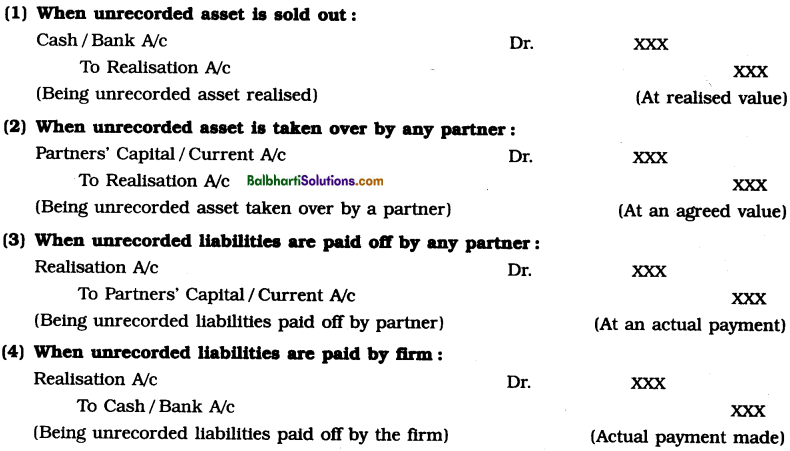

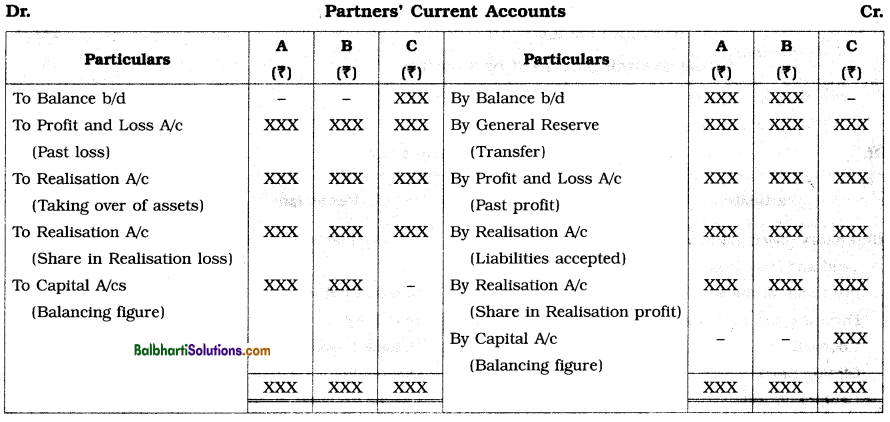

Pro forma of Ledger Accounts :

(1) Realisation Account :

![]()

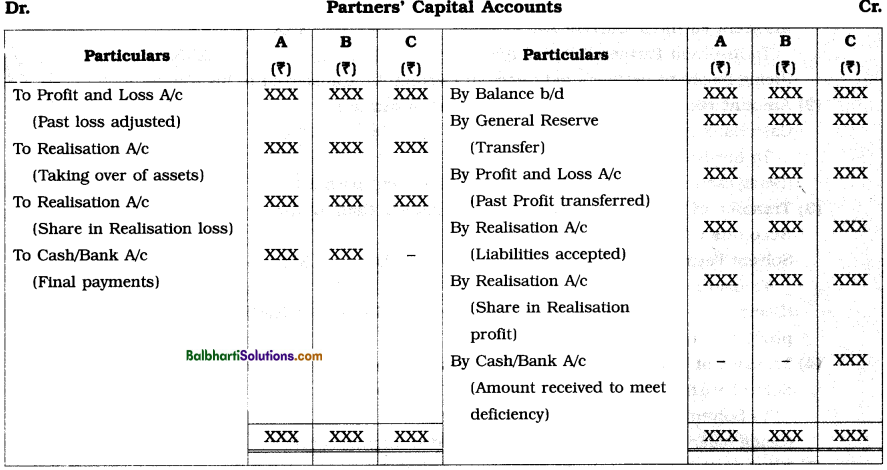

(2) Partners’ Capital Accounts : (A) If Fixed Capital Method is followed by the firm :

It is assumed that opening balance of Current A/cs of A and B showed credit balances and that of C showed a debit balance.

(B) If Fluctuating Capital Method is followed by the firm :

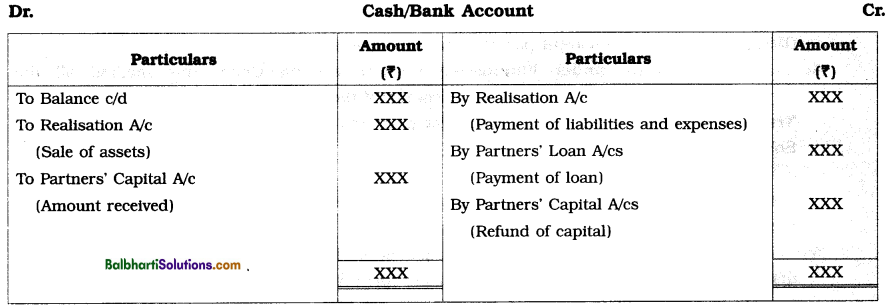

(3) Cash/Bank A/c :

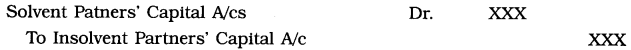

(B) Dissolution Under Insolvency Situation : A person whose liabilities exceed his assets is called an insolvent person. A partner whose capital account shows debit balance and who is not in a position to repay the amount of debit balance on his capital account to the firm is called an insolvent partner. In other words, a partner who is unable to meet his capital deficiency even from his private property is called an insolvent partner. A partner who is in a position to meet his capital deficiency is called a solvent partner. The debit balance of capital account of an insolvent partner which he cannot pay is called his capital deficiency. The capital deficiency of insolvent partner represents a loss to the firm. The capital deficiency of insolvent partner is to be borne by solvent partners in their profit sharing ratio.

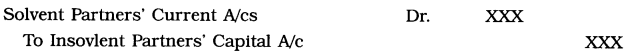

Accounting procedure under Fixed Capital Method :

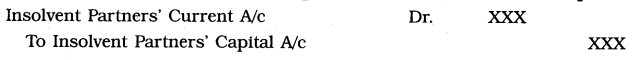

(1) Transfer of balance on insolvent partner’s Current A/c to his Capital A/c :

(Being insolvent partner’s deficiency in Current A/c transferred to his Capital A/c)

(2) Amount recovered from insolvent partner’s estate :

(Being cash recovered from the estate of insolvent partner)

![]()

(3) Transfer of deficiency on insolvent Partner’s Capital A/c to solvent Partners’ Current Accounts :

(Being insolvent partners’ capital deficiency transferred to solvent partner Current A/c in their profit sharing ratio)

(4) Transfer of balance on solvent Partners’ Current A/cs to their Capital A/cs :

(Being balance on Current A/cs transferred to Capital A/cs)

(5) Final settlement of solvent Partners’ Capital dues :

(Being amount paid to solvent partners in final settlement)

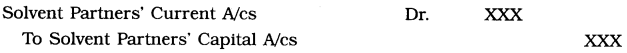

Accounting procedure under Fluctuating Capital Method : Under this method all the adjustments are made through Capital Accounts of the partners.

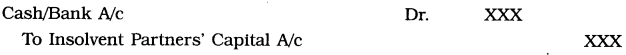

Transfer of capital deficiency of insolvent partner to solvent partners’ Capital A/cs :

(Being insolvent partners’ capital deficeincy transferred to solvent Partners’ Capital A/cs in their profit sharing ratio)

When all partners are insolvent: If all the partners of a firm become insolvent, it is clear that their capital deficiencies will have to be borne by the outside creditors, who will not be able to recover their claims in full but will get only a part of their dues in terms of a dividend of so many paise in the rupee. The available cash in the firm is first used to pay dissolution expenses. The balance amount is paid to creditors proportionately in the ratio of their respective balances.

Accounting treatment before making distribution of insolvent partners’ capital deficiency :

- Transfer only assets to Realisation A/c at their book values to its debit side.

- Outsiders liabilities should not be transferred to Realisation A/c. Open each liability’s A/c separately.

- Adjust the loss on realisation to Partners’ Current A/cs or Partners’ Capital A/cs as the case may be.

- Close the Partners’ Current A/cs and also the Partners’ Loan A/cs by transferring the balances

of such accounts to the capital accounts of the respective partners. - Record the amount of cash recovered from the partners by debiting Cash/Bank A/c and

crediting related Partners’ Capital A/cs. - Close the Partner’s Capital A/cs and transfer the capital deficiency of each partner to a separate

account called ‘Deficiency A/c’. - Distribute the available cash (i.e. opening balance of cash + cash received on sale of assets + cash received from private estate of partners) to various creditors in the proportion of their dues.

- Close the Various Liabilities A/cs by transferring unpaid balances to ‘Deficiency A/c’.

- Ultimately ‘Deficiency A/c’ is suppose to tally.