By going through these Maharashtra State Board Secretarial Practice 12th Commerce Notes Chapter 5 Deposits students can recall all the concepts quickly.

Maharashtra State Board Class 12 Secretarial Practice Notes Chapter 5 Deposits

→ Company can raise funds by accepting deposits from public. It is a cheap source to raise funds. There is no dilution of control.

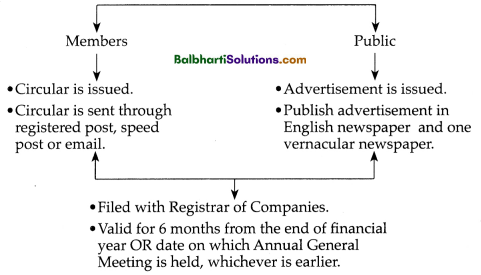

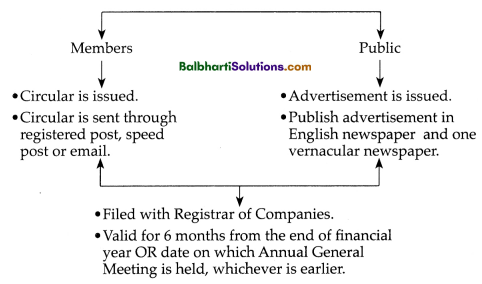

→ Company can invite deposits:

→ Deposit can be secured or unsecured. For secured deposits, a charge on company’s tangible assets are created

![]()

Period / Tenure of Deposit-

- Minimum 6 months, maximum 36 months.

- Premature repayment – after minimum 3 months.

- Company can also renew deposit with same terms and conditions of issue.

- Company cannot accept deposits repayable on demand made by depositor.

→ Deposit Receipt has to be issued within 21 days from date of receipt of deposit money.

Deposit Trustee-

- Appointed when secured deposits are issued.

- The company can appoint one or more Deposit Trustees.

- Protect the interest of depositors.

Trust Deed-

- Company signs a contract with Deposit Trustees.

- Contains terms and conditions of the contract.

- Must be signed at least 7 days before issuing the circular or advertisement.

→ If Deposit Amount + Interest is more than Rs. 20,000, then Deposit Insurance must be taken.

Deposit Repayment Reserve Account-

- Opened in Scheduled Bank.

- On or before 30th April, the company deposits up to 15% amount in DRRA.

- used for repaying deposits.

- Private companies accepting deposits from members cannot open Deposit Repayment Reserve Account.