Std 12 Hindi Chapter 7 Ped Hone Ka Arth Question Answer Maharashtra Board

Balbharti Maharashtra State Board Hindi Yuvakbharati 12th Digest Chapter 7 पेड़ होने का अर्थ Notes, Textbook Exercise Important Questions and Answers.

Hindi Yuvakbharati 12th Digest Chapter 7 पेड़ होने का अर्थ Questions And Answers

12th Hindi Guide Chapter 7 पेड़ होने का अर्थ Textbook Questions and Answers

कृति-स्वाध्याय एवं उत्तर

आकलन

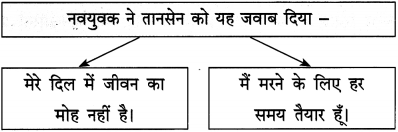

प्रश्न 1.

(अ) लिखिए : पेड़ का बुलंद हौसला सूचित करने वाली दो पंक्तियाँ :

(a) ……………………………………………..

(b) ……………………………………………..

उत्तर :

(a) भेड़िया, बाघ, शेर की दहाड़ पेड़ किसी से नहीं डरता है।

(b) पेड़ रात भर तूफान से लड़ा है।

![]()

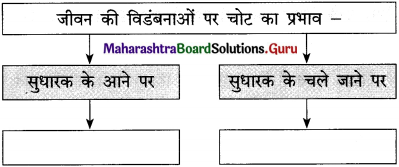

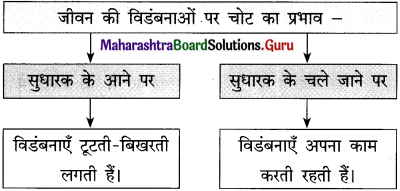

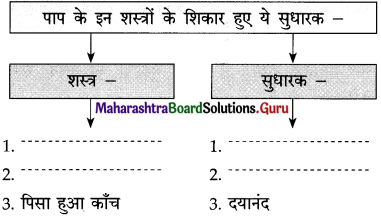

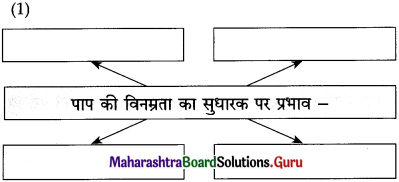

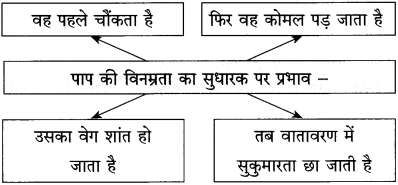

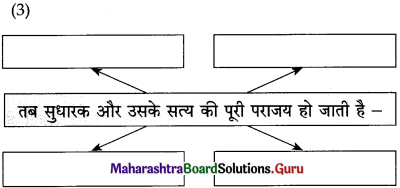

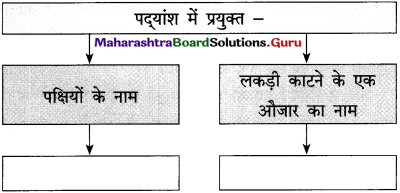

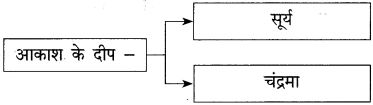

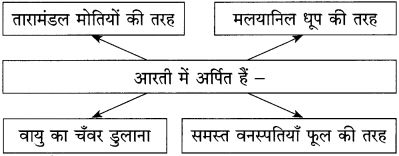

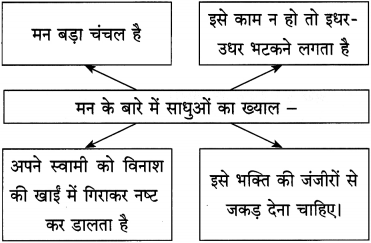

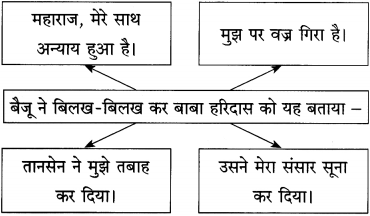

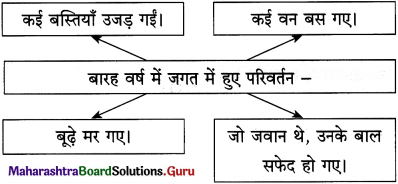

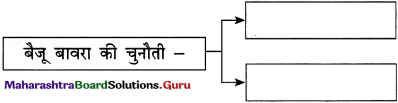

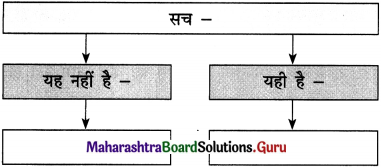

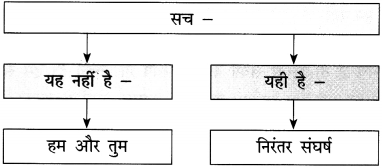

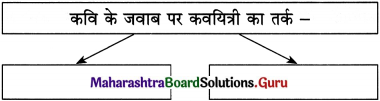

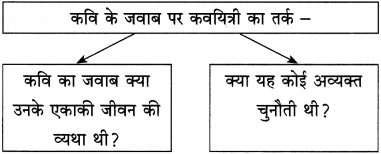

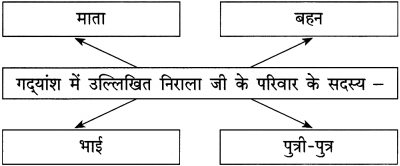

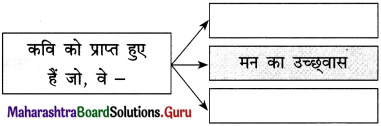

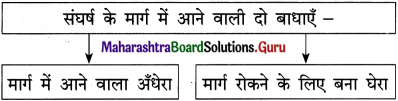

(आ) कृति पूर्ण कीजिए :

उत्तर :

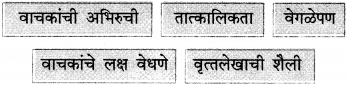

शब्द संपदा

प्रश्न 2.

निम्नलिखित भिन्नार्थक शब्दों का अर्थपूर्ण वाक्य में प्रयोग कीजिए :

(१) साँस – सास

……………………………………………

……………………………………………

(२) ग्रह – गृह

……………………………………………

……………………………………………

(३) आँचल-अंचल

……………………………………………

……………………………………………

(४) कुल-कूल

……………………………………………

……………………………………………

उत्तर :

(1) साँस – सच कहा गया है कि जब तक साँस है, तब तक आशा नहीं छोड़नी चाहिए।

सास – अपने गुणों के कारण रुचि सास की बहुत लाड़ली है।

(2) ग्रह – संपूर्ण सौर मंडल में शनि सबसे सुंदर ग्रह है।

गृह – आलोक ने गृह-प्रवेश के अवसर पर बड़ी शानदार पार्टी दी।

(3) आँचल – अनन्या सात साल की हो गई है पर अभी भी माँ का आँचल पकड़े उसके पीछे-पीछे घूमती रहती है।

अंचल – भाई की पोस्टिंग चंबल अँचल में होने पर घर के सभी लोग बहुत चिंतित हुए।

(4) कुल – रामचंद्र जी सूर्य कुल के सूर्य थे।

कूल – नदी के कूल पर ठंडी हवा मन को मोह रही थी।

अभिव्यक्ति

प्रश्न 3.

(अ) ‘पेड़ मनुष्य का परम हितैषी’, इस विषय पर अपना मंतव्य लिखिए।

उत्तर :

पेड़ मनुष्य का परम हितैषी है। प्रकृति की ओर से धरती को दिया गया अनमोल उपहार है पेड़। सभी प्रकार की वनस्पतियाँ, फल, फूल, अनाज, लकड़ी, खनिज सभी हमें पेड़ों से ही मिलते हैं। पेड़ हमें इमारती लकड़ी, ईंधन, पशुओं के लिए चारा, औषधि, लाख, गोंद, पत्ते आदि देते हैं।

हम जो विषैली वायु बाहर छोड़ते हैं, वृक्ष उसे ग्रहण करके स्वच्छ और स्वास्थ्यवर्धक वायु हमें प्रदान करते हैं और हमें जीवन देते हैं। पेड़ वर्षा कराने में भी सहायक होते हैं। हमें अपने जीवन में वृक्षों के महत्त्व को समझना चाहिए।

![]()

(आ) ‘भारतीय संस्कृति में पेड़ का महत्त्व’, इस विषय पर अपने विचार व्यक्त कीजिए।

उत्तर :

भारतीय संस्कृति में आदि काल से पेड़ों का महत्त्वपूर्ण स्थान रहा है। पेड़ों को देवताओं का स्थान दिया गया है। पेड़ों की पूजा की जाती थी। उनके साथ मनुष्यों के समान आत्मीयता बरती जाती थी। पीपल के पेड़ की पूजा-अर्चना की जाती थी।

स्त्रियाँ उपवास करके उसकी परिक्रमा करती थी और जल अर्पण करती थी। इसी प्रकार केले के पेड़ के पूजन की भी प्रथा थी। तुलसी का पौधा तो आज भी अत्यंत पवित्र माना जाता है। बेल के पेड़ के पत्ते भगवान शंकर के मस्तक पर चढ़ाए जाते हैं।

वातावरण की शुद्धता के लिए पेड़ अत्यंत आवश्यक हैं क्योंकि हम जो विषैली वायु बाहर छोड़ते हैं, पेड़ उसे ग्रहण करके स्वच्छ और स्वास्थ्यवर्धक वायु हमें प्रदान करते हैं और हमें जीवन देते हैं।

रसास्वादन

प्रश्न 4.

‘पेड़ हौसला है, पेड़ दाता है’, इस कथन के आधार पर संपूर्ण कविता का रसास्वादन कीजिए।

उत्तर :

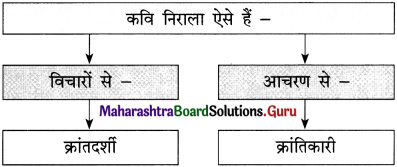

पेड़ होने का अर्थ कविता में कवि डॉ. मुकेश गौतम पेड़ के माध्यम से मनुष्य को मानवता, परोपकार आदि मानवोचित गुणों की प्रेरणा दे रहा है। मनुष्य जरा-सी प्रतिकूल परिस्थिति आने पर या किसी कार्य में मनचाही सफलता न मिलने पर हौसला खो बैठता है। पेड़ भयंकर आँधी-तूफान का सामना करता है, घायल होकर टेढ़ा हो जाता है, परंतु वह अपना हौसला नहीं छोड़ता।

पेड़ के हौसले के कारण शाखों में स्थित घोंसले में चिड़िया के चहचहाते छोटे-छोटे बच्चे सारी रात भयंकर तूफान चलते रहने के बाद भी सुरक्षित रहते हैं। सचमुच पेड़ का हौसला बहुत बड़ा है। पेड़ बहुत बड़ा दाता है। पेड़ की जड़, तना, शाखाएँ, पत्ते, फूल, फल और बीज अर्थात पेड़ का कोई भी भाग अनुपयोगी नहीं होता। अपने स्वार्थ के लिए पेड़ पर कुल्हाड़ी चलाने वालों, उसे काटने वालों के किसी भी दुर्व्यवहार व अत्याचार का पेड़ कभी बदला लेने का नहीं सोचता। वह तो जीवन भर देता ही रहता है।

हम श्वासोच्छ्वास के माध्यम से जो विषैली वायु बाहर छोड़ते हैं, पेड़ उसे स्वच्छ करके हमें स्वास्थ्यवर्धक वायु प्रदान करता है। पेड़ रोगों के लिए विभिन्न प्रकार की औषधियाँ देता है। मनुष्य समाज में किसी की शवयात्रा हो या कोई शुभ कार्य, या फिर किसी की बारात, पेड़ सभी को पुष्पों की सौगात देता है।

पेड़ कवि को कागज, कलम तथा स्याही, पेड़ वैद्य और हकीम को विभिन्न रोगों के लिए दवाएँ तथा शासन और प्रशासन के लोगों को कुरसी, मेज और आसन देता है। वास्तव में देखा जाए तो पेड़ की ऐसी कोई भी वस्तु नहीं है, जो मनुष्य के काम न आती हो।

पेड़ संत के समान है, जो दूसरों को देते ही हैं, किसी से कुछ भी अपेक्षा नहीं रखते। वास्तविकता तो यह है कि पेड़ दधीचि है। जिस प्रकार दधीचि ने देवताओं की रक्षा के लिए वज्रास्त्र बनाने के लिए जीते-जी अपनी अस्थियाँ भी दान कर दी थीं, उसी प्रकार पेड़ बिना किसी स्वार्थ के जीवन भर देता ही रहता है।

साहित्य संबंधी सामान्य ज्ञान

प्रश्न 5.

(अ) नयी कविता का परिचय – ……………………………………………..

उत्तर :

नयी कविता में काव्य क्षेत्र में नए भाव बोध को व्यक्त करने के लिए शिल्प पक्ष और भाव पक्ष के स्तर पर नए प्रयोग किए गए। नए प्रतीकों, उपमानों और प्रतिमानों को ढूँढ़ा गया। परिणामस्वरूप नयी कविता आज के मनुष्य के व्यस्त जीवन का दर्पण और आस-पास की सच्चाई की तस्वीर बनकर उभरी।

(आ) डॉ. मुकेश गौतम जी की रचनाएँ – ……………………………………………..

उत्तर :

- अपनों के बीच

- सतह और शिखर

- सच्चाइयों के रू-ब-रू

- वृक्षों के हक में

- लगातार कविता

- प्रेम समर्थक हैं पेड़

- इसकी क्या जरूरत थी (कविता संग्रह)

![]()

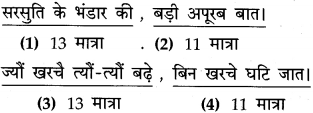

अलंकार

उत्प्रेक्षा : जहाँ पर उपमेय में उपमान की संभावना प्रकट की जाए या उपमेय को ही उपमान मान लिया जाए; वहाँ उत्प्रेक्षा अलंकार होता है।

उत् – + प्र + ईक्षा – अर्थात् प्रकट रूप से देखना।

इस अलंकार में मानो, जनु – जानहुँ, मनु – मानहुँ जैसे शब्दों का प्रयोग किया जाता है।

- सोहत ओढ़े पीत पट श्याम सलोने गात।

मनों नीलमनि शैल पर, आतप पर्यो प्रभात।। - उस क्रोध के मारे तनु उसका काँपने लगा।

मानो हवा के जोर से सोता हुआ सागर जगा।। - लता भवन ते प्रगट भए तेहि अवसर दोउ भाइ।

निकसे जनु जुग विमल बिंधु, जलद पटल बिलगाइ।। - जान पड़ता है नेत्र देख बड़े-बड़े।

हीरकों में गोल नीलम हैं जड़े।। - झूठे जानि न संग्रही, मन मुँह निकसै बैन।

याहि ते मानहुँ किए, बातनु को बिधि नैन।।

Hindi Yuvakbharati 12th Digest Chapter 7 पेड़ होने का अर्थ Additional Important Questions and Answers.

कृतिपत्रिका के प्रश्न 2 (अ) तथा प्रश्न 2 (आ) के लिए)

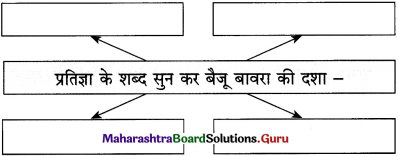

पद्यांश क्र. 1 प्रश्न. निम्नलिखितपद्यांश पढ़कर दी गई सूचनाओं के अनुसार कृतियाँ कीजिए :

कृति 1 : (आकलन)

प्रश्न 1.

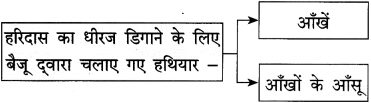

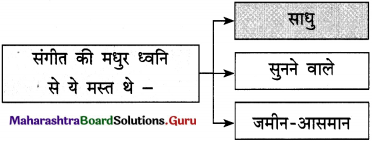

आकृति पूर्ण कीजिए :

उत्तर :

प्रश्न 2.

वाक्य पूर्ण कीजिए :

(1) पेड़ किसी के पाँव

(2) आदमी एक पेड़ जितना

उत्तर :

(1) पेड़ किसी के पाँव नहीं पड़ता है।

(2) आदमी एक पेड़ जितना बड़ा कभी नहीं हो सकता।

![]()

कृति 2 : (शब्द संपदा)

प्रश्न 1.

निम्नलिखित शब्द के वचन बदलकर लिखिए :

(1) साँस – …………………………….

(2) कमरे – …………………………….

(3) हौसला – …………………………….

(4) आँधी – …………………………….

उत्तर :

(1) साँस – साँसें

(2) अर्थ – आर्थिक

(3) हौसला – हौसले

(4) तूफान – तूफानी।

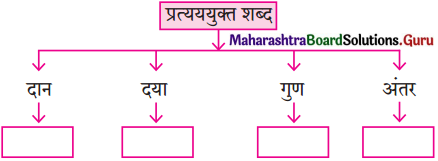

प्रश्न 2.

निम्नलिखित शब्दों में प्रत्यय लगाकर नए शब्द बनाइए :

(1) आदमी – …………………………….

(2) अर्थ – …………………………….

(3) बड़ा – …………………………….

(4) तूफान – …………………………….

उत्तर :

(1) आदमी – आदमियत

(3) बड़ा – बड़प्पन

(2) कमरे – कमरा

(4) आँधी – आँधियाँ।

कृति 3 : (अभिव्यक्ति)

प्रश्न 1.

‘हालात से भागने की बजाय उसका सामना करना ही बेहतर है’ इस विषय पर अपना मत स्पष्ट कीजिए।

उत्तर :

कहा जाता है कि मनुष्य परिस्थितियों के हाथ में एक कठपुतली के समान होता है। यह भी कहा जाता है कि जब रेतीला तूफान आता है तो शुतुरमुर्ग अपनी गरदन रेत में गड़ा लेता है और समझता है कि खतरा टल गया। परंतु खतरा टलता नहीं है। ऐसा ही स्वभाव अनेक व्यक्तियों का भी होता है।

जब भी प्रतिकूल परिस्थितियाँ सामने आ जाती हैं, ऐसे लोग उनका सामना करने की बजाय अपना उद्देश्य ही बदल लेते हैं। ऐसा करना उचित नहीं है। स्थिति से भागने के बजाय डटकर उसका सामना करना चाहिए।

आज नहीं तो कल सफलता अवश्य मिलेगी। हमें पेड़ से सीख लेनी चाहिए। कैसा ही भयंकर आँधी-तूफान हो, पेड़ हार नहीं मानता, डटा रहता है।

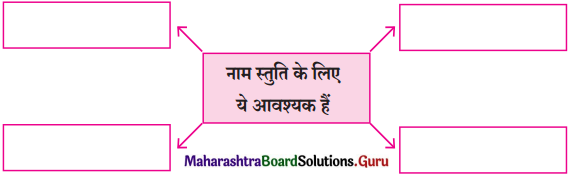

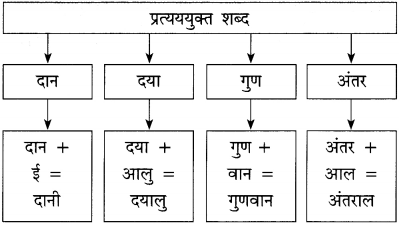

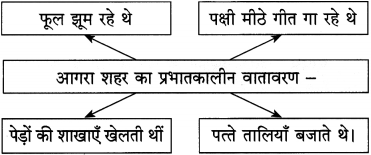

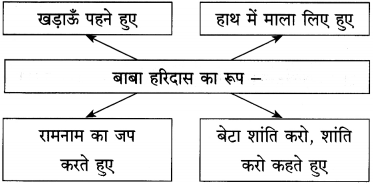

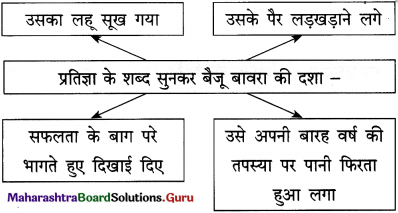

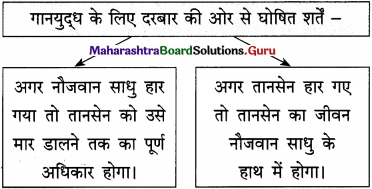

पद्यांश क्र. 2

प्रश्न. निम्नलिखित पद्यांश पढ़कर दी गई सूचनाओं के अनुसार कृतियाँ कीजिए :

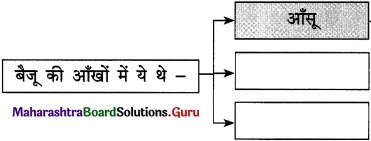

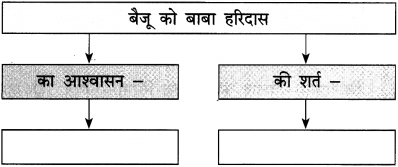

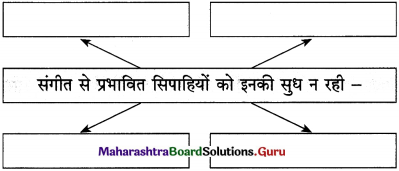

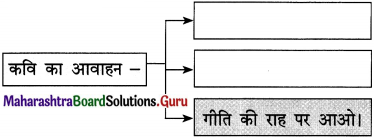

कृति 1 : (आकलन)

प्रश्न 1.

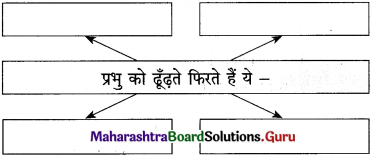

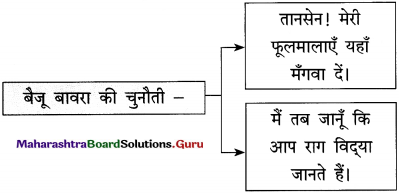

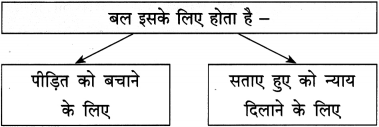

आकृति पूर्ण कीजिए :

(1) पेड़ करता है – [ ]

(2) पेड़ देता है – [ ]

उत्तर :

(1) पेड़ करता है – सभी का स्वागत

(2) पेड़ देता है – सभी को विदाई

![]()

कृति 2 : (शब्द संपदा)

प्रश्न 1.

निम्नलिखित शब्दों का लिंग बदलकर लिखिए :

(1) चिड़िया – …………………………………….

(2) शेर – …………………………………….

(3) पहाड़ – …………………………………….

(4) बाघ – …………………………………….

उत्तर :

(1) चिड़िया – चिड़ा

(2) शेर – शेरनी

(3) पहाड़ – पहाड़ी

(4) बाघ – बाघिन।

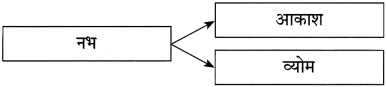

प्रश्न 2.

निम्नलिखित शब्दों के समानार्थी शब्द लिखिए :

(1) पेड़ = …………………………………….

(2) हवा = …………………………………….

(3) पहाड़ = …………………………………….

(4) राहगीर = …………………………………….

उत्तर :

(1) पेड़ = तरु

(2) हवा = अनिल

(3) पहाड़ = पर्वत

(4) राहगीर = यात्री।

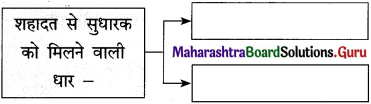

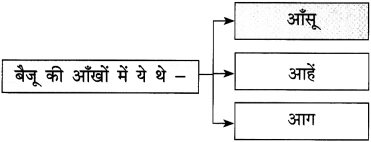

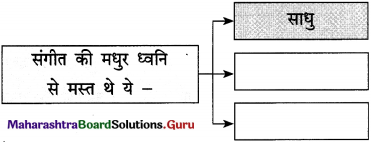

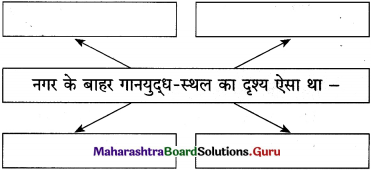

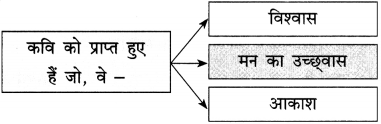

पद्यांश क्र. 3

प्रश्न. निम्नलिखित पद्यांश पढ़कर दी गई सूचनाओं के अनुसार कृतियाँ कीजिए :

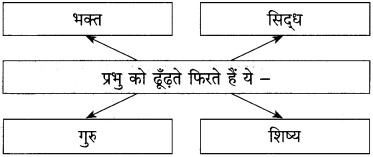

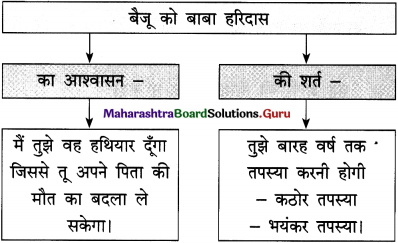

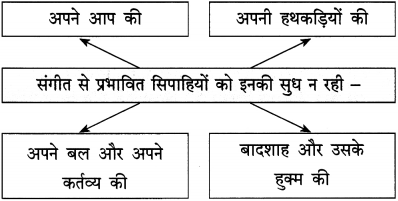

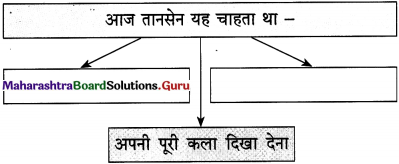

कृति 1 : (आकलन)

प्रश्न 1.

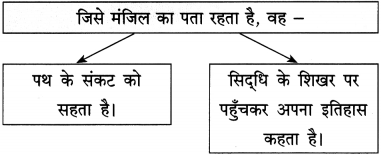

कविता की पंक्तियों को उचित क्रमानुसार लिखकर प्रवाह तख्ता पूर्ण कीजिए:

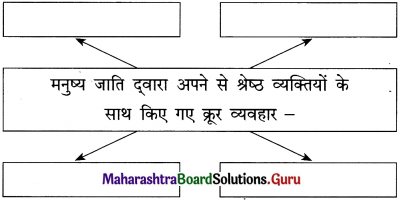

(1) वृक्ष के पास ऐसी एक भी चीज नहीं है

(2) हमेशा देता आया है मनुष्य का साथ

(3) हमारे लिए ही तो है पेड़ की हर एक चीज

(4) सभी के लिए देता है पुष्पों की सौगात

उत्तर :

(1) हमारे लिए ही तो है पेड़ की हर एक चीज

(2) सभी के लिए देता है पुष्पों की सौगात

(3) हमेशा देता आया है मनुष्य का साथ

(4) वृक्ष के पास ऐसी एक भी चीज नहीं है

![]()

कृति 2 : (शब्द संपदा)

प्रश्न 1.

निम्नलिखित शब्दों के भिन्न अर्थों को वाक्यों द्वारा स्पष्ट कीजिए :

(1) जड़

(2) तना

(3) फल।

उत्तर :

(1) जड़ :

- अर्थ : वृक्ष का मूल।

वाक्य : वृक्ष अपनी जड़ के द्वारा धरती से पोषक तत्त्व ग्रहण करता है। - अर्थ : मूर्ख।

वाक्य : मनीश को दर्शन की बातें क्या समझ आएँगी, वह है तो बिलकुल जड़ है।

(2) तना :

- अर्थ : पेड़ का जमीन से ऊपर का मोटा भाग।

वाक्य : तने के कारण ही पेड़ खड़ा रहता है। - अर्थ : अकड़ा हुआ।

वाक्य : धीरज जाने अपने आपको क्या समझता है, हर समय तना रहता है।

(3) फल :

- अर्थ : खाने का फल।

वाक्य : हमें अपने भोजन में मौसमी फलों का समावेश अवश्य करना चाहिए। - अर्थ : परिणाम।

वाक्य : परीक्षा-फल के दिन मंदिरों में छात्र-छात्राओं की भीड़ लग जाती है।

प्रश्न 2.

पद्यांश में प्रयुक्त विलोम शब्दों की जोड़ियों को वाक्य में प्रयोग कीजिए :

(1) ……………………………… वाक्य :

(2) ……………………………… वाक्य :

उत्तर :

- सुबह-शाम।

वाक्य : मेरी माँ सुबह-शाम नियमपूर्वक मंदिर जाती है। - दिन-रात।

वाक्य : नेहा ने मेडिकल की प्रवेश परीक्षा की तैयारी के लिए दिन-रात एक कर दिया।

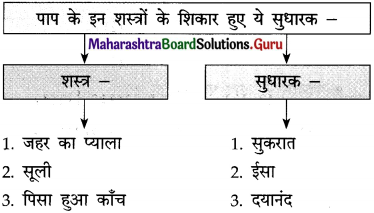

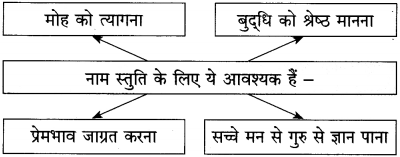

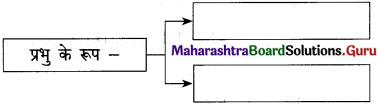

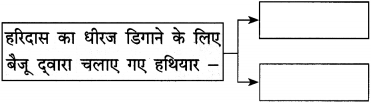

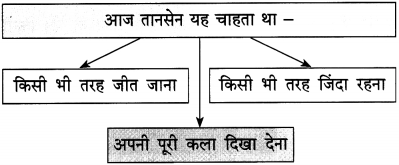

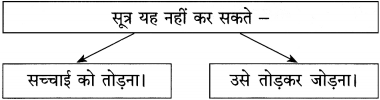

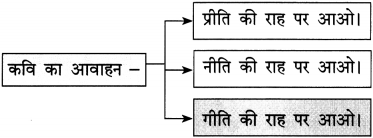

रसास्वादन मुद्दों के आधार पर

कृतिपत्रिका के प्रश्न 2 (इ) के लिए

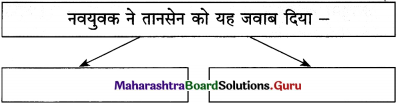

प्रश्न 1.

निम्नलिखित मुद्दो के आधार पर पेड़ होने का अर्थ’ कविता का रसास्वादन कीजिए :

उत्तर :

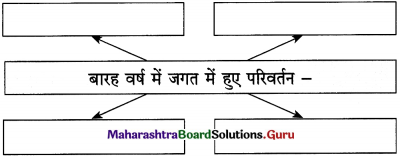

(1) रचना का शीर्षक : पेड़ होने का अर्थ।

(2) रचनाकार : डॉ. मुकेश गौतम।

(3) कविता की केंद्रीय कल्पना : सब कुछ दूसरों को देकर जीवन की सार्थकता सिद्ध करना। पेड़ मनुष्य का बहुत बड़ा शिक्षक है। पेड़ मनुष्य का हौसला बढ़ाता है। वह उसे समाज के प्रति जिम्मेदारी का निर्वाह करना सिखाता है। पेड़ ने भारतीय संस्कृति को जीवित रखा है और उसने मानव को संस्कारशील बनाया है।

![]()

(4) रस-अलंकार :

(5) प्रतीक विधान : कवि ने पेड़ को परोपकार के लिए अपना सर्वस्व न्योछावर करते हुए दर्शाया है। कवि ने इस तरह के महान त्यागी के लिए महर्षि दधीचि जैसे महान दाता तथा संत का प्रतीक के रूप में सटीक उपयोग किया है।

(6) कल्पना : पेड़ आदि काल से मनुष्य का सबसे बड़ा शिक्षक, उसका हौसला बढ़ाने वाला तथा समाज के प्रति उसको अपनी जिम्मेदारियाँ निभाने का बोध कराने वाला रहा है। उसने भारतीय संस्कृति को जीवित रखने और मनुष्य को संस्कारशील बनाने का काम किया है।

(7) पसंद की पंक्तियाँ तथा प्रभाव : कविता की पसंद की पंक्तियाँ इस प्रकार हैं :

राह में गिरा देता है फूल,

और करता है इशारा उसे आगे बढ़ने का।

(8) कविता पसंद आने का कारण : प्रस्तुत कविता में कवि ने पेड़ के माध्यम से मनुष्य को मानवता, परोपकार जैसे मानवोचित गुणों की प्रेरणा दी है।

अलंकार

प्रश्न 1.

निम्नलिखित काव्य पंक्तियों में निहित अलंकार पहचानकर उसका नाम लिखिए :

(1) चरन-कमल बंदी हरिराई।

(2) पीपर पात सरिस मन डोला।

(3) हनुमान की पूँछ में लगन न पाई आग।

लंका सगरी जल गई, गए निसाचर भाग।

उत्तर :

(1) रूपक अलंकार।

(2) उपमा अलंकार।

(3) अतिशयोक्ति अलंकार।

रस

प्रश्न 1.

निम्नलिखित काव्य पंक्तियों में निहित रस पहचानकर उसका नाम लिखिए :

(1) अखिल भुवन चर, अचर सब, हरि मुख में लख मातु।

चकित भई, गद्गद वचन, विकसित दृग पुलकातु।

(2) सुनहूँ राम जेहि शिवधनु तोरा।

सहसबाहु सम सो रिपु मोरा।

(3) मेरे तो गिरधर गोपाल, दूसरो न कोई।

जाके सिर मोर मुकुट, मेरो पति सोई।

उत्तर :

(1) अद्भुत रस

(2) रौद्र रस

(3) शांत रस।

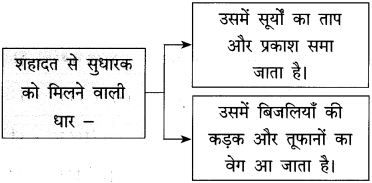

मुहावरे

प्रश्न 1.

निम्नलिखित मुहावरों के अर्थ लिखकर वाक्य में प्रयोग कीजिए :

(1) आसमान पर थूकना

अर्थ : अशोभनीय कार्य करना।

वाक्य : जिनके माता-पिता अपने बच्चों को अच्छे संस्कार नहीं देते, उनके बच्चे आसमान पर थूकने वाले हों, तो ताज्जुब नहीं।

![]()

(2) उल्टी गंगा बहाना

अर्थ : उल्टा काम करना।

वाक्य : जब देखो तब ये सज्जन उल्टी गंगा ही बहाते हैं।

(3) एक लाठी से हाँकना

अर्थ : सबके साथ समान व्यवहार करना।

वाक्य : कुछ लोग अच्छे-बुरे सबको एक ही लाठी से हाँकने की कोशिश करते हैं।

(4) चार चाँद लगाना

अर्थ : शोभा बढ़ाना।

वाक्य : उस विद्वान की शालीनता उनके व्यक्तित्व में चार चाँद लगा रही थी।

(5) कोल्हू का बैल

अर्थ : बहुत परिश्रम करने वाला।

वाक्य : मुनीम जी की बात और है, वे तो कोल्हू के बैल

(6) कौड़ी-कौड़ी का मोहताज

अर्थ : अत्यंत निर्धन होना।

वाक्य : गनेश शेठ अपने जमाने में इस बाजार के सबसे बड़े सेठ थे, पर उनके बेटे ऐसे नालायक निकले कि आज वे कौड़ी-कौड़ी के मोहताज हो गए हैं।

काल परिवर्तन

प्रश्न 1.

निम्नलिखित वाक्यों को कोष्ठक में सूचित काल में परिवर्तन कीजिए :

(1) कवि पेड़ को देख रहा था। (सामान्य भूतकाल)

(2) पेड़ सभी का स्वागत करता है। (अपूर्ण वर्तमानकाल)

(3) किशोरी का पत्र पाकर खुशी हुई। (सामान्य भविष्यकाल)

उत्तर :

(1) कवि ने पेड़ को देखा।

(2) पेड़ सभी का स्वागत कर रहा है।

(3) किशोरी का पत्र पाकर खुशी होगी।

वाक्य शुद्धिकरण

प्रश्न 1.

निम्नलिखित वाक्य शुद्ध करके लिखिए :

(1) मनुश्य पेड़ जितना बड़ा कबी नहीं हो सकता।

(2) पेड़ पर चहचाते हुए चिड़िया के बच्चों की घोंसला है।

(3) ओझोन गैस मानव स्वास्थ के लिए हानिकारक होती है।

उत्तर :

(1) मनुष्य पेड़ जितना बड़ा कभी नहीं हो सकता।

(2) पेड़ पर चहचहाते हुए चिड़िया के बच्चों का घोंसला है।

(3) ओजोन गैस मानव स्वास्थ्य के लिए हानिकारक होती है।

पेड़ होने का अर्थ Summary in Hindi

पेड़ होने का अर्थ कवि का परिचय

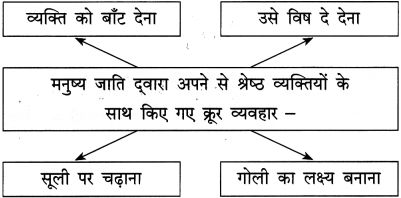

कवि का नाम : डॉ. मुकेश गौतम। (जन्म 1 जुलाई, 1970.)

पेड़ होने का अर्थ कवि परिचय : डॉ. मुकेश गौतम ने आधुनिक कवियों में अपनी विशिष्ट पहचान बनाई है। आज के मनुष्य की समस्याएँ और प्रकृति के साथ होने वाला क्रूर अत्याचार आपकी कविता में प्रखरता से उभरता है। सामाजिक सरोकार की भावना आपके काव्य का मुख्य स्वर है।

प्रमुख कृतियाँ : अपनों के बीच, सतह और शिखर, सच्चाइयों के रू-ब-रू, वृक्षों के हक में, लगातार कविता, प्रेम समर्थक हैं पेड़, इसकी क्या जरूरत थी (कविता संग्रह) आदि।

![]()

विशेषता : आधुनिक भावबोध की सहज-सीधे रूप में अभिव्यक्ति। हास्य-व्यंग्य का सफल मंचन। भावों और विचारों का प्रभावशाली ढंग से संप्रेषण।

विधा : नई कविता

पेड़ होने का अर्थ टिप्पणियाँ

दधीचि : दधीचि एक महान ऋषि थे। कहा जाता है कि एक बार वृत्रासुर नामक राक्षस देवलोक पर अधिकार करने के लिए सभी देवताओं को तरह-तरह से परेशान कर रहा था। उसके अत्याचार बढ़ते ही जाते थे। ब्रह्मा जी ने देवताओं को बताया कि वृत्रासुर को मारने का एक ही उपाय है। वह है पृथ्वीवासी आत्म-त्यागी महर्षि दधीचि की अस्थियों से बना वज्र। देवराज इंद्र के कहने पर महर्षि ने बिना किसी हिचकिचाहट के उसी समय समाधि लगाई और अपनी देह त्याग दी।

विषय प्रवेश : पेड़ और मनुष्य का नाता आदि काल से रहा है। पेड़ मनुष्ये का बहुत बड़ा शिक्षक है। पेड़ मनुष्य का हौसला बढ़ाता है, समाज के प्रति जिम्मेदारी का निर्वाह करना सिखाता है। पेड़ ने भारतीय संस्कृति को जीवित रखा है और मानव को संस्कारशील बनाया है।

पेड़ होने का अर्थ कविता का सरल अर्थ

(1) आदमी पेड़ नहीं हो सकता ………………………………………….. हालात से लड़ता है।

प्रस्तुत कविता में कवि पेड़ के माध्यम से मनुष्य को मानवता, परोपकार आदि मानवोचित गुणों की प्रेरणा दे रहा है। कवि अपने कमरे में खिड़की के पास बैठा है। वह बाहर खड़े पेड़ को देखता है तो पेड़ का हौसला, उसकी दान की प्रवृत्ति कवि को सोचने पर विवश कर देती है। अनगिनत विचार उसके मस्तिष्क में उठने लगते हैं। कवि कहते हैं, मनुष्य कितना भी बड़ा क्यों हो जाए, वह पेड़ जैसा कभी नहीं बन सकता।

पेड़ के हौसले से मनुष्य को सीख लेनी चाहिए। पेड़ जबसे जन्म लेता है अर्थात जब वह कोमल-सा अंकुर होता है, तब से जीवनपर्यंत किसी का आश्रय वह नहीं लेता। कैसा भी आँधी-तूफान आए या सामने कोई कैसा भी बड़े-से-बड़ा, प्रतापी राजा आ जाए, पेड़ कभी किसी के सामने नहीं झुकता।

जब तक पेड़ जीवित रहता है, जैसी भी परिस्थिति हो, एक ही स्थान पर खड़े-खड़े उसका डटकर सामना करता है। जबकि मनुष्य का स्वभाव है कि शक्तिशाली व्यक्ति या स्वार्थपूर्ति करने वाले के पैरों में नाक रगड़ने से भी वह नहीं कतराता। साथ ही जरा-सी प्रतिकूल परिस्थिति आने पर या किसी कार्य में मनचाही सफलता न मिलने पर हौसला खो बैठता है।

![]()

(2) जहाँ भी खड़ा है ………………………………………….. पेड़ बहुत बड़ा हौसला है।

कवि कहते हैं, पेड़ जहाँ भी खड़ा हो, चाहे सड़क पर हो, किसी झील के किनारे हो या फिर पहाड़ के ऊपर हो, उसकी मनोस्थिति एक जैसी रहती है। पेड़ के सामने भेड़िया, बाघ जैसे हिंसक पशु आ जाएँ या शेर दहाड़ने लगे, पेड़ किसी से नहीं डरता। जबकि मनुष्य हिंसक पशु के सामने आने पर डर से ही मर जाता है। पेड़ मनुष्य के समान न कभी किसी की हत्या करता है, न ही आत्महत्या।

इसके विपरीत पेड़ थके हुए यात्रियों को ठंडी हवा देता है, शीतल छाया देता है। यही नहीं पेड़, राहगीरों के समक्ष पुष्प वर्षा करके मानो उन्हें अपनी राह पर आगे बढ़ते रहने की प्रेरणा देता है। पेड़ के समीप जो भी आता है, पेड़ सभी का स्वागत करता है। यात्री जब थकान उतरने के बाद पेड़ के नीचे से उठकर चल देते हैं, तो पेड़ सभी को विदा भी करता है। कवि कहते हैं कि गाँव के रास्ते में मुस्कुराता पेड़ जाने कबसे टेढ़ा खड़ा है।

पहले वह पेड़ टेढ़ा नहीं था। वह पूरी रात तेज तूफान का सामना करता रहा। पेड़ घायल हो गया, इसी के कारण टेढ़ा भी हो गया, परंतु उसने अपना हौसला नहीं छोड़ा। पेड़ की शाखों में एक घोंसले में चिड़िया के चहचहाते छोटे-छोटे बच्चे थे। सारी रात भयंकर तूफान चलते रहने के बाद भी पेड़ के हौसले के कारण वह छोटा-सा घोंसला सुरक्षित है। सचमुच पेड़ का हौसला बहुत बड़ा है।

(3) दाता है पेड़ ………………………………………….. पेड़ संत है, दधीचि है।

पेड़ बहुत बड़ा दाता है। पेड़ के फलों के गुणों से तो सभी परिचित हैं, परंतु इसके साथ ही पेड़ की जड़, तना, शाखाएँ हों या पत्ते, फूल और बीज, पेड़ का कोई भी भाग अनुपयोगी नहीं होता। मानव समाज में ऐसे भी लोग हैं, जो पेड़ को पूजते हैं। दूसरी ओर अपने स्वार्थ के लिए पेड़ पर कुल्हाड़ी चलाने वाले, उसे काटने वालों की भी कमी नहीं है। लेकिन पेड़ मनुष्य के किसी भी दुर्व्यवहार पर कभी भी आँसू नहीं गिराता।

![]()

मानव पेड़ पर कैसा भी अत्याचार क्यों न करे, पेड़ उससे कभी बदला लेने का नहीं सोचता। वह तो जीवन भर देता ही रहता है। हम श्वासोच्छ्वास के माध्यम से जो विषैली वायु बाहर छोड़ते हैं, पेड़ उसे स्वच्छ करके हमें स्वास्थ्यवर्धक वायु प्रदान करता है। पेड़ रोगों के लिए विभिन्न प्रकार की औषधियाँ देता है।

मनुष्य समाज में किसी की शवयात्रा हो या कोई शुभ कार्य, या फिर किसी की बारात, पेड़ सभी को सजावट के लिए पुष्पों की सौगात देता है। जब से सृष्टि का आरंभ हुआ है, अनादि काल से पेड़ हमेशा मनुष्य को देता ही आया है। पेड़ कवि को कागज, कलम तथा स्याही प्रदान करता है।

पेड़ वैद्य और हकीम को विभिन्न रोगों के लिए दवाएँ देता है। पेड़ शासन और प्रशासन के लोगों को कुरसी, मेज और आसन देता है। वास्तव में देखा जाए तो पेड़ की ऐसी कोई भी वस्तु नहीं है, जो मनुष्य के काम न आती हो। पेड़ संत के समान है, जो दूसरों को देते ही हैं, किसी से कुछ भी अपेक्षा नहीं रखते।

वास्तविकता तो यह है कि पेड़ दधीचि है। जिस प्रकार दधीचि ने देवताओं की रक्षा के लिए वज्रास्त्र बनाने के लिए जीते-जी अपनी अस्थियाँ भी दान कर दी थीं, उसी प्रकार पेड़ बिना किसी स्वार्थ के जीवन भर देता ही रहता है।

पेड़ होने का अर्थ शब्दार्थ

- ढूँठ = फूल-पत्ते विहीन सूखा पेड़

- सौगात = भेंट, उपहार

![]()

पेड़ होने का अर्थ टिप्पणी

- दधीचि : एक ऋषि जिन्होंने वृत्रासुर का वध करने हेतु अस्त्र बनाने के लिए इंद्र को अपनी हड्डियाँ दी थीं।

12th Commerce ka Hindi Book Pdf Maharashtra Board

- नवनिर्माण Class 12 Hindi Textbook Solutions

- निराला भाई Class 12 Hindi Textbook Solutions

- सच हम नहीं; सच तुम नहीं Class 12 Hindi Textbook Solutions

- आदर्श बदला Class 12 Hindi Textbook Solutions

- गुरुबानी Class 12 Hindi Textbook Solutions

- वृंद के दोहे Class 12 Hindi Textbook Solutions

- पाप के चार हथियार Class 12 Hindi Textbook Solutions

- पेड़ होने का अर्थ Class 12 Hindi Textbook Solutions

- सुनो किशोरी Class 12 Hindi Textbook Solutions