By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 10 Single Entry System students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 10 Single Entry System

Introduction-

On account of many factors such as incomplete knowledge of accounting principles, lack of experience of writing accounts, less staff,.shortage of finance, time factor, etc., small businessmen cannot adopt the scientific method of accounting to record their business transactions systematically in the separate set of books.

However, they record only a single aspect of every business transaction in their books to ascertain the result of business and to know the amount receivable from customers and amount payable to suppliers or lenders. They keep record of cash received, cash paid, cash sales, cash purchases, debtor’s account, creditor’s accounts, etc. Thus, any set of procedure adopted to ascertain business result is usually referred as Single entry system of accounting. Although single entry system of accounting.is suitable for small business, it suffers from many drawbacks.

Meaning And Definition of Single Entry Book Keeping System-

A system of book-keeping in which the accountant or the businessman records only one aspect of business transaction and ignores the other aspect is called ‘Single entry book keeping system’. Under single entry system of book keeping, only record of cash and personal accounts are maintained.

According to Kohler, single entry book-keeping refers to “a system of book-keeping in which as a rule only records of cash and of personal accounts are maintained, it is always incomplete double entry, varying with circumstances.”

According to this definitioft, under single entry system accountants or businessmen keep records of those transactions and accounts which they find absolutely necessary. Under this system cash accounts, debtor’s accounts and creditor’s accounts are maintained. The record of impersonal accounts such as real accounts and nominal accounts is not maintained under this system.

When businessmen or accountants adopt single entry book-keeping system, they calculate profit or loss made during the accounting year by any one of the following two methods viz. (i) Statement of Affairs methods and (ii) Conversion method.

![]()

Difference Between Single Entry System And Double Entry System-

Single Entry System:

- Meaning: A book keeping system in which only one aspect of every business transaction either debit or credit is recorded in the books of accounts is called ‘Single Entry System’.

- Nature : It is unscientific and incomplete system of accounting.

- Transactions Recorded: Under this system, records of only personal accounts of debtors and creditors and cash book are prepared and maintained.

- Suitability: It is suitable for small business organisations such as sole trading concerns and partnership firms.

- Arithmetical Accuracy: Under this system trial balance cannot be prepared to check arithmetical accuracy.

- Final Accounts: Under this system final accounts cannot be prepared. Instead statements of affairs and statement of profit or loss to find out business result and financial position.

- Authenticity: This system cannot be considered authentic and hence it is not accepted by the court of law.

- Cost: This system is relatively less expensive.

Double Entry System:

- Meaning: A book keeping system in which dual aspects of every business are systematically recorded in the books of accounts is called ‘Double Entry System’.

- Nature : It is more complete and scientific system of accounting.

- Transactions Recorded: Under this system, personal, nominal and real accounts including cash accounts are prepared and maintained.

- Suitability: It is suitable for all types of business organisations whether small or large scale.

- Arithmetical Accuracy: Under this system trial balance is prepared to find out arithmetical accuracy.

- Final Accounts: Under this system final accounts are prepared to find out true business result and financial position of the business.

- Authenticity:This System is considered authentic and hence it is accepted by the court of law.

- Cost: This system is relatively more expensive.

Statement of Affairs-

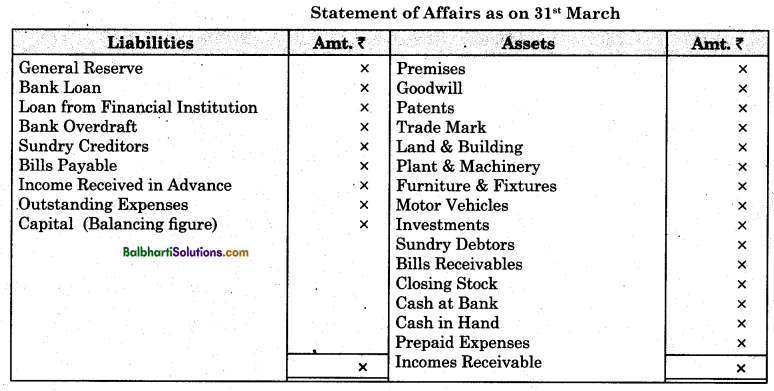

A list of all assets and liabilities prepared under single entry system to find out capital balance is called statement of affairs. It is just similar to Balance Sheet prepared under double entry system. On left hand side of this statement all liabilities are recorded and on the right hand side all assets are recorded. It is usually prepared to find out capital employed in the business.

Statement of affairs prepared on the basis of opening balances of assets and liabilities in the beginning of the accounting year is called opening statement ,

of affairs and a statement of affairs prepared on the basis of closing balances at the end of the year is called closing statement of affairs. From the opening statement of affairs, opening capital is ascertained and from closing statement of affairs capital at the end of year is ascertained. If capital at the end of the year exceeds the opening capital, there is a profit. If opening capital exceeds the capital at the end of the year, there will

be loss.

Proforma of Statement of Affairs :

Difference Between Balance Sheet And Statement of Affairs-

Balance Sheet:

- Meaning: A statement showing the position of assets and liabilities at their correct values at the end of the accounting year is called Balance Sheet.

- Objective : The objective of preparing balance sheet is to ascertain the financial position of the business.

- Accounting System: Balance Sheet is prepared under double entry book-keeping system.

- Value of Assets and Liabilities : In the balance sheet assets and liabilities are shown at their actual cost shown by the ledger.

- Capital: In the balance sheet, capital account balance is taken from ledger account.

- Reliability: As Balance Sheet is prepared by following the principle of double entry system, it is more reliable.

- Arithmetical accuracy: If balance sheet is tallied it proves that there is no arithmetical mistakes.

- Omission: Omission of any asset or liability can be easily trace out in case balance sheet does not tally.

Statement of Affairs:

- Meaning: A statement showing the position of assets and liabilities at their approximate or estimated value at the beginning or end of the accounting year is called ‘Statement of Affairs’.

- Objective : The objective of preparing statement of affairs is to find out capital invested in the business and thereby find out profit or loss of the business.

- Accounting System: Statement of affairs is prepared under single entry system.

- Value of Assets and Liabilities : In the statement of affairs assets and liabilities are shown at their estimated values.

- Capital: In the statement of affairs, capital fund is worked out by ascertained balancing figure.

- Reliability: As statement of affair is prepared on the basis of estimated amount, it is less reliable.

- Arithmetical accuracy: In the case of statement of affairs, there is no scope for finding out arithmetical accuracy.

- Omission: In case of statement of affairs omission of any asset or liability cannot be traced out.

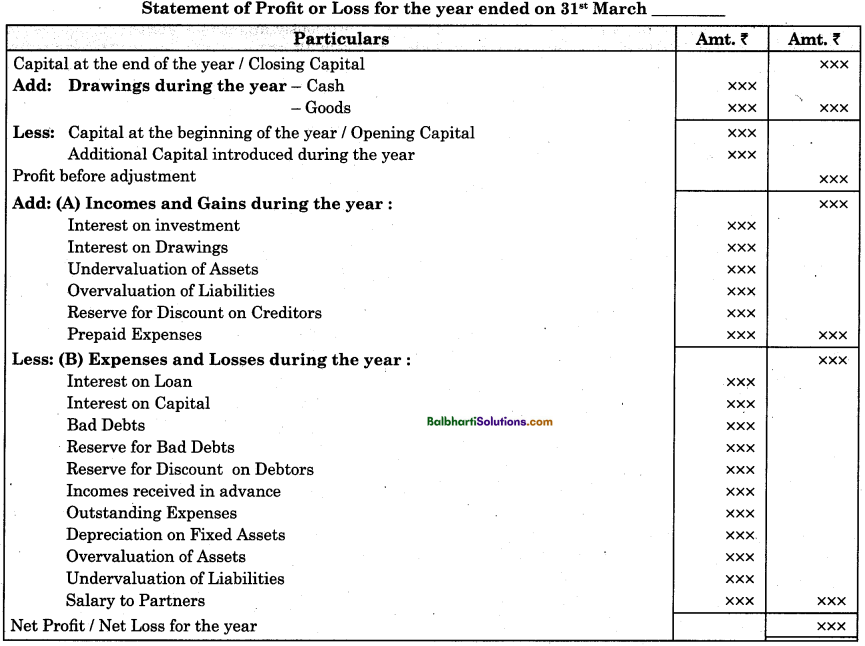

Statement of Profit or Loss-

Under single entry system financial position is ascertained by preparing statement of affairs. Similarly business result is ascertained by preparing statement of Profit or Loss.

Under single entry book keeping system, Profit or Loss of the business in a particular year is calculated by following one of the following two method viz.

(i) Net Worth Method and (ii) Conversion Method

(Please note that conversion method is not prescribed in XI syllabus)

Net Worth Method :

Under this method profit is calculated by deducting capital at the beginning of the year from the capital at the end of that accounting year. From the balancing figure amount of drawings made during the accounting year is added and addition made to capital if any is deducted. The balancing figure represents trading profit or profit before adjustments. From trading profit business expenses are deducted and business incomes are added to get net profit of the business. For this statement of Profit or Loss is prepared.

![]()

The statement prepared by the business organisation under single entry to find out profit earned or loss suffered is called statement of Profit or Loss. The following accounting items are considered in the Statement of Profit or Loss viz. Opening Capital, Capital at the end of the year, drawings made during the year, additional capital introduced during the year, interest on capital, interest on drawings, all business expenses and all business incomes.

Proforma of Profit or Loss :

[Note: If result comes positive there is profit and if result comes negative there is loss]

Additional Information (Adjustments):

Information in respect of unrecorded transactions or unrecorded accounting effects are called additional information or adjustments :

(1) Additional Capital : Amount of cash or any other asset brought into the business by the proprietor any time during the accounting year is called additional capital.

Additional capital is introduced into the business by the proprietor, it increases the amount of closing capital. Hence, in order to calculate the profit, additional capital is deducted from the Closing Capital.

(2) Drawings: Total amount of cash or any other business asset withdrawn by the proprietor from the business for self use or family use is called drawings. Due to withdrawal of funds or assets closing capital decreases. Hence the amount of drawings is added to Closing Capital.

(3) Depreciation: The reduction in the value of fixed assets due to it use, wear and tear, etc. is called depreciation. Depreciation is charged against profit. Hence the amount of depreciation is deducted from trading profit.

(4) Bad Debts : Irrecoverable amount from the debtor is called Bad debts. Bad debts is treated as business loss. Hence the amount of bad debts is deducted from trading profit.

(5) Reserve for Doubtful Debts (Provision for Bad and Doubtful Debts): The provision made for probable loss is called ‘Provision for Bad and Doubtful Debts’. The amount of Provision for Bad and Doubtful Debts is deducted from Trading Profit.

(6) Undervaluation of Assets : Assets which are undervalued previously and if they are brought to correct value, there will be increase in the value of concerned assets.

Since Capital = Assets – Liabilities.

Increase in the value of asset results into the capital gain and therefore such increase is to be added to trading profit.

(7) Overvaluation of Assets : Assets which are overvalued previously and if they are brought to correct value, there will be decrease in the value of the concerned assets. Decrease in the value is a loss and hence overvaluation i.e. decrease in the value of asset is to be deducted from the trading profit.

(8) Undervaluation of Liabilities: Liabilities which are undervalued previously and if they are to be brought to the correct value, there will be increase in the value of liabilities. Increase in the value of liabilities deduces the volume of profit and hence undervaluation of liabilities i.e. increase in the value of liabilities is deducted from the trading profit.

(9) Overvaluation of Liabilities : Liabilities which are overvalued previously and if they are brought to correct value, there will be decrease in the value of liabilities. Decrease in the value of liabilities is a gain to the business and hence overvaluation of liabilities i.e. decrease in the value of liabilities is to be added to trading profit.

(10) Interest on Loan : Amount borrowed by the business enterprises from the financial institutions including banks for productive purpose is called loan. Interest on loan required to be paid by the business enterprise to the lending institutions. While calculating interest on loan the period for which it is used is to be considered. Interest on loan is an expenditure and hence the amount interest is to be deducted from trading profit.

(11) Interest on Capital: Interest on capital changed by the proprietor is an expense of the business. Hence amount of interest is deducted from the trading profit. On opening balance of capital interest at specified rate is to be calculated for complete one year and interest on additional capital introduced into the business during the accounting year is to be calculated at specified rate for the proportionate period i.e. from the date of investment of additional capital to the 31st March of the accounting year. E.g..Capital as on 1st April 2019 is ₹ 2,50,000 and additional capital of ₹ 50,000 is introduced into the business on 1st August 2019. The rate of interest on capital is 12% p.a.

![]()

Interest on capital is calculated as follows:

- On opening balance of ₹ 2,50,000 @ 12% for 1 year = 2,50,000 x 1 x \(\frac{2}{100}\) = ₹ 30,000

- On additional capital of ₹ 50,000 @ 12% for 8 months = 50,000 x \(\frac{8}{12} \times \frac{12}{100}\) = ₹ 4,000

(i.e. from 1st August 2019 to 31st March 2020)

Total interest on capital = 30,000 + 4,000 = ₹ 34,000

(12) Interest on Drawings : Interest charged on the drawing is an income for the business enterprises. Hence, amount of interest is always added to trading profit. If the dates of drawings are given, then interest is to be charged at specified rate for proportionate period i.e. from the date of drawing to the end of that accounting year.

If the dates of drawings are not given, then interest at the specified rate is to be calculated for average period of 6 months.

(13) Outstanding / Unpaid Expenses: Expenses that are due for payment but not yet paid are called outstanding or unpaid expenses. The amount of outstanding or unpaid expenses is charged against Profit and Loss A/c and hence the amount of outstanding/unpaid expenses is deducted from the trading profit.

(14) Prepaid Expenses / Expenses paid in Advance: Expenses that are paid before they are due for payment are called prepaid expenses. The amount of prepaid expense is added to the trading profit.