By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 3 Journal students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 3 Journal

Introduction-

The businessman or accountant records all day-to-day business transactions in the books of account on the basis of supporting documents. The word ‘document’ means a piece of paper or booklet providing information, especially of an official or legal nature. Accordingly, a source document refers to the first document to record the transactions in the journal or subsidiary books of account. It is a first or original document on the basis of which information is recorded in, the different books of accounts. When we purchase machinery in cash for ₹ 50,000, we get the cash memo. Such a cash memo is a sources document.

Thus, cash memos, vouchers, debit and credit notes, pay-in-slip, receipts, withdrawal slips, inward and outward invoices, cheques, etc. are the different source documents, businessmen use in their day-to-day business transactions. Each and every accounting entry is supported by the relevant documentary evidence called ‘accounting documents’. Accounting documents provide a base for entering business transactions in the books of accounts.

Importance and Utility Of Accounting Documents-

- Accounting documents are useful for recording all business transactions into the books of accounts.

- Accounting documents help to record business transactions in the proper mode.

- Accounting documents can be kept physically in files or they can be stored in the software.

- Accounting documents can be used as legal evidence in a court of law.

- They are also required by the charity commissioner’s office.

- They are needed for payments of state government and local body authority.

Important Accounting Documents are Explained As Follows-

Voucher : A document that supports a payment made by the business is called voucher. It is a legal proof of certain amount money is paid to a person or party. The different types of vouchers prepared by the accountants, e.g. Cash voucher, Bank voucher, Purchase vouchers, Sales vouchers, Travel bills, Wage bill, Salary bill, etc. Vouchers are classified as internal voucher and external voucher.

- Internal voucher : The voucher which is prepared in the organisation by the accountant is called internal voucher. It is created by the accountant and singed by the payee. It is prepared when organisation cannot get receipt or any other legal proof for payment made, e.g. payment of taxi fare, auto fare, coolie charges, payment made to scavengers, etc.

- External voucher : The vouchers which are generated or prepared outside the business organisation are called external voucher. It is a document receipt from outside agency after making payments, e.g. receipt of electricity bill paid, tax invoice received from seller for purchase of goods, etc. Debit note, credit note, cash memo, etc. are called external voucher.

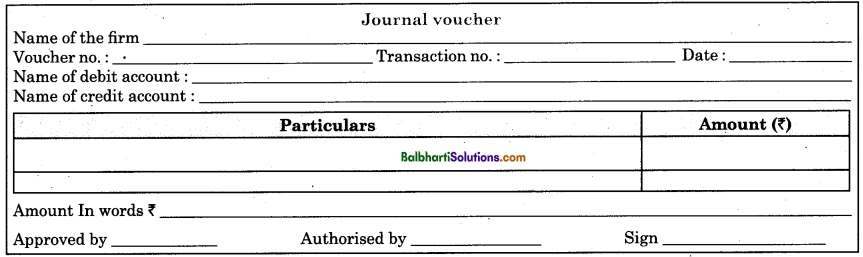

- Journal voucher : The vouchers on the basis of which business transactions are recorded in the journal book. The specimen of journal voucher is given below:

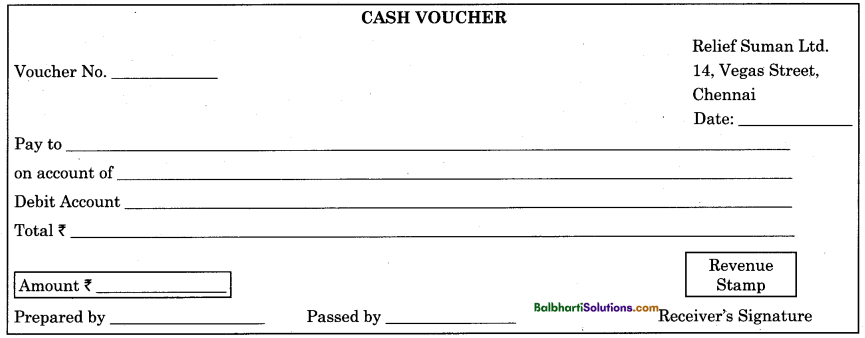

(iv) Cash voucher : The legal proof or evidence of cash receipts and cash payments is called cash voucher. Accounting document obtained from payee is also called cash voucher. Entries in the cash book are made on the basis of cash vouchers. The specimen of cash voucher is given below:

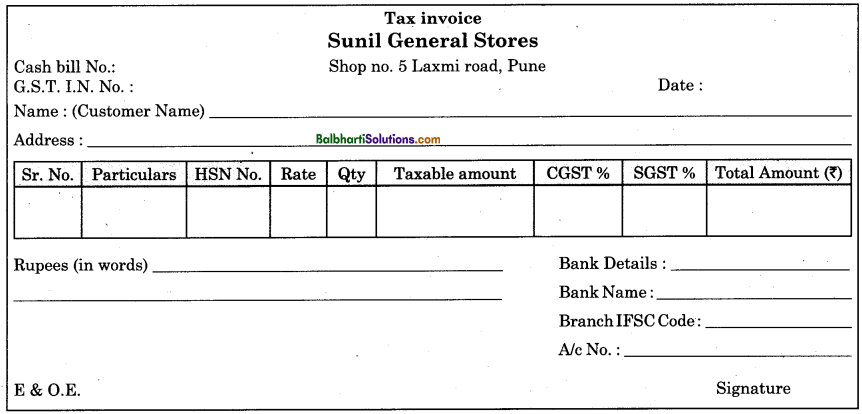

(v) Tax invoice : A document which is prepared by the seller to inform the buyer about the quantity of goods supplied rates and terms of payment, trade discount if any allowed, CGST and SGST charged on the goods supplied and total amount payable by the buyer is called Tax invoice. Tax invoice is considered by buyer as ‘Purchase invoice’ or ‘Inward invoice’. Same tax invoice is considered by seller as ‘Sales invoice’ or ‘Outward invoice’. Tax invoice is prepared and sent by seller to buyer after the goods are supplied to buyer. The buyer makes the entries in the purchase book on the basis of purchase invoice and the seller makes the entries in the sales book on the basis of sales invoice.

The specimen of Tax invoice is given below :

(vi) Credit Memo : When the goods are sold on credit the supplier of the goods issues a document called credit memo to the purchaser of goods. It is also known as ‘Bill’ or ‘Invoice’. The period of credit, date of payment, name of customer, address of the customer, etc. are mentioned on this document. Credit memos are usually printed and serially numbered by machine. Credit memo is prepared in duplicate. The second copy i.e. carbon copy is retained by the seller. On the basis of carbon copy of the credit memo entries in the books of seller are made. Credit memo is sent by the seller to the buyer. The buyer’s signature is obtained on the carbon copy. The entries made in the sales book are verified on the basis of credit memo.

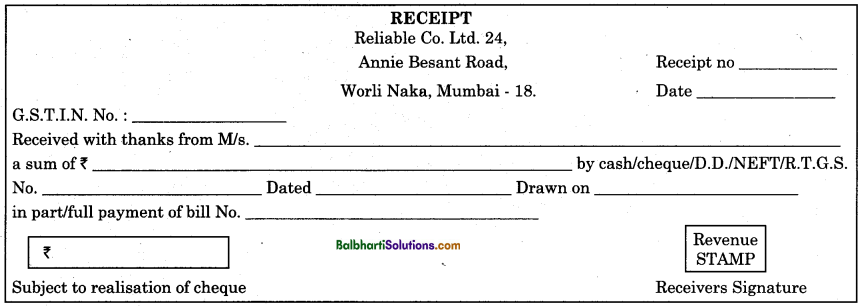

(vii) Receipt : A document issued by the receiver of money or creditor to acknowledge the receipt of cash or payment of debt is called a receipt. It serves as proof of payment. It is a written acknowledgement that one has received goods or money. It is issued by the receiver to the person who makes payment or gives money. Receipt is a main document on the basis of which the debit side or the receipts side of the cash book is written. The specimen of Receipt is given below:

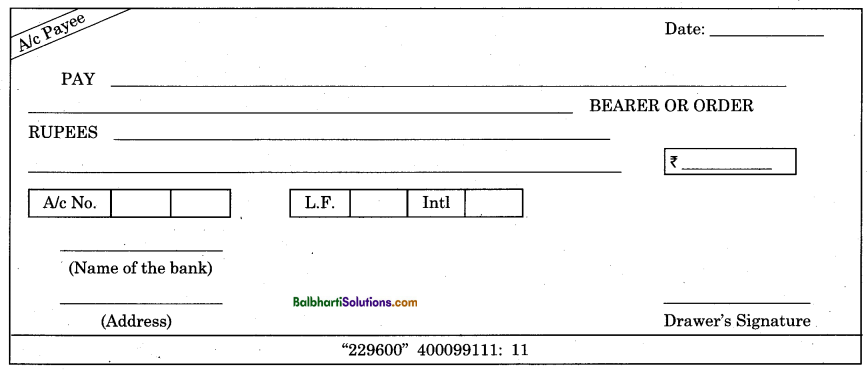

(viii) Cheque : A cheque is a document used by an account holder for withdrawing cash from the bank or for making payments to other people through the bank. A cheque book contains 10, 25, 50 or 100 blank cheques. Cheques are serially numbered. A cheque book is provided by the bank to account holders free of charge, if the account holder agrees to keep a minimum balance of ₹ 1,000/- in his account.

In legal language, a cheque is a written unconditional order of the account holder to his banker to pay a certain sum of money only to himself or to bearer or to the person named therein. The person to whom the amount of cheque is payable is called payee and the bank on whom the cheque is drawn is called the drawee bank, and account holder who issues the cheque is called the drawer.

A separate slip with the printed columns are attached at the end of the cheque book to write details regarding cheques issued.

The cheque may be classified as Bearer Cheque, Order Cheque and Crossed Cheque.

Contents : The cheque contains the following details:

- Name of the bank and its branch. The address of the branch. They are printed on the cheque.

- Date of banking transaction.

- Name of payee.

- Amount in words and in figures.

- Account No. / L.F.

- Signature of the Account holder.

- Cheque No.

- MICR No. / Code No. They are usually printed.

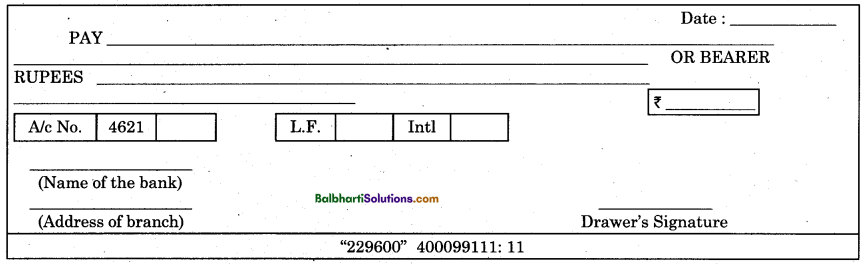

Specimen of cheque is given below:

(a) Bearer Cheque: Bearer means possessor. In case of bearer cheques, a bank makes immediate cash payment to the possessor of the bearer cheque on its presentation. For immediate withdrawal of cash, a bearer cheque is used by the account holder. A cheque on which instead of writing name of the payee, the word self is written, is called a bearer cheque. The bearer of a cheque has to make a signature on the back

of the bearer cheque before withdrawing money from the bank. While making cash payment, against bearer cheques a bank never makes inquiry whether the payee is a wrong doer or not. A bearer cheque is very dangerous, because, in case it is lost, the possessor, can easily obtain cash from the bank. A bearer cheque is as good as cash, because it can be encashed by any one at any time during banking hours.

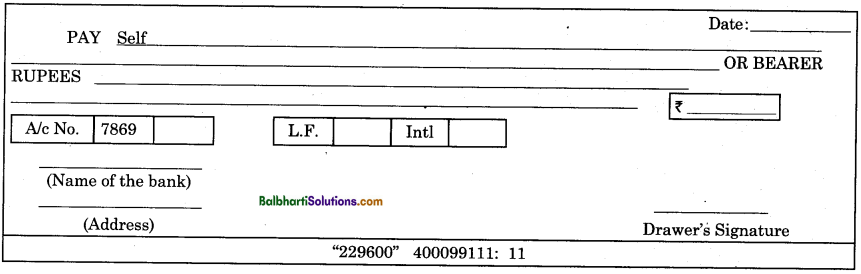

Specimen of bearer cheque is given below:

(b) Order Cheque : A cheque in which the account holder orders the bank to make payment to a person whose name appears on the cheque, is called an order cheque. In this type of cheque, word ‘bearer;’ after the name of payee is struck off and word ‘order’ is retained. An order cheque is safer than a bearer cheque. While making cash payments against order cheques, a bank makes inquiry whether the possessor of the order cheque is the right person or not.

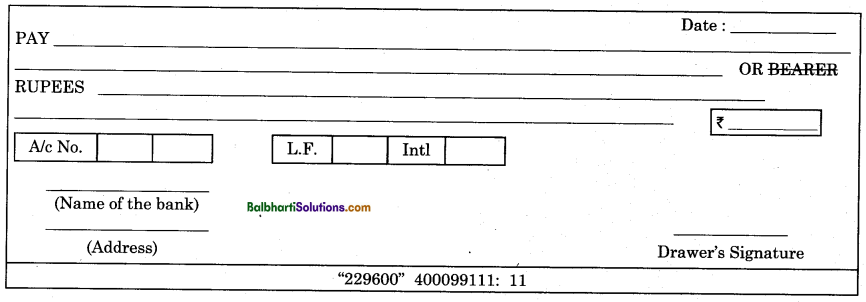

Specimen of order cheque is given below :

(c) Crossed Cheque :

Crossed cheque is a cheque on which two parallel transverse lines are drawn on the face of the cheque at the left hand top corner with some words or without any word. When the crossed cheque is presented for payment it is not paid in cash to payee or possessor, but it is credited to the payee’s account in the bank and after two or three days, payee i.e. account holder is permitted to withdraw the amount from the bank if it is cleared and not dishonoured. This type of cheque is more safe than any other. If a crossed cheque is lost, a wrong doer cannot obtain payment from the bank. The bank never makes immediate cash payment on counter on presentation of a crossed cheque. Crossed cheques are sent to distant places by ordinary post safely.

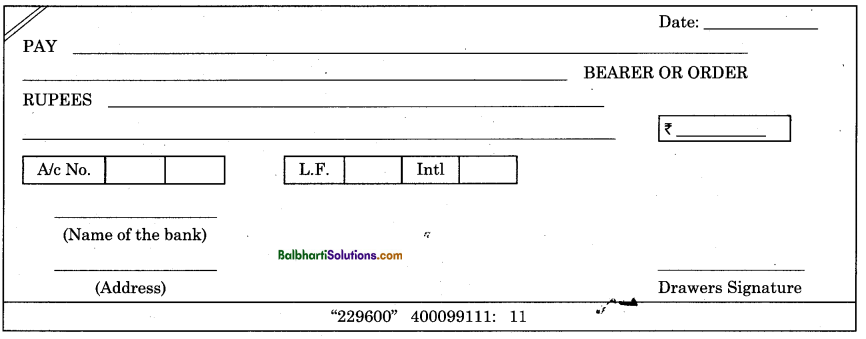

Specimen of crossed cheque is given below :

(d) Account Payee Cheque :

A cheque is said to be A/c payee crossed cheque, when the drawer inserts the words ‘A/c payee’ in between the two parallel transverse lines of a crossed cheque. When the drawer of a cheque desires to pay the amount of a cheque to the banker who has an account of the payee for the benefit of the payee; he issues an A/c payee crossed cheque. In this type of crossing, there is direction to the collecting banker to collect the amount of the cheque for the benefit of the payee. This type of crossing prevents further negotiability of a cheque.

Specimen of an A/c payee crossed cheque is given below:

Journal-

Meaning:

Journal is the most important book of accounts, in which business transactions are systematically recorded.

It is a book of daily records. As and when a businessman completes a business transaction, he records it in

the rough or waste book in a short and summarised form. Then this business information from the rough

book is recorded in a journal. Thus, business transactions are recorded in a journal on the basis of the rough

book or waste, book.

The word bJournal is derived from the French word ‘jour’, which means ‘a day’. Accordingly, journal is a book of daily records. Journal is one of main books of original entry in which transactions are recorded for

the first time, from source documents. This is also known as the book of original entry or first entry or

primary entry. Business transactions are first entered in a journal and subsequently they are posted to another account book called ledger. Journal is a book of account in which all types of day to day business transactions are recorded in chronological order (i.e. datewise). In a journal, business transactions are recorded systematically and in summarised form by following the rule of debit and credit.

According to L. C. Cropper, “A journal is a book, employed to classify or sort out transactions in a form convenient for their subsequent entry in the ledger. ”

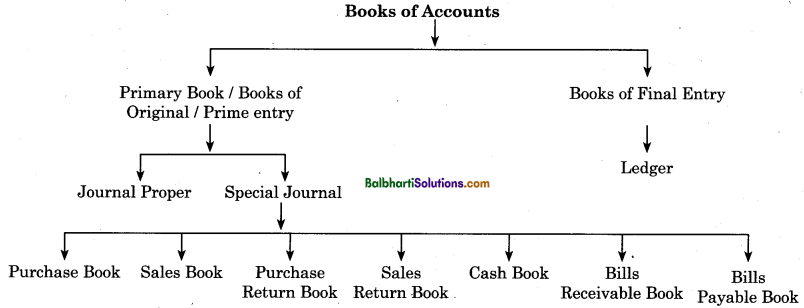

Generally, the following Books of Accounts are maintained by a businessman for recording the business transactions.

(ii) JOURNAL (Definition) :

- According to a Dictionary for Accountant written by Eric Kohler – “A Journal is the book of original entry in which are recorded transaction not provided for in specialised journals. ”

- “Journal is a book of original entry or prime entry in which all day to day transactions of business are recorded first in chronological order firstly in debit and credit form in a systematic manner. ”

(iii) IMPORTANCE OF JOURNAL :

The importance of a journal is explained as below:

- A journal is very important from the business point of view as it creates complete, preliminary and basic records of accounting transactions.

- In a journal business transactions are recorded in chronological order which is useful for easy reference in the future.

- Information recorded in the journal serves as a proof or evidence which can be used to defend the suit filed against the business concern or to prove claims in the court of law.

- Information recorded in the journal provides the base for ledger posting.

- It provides a base for cross checking of accounting entries posted in the various ledger accounts.

- It maintains the detail records of each transaction in the form of narration which is written immediately after passing the accounting entry.

- It provides the base for advanced accounting work and helps in preparation of final accounts.

- Arithmetical accuracy of the entries is ensured when the totals of debit and credit amount columns agree.

(iv) Utility of Journal :

Utility means usefulness. Journal is useful to different parties in different ways. The utility of a journal is explained as below:

- The journal as an account book is useful to the businessmen because it provides complete, detailed, datewise and accurate records of business transactions to businessmen as and when they need.

- The journal creates permanent records of business transactions which will be useful to businessmen in future.

- In a journal, business information is recorded in chronological order i.e. datewise systematically for easy reference.

- The business information in a journal is written on the basis of the waste book and different source documents systematically. Explanation of business transaction is also written just below the entry for a better understanding of the nature of business transactions.

- By referring to the Ledger Folio column in a journal, a businessman can easily refer to the position of that account in the ledger.

- On the basis of recorded business information in journal, ledger posting or filling of ledger can be done easily and at a convenient time.

- Business information which is recorded chronologically in a journal serves as valuable evidence in the court of law. The court of law recognizes a journal as an important evidence while proving or disproving the business claims. If insured goods are lost by fire, the insurance company or court of law determines the claim amount on the basis of information noted in the journal.

- With the help of journal and ledger, cross checking of business transaction is possible and bogus entries if at all passed can be easily found out.

(v) Specimen Form of the Journal :

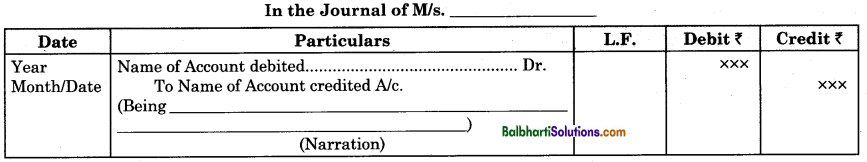

(a) Specimen form of the journal is given below:

(b) Significance and explanation of columns provided in the journal :

(1) Date column: In this column of the journal, the date of transaction is written. Date of transaction is written in order of year, month and date. For example, 1st July, 1997 is written as 1997 July 1st.

(2) Particulars column: In the particulars column of the journal, the accounting entry is written in summarised form of debit and credit. On the first line account debited is written. The word ‘Dr’ is written at the right end of particular column or the same line of account debited. On the second line account credited is written with a prefix the word ‘To’ after leaving short space from the date column. Just below this accounting entry narration i.e. explanation of business transaction, is written in brackets. Narration begins with the word “Being”.

(3) Ledger Folio No. Column : In the Ledger Folio No. (L.F. No.) column of the journal, the page number of s

the ledger on which the journal entry is posted, is recorded. The page number of the ledger is recorded in ,

red ink for easy reference. By referring to the ledger page as indicated in the journal under L.F. No. column, businessman can easily ascertain the exact financial position of that account.

(4) Debit amount and Credit amount columns : In the journal, the fourth and fifth columns are provided

for debit amount and credit amount respectively. In those columns, amounts of business transactions are entered, in figures.

Totalling (Casting) of Journal: At the end of each page of the journal, the total of the amounts recorded ‘

in Debit column and Credit column is done to check arithmetical accuracy of the amount recorded in debit ‘

and credit columns of the journal. The total of both the columns must agree with each other. This totals are again recorded on the next page in the beginning as total brought forward from the previous page. On the

last page of journal ‘Grand Total’ is cast.

(vi) Journalisation:

(a) Meaning of Journalisation : Journalisation refers to recording business transactions systematically and in summarised form in the journal. In other words, journalisation means a process of entering two fold effects of business transactions –

in the summarised form of debit and credit in the journal.

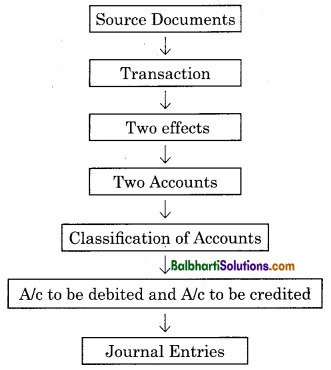

(b) Steps to be taken for journalisation of business transactions are discussed below:

- Read the given business transaction, understand it and find out the different accounts involved in it.

- As per nature and types of those accounts, apply rules of journalisation for giving debit and credit effects to those accounts.

- Record date of business transaction in the date column and account to be debited on first line and account to be credited on the second line in the particulars column of the journal.

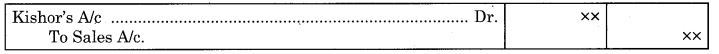

- The word Debit in abbreviation is written as ‘Dr’, and the same letters are written against the name of the account debited. The word ‘To’ is written preceding to the name of account credited. For example, the entry for credit sale of goods to Kishor is recorded in the journal under particulars coloumn as:

- Enter the amount of business, transaction in debit column and credit column of the journal. Draft the narration in simple and short words.

- A blank line should be drawn or left before writing the next entry in the particulars column of the journal.

- L.F. (Ledger Folio) i.e. the page on which the particular account is opened in ledger is stated under the LF. column for easy reference.

Steps in journalisation :

(vii) Goods Account : In the books of account, Goods Account does not appear. It is usually classified as Purchase A/c, Return Outward A/c (Purchase Return A/c), Sales A/c, Return Inwards A/c (Sales Return A/c), Goods destroyed by Fire A/c, Goods distributed as free samples, Goods withdrawn by the Proprietor’s A/c, Goods damaged or Lost in Transit A/c, etc.

Purchases are of two types viz. Cash Purchases and Credit Purchases. Similarly Sales are of two types viz. Cash Sales and Credit Sales.

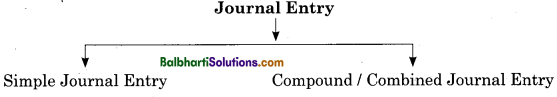

(viii) Types of Journal Entry :

The different types of journal entries are shown in the following chart:

The different types of journal entries are explained below:

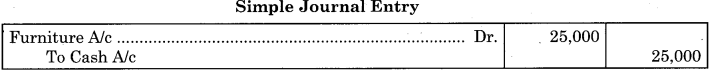

(a) Simple Journal Entry : A journal entry in which only two accounts are affected of which one account is debited and the other account is credited is called simple journal entry. In a simple entry, one account is always debited and othei account is always credited.

Example of simple jourr al entry is given below:

Purchase furniture for ₹ 25,000.

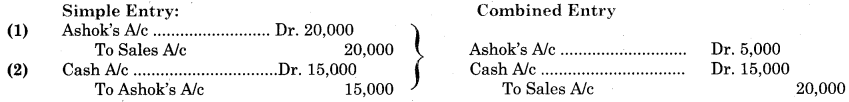

(b) Combined Journal Entry: Journal entry may be classified as simple journal entry and compound / combined journal entry. A journal entry which contains more than one debit and more than one credit or both is called combined or compound journal entry. In a combined journal entry: (i) one account is debited and more than one account are credited or (ii) more than one account are debited and one account is credited or (iii) more than one account are debited and more than one account are credited.

Illustration of combined entry is shown below :

(c) Opening Entry: The combined journal entry which is passed in the books of accounts in the beginning of the accounting year to record the balances of all assets and liabilities of the business carried forward from the last Balance Sheet is called opening entry. In the Balance Sheet, balancing value of assets, liabilities and capital of the business enterprise on the last day of the financial year are recorded. In the beginning of the next financial year, new books of accounts are opened and balances of assets, liabilities and capital account recorded in the previous balance sheet are brought forward. The positive difference between account debited and account credited in the opening entry is treated as capital fund of the proprietor. Thus, in the beginning of the year capital fund is ascertained by deducting all liabilities from all the assets. In the form of equation.

Capital = Total Assets – Total Liabilities

GST-

(i) Meaning : GST is the abbreviation of Goods and Service Tax. Before the application of GST every state used to impose variety of taxes at different stages of trading. The different taxes which existed before were: Excise duty, Custom duty, VAT i.e. Value Added Tax, Entertainment Tax, Central Sales Tax, Octroi, etc. Now all these taxes are brought under one head called GST. GST is also called One nation, one tax, one market. GST is implemented with effect from 1st July, 2017.

In the tax invoice for Goods there is Harmonised System of Nomenclature Code (HSN) whereas in the tax invoice for services there is Service Accounting Code (SAC).

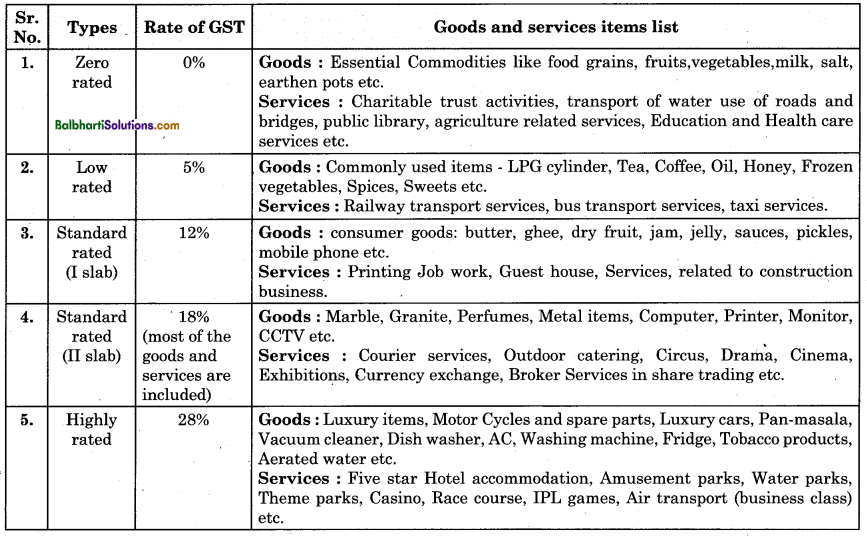

The chart showing goods and services and Rate of GST applicable is given below :

Note :

(1) The rates and types of GST are as prescribed by the government. GST rates are subject to change. Electricity, petrol, diesel etc are not under purview of GST.

(2) IGST means Integrated Goods and Service Tax. This is one of the three categories under Goods and service Tax (CGST, IGST and SGST) with concept of‘One Tax One Nation’.

IGST falls under integrated Goods of Service Tax Act 2017.

IGST is charged when movement of goods and services take place from one state to another.

Discount-

Discount is a concession given in monetary term by one trader to another trader for purchase of large quantity or for quick repayment. There are two types of discount viz.

(i) Trade discount and (ii) Cash discount.

(i) Trade Discount: It is a discount given by one trader to another trader like manufacturer to wholesaler or wholesaler to retailer to induce the later to purchase a large quantity of goods. It is given for credit transaction also. It is deducted from invoice price of goods and not recorded in the books of account, e.g. Sold goods to Ravi for ₹ 1,000 on 10% Trade discount.

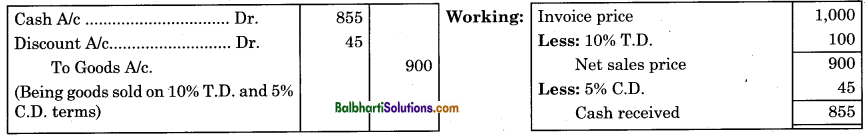

(ii) Cash Discount: It is a discount given by the seller to the purchaser for quick cash payment. It is given or received for cash transaction and cash payment only. It is calculated after deducting trade discount i.e. on the net price and recorded in the journal by means of entry, e.g. Sold goods to Ravi for ₹ 1,000 on 10% T.D. and 5% C.D. terms and cash paid.

Distinguish Between Trade Discount And Cash Discount-

Trade Discount Cash Discount:

- It is given for cash as well as credit transactions.

- It is calculated on the gross price i.e. invoice price.

- It is calculated before cash discount.

- It is deducted from the price and not recorded in the books of account.

- It is given for large purchases to encourage a buyer to buy more and more quantities.

Cash Discount:

- It is given for cash transactions only.

- It is calculated on net price.

- It is calculated after trade discount.

- It is recorded in the books of account.

- It is given for quick payment to induce the buyer to make quick payment.