By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 4 Ledger students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 4 Ledger

Meaning And Definition of Ledger-

(i) Meaning : Ledger is another important and principal book of accounts in which a businessman keeps individual records of persons, properties, expenses, incomes, gains and losses. It is the end point of entries made in the journal, or subsidiary books. Ledger may be in the form of a bound register or cards or separate sheets may be attached and maintained in a loose leaf binder. For every person with whom the business keep dealings, a separate account is prepared in the ledger. Similarly, a separate account is maintained in the ledger for each kind of assets, expenses, losses and gains.

As and when business transactions occur, they are first recorded in the journal and subsequently those recorded entries from journal are transferred and posted to the respective account in the ledger. Each ledger account is totalled at the end of the accounting period. This book contains many pages and each page is called ledger folio. The relationship between the business and a particular account on given date can be ascertained only from the ledger. For example, if a businessman wants to know on a particular date the amount due from a certain customer or debtor, it can be known easily only from the ledger. Various transactions pertaining to different dates of a particular account may be spreaded over in the journal on various pages but in the ledger they are found on one page.

Ledger is also called as book of final entry. The word ‘Ledger’ is originated from the Latin word ‘Ledger’ which means ‘to contain.’ Ledger is the collection of all the account. Ledger contains all the account opened and operated.

(ii) Definition: According to S.P. Jain’s and K.L. Narang’s Advanced Accountancy,

“A Ledger Account may be defined as a summary statement of all the transactions relating to persons, assets, expenses and revenues, which have to be taken place during a given period of time and show their net effect.” According to the Oxford Dictionary, ledger is the main record of the accounts of a business, traditionally, a ledger was a large book with separate pages for each account. In modern systems ledger may consist of separate cards or computer records.

![]()

Importance of Ledger-

Importance of Ledger is explained as follows :

- Ledger is useful for maintaining individual records of person with whom the business keep dealings.

- It keeps records of every item of properties, expenses, incomes, gains and losses.

- Amount due from various debtors can be known easily and quickly from the ledger. This will help the businessman to send reminders to recover the outstanding amount due from the debtors.

- Amount due to suppliers or creditors can be known easily and quickly to make timely payments to gain their confidence.

- Trial balance can be prepared easily on the basis of balances ascertained from the ledger accounts. Therefore ledger is necessary for preparation of trial balance.

- It is easier to prepare business planning and strategies on the basis of balances shown by the ledger accounts.

- The financial position of the business can be easily known by referring to balances of various assets and liabilities.

- Various income statements can be prepared on the basis of the balances shown by the ledger accounts.

- Ledger is useful tool to control various expenses because ledger shows accounts of various expenses with total amount spent on them.

- Ledger facilitates the management to get classified information of various accounts such assets, liabilities, capital etc. They can easily prepare plans for various business activities.

Ledger also facilitates decision making process.

Contents of A Ledger-

The contents of a ledger are explained as below:

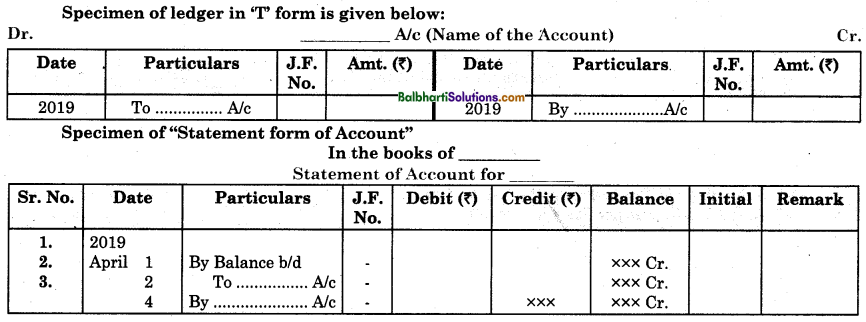

A ledger contains many pages and each page is called ledger folio. Each page of a ledger is serially numbered. Each ledger account has two main sides viz. left hand side which is called the debit side and right hand side which is called the credit side. A list of ledger account in alphabetically order is given on the first page of a ledger which is called as an ‘Index’. Each side has four sub-columns. These sub-columns are:

- Date Column: In this column, the date of transaction is written. Date of transaction is written in order of year, month and date. In the beginning of each page the year, month and date are written. For subsequent transactions on the same page only dates are written for the same month and year.

- Particulars Column: In the particulars column the name of the account is written. In the particulars column on the debit side of the account, the name of the account to be credited is written and on the credit side in the particulars column, the name of the account to be debited is written.

- Journal Folio No. Column: In Journal Folio No. (J.F. No.) column of the ledger, the page number of the journal from which the entry is posted is recorded in red ink for cross reference. By referring to the journal page as shown in the ledger, a businessman can understand the nature of transaction by

- reading the journal entry and narration.

- Amount Column: In this column the amount of the transaction is entered in figures.

Specimen of The Ledger :

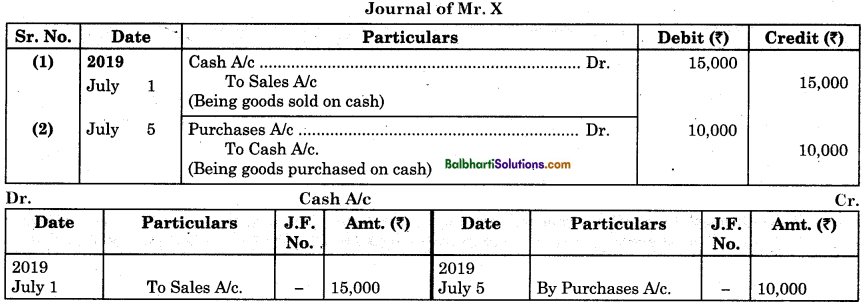

Steps to be Taken For Preparation of Ledger Account:

(1) At the top of ledger, in the middle, the name of the account should be written.

(2) The date of transaction should be written in date column in the same order as we record in the journal.

(3) In the particulars column on the debit side of the ledger account the name of account credited is written and in the particulars column on the credit side of ledger account, the name of account debited is written. For example the following journal entries are posted in the cash account as follows:

(4) Opening balance of ledger account should be shown as Balance (b/d). Real account like Cash A/c, Furniture A/c, Goods A/c, Machinery A/c. etc. always show debit balances, and liabilities like Capital A/c, Sundry Creditor’s A/c. Bank Loan A/c, etc. always show credit balances.

![]()

Posting of Entries From Journal And Subsidiary Books to Ledger-

(i) Posting of entries from journal to ledger :

Transferring or recording journal entries from journal to the respective ledger account is called ledger posting. Ledger posting implies entering the information in the ledger from journal for individual records. Ledger posting is done from time to time by the accountant. The account credited is posted on the credit side of that account and account debited is posted on the debit side of the same account. Process of ledger posting is continued throughout the year. At the end of the financial year all ledger accounts are closed and thereafter they are totalled and balanced.

(ii) Posting” of entries from subsidiary books to ledger:

(1) Single column and double column cash book: While posting the entries from single column and double columns Cash book, Cash Account and Bank Account are not opened. Cash column and Bank column are served as Journal as well as Ledger. Each Person’s Asset’s Account is opened and entries passed on the debit side of cash book are posted to credit side of Person’s A/c or Asset’s A/c. Similarly entries appeared on the credit side of cash book are posted to debit side of related Person’s A/c or Asset’s Account.

(2) Purchase Book: The total of posted to Purchases at the end of the month or year is posted to Purchases Account on the debit side as ‘To Sundries as per Purchases book”. Each Supplier’s Account is opened and related entries are recorded on the credit side as “By Purchases A/c.”

(3) Purchase Return Book / Return Outward Book: The total of Purchase Return Book is posted to Purchase Return A/c as “Sundries as per Purchase Return Book”. Each Supplier’s account is debited with the account of goods returned as ‘To Purchase Return A/c.”

(4) Sales Book: The total of Sales book at the end of month or year is posted to Sales A/c on the credit side as “By Sundries as per Sales Book”. Each Customer’s Account is opened and related entries are recorded on the debit side as ‘To Sales A/c”.

(5) Sales Return Book: The total of Sales Return Book is posted, to debit side of Sales Return Account as ‘To Sundries as per Sales Return Book”. Each Customer’s A/c is credited with the amount of goods returned as “By Sales Return A/c”.

(6) Journal Proper: Each entry from journal is posted to respective Account in the ledger.

Balancing of Ledger account-

Balancing of ledger account means finding the difference between the heavier total, and lighter total of ledger account and recording that difference on lighter total side.

At the end of the accounting year all accounts operated in the ledger are totalled and balanced.

Steps required for balancing of ledger account are given below:

- First do totalling of debit side and credit side of ledger account separately on rough sheet.

- Find out difference by subtracting lighter total from heavier total. Such difference is called balance.

- Draw a single line before making the totals.

- Draw double lines across the amount column after the totals are made.

- If total of debit side of ledger account is heavier than total of credit side of that account, the balance is called debit balance and is written on credit side (i.e. on the side where total is lighter) as “By Balance (c/fd.) or (c/d)”.

- If total of credit side of ledger account is heavier than total of debit side of that account, the balance is called credit balance, and is written on debit side (i.e. on the side where total is lighter) as “To Balance (c/fd) or (c/d),”

- Last year’s closing balance, becomes opening balance of current year. If there is debit balance it should be shown on debit side of concerned account as “To Balance (b/d) or (b/fd)” and vice versa.

Preparation of Trial Balance-

(i) Introduction: As and when business transactions take place, the same are first recorded in the journal in the summarised form and subsequently they are posted to respective ledger accounts. This in short is known as journalisation and ledger posting respectively. This process of normalisation and ledger posting are continuously done throughout the accounting year and then at the end of the accounting year all ledger accounts are closed, totalled and balanced.

On totalling and balancing, some ledger accounts show debit balances and some ledger accounts show credit balances. In rare cases some ledger account do not show any balance. After this process, a statement is prepared by businessman or accountant wherein total of debit side and credit side of every ledger account or net balance shown by every ledger account is systematically recorded to ascertain arithmetical accuracy and to detect errors or frauds committed in the business. This statement is called the trial balance.

(ii) Meaning: Trial balance is an abstract or list of all the ledger accounts as on a specified date showing debit total and credit total of all the accounts or their balances. A trial balance may be prepared on any date, but it must be prepared by a businessman at the close of the accounting year.

(iii) Definitions: (1) “It is the final list of balances, totalled and combined.” – Rolland

(2) “It is a list of abstract of the balances or of total debits and total credits of accounts in a ledger, with the purpose being to determine the equality of posted debits and credits and to establish a basic summary for financial statements.” – Eric Kohler.

![]()

(iv) Types of Trial Balance: A trial balance can be prepared in one of the following two forms, viz.

(i) Gross trial balance, and

(ii) Net trial balance. Each of them is discussed below:

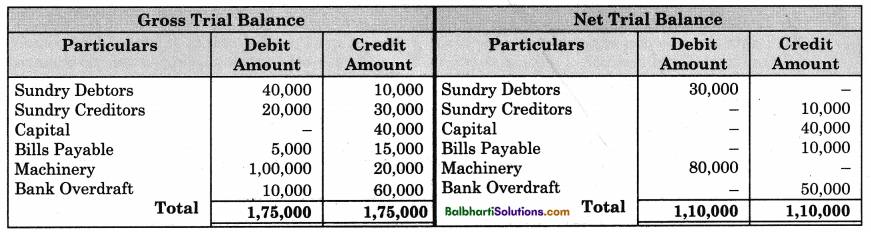

(i) Gross Trial Balance: Gross Trial Balance is a type of trial balance in which total of debit column and total of credit column of all ledgers are recorded and posted in respective columns of trial balance. Gross trial balance is prepared by transferring the total of debit column and total of credit column from each ledger account and posted and entered in the respective columns of the trial balance. Gross Trial Balance is not so popular or common in the business world.

(ii) Net Trial Balance: Net trial balance is a type of trial balance in which net balance shown by each ledger account is systematically transferred and recorded. Net trial balance is prepared by transferring net balance shown by ledger accounts in respective columns, i.e. debit balance in debit column and credit balance in credit column of the trial balance. Ledger account which does not show balance is not transferred to trial balance. Net trial balance is more common and popular in the business world. It is extensively used by the business people.

The following illustration will explain the difference between Gross trial balance and Net trial balance.

(v) Methods of preparing trial balance :

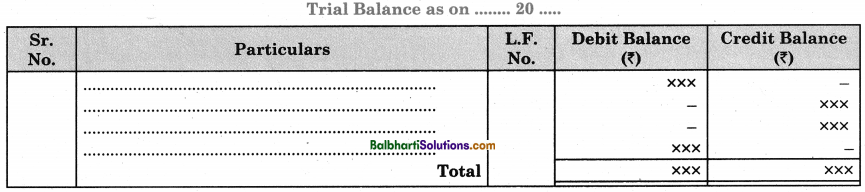

Trial balance can be prepared in any one of the following 2 forms : (i) Vertical or Journal form of Trial Balance and (2) Horizontal or Ledger form of Trial Balance.

(1) Vertical or Journal Form of Trial Balance

Explanation of columns:

- Particulars Column: In this column name of account is written.

- Ledger Folio (L.F.): In this column page number of ledger from where balance is extracted and transferred to trial balance is written.

- Debit balance: In this column accounts having debit balances are written in figures.

- Credit balance: In this column accounts having credit balances are written in figures.

- After writing all the balances in debit column and credit column, amounts written in debit column and amounts written in credit column are totalled separately. If the total of debit column agrees with the total of credit column, it is said that trial balance is tallied.

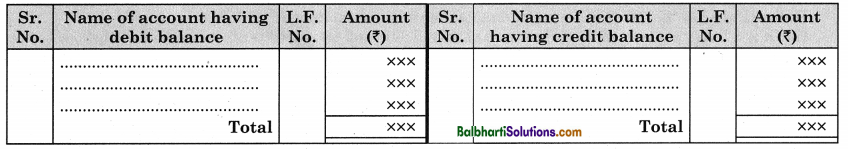

(2) Horizontal or Ledger Form of Trial Balance:

This trial balance has two main sides viz left-hand side and right-hand side. On the left-hand side debit balances are written down and on the right-hand side, credit balances are noted down.

Each side has three columns viz. name of the accounts, L.F. No. and Amount.

Explanation of columns:

(1) Left-hand side: In the first column names of the accounts having debit balances are written.

In the second column i.e. L.F. column Page No. of Ledger from where balance is extracted and transferred to Trial balance is written. In the third column balance amount of the account is written in figures.

(2) Right-hand side: In the first column names of the accounts having credit balances are written.

In the second column i.e. L.F. column Page No. of Ledger from where balance is transferred is written.

In the third column balance amount of Account is written in figures.

![]()

(vi) Utility of Trial Balance :

(1) Trial balance is prepared to know the final balance of every account.

(2) Trial balance is prepared to ascertain arithmetical accuracy of ledger accounts. If total of debit column and total of credit column of the trial balance tallies with each other, then it is proved that, no mistakes of whatsoever nature, has been committed in writing accounts. It is also confirmed that the posting to ledger account in terms of debit and credit amount, carry forward, etc. are accurate.

(3) Trial balance is also useful for preparation of final accounts like Trading Account, Profit and Loss Account and Balance Sheet. It is also useful to prepare other important financial statements.

(4) To locate accounting errors committed in writing accounts, a trial balance is used. Trial balance will not tally if mistakes or omissions in writing accounts carry forward, etc. are committed.

(5) Trial balance provides a condensed picture of each account opened and operated in the ledger. With the help of trial balance, the position of any account prepared in the ledger can be easily known or found without referring to the ledger.