By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 5 Subsidiary Books students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 5 Subsidiary Books

Introduction-

Journal is the main accounts book in which all types of day to day business transactions are recorded systematically and in chronological order. As in the past, business was small in size and transactions carried on by businessman were less in numbers, the journal as a book of accounts was adequate and convenient to record all transactions. Today, the journal is useful for traders whose business is small and limited in size. Journal as a single book of account is not convenient to those traders whose business is large in size and who carries on unlimited business transactions every day.

If a single journal is kept for an entire large scale business, it will be bulky and difficult to operate and handle and carry from one place to another in the same organisation. Similarly, many clerks simultaneously cannot do office work based on information written in the journal. Similarly, if all transactions are recorded in one journal, it will be time consuming to obtain necessary information. Due to this, need was felt to have subsidiary books.

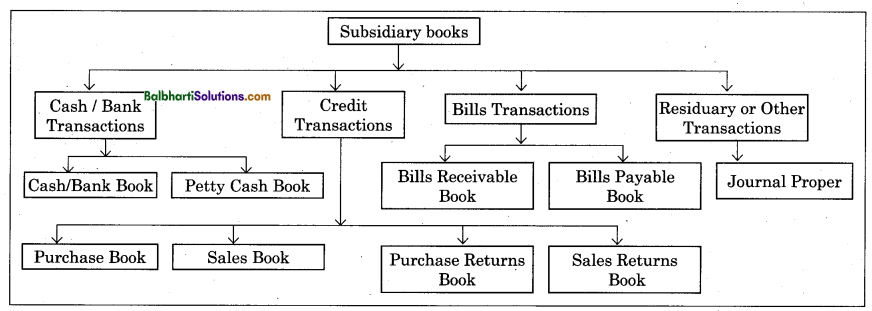

Meaning: When journal is divided into a number of parts, each of those parts is individually called subsidiary book. Thus, subsidiary book is sub-division of journal. In other words sub-division of journal on the basis of ‘

nature of transactions such as purchases, sales, cash expenses, cash receipts, return of goods, etc. is called subsidiary books. When subsidiary books are prepared and maintained, transactions are first recorded in

the subsidiary books and then conveniently posted to the respective ledger accounts. That is why subsidiary books are also called books of original entry or prime entry. They are also called as special journals or day books.

![]()

Need For Subsidiary Books-

The need for subsidiary books is explained below:

- Division of work: When journal is divided into a number of books, it facilitates division of work among the staff of the businessman. Many clerks work simultaneously in the office.

- Specialisation: When employees are assigned with same type of work everyday, it will lead to specialisation. Specialisation increases efficiency.

- Time Savings: Due to division of work various accounting processes can be undertaken simultaneously by the employees which in turn helps in saving of time.

- Information available readily: Maintaining separate books for each type of transaction, the information relating to each transactions is easily and readily available to the traders from the books of accounts.

- Facilitates easy internal audit: Division of journal into different sub parts helps in conducting effective internal audit of accounts prepared by the organisation.

- Verification of correctness: Division of journal into different sub parts facilitates the verification of correctness of the books of accounts.

- Helps in preventing frauds: Since entries are passed in the subsidiary books in chronological order, they help in preventing fraudulent entries in an account.

Types of Subsidiary Books-

The different types of subsidiary books are:

- Purchase Book or Bought Day Book,

- Sales Book or Sales Day Book,

- Purchase Return Book or Return Outward Book,

- Sales Return Book or Return Inward Book,

- Cash Book,

- Bills Receivable Book,

- Bills Payable Book and

- Journal Proper.

Types of subsidiary books on the basis of transactions.

The different types of subsidiary books are explained as follows:

(1) Cash Book :

Cashbook is an important subsidiary book of accounts, which is used by a businessman for recording cash and banking transactions of the business. Credit and barter transactions do not find any place in this book. Purchase of goods and assets on cash, sale of goods and assets on cash, payment of expenses in cash, receipt of income in cash, deposits and issues of cheques etc. are recorded in the cash book. In this book all receipts in cash and deposit of cheques are debited and all payments in cash and issue of cheques are credited. Cashbook is similar to a Cash A/c and hence no separate Cash A/c is opened and maintained in the ledger when the Cash Book is operated by the businessman.

Cash in hand is an asset of the business. Unless a business has cash, it cannot be spent and hence cash book always shows a debit balance. Cashbook is written on the basis of cash receipts and cash vouchers. Like a Ledger A/c, a cash book has two main sides namely receipt side and payment side. On the left-hand side i.e. on the debit side all cash receipts are recorded and on the right-hand side i.e. on the credit side, all cash payments are recorded. The cash book is totalled and balanced periodically. By balancing a cash book, a trader can ascertain the balance of cash and can plan the business activities. When the cash book is operated, no journal entries and ledger posting of cash transactions are required to be passed, in the journal and ledger. It results in saving of labour, time, stationery, and business cost.

![]()

Types of Cash Book :

Cash Book is classified under the following heads :

- Simple or Single Column Cash Book.

- Cashbook with cash and bank columns – Two-column cash book.

- Petty Cash Book.

The types of cash books are explained in detail:

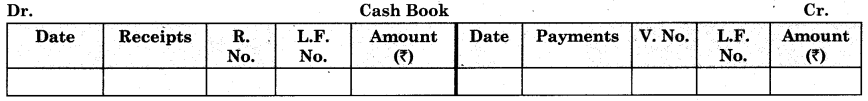

(1) Single Column Cash Book :

(A) Meaning: This cash book is also called simple cash book. It has two sides viz. receipt side and payment side. The debit side of cash book is meant for recording all receipts and the credit side of the cash book is meant for recording all payments. This book is written on the basis of cash receipts received, cash receipts issued, cash memos received, cash memos issued and cash vouchers. The cash book is balanced from time to time and the balance is carried forward. The cash book always shows a debit balance. In this book discount earned or allowed and banking transactions are not recorded.

Specimen of single column cash book :

(B) Explanation of columns of Simple Cash Book: The columns drawn on receipt side (Debit side) are explained below:

- Date: In this column the date on which cash received is recorded. The date of transactions is written in order of year, month and date. In the beginning of each page year, month and date are written and then for each subsequent transactions on the same page only date is written.

- Particulars: In this column name of the other accounts credited is written. The name of the account begins with the word ‘To’.

- Receipt Number: In this column of cash book, the serial number of the receipt and cash memos is recorded.

- Ledger Folio Number: In this column of cash book the page number of the ledger on which concerned account opened is recorded.

- Amount: This column of cash book shows amount received. The amount is written in figures.

The columns drawn on payment (credit) side are explained below:

- Date: In this column, the date on which cash paid is recorded.

- Particulars: In this column name of the other account debited is written. The name of the account begins with the word ‘By’.

- Voucher Number: In this column, the serial number of voucher and cash memo is recorded.

- Ledger Folio: In this column page number of ledger on which concerned account opened is recorded.

- Amount: In this column actual amount paid is recorded in figures.

(C) Recording in Simple Cash Book: The procedure of recording entries for cash transactions in simple cash book is explained as follows:

- Opening balance: Previous month’s balance if any, appears on the debit side (Receipts side) as “To Balance b/d”. Here b/d stands for “brought down”.

- Opening Capital: In the case of new business, capital contributed by the proprietor appears on the Receipts side as “To Capital A/c”.

- Receipts of Cash: When cash is received on any account, it is recorded on the receipts side under the “Particulars” column.

- Cash Payments: When ’cash is paid on any account, it is recorded on the payments side under

“Particulars” column. , - Chronological order: Transactions are always recorded in the cash book in chronological (datewise) order only.

(D) Balancing of Simple Cashbook: Generally, at the end of the month, cash book is balanced to find out balance of cash in hand. First ‘Amount’ column on the debit side of cash book is totalled. Thereafter ‘Amount’ column on the credit side of cash book is totalled in rough. The difference is ascertained by deducting the total of the amount appearing on credit side from the total of the amount appearing on debit side. This difference is recorded on the credit side under “Particular” column as “By Balance c/d”. Here c/d stands for carried down.

Cashbook always shows debit balance. This is because one cannot spend more than what one has. This balance is then recorded on the receipt side as “To Balance b/d” to start next period, as cashbook records only cash transactions and will always have excess of receipts overpayments.

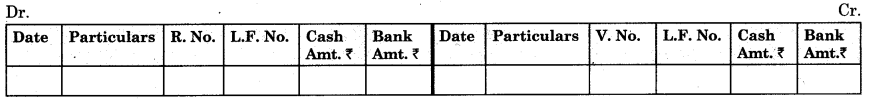

(2) Cash Book with Cash and Bank Columns :

(A) Meaning: This cash book is also called as cash book with cash and bank columns. A businessman who does business transactions through a bank, records his banking transactions along with cash transactions in double column cash book. Banking transactions like receipts and deposit of cheques, issue of cheques, deposit and withdrawal of cash from bank, etc. are recorded in the double column cash book.

By maintaining double column cash book, a businessman gets information of inflow and outflow of cash and details of banking transactions. Exact position of cash in hand and balance of cash at bank can be ascertained quickly by referring to the double column cash book. Double column cash book is useful for a businessman to take quick decisions on the business matters.

This cash book has two columns on receipts side and the payment side viz. Cash column and Bank column. Bank column appearing in two-column cash book represents bank current account.

(B) Specimen of Two Column cash book:

(C) Types of Bank Accounts :

On the basis of nature, characteristics and advantages, bank accounts are classified into the following four types, viz. (i) Current account, (ii) Savings account, (iii) Fixed deposit account and (iv) Recurring deposit account.

The above types of bank accounts are explained in detail as follows:

(i) Current Account: This type of bank account is more useful to businessmen. It is a type of bank account in which there is no restriction on deposits of money into the bank and on withdrawals of money from the bank. The account holder is permitted to deposit money into his account any number of times in a day. Similarly, the account holder is at liberty to withdraw money or issue cheques from the bank any number of times provided he has sufficient balance in his account to honour withdrawals and cheques issued.

The bank pays interest at the lowest rate ranging from 0.5% to 1% p.a. on balance amount remaining in this account, and also gives overdraft facility to account holders. Current account is a running account, as it is operated daily and continuously by the account holder. It should be noted that the bank columns in the cash book implies Current Bank Account.

![]()

(ii) Savings Account: This is a type of bank account in which the bank keeps no restrictions on deposits, but imposes restrictions on withdrawals of money from the bank. In this type of account maximum of 2 withdrawals per week and maximum 25 withdrawals per every 3 months, are permitted by the bank. The main intention of savings account is to increase the savings of account holders and to channelise them into investment and thus capital formation of the nation. This account is more useful to non-business community. Bank allows interest at the prescribed rate on balance remaining in the savings account.

(iii) Fixed Deposit Account: Fixed deposit account is a blocked account as money once deposited into the bank by account holders, cannot be withdrawn by them until the period for which it is deposited, is over. It is a type of bank account in which money is deposited for specific period of time.

This account is more useful to retired people or non-business community who are interested in earning regular fixed income. On fixed deposits, a bank pays a higher rate of interest to deposit holders. Payment of interest is made half-yearly or yearly. If interest is not paid periodically, then accumulated interest is paid to deposit holders at the time of maturity along with the principal amount deposited. The minimum period for which deposit is accepted by the bank is upto 30 days and maximum period is 6 years or even more than 6 years. The rate at which interest is paid on deposits is not fixed, but fluctuates with the length of period for which deposits are kept.

The longer the period, higher is the rate of interest payable on deposit by the bank. The rate of interest also depends on the monetary policy of the government. In case of need, an account holder can borrow from the same bank the amount equivalent to 70% of the fixed deposit against the security of the deposit. In such a case, the bank charges 2% interest more than the rate of interest paid on the fixed deposit by the bank.

(iv) Recurring Deposit Account: A bank account in which an account holder is required to deposit a fixed sum of money after every fixed interval for a specific period of time is called a recurring deposit account. In this type of account, the bank accepts the fixed amount daily or once in a month on fixed date upto the maturity date. The deposit holder is not permitted to withdraw money from this account, but in case of need, the bank gives loan to the account holder on the credit balance standing in his account.

On maturity, the bank pays the total amount deposited and interest accrued on that amount in lump sum to the account holder. The main purpose of this account is to increase savings and thereby helps lower-income groups to purchase costly articles with accumulated savings. This account is more useful to the non-business community, specially lower-income groups.

(D) Documents used by the Account Holder:

The following documents are provided by bank, free of charge to account holders. These documents are used by account holders while doing transactions with the bank. These documents are: (i) Bank Pass Book,

(ii) Pay-in-slip Book, (iii) Cheque Book, (iv) Withdrawal Slip.

The documents are explained in detailed:

(i) Bank Pass Book: The bank passbook is a small booklet, given to account holders free of charge to record their transactions with bank. Banking transactions are recorded in the passbook by bankers only. In other words, passbook is a small booklet having a number of pages, used for recording banking transactions. It provides identity giving document of account holder. By referring to the passbook, an account holder comes to know his financial position with the bank. Current account holder is not given the passbook, instead, they are provided with the monthly statement of the transactions with the bank.

(ii) Pay-in-Slip Book: Pay-in-slip book is another document used by account holder for depositing cash and cheque into the bank. Pay-in-slip book consists of either ten slips or hundred slips. Each slip is divided into two parts which can be separated easily from the other.

The longer part of the slip is called foil and smaller part is called the counterfoil. Before depositing cash or cheque into the bank, an account holder is required to fill up both parts of the pay-in-slip. Information regarding name of account holder, his account number, amount in figures and words, signature etc are required to be filled up on both the parts of the pay-in-slip. The Cashier of the bank accepts cash or cheque along with duly filled in pay-in-slip. The foil of the pay-in-slip remains with the bank for making records in the books of the bank and the counterfoil after stamping and signature of cashier is given back to the account holder.

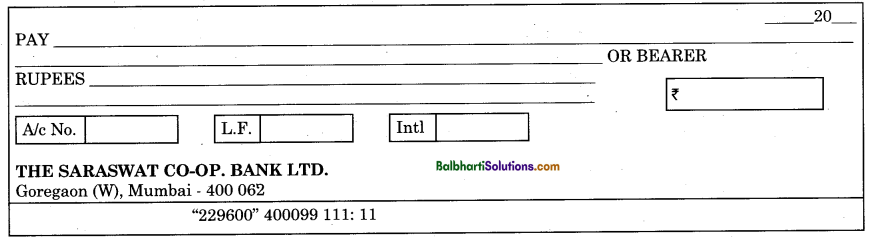

![]()

(iii) Cheque Book: A cheque is a document used by the account holder for withdrawing cash from the bank or for making payments to other persons through the bank. A book which consists of 10 or 20 blank cheques is called a cheque book. A Cheque book is provided by the bank to account holders free of charge, if an account holder agrees to keep minimum balance of? 500/- or more in his account.

In legal language, “a cheque is a written unconditional order of the account holder to his banker to pay a certain sum of money only to himself or to the bearer or to the person named therein.” There are three parties to a cheque i.e. Drawer, Drawee and Payee. The person to whom the amount of cheque is payable is called payee and the bank on whom the cheque is drawn is called drawee bank, and the account holder who issues the cheque is called drawer.

Specimen of cheque is given below:

Types of Cheques-

Cheques used by the account holder are classified into the following three categories viz.

- Bearer cheque,

- Order cheque and

- Cross cheque.

The above types of cheques are explained as below:

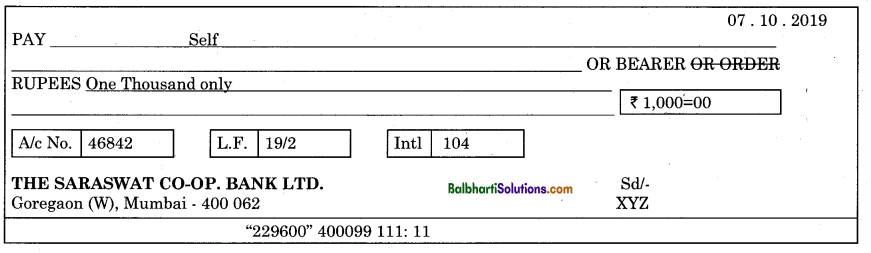

1. Bearer Cheque: Bearer means possessor. In case of bearer cheques, the bank makes immediate cash payment to the possessor of the bearer cheque on its presentation. For immediate withdrawal of cash, a bearer cheque is used by the account holder. A cheque on which instead of writing the name of the payee, the word ‘self ’ is written, is called a bearer cheque.

Bearer of the cheque has to sign on the reverse of the bearer cheque before withdrawing money from the bank. While making cash payment against bearer cheque, the bank never makes inquiry whether payee is a wrong doer or right person. Bearer cheque is dangerous because in case if it is lost the wrong doer who possesses the cheque, can easily obtain cash from the bank. Bearer cheque is as good as cash, because it can be encashed by any one at any time during banking hours.

Specimen of bearer cheque :

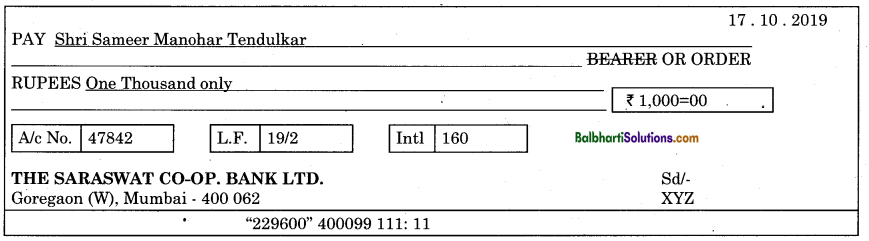

2. Order Cheque: A cheque in which an account holder orders the bank to make payment to the person whose name appears on the cheque, is called an order cheque. In this type of cheque, the word ‘bearer’ after the name of payee is struck off and the word ‘order’ is retained. Order cheque is safer than bearer cheque. While making cash payment against order cheques, if bank suspects, it makes inquiry whether possessor of order cheque is the right person or not.

Specimen of order cheque :

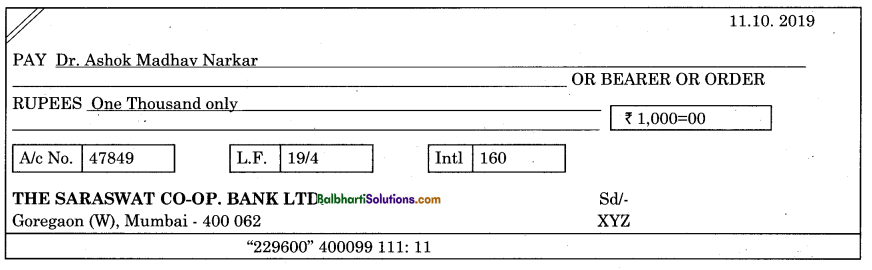

3. Crossed Cheque: A crossed cheque is a cheque on which two parallel transverse lines are drawn on the face of the cheque at the left-hand top corner with some words or without any words written between them. When the crossed cheque is presented for payment it is not paid in cash to payee or possessor, but it will be credited to payee’s account in the bank and after three days, the payee i.e. the account holder is permitted to withdraw the amount from the bank, if it is cleared and not dishonoured.

This type of cheque is more safer than any other type of cheque. If a crossed cheque is lost, a wrongdoer cannot obtain payment from the bank. The bank never makes immediate cash payment on counter on presentation of crossed cheque. Crossed cheques are sent to distant place by ordinary post safely.

Specimen of crosscd cheque:

![]()

Dealings of Cheque-

The different types of dealings of the cheque are explained below :

1. Honour of cheque,

2. Dishonour of cheque, and

3. Endorsement of cheque.

The dealings of cheque is explained :

1. Honour of Cheque: A cheque is said to be honoured if the drawee bank pays the entire amount of cheque to its holder on presentation of cheque before the bank. The bank always honours a cheque if there is sufficient fund in the account of the drawer.

2. Dishonour of Cheque: A cheque is said to be dishonoured if the drawee bank refuses to make payment to the holder of a cheque on its presentation. The drawee bank never dishonours a cheque but under the following circumstances, the drawee bank is compelled to dishonour the cheque.

- If signature on cheque does not tally with the specimen signature of drawer (i.e. account holder.)

- If amount mentioned on cheque in figures and in words does not agree with each other.

- If funds in the account of the drawer in drawee bank is not sufficient to honour the cheque.

- If a cheque is a stale cheque or post dated cheque. A cheque is valid for a period of three months from the date of its issue.

- A cheque is said to be stale if a period of three months is over from the date of its issue. A stale cheque is always dishonoured by the bank. Post dated cheque is a cheque which bears a future date. Post-dated cheque is always dishonoured by the bank if it is presented before its date of presentation.

- If a cheque is overwritten and if overwriting is not supported by the signature of its drawer.

- If a cheque is torn from anywhere.

(3) Endorsement of Cheque: Endorsement of cheque refers to an act of signing on the reverse of a cheque by its holder to transfer it to another person. Cheque may be endorsed in favour of a creditor to settle his debts or it may be endorsed in favour of debtor to give further loan. A person who endorses a cheque is called endorser and a person in whose favour a cheque is endorsed is called the endorsee. Endorsement is necessary in case of transfer of order and crossed cheque. Endorsement is not necessary for transfer of bearer cheque.

Contra Entry-

The accounting entries which appear on both the sides of the cash book with cash and bank column is called contra entries. Contra entry appears only in cash book with cash and bank column and not in single column cash book. An accounting entry for an amount withdrawn from bank which is posted on the debit side of a two column cash book in the cash column and on the credit side in the bank column or an accounting entry for an amount deposited with the bank which is posted on the debit side of two column cash book in the bank column and on credit side in cash column is called contra entry. Letter ‘C’ which stands for contra is written in“L.F. No.” column to identify, contra entry.

Contra entry is passed in three column cash book under the following circumstances :

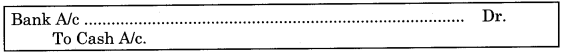

1. Cheque received on earlier day and deposited today: Journal entry for this transaction is:

2. Cash deposited into the bank: Journal entry for this transaction is:

(The above entries appear in the bank column on the debit side of the three-column cash book and in the cash column on the credit side).

3. Cash withdrawn from the bank for office use: Journal entry for this transaction is:

(This entry appears in cash column on debit side of the three-column cash book and in bank column on the credit side.)

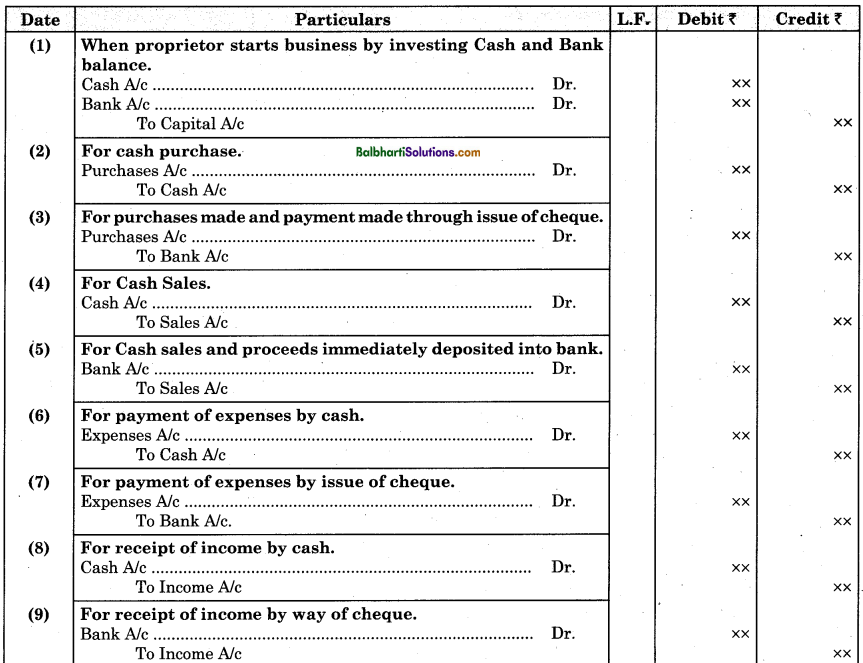

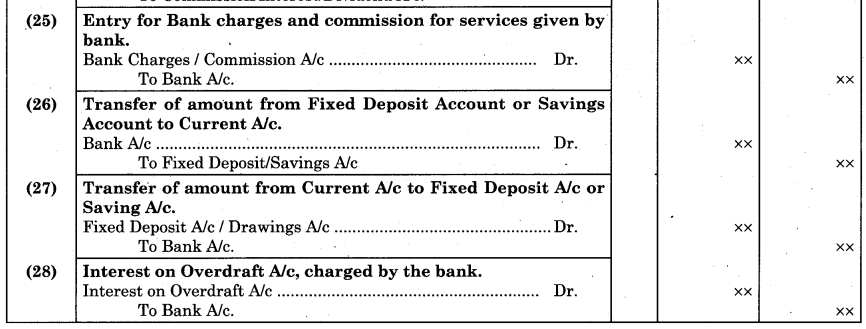

(A) Journal Entries For Cash And Banking Transactions :

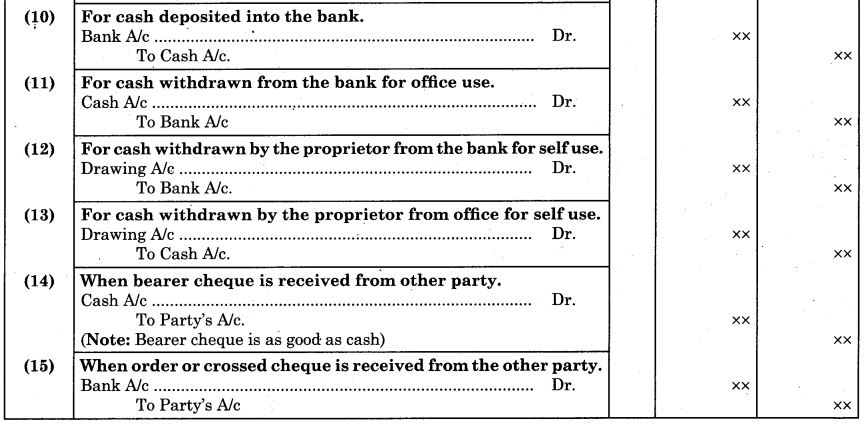

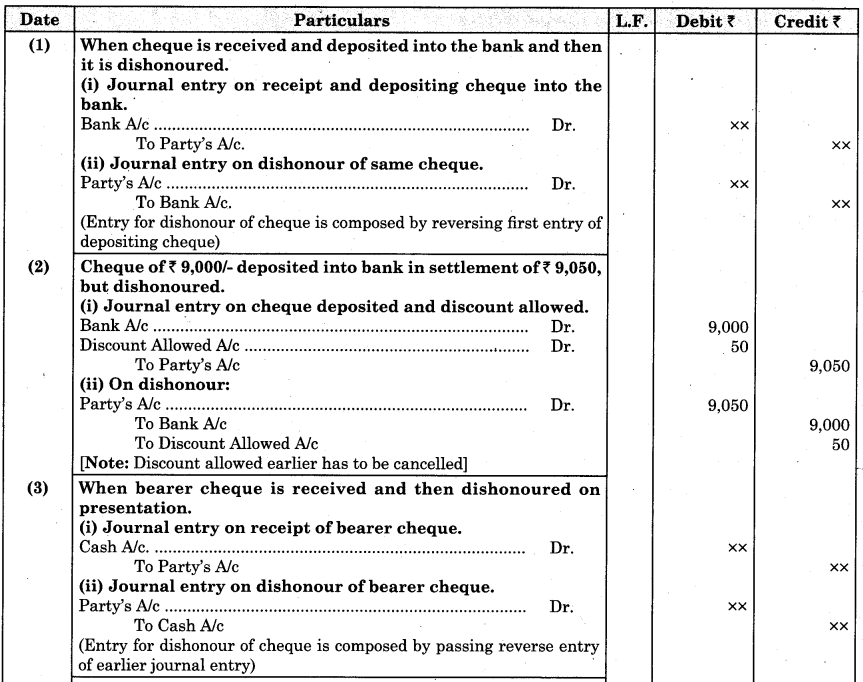

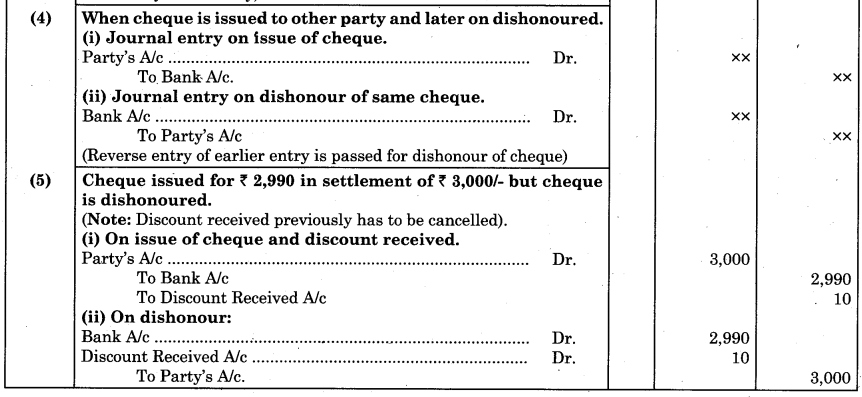

(B) Journal Entries For Dishonour of Cheque-

Dishonour of Cheque: When a bank refuses to make payment on cheque on any justifiable ground, cheque is said to be dishonoured. When a cheque is dishonoured, the value of cheque reduces to zero. On dishonour of cheque, earlier accounting effects given to cheque are required to be cancelled. Accounting effects of cheque are cancelled by passing reverse entry of earlier entry. For example:

![]()

Petty Cash Book-

When business develops, a businessman prefers to meet his business payments and receipts through the bank. Due to fast development in banking sectors, most of the businessmen carry on their day to day business activities through the bank. Generally, bank cheques are used for payments and receipts of higher amount. But generally a cheque is not used for payments and receipts of small or minor amount whose payments and receipts are inevitable in the business. For example cheque is not used for payment of taxi fare, coolie charges, sweeping charges, payment of postage etc. and receipt of sale proceeds of old newspapers etc.

In big business house or in industry to manage and pay minor expenses in cash, a separate clerk or cashier is appointed. The cashier or clerk who manages, looks after and makes payment of petty i.e. minor expenses in the organisations is called petty cashier. An account book in which the petty cashier records payments of petty expenses and receipts is called petty cash book.

In other words, a petty cash book is a separate account book in which a businessman keeps records of daily transactions which are minor in nature and whose payments and receipts are made in cash only. The Petty cashier is given lump sum amount of cash at the beginning of every month by the head cashier and he is also permitted to spend that amount on various minor expenses and also permitted to receive minor receipts during a specific period. At the end of the month the petty cashier is required to return the balance amount to the head cashier. This procedure is followed every month.

Types of Petty Cash Book-

Petty cash book is classified into the following three categories viz.

1. Simple petty cash book,

2. Columnar petty cash book,

3. Petty cash book kept on imprest system.

They are explained below.

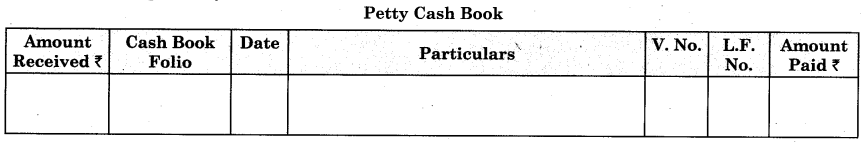

1. Simple Petty Cash Book: A Simple petty cash book is similar to simple or single column cash book. To record receipts and payments made in cash, this cash book has two main sides viz. receipts side and payments side. In this cash book, columns like date and particulars are common for both receipt and payment side. This cash book is not extensively used in business field.

Specimen of Simple Petty Cash Book :

Importance of Columns:

- Amount received column: In this column the petty cashier records the amount received from head cashier and proceeds received on sale, etc.

- Cash book folio column: In this column the page number of cash book on which entry for payment of lump-sum amount of cash made by head cashier to petty cashier is mentioned for future reference.

- Date column: In this column, the date of transaction is recorded.

- Particulars column: In particulars column, the name of expenses on which the amount is spent and name of receipts from which amount is received are recorded. After entry narration is not written in this column. Entry for receipt is written with word ‘To’ and entry for payment is written with word ‘By’.

- V. No. Column: Voucher number of various minor payments are recorded in V. No. column for future reference.

- L.F. No.: Page number of ledger where entry of expenses and receipts are posted, is recorded in L.F. No. column.

- Amount paid column: In this column, amount paid on various minor expenses is recorded.

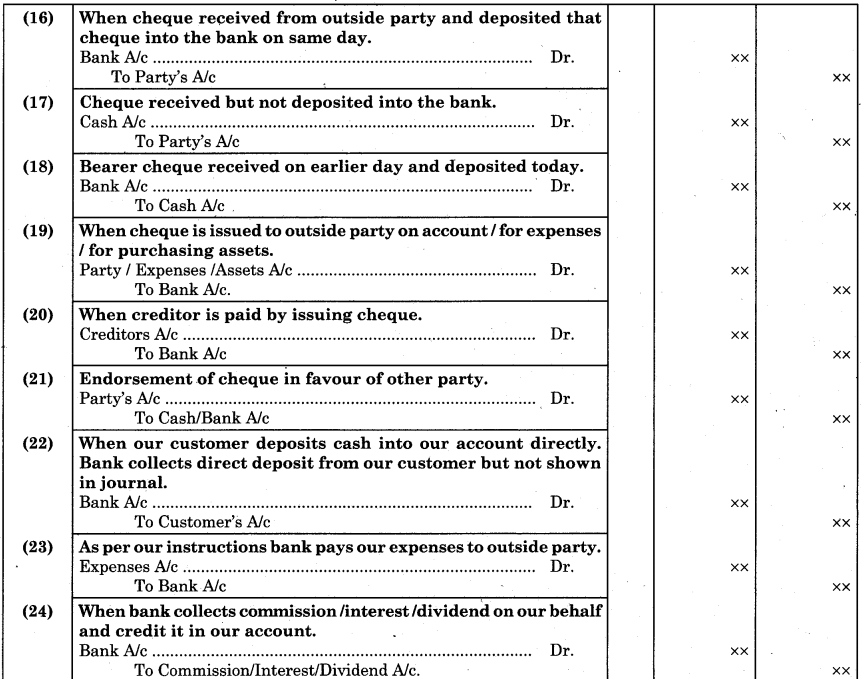

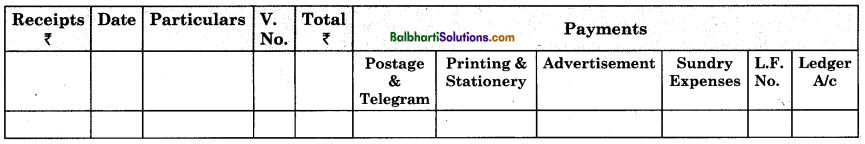

2. Columnar Petty Cash Book: As the name indicates, this petty cash book has many sub-columns on payment side to record minor expenses individually. This cash book has two main sides viz. receipts.side and payment side. In comparison to receipt side, the payments side is much longer. The payment side of this cash book has many sub-columns which are not fixed in number.

On. the payment side of this cash book, one sub-column is provided for one similar nature of expenditures. In short, the payment side has as many columns as expenditures on which the business has spent money. In addition to these columns, at the end, two more columns are provided for L.F. No. and ledger account. In ledger account column, entries of personal account and real account are posted. This cash book is more popular and extensively used in the business field.

Specimen of columnar petty cash book :

![]()

3. Petty Cash Book kept on Imprest System: In many business houses, Petty Cashbook kept on imprest system is more popular. In this system, at the beginning of every month, the head cashier gives to the petty cashier that much amount of cash or cheque which is equivalent to amount spent in the last month. This makes the opening cash in hand with petty cashier equal in the beginning of every month. In other words, in imprest system, a definite amount of cash is given to the petty cashier at the beginning of a certain period.

This amount is known as imprest money. The petty cashier is then allowed to spend money on various petty expenses and when he has spent substantial amount of his imprest amount, he gets reimbursement of the amount he has spent from the head cashier. Thus, he again has the same amount of imprest cash. The reimbursement may be made on a weekly, fortnightly, or monthly basis, depending on the frequency of small payments.

This system renders the following advantages:

- No excess cash is issued to petty cashier than actually required.

- Petty cashier will not have excess or idle cash.

- Misuse of cash is avoided as far as possible.

- Records of petty expenses can be easily checked and compared.

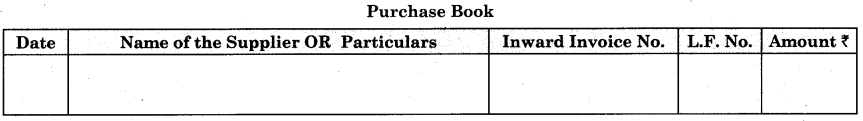

Purchase Book-

A subsidiary book in which only credit purchases of goods are recorded is known as the purchase book. This book is used to record credit purchase of goods in which a trader regularly deals. In this book, cash purchases of goods and assets are not recorded. Similarly, the purchase of asset on credit is also not recorded in this book. The purchase book is written on the basis of inward invoice i.e. a statement received from the supplier.

Trade discount is never recorded in this book. Trade discount is calculated and deducted from invoice price and net price is recorded in the purchase book. If a bookseller purchases books on credit, same will be recorded in his purchase book. Purchase of furniture by the bookseller on credit, will not be recorded in his purchase book. At the end of each month the purchase book is totalled and this total shows the total amount of goods purchased on credit. Purchase Book is also known as Purchase Journal, Purchase Register and Bought Book.

Specimen of Purchase book is given below :

Explanation of Columns :

- Date: This column meant for recording the date of credit purchase of goods.

- Particulars: In this column, the name of the supplier from whom the goods are purchased on credit is recorded. Along with the name of the supplier, his address and description of goods is also written in this column.

- L.F. No. : In this column, the page number of the ledger on which the supplier’s account is prepared is recorded for ready reference.

- Inward Invoice No.: Statement received from supplier along with goods purchased is called inward invoice. In this column, the number of inward invoice is mentioned.

- Amount: This column shows the net amount of credit purchases of goods.

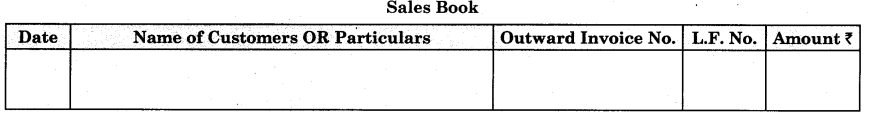

Sales Book-

A subsidiary book in which only credit sales of goods are recorded, is known as sales book. This book is meant for recording credit sales of goods in which the trader regularly deals. In this book sale of goods as well as assets on cash basis are not recorded. Similarly, sale of assets on credit is also not recorded in this book. This book is written on the basis of the outward invoice. Trade discount never appears in this book. Trade discount is simply calculated and deducted from the invoice price and net price is recorded in this book.

If a grocer sells different types of grains to his customers on credit, it will be recorded in his sales book. Cash sales made by the grocer will not be recorded in his sales book. Sales book is also known as sales day book. At the end of each month the sales book is totalled and this total shows the total amount of goods sold on credit, and the net amount receivable from customers. Sales book is also known as Sales Day Book, Sales Journal, Sales Register and Sold Book.

Specimen .of Sales Book is given below :

Explanation of Columns :

- Date: In this column date of credit sale is recorded.

- Particulars: In this column, name of customers to whom the goods has been sold on credit is recorded. Along with name, address of customers and description of goods are also written.

- L.F. No.: In this column, page number of ledger on which the customer’s account is prepared, is mentioned for ready reference.

- Outward Invoice No.: The statement sent along with goods sold is called outward invoice. In this column the outward invoice number is recorded.

- Amount: This column shows net amount receivable from the customers, i.e. net amount of credit.

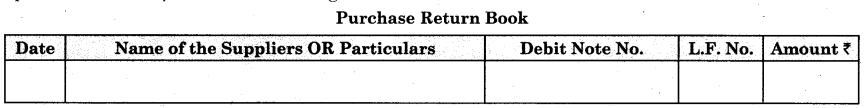

Purchase Return Book :

A subsidiary book in which return of goods purchased on credit is recorded, is known as the purchase return book. The purchase return book is also known as return outward book or debit note book or purchase return journal. This book is used by the trader for recording the returns of goods purchased on credit to the suppliers. Goods may be returned by trader to supplier on one of the following reasons, viz.

(a) defective goods,

(b) damaged goods,

(c) delayed goods,

(d) inferior goods,

(e) goods which are not as per design, colour or sample sent

(f) excess goods received, etc. This book is written on the basis of debit. Purchase return book is totalled at the end of each month. This total shows value of goods returned to suppliers.

Specimen of Purchase Return Book is given below :

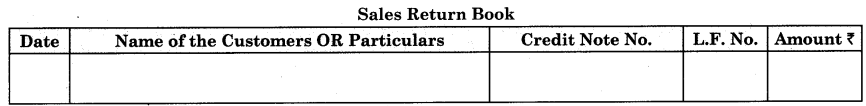

Sales Return Book-

A subsidiary book in which transactions relating to return of goods sold on credit are recorded, is called

the sales return book. This book is used by the trader for recording the goods returned by customers which were purchased by them on credit. Goods sold to customers on credit, may be returned by them for one of the following reasons, viz. (a) defective goods, (b) damaged goods, (c) delayed goods, (d) inferior quality goods, (e) goods not in accordance with sample, specification, colour, design, (f) over supply of goods, etc. Sales return book is written on the basis of a credit note. This book is also called credit note book or return ’ inward book or sales return journal. At the end of each month sales return book is totalled.

Specimen of Sales Return Book is given below :

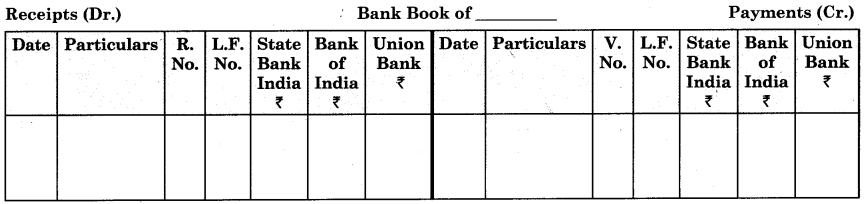

Bank Book-

When businessman operates more than one bank account, it is convenient for him to maintain separate account book to record only hanking transactions entered with various banks. The account book in which only banking transactions are recorded is called Bank Book. The bank book is combined with discount columns for recording discount allowed and earned in banking transactions.

This book has two main sides viz left hand side (i.e. Debit / Receipt side) and Right hand side (i.e. Credit

/ Payment side). Cheque received and deposited into the bank, direct deposit received by bank, dividend,

interest and commission collected by the bank, etc. are recorded on the receipt side and cheques issued, bank charges paid, interest on overdraft, payments made by cheques, etc. are recorded on the payments side of Bank Pass Book.

Advantages: Maintaining Bank book is benefited the businessman in different ways such as:

- He get easy reference of banking transactions.

- It saves labour and time of businessman as he is not required to pass entries in subsidiary books and

ledger. - It facilitates preparation of Bank Reconciliation Statement.

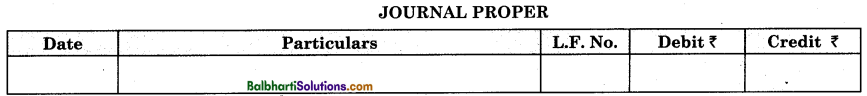

Journal Proper-

A subsidiary book which is used to record all those business transactions which do not find any place in the purchase book, sales book, return books, cash book, bills receivable book, bills payable book, etc. is called journal proper.

This book is used for recording the following types of the transactions viz.

(1) Purchase and sale of assets on credit.

(2) Opening entries

(3) Transfer entries

(4) Rectification entries

(5) Adjustment entries

(6) Closing entries

(7) Other transactions like bad debts written off, dishonour of the bill, depreciation, interest on capital, loss of goods by fire or theft or goods damaged in transit, distribution of goods as free samples, withdrawal of goods by proprietor, discount received and allowed on cash transactions, etc.

General Information-

The following points should be considered while recording entries in the subsidiary books:

- Cash sale of goods should not be recorded in sales book and cash purchases of goods should not be recorded in purchase book.

- Sale of assets on cash and credit should not be recorded in sales book, and purchase of assets on cash and credit should not be recorded in purchase book.

- Only credit sale of goods should be recorded in sales book and credit purchase of goods should be recorded in purchase hook.

- Cash transactions should be recorded in cash book and non-cash transactions should be recorded in subsidiary books.

- Assets purchased on credit and assets sold on credit should be recorded in journal proper.

- Trade discount is to he calculated and simply deducted from invoice price and net sales or net purchases should be entered in related subsidiary books.

Debit Note And Credit Note-

Sometimes some corrections become necessary in the original documents prepared for business transactions. Such correction cannot be made by cancelling the entry on the original documents or adding new entry in the original documents. Such correction can be done by preparing another new document for the amount of difference in the original document. Such a new document is called as debit note or credit note. Debit note is prepared for debiting the account of the counterpart with the amount by specifying reasons thereon. It is issued:

- When less debit is formerly given.

- When additional debit is to be given and

- When extra credit or wrong credit is to be cancelled.

Credit note is prepared for crediting the account of the counterpart with amount by specifying reasons thereon. It is issued:

- When less credit is formerly given.

- When additional credit is to be given and

- When extra debit or wrong debit is to be cancelled.

In order to avoid the handling of original documents again and again such are prepared.

When a businessman issues debit note to a party, the party receiving debit note should issue a corresponding credit note to give acknowledgement of acceptance and vice versa. The entry of such debit and credit should be passed in the journal proper. If they are recurrent and large in numbers, the separate register called Debit Note Register and Credit Note Register should he maintained.

Usually these are printed and are serially numbered by machine. These are prepared in duplicate. The original copy is issued to the opposite party and second copy is retained by the businessman for office record. These are kept serially and in chronological order in the bound book.

Circumstances under which are issued:

- Difference in the quantity mentioned in the bill and the quantity actually delivered.

- Either higher or lower rates are charged in the bill.

- Wrong calculations made on the bill.

- Goods are rejected and returned.

- Wrong rate of tax, packing, forwarding, transportation, etc. are charged.

- Adjustments in discount and commission are done.

- Difference in the quality descriptions of goods ordered or delivered.

- Dishonour of cheque or bill of exchange.

- Interest is charged on outstanding amount due.

Importance of Notes-

- On the basis of debit note and credit accounting entries are passed in the journal proper.

- On the basis of debit, buyer makes entries in the Purchase Return Book and on the basis of credit seller records entries in the Sale Return Book.

- If due to mistakes invoice is undercharged by the seller, the seller prepares a credit note and the buyer prepares debit note and the parties sent these to each other.

- On the basis of these entries are passed to rectify the mistakes made earlier.

- As these are signed by the responsible authority, they became authentic proofs of goods returned by the buyer or seller.

Contents of: The debit note and credit note contains the following details:

- Name and address of the party or organisation issuing the note.

- Number of the note (Debit/ Credit Note).

- Date of transaction.

- Reasons for debiting or crediting the account.

- Amount in words as well as in figures. .

- Signature of the person preparing note and the person verifying the note.