By going through these Maharashtra State Board Bookkeeping and Accountancy 11th Notes Chapter 9 Final Accounts of a Proprietary Concern students can recall all the concepts quickly.

Maharashtra State Board 11th Accounts Notes Chapter 9 Final Accounts of a Proprietary Concern

Meaning of Final Accounts-

Every business organisation prepares two important financial statements viz. income statements and statement of financial position to find out the result of business done in the accounting year and to find out financial position in the form of assets owned and liabilities payable to outsiders. In income statements Trading Account and Profit and Loss Accounts are prepared and in the statement of financial position Balance Sheet is prepared.

Thus, final account refers to the group of Trading Account, Profit and Loss Account and Balance Sheet. Final Accounts are prepared on the basis of trial balance and additional information called adjustments at the end of every accounting year.

Final Accounts may be defined as “the statements prepared at the end of an accounting year to disclose the financial position and performance of a business concern”.

Final Accounts include Trading Account, Profit and Loss Account and Balance Sheet.

![]()

Objectives of Final Accounts-

- To know the amount of Profit earned or loss if any suffered during the accounting period.

- To know the amount of assets and liabilities in the business on a particular date.

- To know the amount of capital in the business. ,

- To know the amount receivable from various debtors and the amount payable to various creditors.

- To know the Trading (Gross) profit, Operating (Net) profit and abnormal gains and losses.

- To enable the trader to compare the result and financial position of the business with other similar business.

- To find out or ascertain the amount of taxes, i.e. Income tax, Sales tax, Wealth tax, etc. payable to the government.

- To calculate the various ratios for the purpose of financial analysis.

- To enable the trader to take necessary policy decisions regarding future business activities.

Importance of Final Accounts-

- With the help of final accounts businessman can find out gross result, i.e. gross profit earned or gross loss suffered during the accounting period.

- Final Accounts helps to find out cost of goods sold.

- Current year’s stock can be compared with the previous year’s stock.

- Net Profit or Net Loss can be easily ascertain.

- Ratio of Net Profit to Net Sales can be easily calculated.

- Ratio of expenses to Net Sales can be ascertained.

- Comparison of actual performance with desired performance can be easily done.

- Financial position of the business can be ascertained.

- Proprietor’s equity can be ascertained.

- Facilitates the accountant to check arithmetical accuracy of the accounting records.

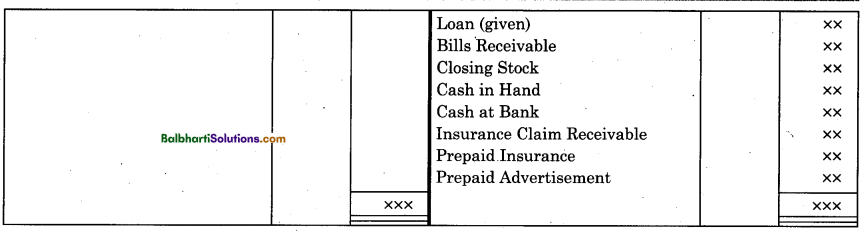

Trading Account-

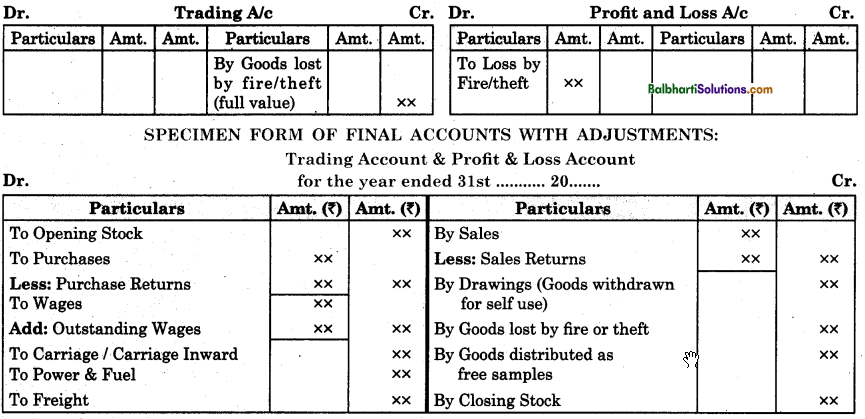

Trading Account is a part of final accounts which is prepared on the basis of direct expenses and direct incomes of business to ascertain the gross result of the business, done in the accounting year. Preparation of Trading Account is the first step in preparation of final accounts. Trading Account is prepared by considering only direct expenses and direct incomes of the business. Expenses and incomes which have a direct connection with production are called direct expenses and direct incomes, e.g. power and fuel, cost of raw materials, wages etc. are called direct expenses, and sales proceeds are called direct incomes.

Thus, the Trading Account shows gross result of trading or business activities carried out in the particular accounting year. It is prepared with the basic objective of ascertaining how much gross profit is earned or loss suffered as a result of manufacturing goods or services or buying and selling of goods. Service industries like banks, insurance companies, medical and education institutions never prepare Trading Account. They prepare revenue account, instead of trading account. On the debit side of Trading Account, direct expenses, opening stock and purchases are recorded and on the credit side of account direct income, closing stock and sales are recorded. This account is also credited if goods are lost on account of fire or theft and goods distributed as free samples.

Debit balance of this account indicates gross loss and credit balance of this account indicates gross profit. Results shown by this account i.e. either gross profit or gross loss is carried forward to the Profit and Loss Account.

![]()

Specimen Form of Trading Account –

Equation of Gross Profit And Gross Loss –

- Gross Profit = Net Sales – Cost of goods sold

- Gross Loss = Cost of goods sold – Net Sales

- Net Sales = Total Sales – Sales Returns (Return Inwards)

- Total Sales = Cash Sales + Credit Sales

- Cost of Goods Sold = Opening Stock + Net Purchases + Direct expenses – Unsold goods

- Net Purchases = Total Purchases – Purchase Returns (Return Outward)

- Total Purchases = Cash Purchases + Credit Purchases

Unsold goods at the end of the accounting year refers to Closing Stock.

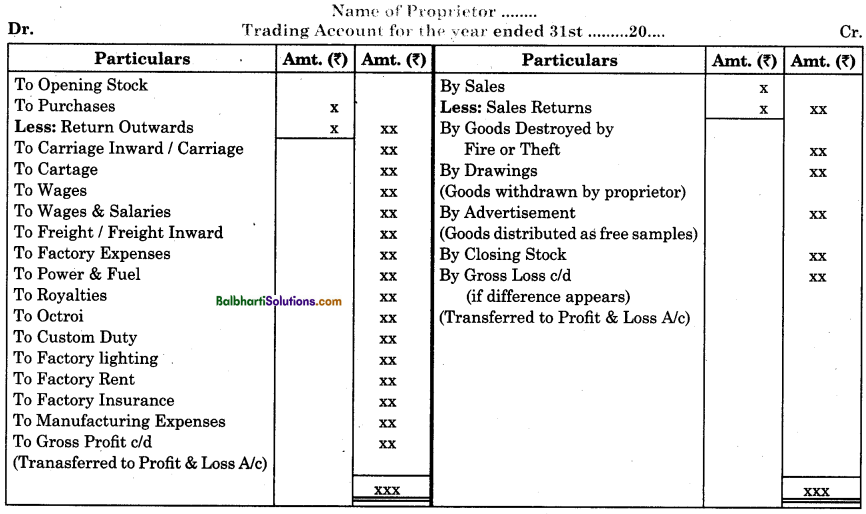

Journal Entries For Preparation of Trading A/C –

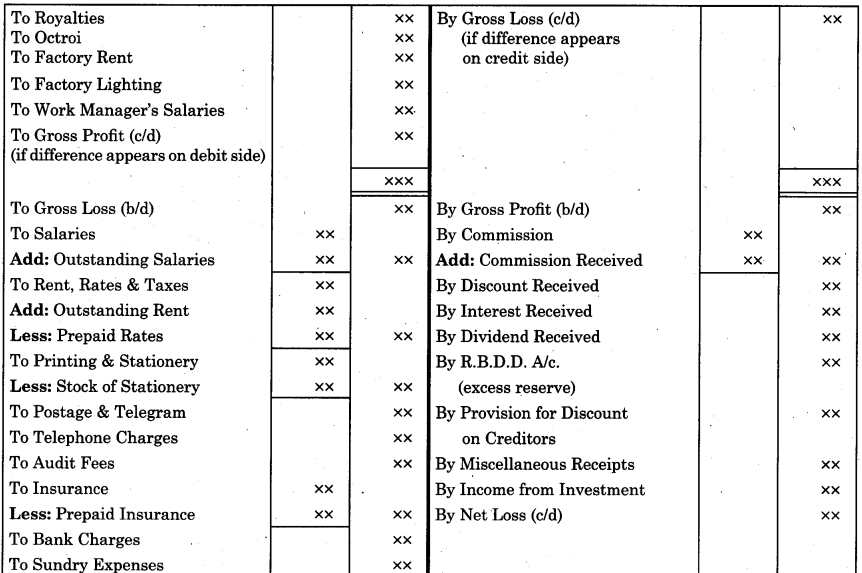

Profit And Loss Account-

Profit and Loss Account is a part of final accounts which is prepared on the basis of indirect expenses and indirect incomes of the business to ascertain the net result of the business, done in the accounting year. On completion of Trading Account, Profit and Loss Account are prepared by considering only indirect expenses and indirect incomes of the business. Expenses and incomes which have no direct relation with production and whose absence do not affect production, are called indirect expenses and indirect incomes, e.g. salaries, interest, rent, cost of stationery etc. Indirect expenses are recorded on the debit side of the Profit and Loss Account and indirect incomes are shown on the credit side of the Profit and Loss Account. Indirect expenses of business are classified as:

(i) Office expenses (they are also called administrative expenses.) (ii) Selling expenses and (iii) Distribution expenses.

Indirect incomes and gains include discount received, commission earned, interest received, rent received etc.

Debit balance of Profit and Loss Account indicates net loss incurred in the business and credit balance of Profit and Loss Account shows net profit earned in the business in the accounting year.

Net profit is then carried forward and added to the capital where net loss is adjusted in the capital account of the proprietor.

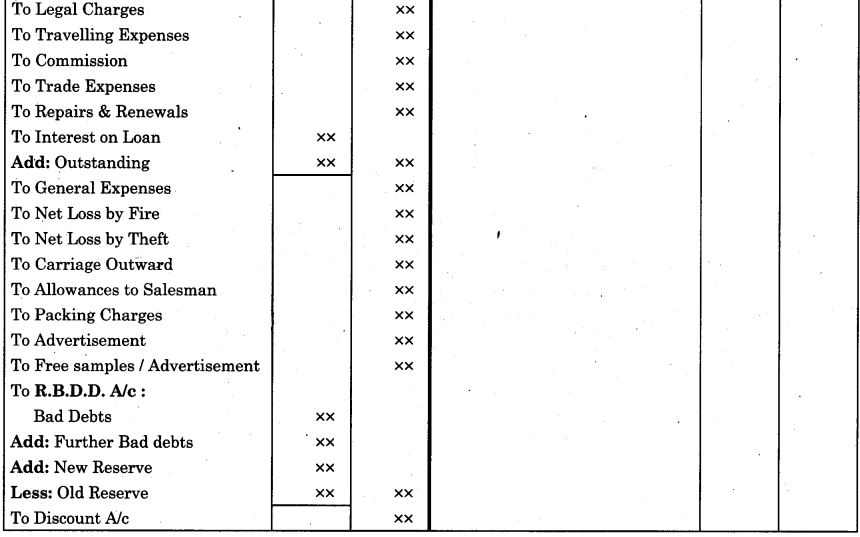

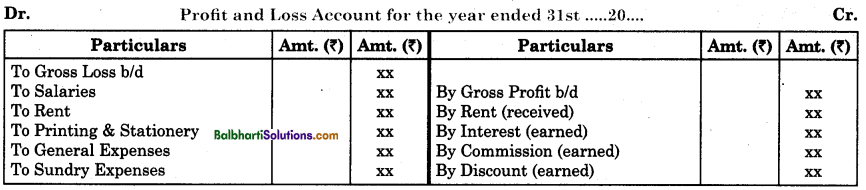

![]()

Specimen Form Of Profit And Loss Account-

Note : R.B.D.D. A/c. stands for Reserve for Bad and Doubtful Debts Account.

N/R stands for New Reserve O/R stands for Old Reserve

F/B/D stands for Further Bad Debts.

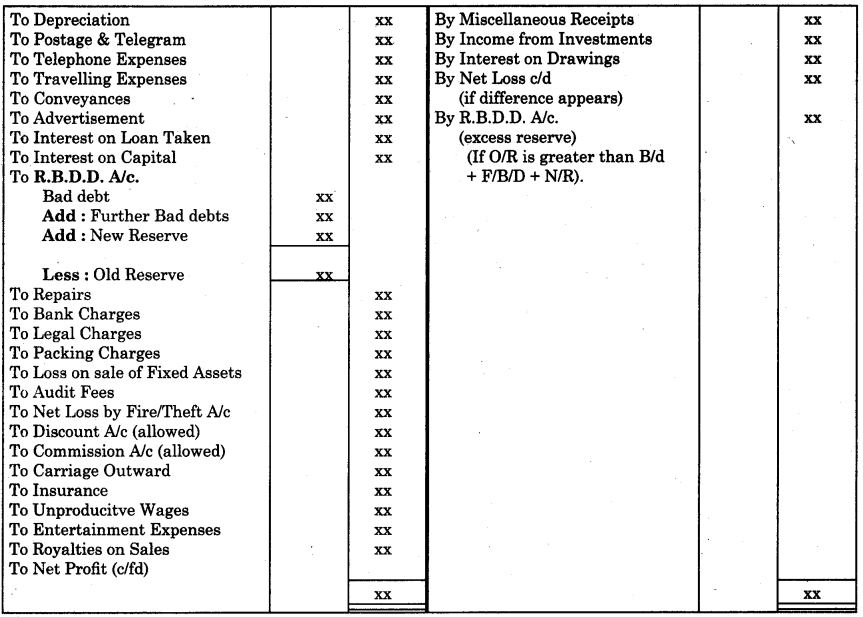

Journal Entries Relating to Profit And Loss Account-

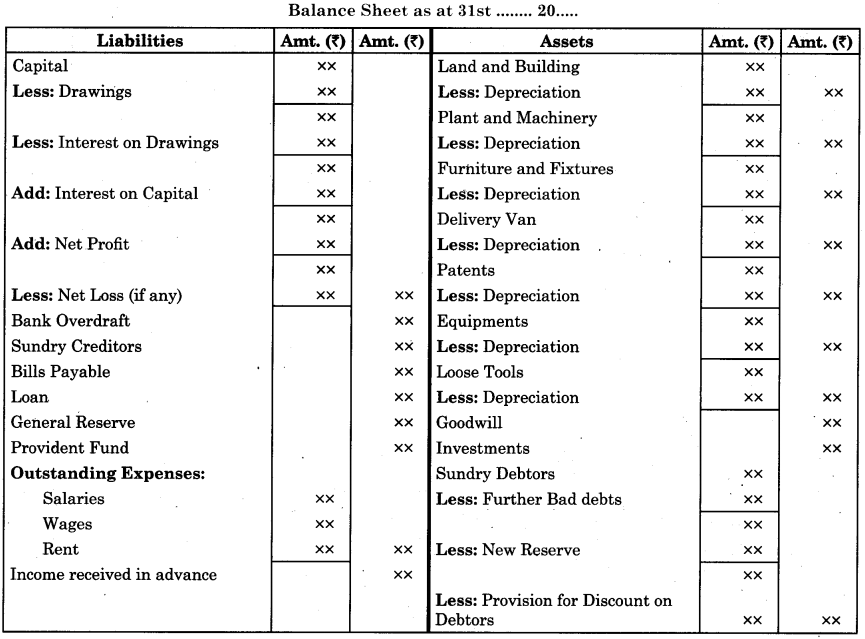

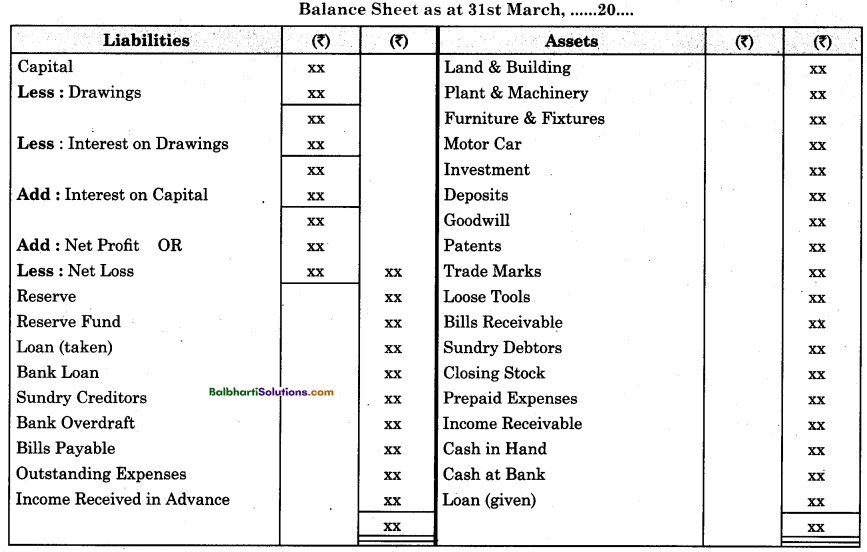

Balance Sheet: –

An accounting statement which shows the financial position of all assets and liabilities of the business as on particular date is called the Balance Sheet. Balance Sheet is not an account but a positional statement showing financial position of a business concern as on a particular date. On the left hand side of this statement liabilities of various types are systematically recorded and on the right hand of this statement all types of business assets are shown systematically. Business liabilities include short term liabilities like sundry creditors, bank overdraft, bills payable, outstanding expenses etc. and long term liabilities like bank loan, capital, loan etc. Business assets are classified as fixed assets, tangible assets, intangible assets, current or circulating assets and fictitious assets.

According to Palmer, “The Balance Sheet is a statement at a given date showing on one side the trader’s property and possession and on the other side his liabilities.”

![]()

Features of Balance Sheet-

- Balance Sheet is not an account but it is a statement.

- It depicts financial position of the business as on a particular date.

- It is prepared usually at the end of every accounting period, i.e. on 31st March every year.

- The balances of ledger accounts which are not transferred to Trading A/c and Profit and Loss A/c are ultimately transferred to Balance Sheet.

- Balance of Real A/cs and Personal A/cs are transferred to Balance Sheet.

Specimen Form of Balance Sheet-

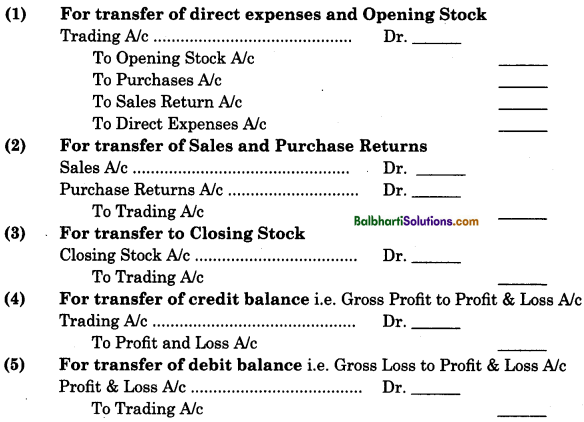

Adjustments-

Additional business information provided after completion of trial balance for preparation of final accounts are known as adjustments. To get a clear view and real results of business done in the trading year, some other business information, which do not find place in the trial balance, are required to be considered, while preparing final accounts. These adjustment items are required to be given proper effects in the final accounts. For every adjustment item, double effects (i.e. debit and credit) are given in the final accounts, e.g. outstanding wages are first added to wages on the debit side of the trading account and Secondly outstanding wages are shown separately on the liability side of the balance sheet.

Some Important Adjustments And Their Double Effects Are Discussed And Shown Below-

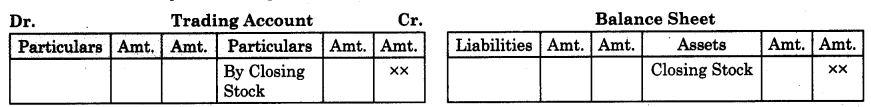

(i) Closing Stock : Value of stock in hand at the end of the accounting period is called closing stock. If closing stock is given in the list of adjustments, the same is to be recorded twice as – 1st effect: It is to be recorded separately on the credit side of the Trading Account.

2nd effect: Same is to be shown separately on the asset side of the Balance Sheet as it is shown below.

[Note: Closing Stock is always valued at cost price or market price whichever is less.]

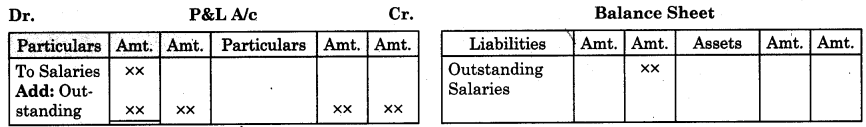

(ii) Outstanding Expenses : Expenses which are not paid or remains unpaid at the end of year, are called outstanding expenses, e.g. outstanding wages, outstanding rent, outstanding salaries etc. If outstanding expense is included in the trial balance, it is to be recorded only on the liability side of the Balance Sheet. If outstanding expense is given in the list of adjustments, the same is to be treated as: E.g. Outstanding Salaries.

1st effect: Add to Salary on the debit side of the Profit and Loss A/e.

2nd effect: Show separately on liability side of the Balance Sheet.

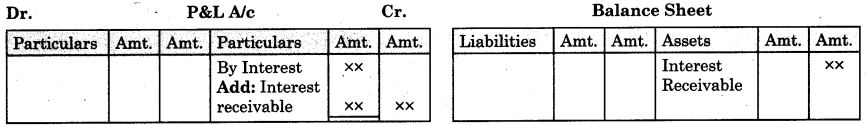

(iii) Income Receivable OR (Income earned but not received) : Income which is not received when it is due, is called as income receivable e.g. outstanding interest (receivable). If income receivable is included in trial balance, than it is to be shown only on the assets side of the Balance Sheet separately. If it is given in the adjustment list, same is to be shown as below : E.g. Interest Receivable.

1st effect: Add to interest received on the credit side of the Profit and Loss Account.

2nd effect: Show separately on the asset side of the Balance Sheet.

![]()

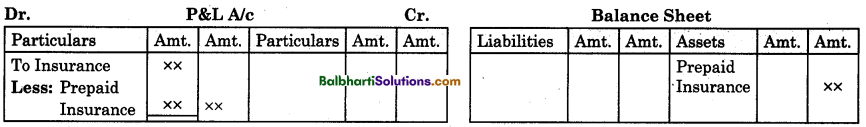

(iv) Expenses Paid in Advance (Prepaid Expenses) : When any expense is paid before it is due, the same is called as prepaid expense, e.g. prepaid insurance, prepaid rent etc. If it is given in the trial balance, the same is to be shown on the the assets side of the Balance Sheet. If prepaid expenses are given in the list of adjustments same is to be shown as below. E.g. Prepaid Insurance.

1st effect: Deduct prepaid insurance from the insurance premium paid in the Profit & Loss A/c on debit side.

2nd effect: Show prepaid insurance on the asset side of the Balance Sheet.

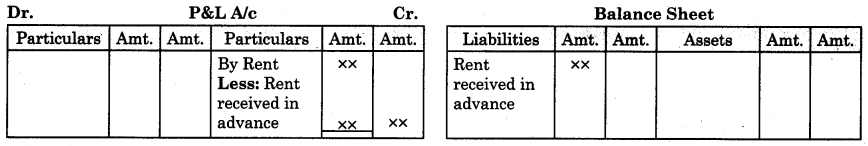

(v) Income Received in Advance : Income which is received before it is due, is called as income received in advance e.g. rent received in advance. If it is given in the trial balance, it is to be recorded on the liability side of the Balance Sheet only. If an item of income received in advance is given in the list of adjustments, the same is to be shown as below : E.g. Rent received in advance.

1st effect: Deduct rent received in advance from rent received in Profit & Loss account on credit side.

2nd effect : Show rent received in advance separately on the liability side of the Balance Sheet.

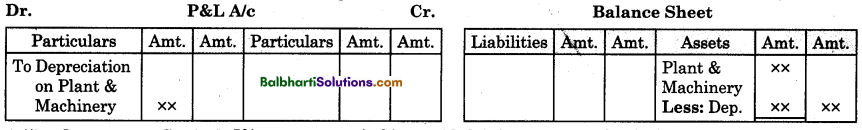

(vi) Depreciation : Depreciation means reduction in the value of fixed asset due to its continuous use, wear and tear or any other similar cause. Depreciation is charged on fixed assets like land & buildings, plant & machinery, furniture and fixtures etc. If depreciation item is provided in the trial balance it is to be debited to Profit and Loss Account only. If depreciation on fixed assets is given in the list of adjustments, the same is to be shown in final accounts as follows:

E.g. Depreciation on Plant & Machinery.

1st effect: Record depreciation separately on the debit side of Profit & Loss A/c.

2nd effect: Deduct the amount of depreciation from the related asset on asset side of the Balance Sheet.

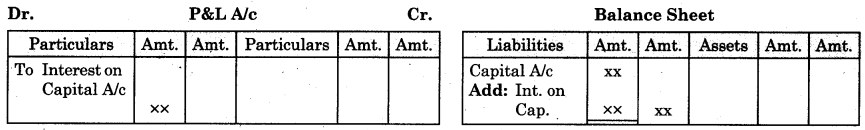

(vii) Interest on Capital: If interest on capital is provided, it is an expense for the business and an income for the proprietor. Adjustment effects of interest on capital are given below.

1st effect: Interest on capital is to be shown on the debit side of Profit and Loss Account separately. 2nd effect: Same amount of interest is to be added to the capital of proprietor, on the liability side of the Balance Sheet.

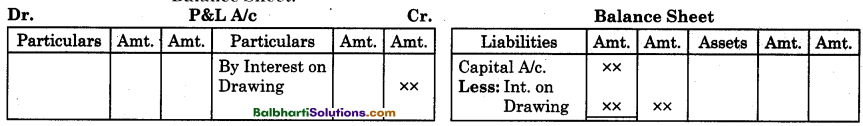

(viii) Interest on Drawings : Interest charged on the drawings is an income to the business and an expense for the proprietor. Adjustment effects of interest on drawings are given below:

1st effect: Interest on drawings is to be shown on the credit sideof Profit and Loss Accountseparately.

2nd effect: Deduct the same amount of interest from the capital of proprietor on liability side of the Balance Sheet.

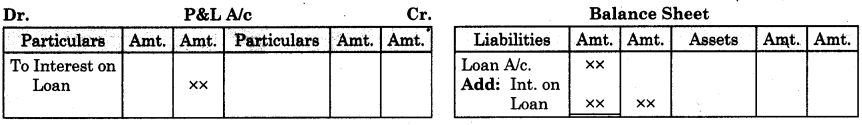

(ix) Interest on loan taken : Loan taken is a liability of the business. Interest on loan taken is an expense of the business. Adjustment effects of interest on loan taken is shown as below:

1st effect: Show interest on loan separately on the debit side of the P & L A/c.

2nd effect: Add this amount of interest to loan taken on the liability side of the Balance Sheet.

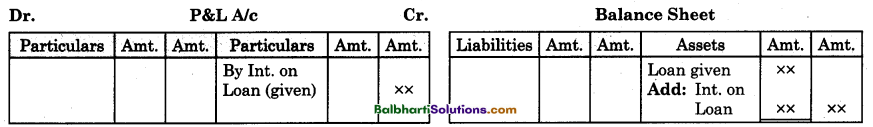

(x) Interest on loan given : Loan given is an asset of the business. Interest due on such loan is an income for the business. Two effects of interest on loan given are shown below:

1st effect: Show interest on loan separately on the credit side of the P&L A/c.

2nd effect: Add this amount of interest to loan taken on the asset side of the Balance Sheet.

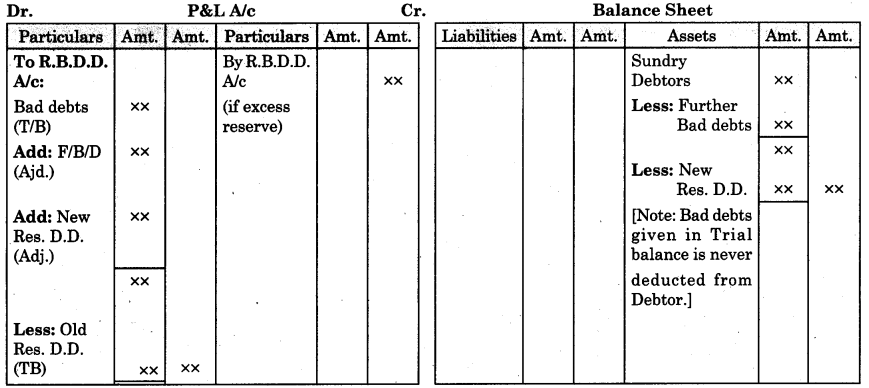

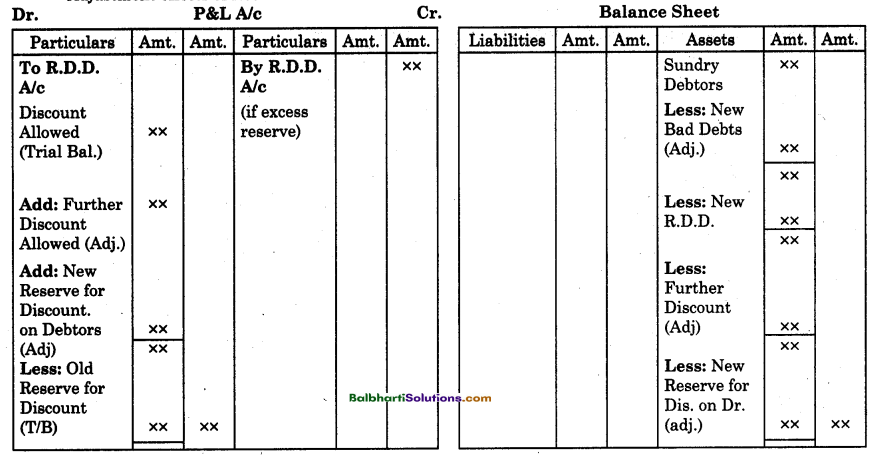

(xi) Reserve for Bad and Doubtful Debts Account (R.B.D.D. A/c) : This provision is created on Sundry Debtors. In connection with this account, bad debts incurred during the year and opening balance of R.B.D.D. . A/c (or R.D.D. A/c) are given in the trial balance. Further, bad debts and closing balance of R.B.D.D. A/c (or R.D.D. A/c) are provided in the list of adjustments. Their location and adjustments effects in final accounts . are shown below:

Where: F/B/D → stands for further bad debts.

New Res. D.D. → stand for New Reserve for Doubtful Debts.

Old Res. D.D. → stand for Old Reserve for Doubtful Debts.

R.B.D.D. A/c → stand for Reserve for Bad and Doubtful Debt Account.

Adj. → stands for Adjustment & T.B. stands for Trial Balance.

If (Bad debts + F/BID + NIR) > Old Reserve, the result is to be shown on the debit side of the Profit and Loss

Account.

If Old Reserve> (BID + FIBID + NIR), the result is to be shown on credit side of Profit and Loss Account.

![]()

(xii) Reserve for Discount on Debtors A/c : It is calculated on Sundry Debtors. Accounting treatment and adjustment effects of Reserve for Discount on Debtors are same as like adjustment effects of R.B.D.D. A/c

Where: R.D.D. A/c → stands for Reserve for Discount on Debtors Account.

If (Discount + F/Discount + New Reserve) > Old Reserve, result is to be shown on debit side of Profit & Loss account.

If Old Reserve > (Discount + F/Discount + New Reserve), the result is to be shown on credit side of Profit & Loss Account.

Discount on debtors is to be carried out after completion of adjustment effects of reserve for bad and doubtful debts.

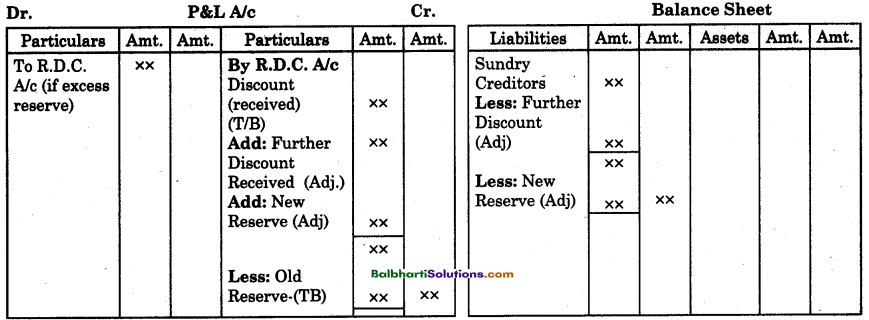

(xiii) Provision for Discount on Creditors Account: It is calculated on Sundry Creditors. Accounting treatment and adjustment effects for provision for discount on creditors are given below :

Where: R.D.C. A/c stands for Reserve for Discount on Creditors Account.

If (Discount + Further Discount + New Reserve) > Old Reserve, the result is to be shown on credit side of Profit and Loss Account.

If Old Reserve > (Discount + Further Discount + New Reserve), the result is to be shown on debit side of Profit and Loss Account.

(xiv) Goods Distributed as Free Samples : Newly established firms and even well established firms distribute samples of new product free of charge in the nearby areas to increase their sale. Adjustment effects of free samples are shown below:

1st effect: Show separately as “Goods distributed as free samples”on the credit side of Trading Account or deduct the amount of free sample from purchases on debit side of Trading Account.

2nd effect: Show separately on the debit side of Profit and Loss Account under the heading “Advertisement Account.”

![]()

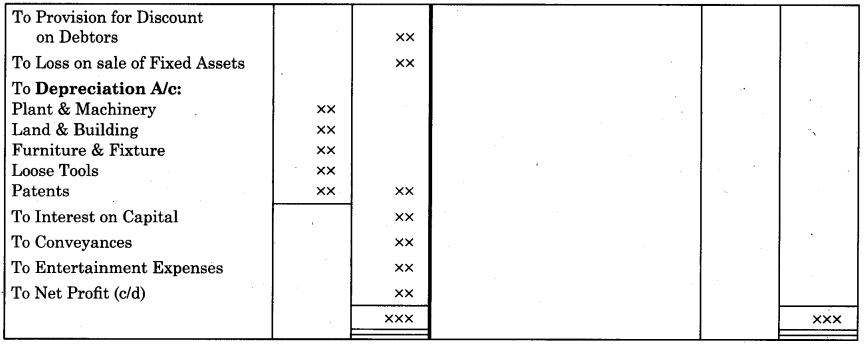

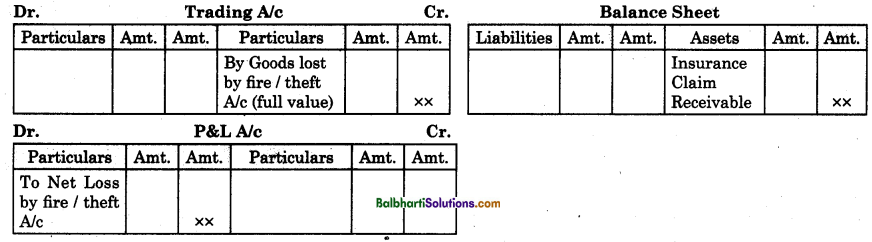

(xv) Loss of Goods by Fire or Theft: Adjustment effects of goods lost by fire or theft are shown below:

(A) If goods are insured :

1st effect: Show separately, on the credit side of Trading Account, the full value of goods lost.

2nd effect: Show separately on debit side of Profit and Loss Account, the difference between value of goods lost and insurance claim receivable i.e. net loss by fire or theft.

3rd effect: Show the insurance claim admitted by the insurance company on the asset side of the Balance Sheet. This is shown as below:

(B) If goods are not insured :

1st effect: Show separately on the credit side of Trading Account the full value of goods lost by fire or theft.

2nd effect: Show separately on debit side of Profit & Loss Account the full value of goods lost by fire or theft.

This is shown as below.