By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 3 Reconstitution of Partnership (Admission of Partner) students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 3 Reconstitution of Partnership (Admission of Partner)

Meaning of Reconstitution of Partnership-

To reconstitute means to form or create it again. Accordingly reconstitution of partnership means to change the earlier relationship and form a new relationship between or among the partners. It refers to the change in the form of partnership due to making of new agreement by the partners. Such reconstitution of partnership takes place on account of admission of a new partner or retirement or death of existing partner.

Different forms of reconstitution : The different forms of reconstitution of partnership are stated

below :

(1) Change in profit-sharing of existing partner : Sometimes due to certain circumstances, existing partners may decide to change their profit and loss ratio. If one of the partners purchases certain profit sharing ratio from another partner, the old partnership deed may get terminated and new agreement comes into force stating the new profit sharing ratio.

(2) Admission of a new partner : If need arises a new person may be admitted into the partnership firm with the consent of all the existing partners. On admission, new partner becomes a new owner of the firm. He is required to bring in his share of capital and goodwill and is entitled to share in future profit. Hence, partnership agreement changes.

(3) Retirement of existing partner : On account of old age, continuing ill health or by sweet will an existing partner may retire from the partnership firm. He is called outgoing partner. Partnership firm is required to pay all his dues on retirement. The profit sharing ratio of continuing partners increases due to reduction in the number of partners.

![]()

(4) Death of partner : When a partner dies, he no more remains as partner of a firm. On natural ground he ceases to be partner of a firm. On death of a partner, the profit sharing ratio of continuing partners get changed and old partnership agreement gets terminated.

Admission of a Partner-

As per the Section 31(1) of the Partnership Act, 1932, if need arises, with the consent of all the i

existing partners a new person can be admitted in the partnership firm. Such a partner is called incoming

partner. :

Meaning and Need of admission of a partner:

Meaning : Admission of a partner refers to a process in which a new person is taken into the existing partnership firm as a partner as per certain terms and conditions of partnership deed.

On admission, a new partner brings in cash for his share of capital and goodwill, skill, services, experience, etc. into the existing partnership business and in exchange he gets certain share in future profit of the firm and right in the assets of the firm.

Need : The need of admission of a partner is stated as follows :

- To increase the capital resources of the firm and :

- To secure the advantages of the new person’s skill, experience and business connections to develop efficiency of the business.

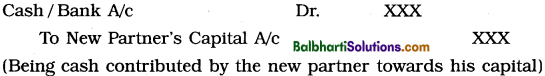

Capital brought in by new partner : At the time of admission, new partner is required to bring .

in cash or/and other assets, if any, as his capital, to get rights in the assets and definite share in the future profit of the firm.

When a new partner brings in cash towards his share of capital, the following journal entry is passed :

In case a new partner brings in other assets towards his capital the following journal entry is ;

passed :

New profit sharing ratio : In all cases of admission of a partner, the new partner gets the agreed share in the future of profit whereas all the old partners together get the remaining share. As a result profit sharing ratio of existing (old) partners changes and newly constituted firm is required to calculate new profit sharing ratio for all the partners including new partner. Such new ratio is used by the firm to write off goodwill and to make adjustments in Capital Accounts of the Partners.

New Ratio is calculated by using following formula :

Assume that total profit be 1, The Balance of 1 = (1 – share given to new partner).

New Ratio = (Balance of 1) x Old Ratio.

If sacrifice ratio of old partners is given along with old ratio, the new ratio can be calculated as

→ New Ratio = Old Ratio – Sacrifice Ratio.

Sacrifice ratio : Sacrifice ratio is the ratio in which two or more old partners surrender or give up their shares in the future profit in favour of a new partner of the firm. Sacrifice ratio is calculated by using the following formula :

Sacrifice Ratio = Old Ratio-New Ratio

![]()

Meaning of Goodwill-

It is often observed that some business firms are in a position to earn higher profit in comparison to other firms dealing in the similar line of products. This extra earning capacity of a business firm is called goodwill. In other words, Goodwill is the monetary value of the reputation of a firm as measured in terms of its expected future profits. In the words of Lord Macnaghten, Goodwill is “the benefits and advantages of the good name, reputation and connections of the business.

According to Institute of Chartered Accountants of India, Goodwill is “an intangible asset

arising from business connection or reputation or trade name of an enterprise. ” Goodwill is built up slowly and gradually by a business concern through great efforts over a long period of time.

The factors on which the value of goodwill depends are : (1) monopoly enjoyed by the business (2) its continued prosperity (3) its reputation, location and connections with leading parties (4) its trade mark, brand name and patents (5) its high profit earning capacity and (6) good and cordial relations with all including customers, employees etc.

Goodwill is an intangible asset because its existence cannot be verified by our senses. It is an asset that cannot be expected to realise or converted into cash unless it is sold along with the business. Goodwill is valued and recorded in the books of accounts by the partnership firm on the following occasions : (1) Sale or purchase of a firm as a going concern (2) Admission of a partner (3) Retirement or death of a partner (4) Change in the profit and loss ratio of the partners.

Methods of Valuation of Goodwill : As prescribed in the syllabus, the value of goodwill as on a ,

particular date is ascertained by using any one of the following methods : ‘

(A) Average Profit Method and (B) Super Profit Method.

(A) Average Profit Method : Under this method, goodwill is valued at certain number of years’ .

purchases of the average profit of the firm. To compute the value of Goodwill as per this ,

method the following formulae are used :

- Total Profits = Profits of the given number of years-losses, if any.

- Average Profit = \(\frac{Total Profits of given no. of years}{No. of years given}\)

- Goodwill = Averge Profit x No. of years’ purchases

Steps to calculate goodwill : Following steps are required to be taken for calculating goodwill :

- Calculate total profit by giving plus sign to profits and minus sign to losses.

- Calculate average profit by dividing total profit by given number of years.

- Calculate the value of goodwill by multiplying average profit by given number of years’ purchases.

(B) Super Profit Method : Under this method, goodwill is valued at certain number of years’ •; purchases of the super profit of the partnership firm. In order to understand the formulae used for computing the value of goodwill under super profit method, the following concepts need to be understood :

(1) Super Profit : Super profit is the profit earned by the business concern over and above the normal profit or return earned on capital exmployed. Super profit is calculated by using the following formula :

Super Profit = Average Profit – Normal Profit.

(Normal Profit or Normal Return on Capital Employed : Normal profit or normal return on capital employed refers to a reasonable profit earned by a business concern to survive in the industry after meeting all its business expenses.

It is ascertained by using the following formula :

Normal Profit or Normal Return on Capital Employed = Capital Employed x Normal Rate of Return.)

(2) Capital Employed : Capital employed is the total amount of capital used by the business concern to run and maintain its business activities. Capital employed is made of fixed assets other than goodwill plus current assets minus current liabilities.

(3) Normal Rate of Return : Normal rate of return is the return or profit normally expected on the capital employed by considering the returns or profit actually earned by other firms in the same industry. This is the average rate of return or profit earned in the industry. Normal rate of return depends on the nature of business and element of risk involved therein.

(4) Goodwill: Super Profit x Number of years’ purchases.

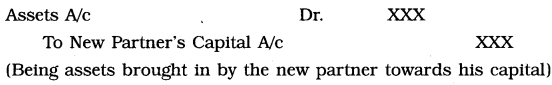

Accounting Treatment of Goodwill: As new partner gets certain share in future profit of the firm from old partners who sacrifice their profit sharing ratio in favour of him, for which they (old partners) must be compensated for such a loss. Therefore, new partner is required to bring in certain amount for goodwill in addition to the amount to be brought in by him towards his share of capital. At the time of admission, goodwill may be given treatment in one of the following two methods, viz.

(A) Premium Method and (B) Valuation Method.

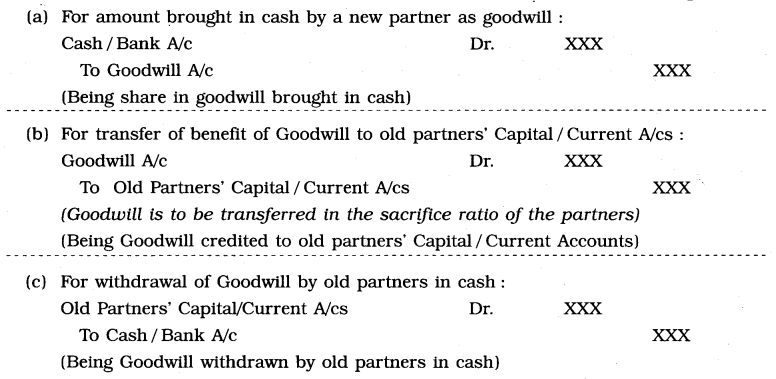

(A) Premium Method : Under premium method following possible cases are considered : Journal entries are shown as follows :

(i) When a new partner brings his share of goodwill in cash which is retained in the business :

(ii) When a new partner brings Goodwill In cash but it is withdrawn by the old partners:

(iii) When a new partner pays amount of Goodwill to old partners privately :

No accounting entry is to be passed in the books of the partnership firm as amount of goodwill is paid privately by a new partner to old partners, business firm as such is not at all benefited and therefore, there is no necessity of recording any entry for goodwill in the books of a partnership firm.

![]()

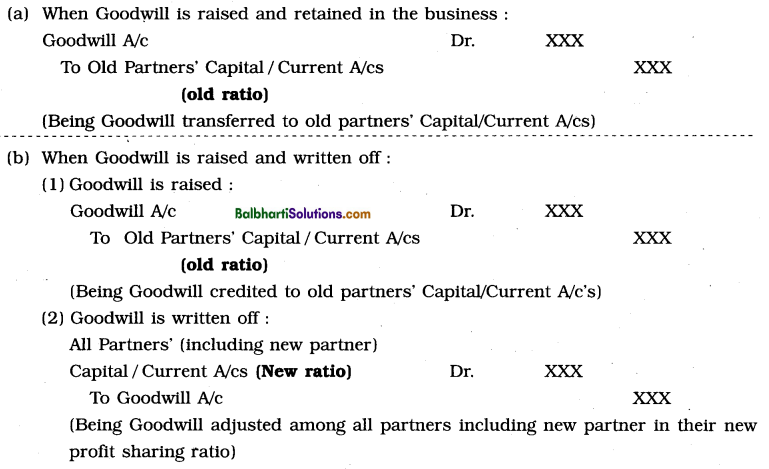

(B) Valuation Method : if the new partner does not bring in his share of goodwill in cash, a new Goodwill A/c may be opened and it may be treated in the following manner :

(i) If goodwill does not appear in the books of accounts :

(ii) If goodwill already appears In the books of accounts:

(a) If on revaluation, the revised value of goodwill Is found to be lower than Its existing value which already appears In the books : (Entry is to be passcd only for difference in the value of goodwill)

(b) If on revaluation, the revised value of goodwill is found to be greater than Its existing value which already appears in the books : (Entry is to be passed only for difference In the value of goodwill)

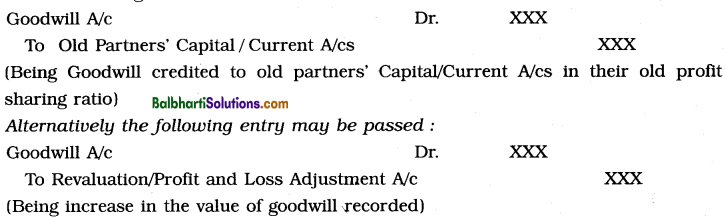

Revaluation of Assets and Liabilities : Just before the admission of a new partner, it is usual practice to revalue the assets and liabilities of the existing firm. The profit or loss which arises due to changes in their values is shared by the old partners alone. To record such changes in the values of assets and liabilities, a separate account is opened and operated. Such an account is called “Profit and Loss Adjustment A/c” or “Revaluation A/c”. It is a nominal account showing the expenses or losses on the debit side and incomes or gains on the credit side.

A decrease in the value of the assets and an increase in the amount of the liabilities are shown on the debit side of this account, while an increase in the assets or a decrease in the liabilities are shown on the credit side of this account. So also this account is debited for recording an outstanding expense and creating a provision for bad and doubtful debts and credited for recording incomes receivables, prepaid expenses and creating a provision for discount on creditors. Any balance of this account is then transferred to old partners’ capital/current accounts in their old profit sharing ratio.

Debit balance of Profit and Loss Adjustment A/c or Revaluation A/c indicates loss incurred on revaluation of assets and liabilities, while credit balance of this account shows profit earned on revaluation of assets and liabilities.

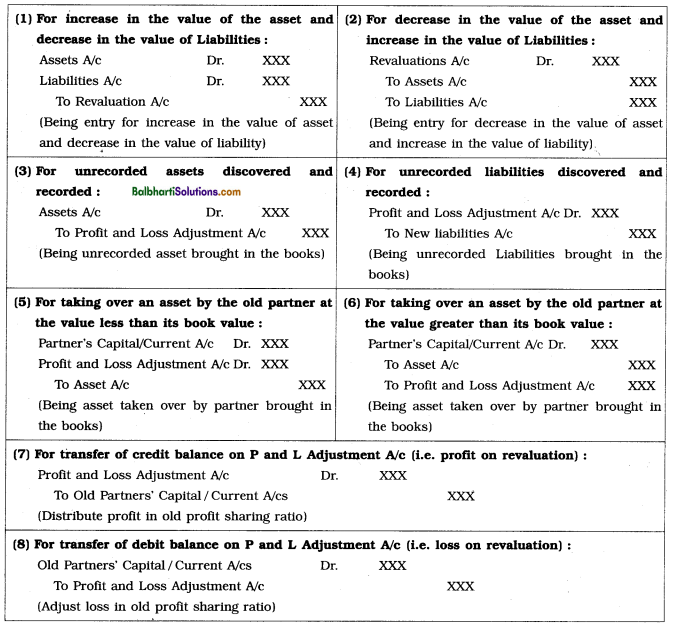

(a) Pro Forma journal entries on revaluation of assets and liabilities are given below :

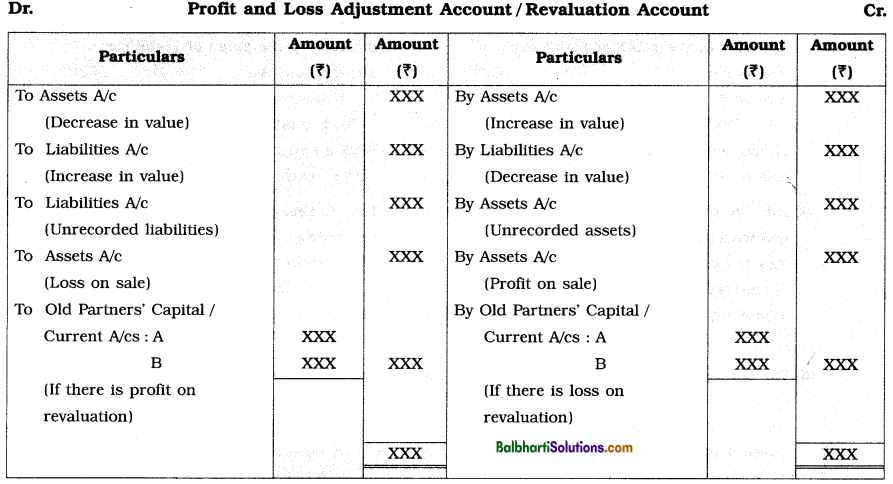

(b) Pro Forma Profit and Loss Adjustment Account/Revaluation Account :

![]()

Adjustment of Accumulated Profits and Losses:

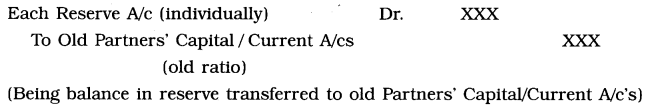

(1) Different type of Reserve Funds : Every year part of the profit, kept aside in a separate account by the partners to meet the loss, if any that may arise due to unforeseen contingencies like flood, fire, theft, sudden fall in prices of firm’s products, etc. is called as General Reserve. The credit balance in General Reserve, Reserve Fund, Workmen’s Compensation Fund, Investment Fluctuation Fund, Joint Policy Reserve, etc., are created out of past profit, the balance of the those reserves entirely belong to old partners and therefore new partner has no right to get any share in those reserves. Hence on admission of a new partner, entire balance in the above mentioned reserves is required to be transferred to old partners’ capital accounts or current accounts in their old profit sharing ratio. The following journal entry is required to be passed for transfer of balance in various reserves :

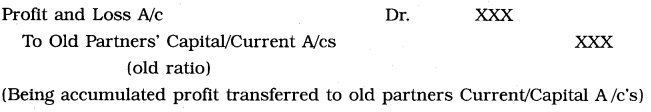

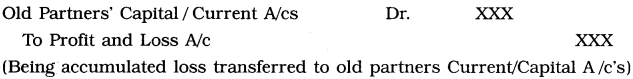

(2) Accumulated Profit/Loss : Every year part of the profit, which remains undistributed among the old partners, is carried forward to next year. Such undistributed profit accumulated over many years is shown in the Balance Sheet on liabilities side under the heading “Profit and Loss A/c”. Similarly, part of the losses unadjusted among the partners is carried forward to next year. Such unadjusted losses if any, accumulated over many years are shown on the Assets side of the Balance Sheet under the heading “Profit and Loss A/c”. At the time of admission of a new partner, entire balance of such accumulated profits or losses is transferred to old partners’ capital/current accounts in their old profit sharing ratio. The following entries are required to be passed for transfer of accumulated profit/losses :

(a) Transfer of accumulated profit:

(b) Transfer of accumulated loss :

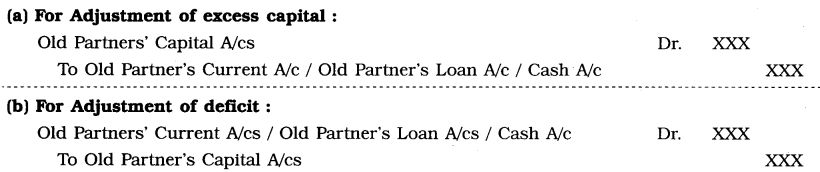

Adjustment of Capitals: At any time when the partners so desire (and especially after admission of a new partner), they may make their capitals proportionate to their new profit ratio either through their Current or Loan A/cs or by actually bringing in or withdrawing cash.

The capital accounts of all the partners are usually adjusted by taking new partner’s capital as the base and then adjust the capital of other partners. Adjusted new capital balance of each old partner is then compared with his actual capital balance to find out deficit or surplus of capital. Ultimately, the deficit or surplus of capital of partners is adjusted either through partners’ current account or his loan account or through cash.

The following journal entries are passed for adjustment of partners’ capitals as mentioned above :