By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 4 Reconstitution of Partnership (Retirement of Partner) students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 4 Reconstitution of Partnership (Retirement of Partner)

Introduction, Meaning and Reasons-

To retire means to give up or to cause a person to give up his work, especially reaching superannuation age. Accordingly, retirement of partner refers to a process in which a partner leaves the firm or severs his connection or relationship with other partners on account of old age or continued ill health or loss of interest in the firm, misunderstanding amongst the partners, loss in the business or any other similar reasons. On retirement, retired partner ceases to be a partner of the firm. A partner who leaves the firm or goes away from the business is called “retiring partner” and partners who continue (or remain) in the partnership firm are called “continuing partners”. On retirement of partner, it is just necessary to ascertain or compute the amount payable to him. It is ascertained by considering net balance in Capital Account and Current Account, his share in accumulated profit, Reserve fund, part losses, goodwill, revaluation profit or loss, etc.

![]()

A partner may retire from the firm due to : (1) old age, or continued sickness (2) loss incurred in the business (3) loss of interest in the firm on account of any reason (4) partner intends to start another or new business (5) differences of opinion or misunderstanding with the other partners, etc.

The partner may retire from the firm by undertaking one of the following steps or procedures : (i) As per the terms mentioned in the partnership agreement or Deed (ii) By taking consent of other partners, (iii) By giving notice of retirement in writing to other partners.

New Ratio-

New ratio is a ratio or proportion in which continuing partners decide to share profits or losses of the business after retirement of a partner.

Calculation of new profit sharing ratio :

Gain Ratio-

Profit sharing ratio which is acquired by continuing partners on account of retirement or death of a partner is called Gain Ratio. It is generally calculated at the time of retirement or death of a partner. Gain ratio is calcualted by using the following formula :

Gain Ratio = New Ratio – Old Ratio.

Gain ratio is calculated and used to write off the goodwill raised or created to the extent of retiring partner’s share only.

Treatment of Goodwill-

At the time of retirement of a partner for adjustment of goodwill, one of the following courses may be adopted :

(1) When goodwill does not appear in the books of account:

If goodwill account is not shown at all in the books of account on the date of retirement, it may be adjusted in any one of the following five ways :

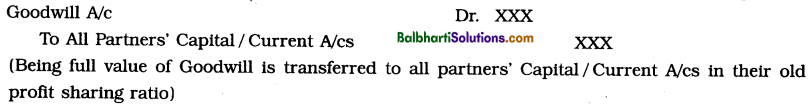

(a) When goodwill is raised to its full value and retained in the business :

(Note : In this case, the full value of goodwill is shown in the Balance Sheet on Assets side.)

![]()

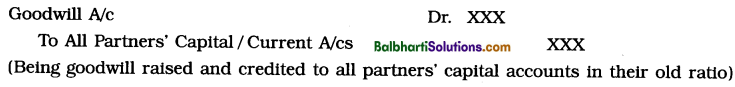

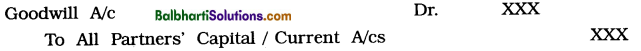

(b) When goodwill is raised to its full value and then written off from the books of account:

(i) When Goodwill is raised :

(ii) When Goodwill is written off:

(Note : In this case, goodwill does not appear in the Balance Sheet.)

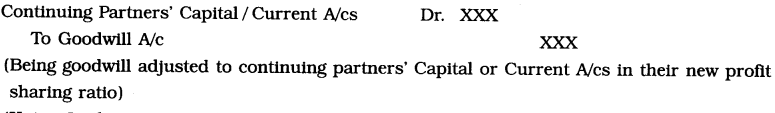

(c) When goodwill is raised partially, that is by an amount equal to retiring partners’ share and then retained in the business :

(Being goodwill to the extent of retiring partner’s share raised and credited to his Capital A/c)

(d) When goodwill is raised only to the extent of retiring partner’s share and then written off from the books of account:

(i) When Goodwill is raised :

(Being goodwill to the extent of retiring partner’s share raised and credited to his Capital A/c)

(ii) When goodwill is written off :

(Being goodwill adjusted to continuing partners’ Capital or Current A/cs In their gain ratio)

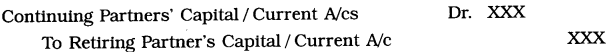

(e) When goodwill is adjusted through Current A/cs or Capital A/cs of the partners without opening a Goodwill A/c :

(Being continuing Partners’ Current A/cs or Capital A/cs are debited in their gain ratio)

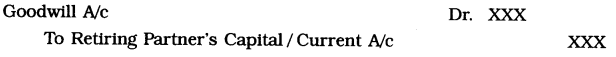

(2) When goodwill is already appearing in the books of account:

(i) If the amount of goodwill appears in the Balance Sheet is less than its actual value of goodwill (undervalued):

(Being increased value of goodwill transferred to all Partners’ Capital A/cs/Current A/cs in their old profit sharing ratio)

(Being increased value of goodwill transferred to Profit and Loss Adjustment A/c or Revaluation A/c)

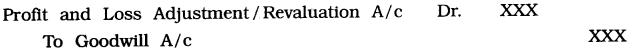

(ii) If the amount of goodwill appears in the Balance Sheet is greater than the value of goodwill (overvalued) :

![]()

(Being decreased value of goodwill adjusted to all Partners’ Capital / Current A/cs in their old profit sharing ratio)

Alternatively, following entry may be passed :

(Being decreased value of goodwill adjusted to Profit and Loss Adjustment A/c or Revaluation A/c)

![]()

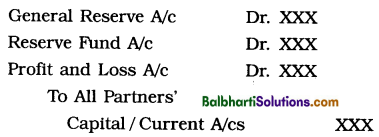

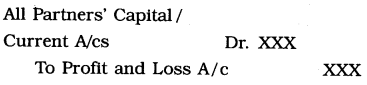

Transfer of Reserve Fund or General Reserve / Accumulated Profit or Loss-

On retirement of a partner, balance in general reserve, as well as past accumulated undistributed profit are transferred to all partners’ capital accounts or current accounts in their old profit sharing ratio. Similarly accumulated past losses of the firm are also adjusted to all partners’ capital accounts or current accounts in their old profit sharing ratio.

However, sometimes, if continuing partners so desire, only retiring partners’ share in general reserve and accumulated past profits or losses is transferred to his capital account or current account. Following journal entries are passed for transfer of general reserve and accumulated undistributed profits or losses, i.e. balance of Profit and Loss Account:

(1) Transfer of general reserve, accumulated profits, etc. :

(Being general reserve. accumulated profit transferred)

(2) Transfer of accumulated losses :

(Being accumulated losses transferred and debited to all partners’ capital/current A/cs in old ratio)

Revaluation of Assets and Re-assessment of Liabilities-

At the time of retirement of a partner, all the assets and liabilities of the partnership firm are usually revalued and changes in their values are, therefore, effected through a Profit and Loss Adjustment A/c or Revaluation A/c. A reduction in the values of assets and an increase in the values of liabilities are debited to this account while an increase in the values of assets and a reduction in the values of liabilities are credited to this account. The balance of Profit and Loss Adjustment A/c or Revaluation A/c is then transferred to all partners’ capital accounts or current accounts in their old profit sharing ratio.

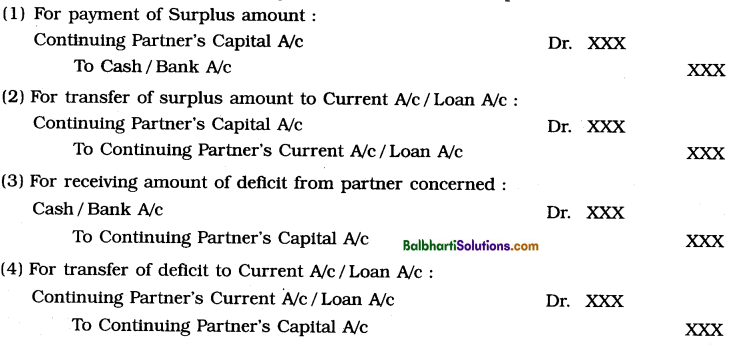

Adjustment of Capitals-

The continuing partners if they so desire, may make their capitals proportionate to their new profit sharing ratio either through their Current Accounts or Loan Accounts or by actually bringing in or withdrawing cash. In this case, total capital of the new firm is decided and following steps are taken :

- From the total capital of the firm, the amount of capital to be maintained in the new firm by each continuing partner is determined as per new profit sharing ratio.

- New capital balance i.e. balance as per new profit sharing ratio of each partner is compared with the latest balance in its Capital Account to ascertain surplus or deficit.

- Surplus or deficit in each partner’s Capital Account is worked out.

- Such surplus or deficit of each partner is adjusted through withdrawal in cash or bringing in cash. Such surplus or deficit may be transferred to Current Account or Loan Account as per the decision taken by the continuing partners or as per the provisions made in the Partnership deed.

Pro forma journal entries of adjustment, of deficit or surplus :

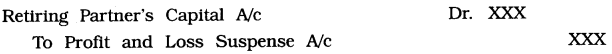

Ascertainment of retiring partner’s share of profit till retirement:

- If a partner retires from the firm during the accounting year i.e. on a date other than the Balance Sheet date, the profit or loss for the period for which he was a partner may be calculated on the basis of last year’s profit or the average of the profits for the last two to five years.

- From the average annual profit of the firm, calculate profit for the proportionate period from the date of last Balance Sheet to the date of retirement of a partner.

- Calculate retiring partner’s share in that proportionate profit or loss.

- To record retiring partner’s share in proportionate profit or loss, following accounting entry is to be passed :

(i) For transfer of retiring partner’s share in proportionate profit:

![]()

(ii) For adjustment of retiring partner’s share in proportionate loss :

![]()

Total payable amount to Retiring Partner-

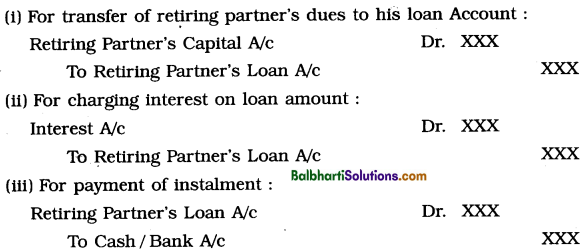

The total amount payable to retiring partner may be paid as per the terms of partnership deed or otherwise as per the mutual agreement among the partners. The partnership firm may pay either full or part of the amount due to retiring partner at the time of retirement and balance if any, is transferred to his Loan A/c. The various types of repayment of retiring partners’ dues are explained as follows :

(1) Lumpsum : Under this method, entire amount due to the retiring partner is paid in one instalment or at a time. The journal entry is given as follows :

Payment of retiring partner’s dues in one instalment or in lumpsum :

(2) Instalment: Under this method, retiring partner’s dues are paid in several convenient instalments. Journal entries relating to this are shown below :

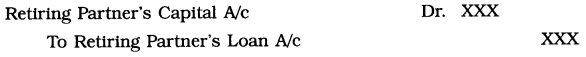

(3) If the total amount due transferred to Loan A/c :

(4) If part of the total amount due to retiring partner is paid in cash and balance is transferred to his Loan A/c :

Accounting steps to record retirement of a partner : The usual accounting steps for recording

the retirement of a partner are stated below :

- Prepare ledger accounts like Partner’s Capital / Current A/cs, Profit and Loss Adjustment A/c, Cash/Bank A/c, Goodwill A/c, etc.

- Transfer opening balances as given in the last Balance Sheet to the respective ledger accounts mentioned above.

- Transfer the balances of General Reserve, the Profit and Loss A/c and other undistributed profits or unadjusted losses to All Partners’ Capital / Current A/cs in their old profit sharing ratio.

- Give accounting treatment to Goodwill.

- Revalue the assets and liabilities and transfer resulting profit or loss to All Partners’ Capital/ Current A/cs (including retiring partner) in their old profit sharing ratio.

- Pass an entry for payment made to retiring partner.

- Transfer unpaid balance on Retiring Partner’s Capital A/c to his Loan A/c.

- Balance the Capital A/cs of continuing partners and prepare the Balance Sheet of the firm after retirement of a partner.