By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 5 Reconstitution of Partnership (Death of Partner) students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 5 Reconstitution of Partnership (Death of Partner)

Meaning-

Death means the permanent end of all functions of life in an organism. Accordingly when a partner dies, he no more remains as partner of a firm. On death of a partner, he ceases to be partner of a firm on natural grounds. Thus, death of a partner is equivalent to compulsory retirement. The surviving partners may continue the business if partnership firm makes provisions in partnership deed. On the death of a partner, total amount due to deceased partner is transferred to his Legal Heir’s Account or Legal Representative’s Account or Executor’s Account. Surviving partners make arrangement to make payment of deceased partner’s dues with his legal representative who is entitled to interest at 6 % p.a. on the amount due from the date of death to the date of payment. On death of a partner, profit sharing ratio of the surviving partners get increased because profit sharing ratio of deceased partner gets divided and received by surviving partners.

New Profit Sharing Ratio-

New profit sharing ratio is a ratio in which the continuing partners share the future profit or loss of the firm after the death of a partner.

![]()

Gain (Benefit) Ratio-

Profit sharing ratio which is acquired by the continuing or surviving partners on account of death of a partner is called Gain Ratio or Benefit Ratio. Gain ratio is calculated by using the following formula : Gain ratio = New ratio – Old ratio. Usually gain ratio is used by the firm to write off goodwill raised only to the extent of deceased partner’s share.

Revaluation of Assets and Liabilities-

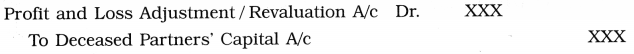

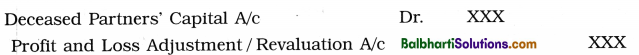

At the time of death of a partner, all the assets and liabilities of the partnership firm are usually revalued and changes in their values are effected through a Profit and Loss Adjustment Account or Revaluation A/c. A reduction in the values of assets and an increase in the values of liabilities are debited to this Account while an increase in the values of assets and a reduction in the values of liabilities are credited to this Account. Tp transfer the deceased partner’s share in profit or loss made on revaluation of assets and liabilities, the following journal entries are passed :

(a) Transfer of profit on revaluation :

(Being share of deceased partner in revaluation profit transferred to his Capital A/c)

(b) Transfer of loss on revaluation :

(Being share of deceased partner in revaluation loss transferred to his Capital A/c)

Note : Please note that journal entries for revaluation of assets and liabilities are the same as those for admission of a partner. For pro forma journal entries and ledger accounts for revaluation of assets and liabilities, refer to Chapter 3 on Admission of a Partner in this book.

Amount due to deceased partner’s executor-

In order to ascertain the total amount payable to the deceased partner’s executor the following counting items are considered :

(1) Capital balance : Capital balance of the deceased partner shown in the last Balance Sheet is required to the transferred to Capital Account of the deceased partner on credit side as ‘By Balance b/d’.

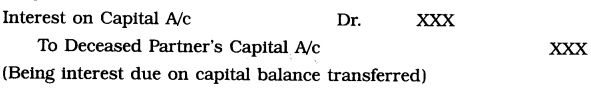

(2) Interest op capital : If there is a provision in the partnership deed to pay interest on Partners’ Capital, the interest bmegpital for the period beginning from the date of the last Balance Sheet to the date of death of a partner is calculated at specified rate and transferred to his Capital Account by recording the following journal entries :

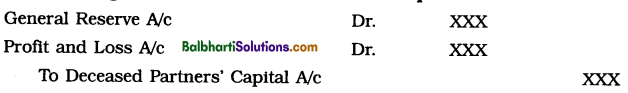

(3) Transfer of the deceased partner’s share in general reserve, undistributed profits and unadjusted losses : If there are any items like Reserve Fund/General Reserve/undistributed profits or unadjusted losses shown in the last Balance Sheet, then the share of the deceased partner in those items should be calculated and transferred to his Capital Account by recording the following journal entries :

(a) Transfer of general reserve and undistributed profits :

(Being share of deceased partner in general reserve and undistributed profit transferred)

(b) Transfer of unadjusted losses :

(Being share of deceased partner in unadjusted losses transferred)

![]()

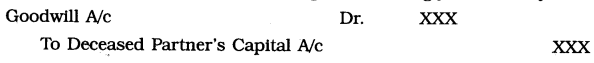

(4) Share of goodwill : On the death of a partner, goodwill of the firm is to be valued as per the terms and conditions contained in the partnership agreement of the partnership firm and accordingly the share of the deceased partner can be ascertained. The share of goodwill of the deceased partner is transferred to his Capital Account by passing the following journal entry :

(Being share of deceased partner in goodwill transferred to his Capital A/c)

(5) Salary due to a deceased partner : If there is a provision in the partnership deed to pay salary to partners, salary payable for the period from last Balance Sheet to the date of death of a partner is calculated and then transferred to the deceased Partner’s Capital Account by recording the following journal entry :

(Being salary due to deceased partner transferred to his Capital A/c)

(6) Drawings of the partner : Deceased partner’s drawings for a period from the date of last Balance

Sheet till the date of his death are to be calculated and transferred to his Capital Account by recording the following journal entry :

(Being drawings of the deceased partner adjusted to his Capital A/c)

(7) Interest on Drawings : If there is a provision in the partnership deed to charge interest on partner’s drawings, the interest on drawings for the period beginning from the date of last balance sheet to the date of death is calculated at specified rate and transferred to his Capital Account by recording the following journal entry :

![]()

(Being interest due on drawings adjusted to Capital A/c)

(8) Share of the deceased partner in the accrued profits of the firm i.e. profits accrued to firm from the date of last Balance Sheet to the date of death of a partner : The accrued profit of the firm from the date of the last Balance Sheet to the date of death of a partner may be calculated either on the basis of the last year’s profit or the average of the profits for last two to five years. Deceased partner’s share for a period from the date of the last Balance Sheet to the date of death, in the accrued profit of the firm can be calculated by using the following formula :

Deceased partner’s share in accrued profit = Deceased partner’s profit sharing ratio x proportionate period for which he was in the firm during the accounting year of death x Average accrued profit of last year’s profit.

To transfer this share of profit to the Deceased Partner’s Capital A/c the following journal entry is to be passed :

(9) Share in revaluation of Assets and Liabilities :

For this, refer to Brief Overview point no. 5.4 of this Chapter.

![]()

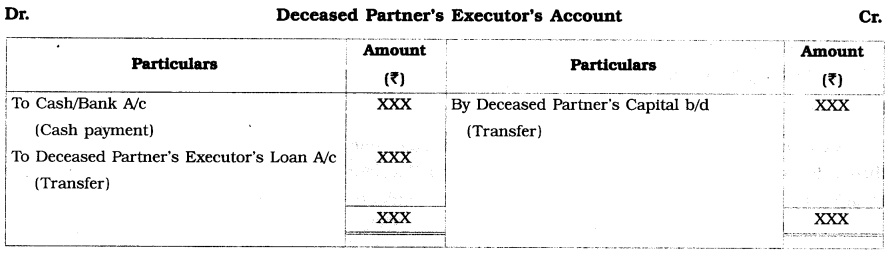

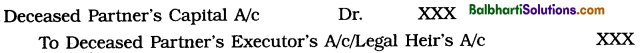

Settlement of amount due-

After recording all the above entries, the total amount due to a deceased partner is calculated and then it is to be transferred to the Deceased Partner’s Executor’s A/c or Legal Heir’s A/c. To effect this transfer, the following journal entry is recorded in the books of the firm :

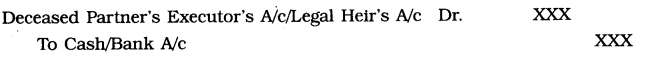

If any payment is made to Deceased Partner’s Executor/Legal Heir, then the following journal entry is passed :

The balance left in Deceased Partner’s Executor’s A/c/Legal Heir’s A/c is then treated as Deceased Partner’s Executor’s / Legal Heir’s Loan.

Accounting treatment-

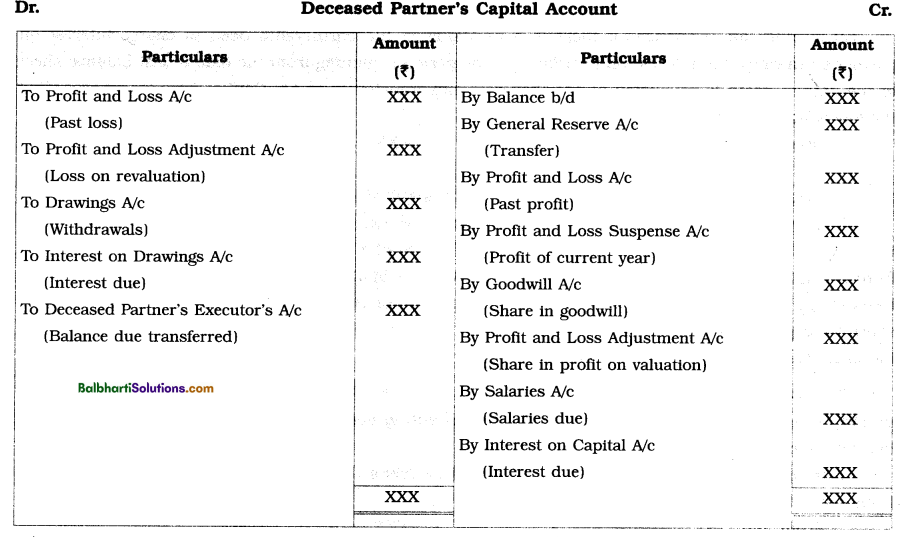

Deceased Partner’s Capital Account:

In order to ascertain the amount due to a deceased partner’s executor or legal heirs or legal representative, his Capital Account is prepared. It is shown below :