By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 8 Company Accounts – Issue of Shares students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 8 Company Accounts – Issue of Shares

Share and Share Capital-

Introduction : As the volume and scale of trade and industry expanded, especially after the Industrial Revolution (i.e. around 1760), a very large unit of commercial organisation requiring large capital and greater managerial skill called joint stock company came into existence rapidly. The company fulfils its need of large amount of capital from large number of investors called shareholders. The company raises its capital in the form of shares and debentures. The capital collected through issue of shares is called “Owned Capital” and capital collected by issue of debentures is called “Borrowed Capital”.

Meaning and Definition- The owned capital of a company, when divided into a large number of small parts having equal face value is called a Share. According to Section 2(84) of the Indian Companies Act, 2013, “Share means share in the share capital of the company and includes stock except where a distinction between stock and share is expressed or implied.”

A share is a unit of measurement of the share capital of a company. For instance, a capital of ₹ 2 crore may be divided into 20 lakh shares of ₹ 10 each.

![]()

According to the provisions made under Section 86 of the Companies Act 1956, now company is authorised to issue two types of shares viz. (i) Equity Shares and (ii) Preference Shares.

(i) Equity or Ordinary Shares : The shares other than preference shares are called Equity or Ordinary Shares. In other words, an equity share is the one which has no special preferential right as to dividend or repayment of capital. They participate in the profits of the company after all preferential rights have

been satisfied. They are risk bearer and real owners of the company. They get the dividend after payment of all expenses and dividend to preference share holders. An equity shareholder has normal voting rights and a right to participate in the management.

(ii) Preference Shares : According to provisions of the Companies Act 2013, a ‘Preference Share’, is a type of share which enjoys priority or preference over equity share for the payment of dividend at a predetermined fixed rate and for repayment of capital. It means preference shareholders are paid dividend at a predetermined fixed rate before any dividend is paid to the equity shareholders. Similarly, in the case of the winding up of the company, preference share capital is refunded first.

Types of Preference Shares : The different types of preference shares are :

- Cumulative and Non-cumulative Preference Shares

- Redeemable and Irredeemable Preference Shares

- Participating and Non-participating Preference Shares

- Convertible and Non-convertible Preference Shares

Types of Share Capital-

The different types of share capital are explained below :

(1) Authorised / Registered / Nominal Capital: This is the maximum limit up to which a company is authorised to raise share capital. It is mentioned in the capital clause of the Memorandum of Association. Authorised capital is determined by considering future financial requirements of the company. It is also called ‘Registered Capital’ or ‘Nominal Capital’. It can, however, be increased subsequently by altering capital clause of the Memorandum of Association.

(2) Issued Capital: It is that part of the authorised capital which is issued or offered for subscription to the public. The company issues shares as and when it needs additional capital. Issued capital also includes the nominal value of shares issued by the company to the public for cash, bonus shares, promoters of the company and vendors other than cash. The part of the authorised capital which is not yet issued to the public is called Unissued Capital.

(3) Subscribed Share Capital: It is that part of the issued capital which the company has actually received by way of application from the public and also allotted by the Company. It is the total amount of the face value of the number of shares applied for. Subscribed share capital also covers the face value of shares issued by the company for consideration other than cash. The part of the issued capital which is not subscribed by the public is called Unsubscribed Capital.

![]()

(4) Called-up Share Capital: The company collects the capital in instalments payable on application, allotment, first call, second call, etc. Called-up share capital is that part of the subscribed capital which is demanded (called-up) by the company from the applicants of the shares. The part of the subscribed capital which is not yet called up by the company is called Uncalled Capital.

(5) Paid-up Share Capital: All the shareholders may not pay the entire amount called-up by the company. That part of the called-up capital which is actually paid by the shareholders is called paid-up share capital. It may be equal to or less than called-up share capital. The difference between called up capital and paid up capital is known as Calls-in-Arrears.

(6) Reserve Capital: According to provisions made under the Companies Act, 2013, a company may maintain reserve capital by passing a special resolution. Reserve share capital is that part of the subscribed capital which is reserved to be called-up only at the time of winding up or liquidation of the company. It is created to offer additional security to the creditors.

Treatment of Share Capital in Balance Sheet-

Types / Methods of Issue of share capital:

- Right issue to equity shareholders (sec. 62)

- Employee stock option scheme (sec. 62 (l)(b))

- To Any person (sec. 62 (1) (c)):

- Private placement of shares (sec. 42)

- Public issue of shares

- Sweat Equity shares (sec. 54)

- Issue of Bonus shares to members / shareholders (sec. 63 (1))

All the above mention methods of issue of shares capital is commonly acceptable by private company and public company.

(1) Right Issue to Equity Shareholders :

Meaning: Right issue of equity shares issued by the company in which existing shareholders are given priority or right of purchasing right issue shares. And also existing shareholders may get right issue shares at discounted price.

Same accounting entries are to be passed in the books of company as those for issue of ordinary shares to the public.

(2) Employees Stock Option Scheme :

Meaning: When company issue shares to its employees at a price lower than market price for the encouragement of employees to acquire ownership in the form of shares is known as Employees stock option scheme.

New accounts like Employees Compensation Expense account, Deferred Employees Compensation Expense account, etc. are opened. Based on fair value and intrinsic value of option, Accounting value is found out.

(3) (a) Private Placement of Shares :

Meaning: Direct private offering of the company’s securities to a selected group of sophisticated investors.

- Private placement is governed through SEBI.

- It is less expensive and less time consuming process.

(b) Public Offer:

Meaning : Public offer of shares implies selling of shares which are listed on stock exchange directly to public by issue of prospectus.

Through IPO capital collected is recorded as stockholder equity in the Balance Sheet.

(c) Sweat Equity Shares :

Meaning: When equity shares are issued by a company to its directors or employees at a discount or for any consideration other than cash, for any obligation of either side etc. is known as sweat equity shares. (Section 2(88) of the companies Act, 2013)

If the consideration is not by the way of cash, then it can be carried to the Balance Sheet of the company as per accounting standards.

![]()

(4) Issue of Bonus Shares :

Meaning : When company distributed equity shares to its current shareholders as fully paid, without any charge, then it is known as bonus shares.

Amount of Bonus shares transferred from different reserve to equity share capital.

Accounting for Share Capital-

Public Issue of Shares:

This is one of the important methods of issue of shares in primary market where new and first hand securities like shares and debentures are sold. Public issue of shares implies selling shares directly to public by issue of prospectus. Under this method issuing company makes direct appeal to the public or prospective investors to buy its shares. The procedure adopted by the issuing company to subscribe its shares is stated as follows :

(1) Issue of Prospectus : Under this method, the issuing company invites the prospective investors or the public to make an offer to purchase its shares through a prospectus. The prospectus gives details of number of shares offered to the public, the face value of shares and amount to be paid on application, allotment and calls.

(2) Receipt of Application : An offer made by the prospective investors to buy the shares is called an application. According to Section 39 (2) of the Companies Act, 2013, a company must receive at least 5 % of the nominal of face value of each share applied for or such other percentage or amount as may be indicated by SEBI. While calculating the amount of application money, premium and discount should not be taken into account. The company makes its application forms available to the public through its brokers and banks. All the money received on application for shares must be deposited in a scheduled bank.

(3) Allotment of Shares : The allotment of shares means distribution to the applicants all or certain number of shares in response to their applications. A company is allowed to make allotment of shares only after receiving minimum subscription amount of 90 % of the issued amount within 60 days from the date of closure of issue. If the company accepts the applications, it issues letter of allotment to the applicants and in case of rejection of shares it issues letter of regret to the applicants and the application money is refunded to the applicants.

(4) Calls on Shares : Call on shares is a request or demand made by the company to its shareholders to pay the whole or part of unpaid balance on shares held by them. There may be 1st call and 2nd and final call. The maximum amount of call per share should not exceed 25 % of the face value of the share. For instance, if the face value of the share is ₹ 10, the amount of a call should not exceed ₹ 2.50 at a time. A minimum notice of 14 days should be issued by the company to the members for the payment of call.

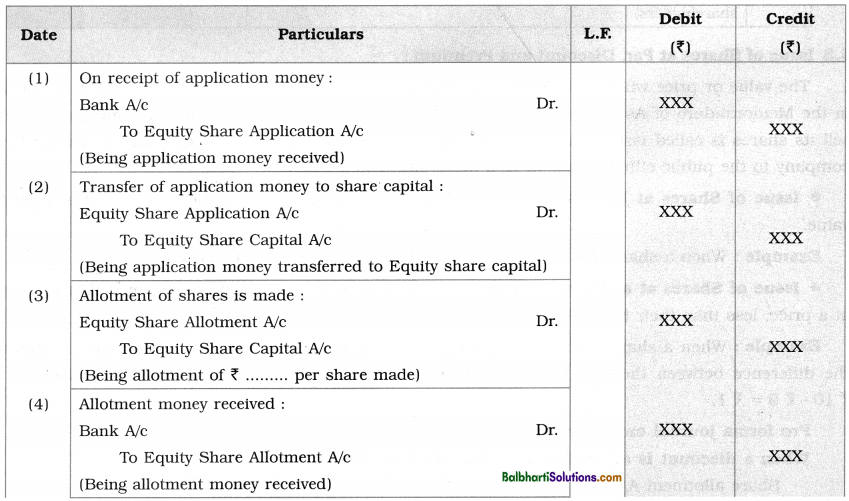

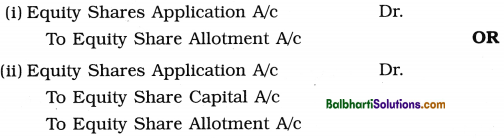

Pro Forma Journal Entries for Accounting of Issue of Equity Shares :

Issue of Shares at Par, Discount and Premium :

The value or price which is fixed for each share by the company is called face value. It is specified in the Memorandum of Association of the company. The value or price at which a company decides to sell its shares is called issue price which is different from its face value. Shares may be issued by the company to the public either at par or at a premium or at a discount.

Issue of Shares at Par : Shares are said to be issued at par when they are issued at their face value.

Example : When a share of ₹ 10 is issued at ₹ 10 only, it is said to be issued at par.

Issue of Shares at a Discount : Shares are said to be issued at a discount when they are issued at a price, less than their face value.

Example : When a share of ₹ 10 is issued at ₹ 9, it is said to be issued at a discount. In this case the difference between the face value and actual selling price is called the amount of discount, i.e. ₹ 10 – ₹ 9 = ₹ 1.

Pro forma journal entry for issue of shares at a discount:

When a discount is allowed at the time of share allotment:

Note : (i) Discount on issue of shares is a capital loss to the company. Hence it is shown on the assets side of Balance Sheet under the head “Miscellaneous Expenditure” as “Discount on Issue of Shares”.

(ii) As per new provision of government Act (2013), Public issue of shares cannot be at a discount.

Issue of Shares at a Premium : Shares are said to be issued at a premium when the shareholders are required to pay a price higher than the face value of the shares. The difference between the issue price and the face value is called the premium. For example, if a share whose face value is ₹ 10 is issued by the company at ₹ 50 the share is said to be issued at a premium of ₹ 40. Section 78 of the Companies Act, 1956, provides that the premium amount collected by the company must be deposited into a separate account called Share Premium Account. It is considered as capital gain. Share premium amount must be disclosed separately in the Balance Sheet of the company.

![]()

The share premium amount should be used for the following purposes :

- Premium amount cannot be paid as dividend to a shareholders. However, premium amount may be capitalised by the company by issuing fully paid bonus shares free of charge at a pro-rata basis to the existing equity shareholders.

- The amount received as premium is required to be deposited in a separate Bank Account called Share Premium Account.

- To write off the preliminary expenses of the company.

- To write off the expenses paid, commission paid or discount allowed on any issue of shares or debentures of the company.

- To provide for the premium payable on the redemption (repayment) of the redeemable preference shares or debentures of a company.

- To buy back its own shares.

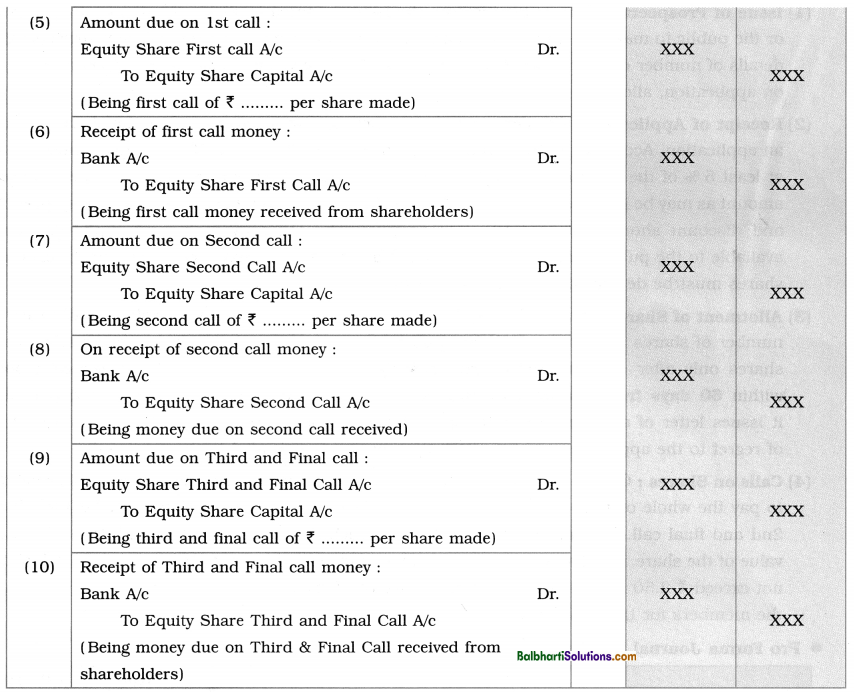

Pro Forma Journal Entries for Issue of Shares on Premium :

(1) When premium amount is called by company with application money :

(Being money received with application transferred to Share Capital A/c and Securities Premium A/c)

(2) If premium amount is called with allotment money :

(Being share allotment money and premium amount due from shareholders)

Over Subscription and Under Subscription-

Over Subscription : When a company is in receipt of shares more than those actually offered or issued to the public, the issue is said to be over-subscribed. In case of over subscription, the company allots the shares by selecting any one of the following methods :

(i) Lottery method (ii) Pro-rata method (iii) Firm allotment method and (iv) Datewise method.

In the recent era most of the companies adopt pro-rata method to allot the shares. Under pro-rata method each applicant is allotted shares in proportion to the number of shares applied for by him.

Under Subscription : When a company is in receipt of applications for shares less than those actually offered or to be issued to the public, the issue is said to be under subscribed.

Full Subscription : When a company is in receipt of applications for shares equal to those actually issued to the public, the issue is said to be fully subscribed.

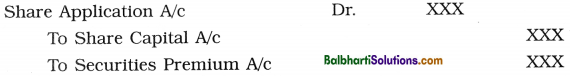

Pro Forma Journal Entries for Over Subscription:

Pro-rata / Proportionate Allotment:

When the number of shares applied for, is more than the number of shares issued, then directors proportionately issued shares on the basis of total shares application received and the number of shares issued. Under this circumstances, each applicant gets the shares less than those demanded or applied by him. In other way, directors can reject certain excess applications and refund their money and can allow full shares to some applicants and make pro-rata allotment to other where excess application money received adjusted with allotment money demanded.

![]()

Journal Entries:

(Being excess application money adjusted with allotment money)

Calls-in-Advance and Calls-in-Arrears-

Calls-in-Arrears : On account of several reasons, some shareholders fail to pay allotment or call money inspite of reminders sent to them. Such unpaid instalments are called Calls-in-Arrears. It is also called Unpaid Calls. Calls-in-Arrears represent the amount due but not yet collected from shareholders.

It is deducted from the called-up capital. The balancing amount represents paid-up capital. Paid-up capital is shown in the Balance Sheet. The defaulter shareholders are required to pay interest on the unpaid call amount at the rate of 5 % per annum for the period from the due date to the date of payment of such call amount. Usually provisions made in Articles of Association empower the directors to charge interest on the amount of Calls-in-Arrears.

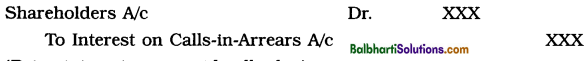

Pro Forma Journal Entries of Calls-in-Arrears :

(1) Entry to record calls-in-arrears :

(Being share allotment money and call money still outstanding)

(2) Interest due on calls-in-arrears :

(Being interest on unpaid calls due)

(3) Receipt of interest:

(Being interest on outstanding calls received from shareholders)

Calls-in-Advance : A company may receive the money in advance from the shareholders, on the calls yet to be made. Calls-in-Advance is accepted by the company only when Articles of Association authorise the company to do so. As per Table A’, a company is required to pay interest at the rate of 6 % per annum on the amount received in advance to the shareholders. At the end of the accounting the balance appearing in the Calls-in-Advance Account is shown in the Balance Sheet under the head ‘Share Capital’. However it is not added to share capital.

Pro Forma Journal Entries of Calls-in-Advance :

(1) Receipt of call-in-advance :

(Being amount received for Calls-in-Advance)

(2) Adjustment of calls in advance :

(Being amount of calls in advance adjusted)

(3) Interest due on calls-in-advance :

![]()

(Being interest due to shareholders)

(4) On payment of interest on the amount of calls-in-advance :

(Being interest amount paid to shareholders)

(5) Transfer of interest on calls-in-advance to Profit and Loss A/c :

(Being interest transferred to Profit and Loss A/c)

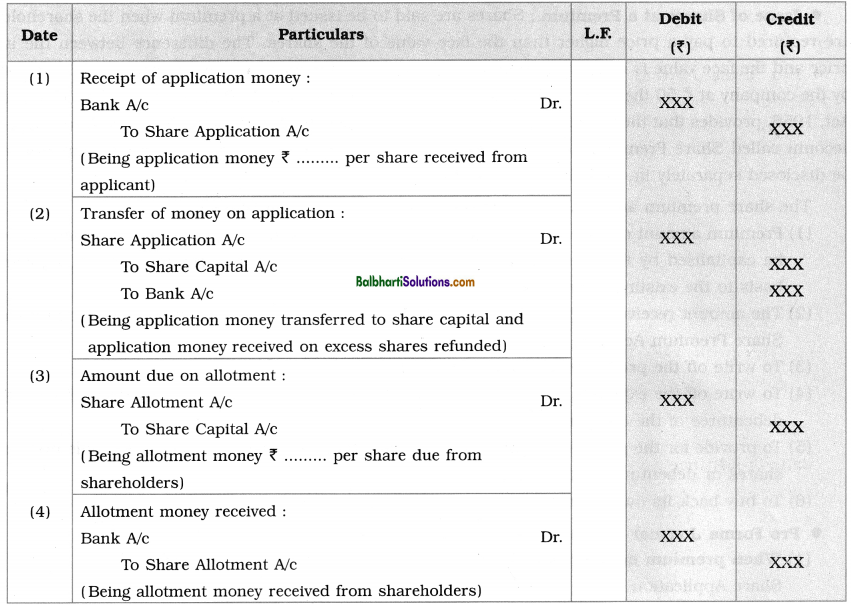

Issue of Shares for Consideration other than Cash-

Many times a company may purchase some fixed assets such as building, machinery, furniture, etc., and pay purchase consideration to the vendor partly in cash and partly in the form of fully paid equity shares. It may also take over the business of partnership firm or other company and pay purchase consideration partly or fully in the form of fully paid-up shares.

![]()

Pro Forma Journal Entries for Issue of Shares for Consideration Other than Cash :

(1) Purchase of fixed assets :

(Being assets and liabilities taken over at agreed values and balance amount payable to vendor)

(2) Purchase consideration paid to vendor :

(Being purchase consideration paid by issue of fully paid shares at premium)

Allotment / issue of Shares to Promoters :

Sometimes a company compensates its promoters for their meritorious services by issuing its shares to them without receiving any payment. The full amount of these shares is regarded on the cost of goodwill. Entry is passed just same as purchase of any asset for consideration of shares :

Accounting Treatment for-

Forfeiture of Shares:

When a shareholder fails to pay the call money or premium on the shares in spite of repeated reminders and warnings, the company forfeits the shares of such defaulters by passing an appropriate resolution in a Board Meeting. Forfeiture means the compulsory termination of membership and the confiscation (taking possession by law) of the shares of defaulting members by way of penalty for the non-payment of a fixed instalment, call or premium. The Articles of Association of a company, therefore, can empower the Board of Directors of the company to forfeit the shares in case of non-payment of call money. The amount of forfeited shares is transferred to a separate account known as Forfeited Shares Account in the books of accounts of the company. At the end of the accouting year, the balance of Forfeited Shares Account is shown on the Liabilities of Balance Sheet under the heading ‘Share Capital’.

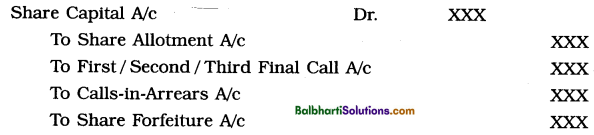

Pro Forma Journal Entries of Forfeiture of Shares and Re-issue of Forfeiture :

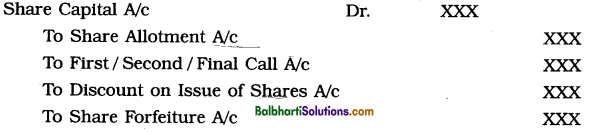

1) Forfeiture of shares issued at par :

(Being shares forfeited for non-payment of 1st or 2nd or Third final call money)

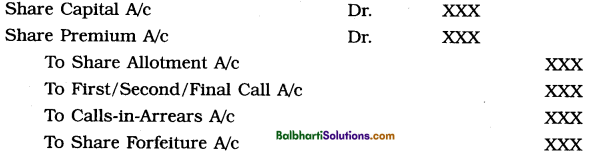

2) For forfeiture of shares issued at premium :

(Being share forfeited for non-payment of lst/2nd/final call money)

3) For forfeiture of shares issued at discount:

(Being shares forfeited for non-payment of allotment / First / Second / Final call money)

4) For re-issue of forfeited shares at par :

(Being forfeited shares re-issued at par)

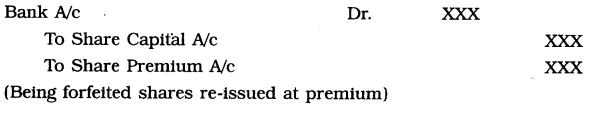

5) For re-issue of forfeited shares at premium :

6) For re-issue of forfeited shares at discount:

(Being forfeited shares re-issued, at discount)

7) For transfer of Share Forfeited A/c :

(Being balance in Share forfeiture A/c transferred to Capital Reserve A/c)

Re-issue of Forfeited Shares :

Forfeited shares remain in the custody of company and become the property of the company. Hence, forfeited shares can be resold by the company at any price. Usually they are sold through auction. They cannot be allotted to the public.

- The issuing company should see that loss incurred on re-issue of forfeited shares should not exceed the forfeited amount.

- If the loss incurred on re-issue of forfeited shares is less than the amount so forfeited, the surplus supposed to be transferred to ‘Capital Reserve Account’.

- If the loss incurred on re-issue of forfeited share is greater than the amount so forfeited, the deficit or loss is required to be transferred and debited to ‘Forfeited Shares Account’.

- If forfeited shares are re-issued at premium, the excess amount so received is to be credited to ‘Share Premium Account’.

- If forfeited shares originally issued at discount are re-issued at loss, the loss incurred on issue of shares originally at discount is to be debited to ‘Discount on Issue of Shares Account’ and the loss incurred on re-issue of shares is to be debited to ‘Forfeited Shares Account’.

- If the total of the amount of forfeiture and amount received on re-issue of shares exceed the face value of the shares re-issued, such surplus amount is required to be transferred to ‘Capital Reserve Account’.