By going through these Maharashtra State Board Secretarial Practice 11th Commerce Notes Chapter 11 Correspondence with Banks students can recall all the concepts quickly.

Maharashtra State Board Class 11 Secretarial Practice Notes Chapter 11 Correspondence with Banks

Bank – Definition-

(a) “Banking means accepting for the purpose of lending or investment of deposits of money from the people repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise.

– Banking regulation Act 1949

(b) “A Bank is an institution which deal in money and credit”.

– Cairns Cross

![]()

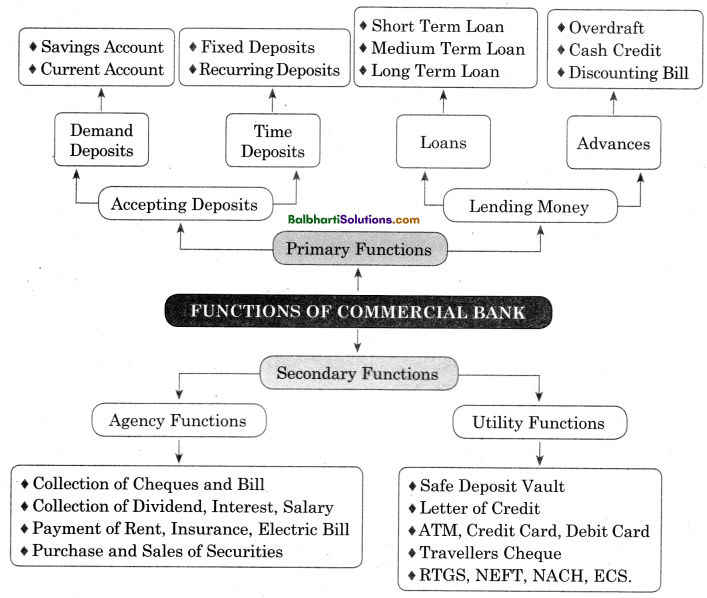

Functions of Commercial Bank-

1. Primary Functions:

- Accepting Deposits

- Lending Money:

1. Accepting Deposits

- Demand Deposits

- Time Deposits

Demand Deposits

- Savings Account

- Current Account

Time Deposits:

- Fixed Deposits

- Recurring Deposits

2. Lending Money:

- Loans

- Advances

Loans:

- Short Term Loan

- Medium Term Loan

- Long Term Loan

![]()

Advances:

- Overdraft

- Cash Credit

- Discounting Bill

2. Secondary Functions:

- Agency Functions

- Utility Functions

1. Agency Functions:

- Collection of Cheques and Bill

- Collection of Dividend, Interest, Salary

- Payment of Rent, Insurance, Electric Bill

- Purchase and Sales of Securities

2. Utility Functions

- Safe Deposit Vault

- Letter of Credit

- ATM, Credit Card, Debit Card

- Travellers Cheque

- RTGS, NEFT, NACH, ECS.

Demand Deposits :

The deposits which are payable on demand are called Demand deposits. There are 2 types of Demand Deposits i.e. Savings Deposits and Current Deposits.

Time Deposits :

The Deposits which are not repayable on demand are called ‘Time Deposits’. There are ‘2 types of Time Deposits i.e. Fixed Deposits and Recurring Deposits.

Loans :

A loan granted for a specific time period against personal security, gold or silver and other movable or immovable assets is called term loan.

![]()

Advances :

An advance is a credit facility provided by the bank to its customers for a shorter period to meet day-to-day requirements of a business.

Overdraft:

Overdraft is a credit facility granted by Bank to its Current Account holders against certain collateral securities. Banks allow its customers to overdraw an amount upto particular limit.

Cash Credit:

It is a facility, where bank allows the borrower to withdraw upto a specific limit as and when he needs by opening separate account.

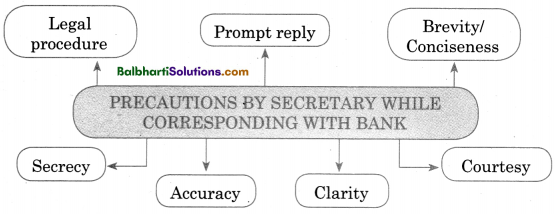

Precautions By Secretary While Corresponding with Bank-

- Legal procedure

- Prompt reply

- Brevity Conciseness

- Secrecy

- Accuracy

- Clarity

- Courtesy

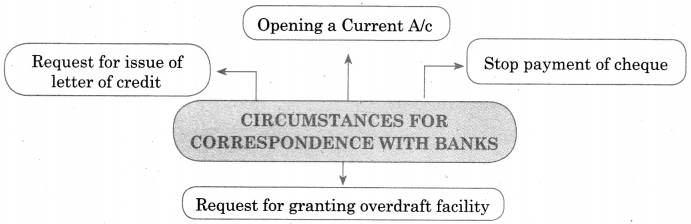

Circumstances For Correspondence With Banks-

- Opening a Current A/c

- Request for issue of letter of credit

- Stop payment of cheque

- Request for anting overdraft facility

Word Meaning:

aids – to help; negotiable – flexible /to bargain; lending – to give money for certain period of time; discounting – deducting the amount; idle – to sit without work / not in use; assistance – to help; surplus – excess/extra; remittances – transfer / to pass on; channelize – planning; executor – a person who is appointed to carry out the work; commercial – business / trading; attorney – legal person; e-statement – statement received in mail of an individual; settlement – payment; overdraft – borrowing money in excess of funds available in individual account for certain period; precautionary – to take care / prevention; recurring – repeatedly; inconvenience – difficulty; periodically – at regular intervals; regretted – to be sorry; immovable – cannot be moved from one place to another for certain days month/years; hypothecation – any commodity kept as a security against a loan; sanctioned – to allow /to approve; specimen – sample; collateral securities – an asset kept as a security for taking loan.