By going through these Maharashtra State Board Secretarial Practice 11th Commerce Notes Chapter 2 Joint Stock Company students can recall all the concepts quickly.

Maharashtra State Board Class 11 Secretarial Practice Notes Chapter 2 Joint Stock Company

Evolution of Business Organization –

- Sole Trading Concern

- Joint Hindu Family Business

- Partnership Firm

- Limited Liability Partnership

- Co-operative Society

- Joint Stock Company

![]()

Sole Trading Concern

Owned, managed and controlled by one person. It is also called as ‘One Man Business’. A person who conducts the business is called “Sole Trader”.

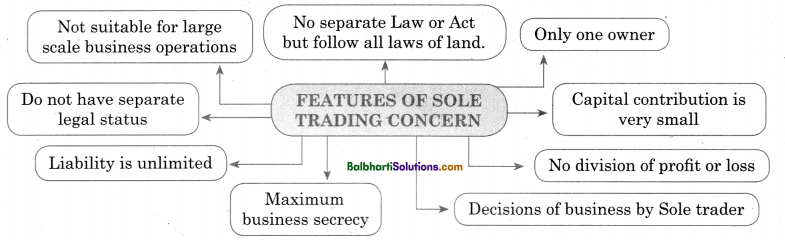

Features of Sole Trading Concern –

- Not suitable for large scale business operations

- No separate Law or Act but follow all laws of land

- Only one owner

- Do not have separate legal status

- Capital contribution is very small

- Liability is unlimited

- No division of profit or loss

- Decisions of business by Sole trader

- Maximum business secrecy

Joint Hindu Family Business-

- When a Hindu Undivided Family conducts business, inherited by it as per Hindu Law, it is called a Joint Hindu Family Business.

- Exists only in India governed by Hindu Succession Act 1956.

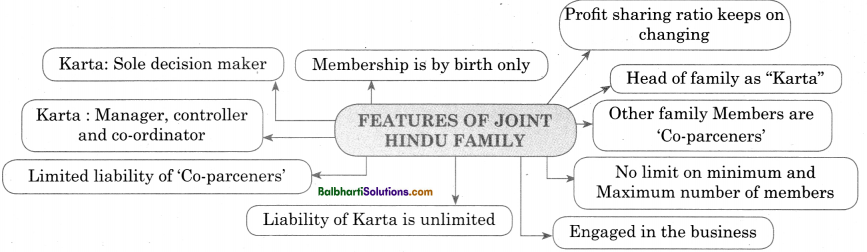

Features of Joint Hindu Family Business-

- Karta decision maker

- Membership is by birth only

- Karta : Manager, controller and co-ordinator

- Limited liability of ‘Co-parceners’

- Liability of Karta is unlimited

- Profit sharing ratio keeps on changing

- Head of family as “Karta”

- Other family Members are ‘Co-parceners’

- No limit on minimum and Maximum number of members

- Engaged in the business

Partnership Firm-

- The business organization which is owned, managed and controlled by two or more person is called a partnership firm.

- Owners are called Partners, Organization is called a firm.

- It is governed by Indian Partnership Act, 1932.

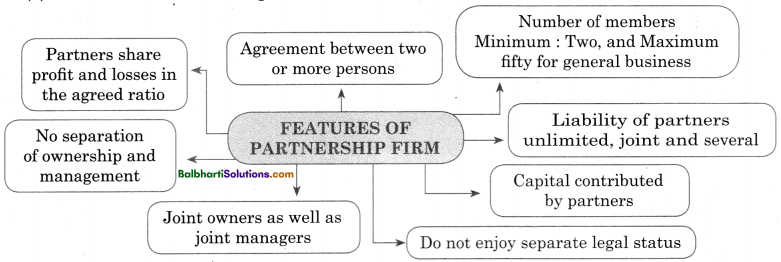

Features of Partnership Firm-

- Partners share profit and losses in agreed ratio

- NO separation of ownership and management

- Agreement between two or more persons

- Number of members Minimum : Two, and Maximum fifty for general business

- Joint owners as well as joint managers Liability of partners unlimited, joint and several

- Capital contributed by partners

- DO not enjoy separate legal status

Limited Liability Partnership (LLP)-

- It has a combination of features of both partnership and joint stock company.

- Partners have limited liability

- Governed by the Limited Liability Partnership Act of 2008.

Features of Limited Liability Partnership-

- Separate legal entity i.e. a body corporate

- Number of partners- Minimum- two. Maximum- unlimited.

- No minimum requirements of capital contribution.

- Simple to form and easy to operate.

- Liability of each partner is limited to his share as written in the agreement.

- Low cost of formation.

- No restriction on joining and leaving the LLP except as stated in partnership agreement.

- Double taxation is avoided, no tax on profit share.

![]()

Co – operative Society-

- It is a voluntary association of persons formed to achieve certain economic objectives.

- It is service oriented.

- Governed under the Maharashtra State Co-operative Societies Act 1960.

Features of Co- operative Society-

- Compulsory Registration

- Membership open to all.

- Number of members- Minimum- ten, Maximum- no limit.

- Limited liability of a member.

- Aim is not maximization of profit but to provide services to its members.

- Independent legal status.

- Democratic in nature, equality in voting right One member one vote’.

- Control and supervision by the state government.

Joint Stock Company (JSC)-

- It is a more formal form of business organization.

- Satisfies requirement of modern industry

- Convenient to conduct large scale business industry

- Types of Joint Stock Companies

- Public

- Private

- Government

- Statutory etc.

![]()

Definition of Joint Stock Company-

- According to Section 2(20) of the Companies Act 2013. “Company means a company incorporated under this Act or under any previous company law.”

- According to Prof. H. L. Haney “A Joint stock company is a voluntary association of individual for profit, having its capital divided into transferable shares, the ownership of which is the condition of membership.”

Features of Joint Stock Company-

1. Voluntary Association –

- Membership is open to all

- Can become a member or leave subject to the provisions of Articles of Association of the company.

2. Incorporated Association-

- Registration or incorporation is compulsory.

- After registration an association obtains the status of a Joint Stock Company.

3. Separate Legal Entity

- Members are the owners and are liable in limited way.

- Members are conferred with rights and duties.

4. Artificial Person

- Created by law.

- Legal process and own independent personality.

- Legal rights to enter into contracts, purchase and sell assets and property etc.

5. Perpetual Succession

- Continuous in existence.

- Not affected by death, insolvency or retirement of any of any members.

- Very long and stable life.

6. Common Seal

- It is a device that acts as a signature of the company.

- Affixed on all the important documents and contracts.

- Usually signed by two directors and the secretary as a witness after the seal is affixed.

7. Limited Liability

- Shareholders have limited liability.

- Shareholder is liable to pay only the unpaid amount of his shares.

- Shareholder is not concerned with debts and liabilities of the company.

8. Separation of Ownership and Management

- Shareholders are real owners of the company, but large and scattered.

- Unable to manage the day to day affairs of the company.

- Board of Directors look after the management and policy decisions of the company. They are elected representative of shareholders.

9. Transferability of shares

- Shares of public company are freely transferable.

- Shares of private company are not freely transferable.

10. Number of Members

- Owned by a large number of persons.

- Private limited company — minimum 2 members maximum — 200 members

- Public limited company — minimum 7 members maximum — no limit

11. Capital

- Raise huge capital.

- In form of shares, debentures, bonds, public deposits

- Obtain loans from banks and financial institutions.

![]()

12. Government Control

- Company is controlled and supervised by the Government.

- Registered company follow rules and regulations of company law.

- Accounts are audited.

- Copy of profit and loss, balance sheet, financial statement are submitted to the registrar.

- To protect the financial interest of small investors.

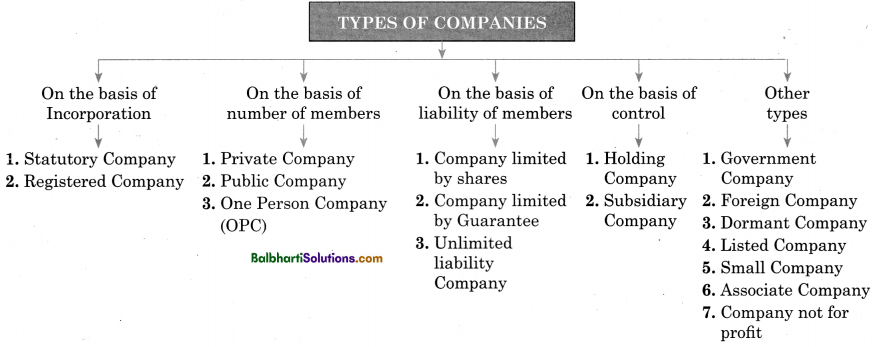

Types of Companies-

- On the basis of Incorporation

- On the basis of number of members

- On the basis of liability of members

- On the basis of control

- Other types

On the basis of Incorporation:

- Statutory Company

- Registered Company

On the basis of number of members

- Private Company

- Public Company

- One Person Company (OPC)

On the basis of liability of members-

- Company limited by shares

- Company limited by Guarantee

- Unlimited liability Company

On the basis of control-

- Holding Company

- Subsidiary Company

Others types –

- Government Company

- Foreign Company

- Dormant Company

- Listed Company

- Small Company

- Associate Company

- Company not for profit

![]()

On the basis of Incorporation-

- Statutory Company

- Registered Company

Statutory Company:

Companies incorporated by Special Act passed by Central or State legislative, e.g. Reserve Bank of India, State Bank of India, Unit Trust of India, Life Insurance Corporation, etc.

Registered Company:

Companies incorporated under the Companies Act, 2013 or any previous company law.

On the basis of Number of Members

Private Company (SECTION 2(68)):

- Restrict the right of members to transfer its shares.

- Maximum number of members upto 200.

- Prohibits any invitation to the public for any securities or deposits of company.

- Company limited by shares or company limited by guarantee or an unlimited company.

- Must add the words “Private Limited” at the end of its

Public Company (Section 2 (71)):

- Has no restriction on the transfer of its shares.

- Minimum number of members should be seven.

- Has minimum paid up share capital.

- Does not prohibit any invitation or acceptance.

- Must add the word “Limited” after the name of the company.

One Person Company (Section 2 (62)):

- Single Promoter who has limited liability.

- Can have one or more directors.

- No need to hold Annual General Meeting.

- Better form of sole proprietorship.

On the basis of Liabilities of Members:

Company Limited By Shares Section 2(22):

- Have share capital and liability limited to the unpaid part of face value of shares purchased by member.

- May be a public company or a private company.

- Most popular type of companies.

Company Limited By Guarantee: Section 2(21)

- May or may not have a share capital.

- Member promises to pay a fixed sum of money specified in the Memorandum of the company.

- Non-profit making companies.

- Purpose of promotion of art, science, culture etc.

Unlimited Liability Company Section 2(92)

- Not having any limit on the liability of its members.

- Members are fully liable to cover the debts of the company.

- Can be either a private or . a public company or a one person private company.

![]()

On the basis of Control –

- Holding Company Section 2(46)

- Subsidiary company section2(87 )

Holding Company Section 2(46):

- Company holds more than one half of thetotal share capital of another company

- Has power to appoint or remove Directors of another Company.

Subsidiary company section2(87):

Company which is controlled by holding company.

Other Types-

1. Government Company:

Section 2(45):

Company in which not less than 51% of the paid up share capital is held by

- Central Government or

- State Government or Governments or

- Partly by Central Government and partly by one or more State Governments

- Subsidiary company of a government company. e.g. H.M.T, BHEL, ONGC etc.

2. Foreign Company:

Section 2(42):

Company incorporated outside India, but having a place of business in India.

e.g. Bata India Ltd, Nestle India Ltd.

3. Dormant Company:

Registered for a future project or has not made any significant accounting transactions in last two years or has not filed financial statements or annual returns in last two years, after making application u/s 455.

4. Listed Company: Section 2(52)

Company which has any of its securities listed on any recognized stock exchange following SEBI’s guidelines and the provisions of the Companies Act.

5. Small Company:

Section 2 (85):

- Paid up share capital of which does not exceed 50 lakh or such higher amount as may be prescribed

- whose turnover as per last profit and loss account does not exceed 2 crores or such higher amount as may be prescribed.

6. Associate Company: Section 2(6)

Company which controls at least 20% of total capital or of business decisions over a subsidiary company.

7. Company not for profit:

Registered u/s 8 of Companies Act.

Word Meaning:

revolution – complete change; radical – entire; anticipation – expectation; evolved – to come in existence; inadequate – insufficient/ not enough; emerged – came into existence; proprietor – single owner of business; operations – working; inherited – getting from ancestors; contribution – collection; formation – coming into being; achieve – to get; differs – unlike; democratic – representatives are elected; stability – fixed; Managerial ability – ability to manage various works at a given time; Statutory – owned by Government company; enactment – passed by; reveal – tells; conclude – end; Perpetual succession – Continuation; obtains – to get; conferred – grant; scattered – spread all over; desires – want; registrar – a person who looks after registration of company; obligations – responsibilities; penalized – fine; prohibit – restricted/stop from doing something; promoter – person who starts with an idea of starting an organization: memorandum – written document specifying the policies of a company; liquidation – converting assets into cash; significant – important; insolvency – financial loss to an individual or company.