By going through these Maharashtra State Board Class 12 Economics Notes Chapter 8 Public Finance in India can recall all the concepts quickly.

Maharashtra State Board Class 12 Economics Notes Chapter 8 Public Finance in India

Meaning:

Public Finance is a combination of two words – Public and Finance.

Here, public represents government and finance is related to income and expenditure.

Definitions of Public Finance:

According to Hugh Dalton: “Public finance is one of those subjects which are on the borderline between economics and politics. It is concerned with the income and expenditure of public authorities and with the adjustment of one with the other. ”

According to Prof. Findlay Shirras: “Public finance is the study of the principles underlying the spending and raising of funds by public authorities.”

Difference between Public Finance and Private Finance:

| Points | Public Finance | Private Finance |

| (1) Objectives | To offer maximum social advantage | To fulfil private interest. |

| (2) Determination of Expenditure | Government first determines the volume and different ways of its expenditure | An individual consider his income first and then determines volume of expenditure |

| (3) Credit status | It enjoys high degree of credit in the market | Credit of private individuals is limited |

| (4) Right to print currency | The government can print notes through R.B.I. | Pvt. individual cannot print notes. |

| (5) Elasticity of Finance | More elastic – greater scope for changes. | Less elastic – no much scope for changes. |

| (6) Effect on economy | It has great impact on economy. | It has marginal impact on economy. |

(4)

![]()

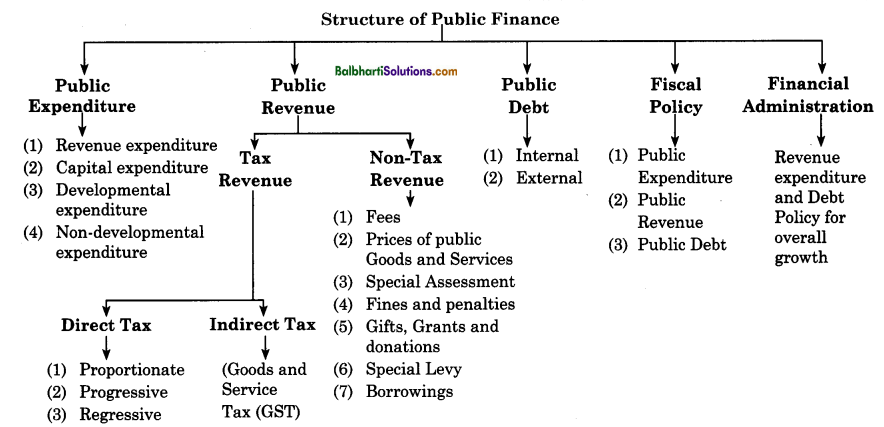

Public Expenditure:

It refers to expenditure incurred by public authority (Central, State and Local bodies).

Public Expenditure is classified as Revenue and Capital Expenditure as well as Developmental and Non-developmental Expenditure.

Reasons for growth in public expenditure:

- Increase in the activities of Government

- Rapid increase in population

- Growing urbanization

- spread

- Spread of democracy

- Inflation

- Industrial Development

- Disaster management

Public Revenue:

It refers to aggregate collection of income with the government through various sources.

Sources of public revenue :

(A) Tax Revenue

(B) Non-Tax Revenue

(A) Tax Revenue: According to Prof. Seligman, “A tax is a compulsory contribution from the person to the Government without reference to special benefits conferred. ”

![]()

Characteristic of Tax:

- Compulsory contribution to the government by every citizen of the country.

- It helps the government to incur welfare expenses for citizen.

- Taxpayer does not get any direct benefit by paying tax.

- It is imposed on income, property, goods and services.

Canons (Principles) of Taxation:

Canons of taxation were propounded by Adam Smith.

→ Canon of Equity or Equality i.e. a person to pay tax as per his ability to pay.

→ Canon of Certainty i.e. a taxpayer should know the amount of tax liability and the way of paying tax.

→ Canon of Convenience i.e. time of levying tax and manner of levying tax should be convenient to taxpayer.

→ Canon of Economy i.e. cost of collecting tax should be minimum.

Types of Taxes:

There are two main types of taxes i.e. Direct Tax and Indirect Tax.

| Direct Tax | Indirect Tax |

| (1) It refers to that tax which is paid by a person on whom it is legally imposed. | It refers to that tax which is imposed on one person but paid by the other. |

| (2) E.g. Income tax, Wealth tax, etc. | E.g. excise duty, custom duty, G.S.T. etc. |

| (3) Impact and incidence of direct tax are on the same person. Tax burden cannot be shifted. | The Impact and incidence of indirect tax may be on different persons. Tax burden can be shifted. |

| (4) Direct tax is paid at the time of earning income. | Indirect tax is paid at the time of spending income. |

![]()

Classification of Direct Tax:

- Proportionate Tax

- Progressive Tax

- Regressive Tax.

Non – tax Revenue:

Revenue received by the government from the source other than tax revenue is called as non-tax revenue.

Sources of Non-tax revenue :

- Fees

- Prices of Public Goods and Services

- Special Assessment

- Fines and Penalties

- Gifts, Grants and Donations

- Special Levies

- Borrowings

G.S.T. – Goods and Services Tax:

It came into effect in India on 1st July, 2017. It is a comprehensive tax base with nationwide coverage of goods and services.

Expected Benefits of G.S.T:

- Creating unified common national market for India.

- Boost foreign investments and “Make in India” campaign.

- Simplify the tax system in the country.

- Improve investment in the country.

- Boost export and manufacturing activity.

- Reducing final price of goods.

- Generating employment and eradicating poverty.

![]()

Public Debt:

Generally, government expenditure exceeds government revenue. So, government needs to raise loans, which is called Public Debt.

Types of Public Debt:

→ Internal Public Debt: Borrowings by government within the country i.e. from its citizens, banks, central bank, financial institutions, business houses, etc.

→ External Public Debt: Borrowings by government from outside the country i.e. from foreign governments, foreign banks, international organisations like IMF, World Bank, etc.

Fiscal Policy:

It is a financial policy implemented by the government. It deals with public expenditure, public revenue and public debt.

Financial Administration:

It is concerned with efficient implementation of revenue, expenditure and debt policy of the government. It includes preparation and implementation of government budgets for economic growth.

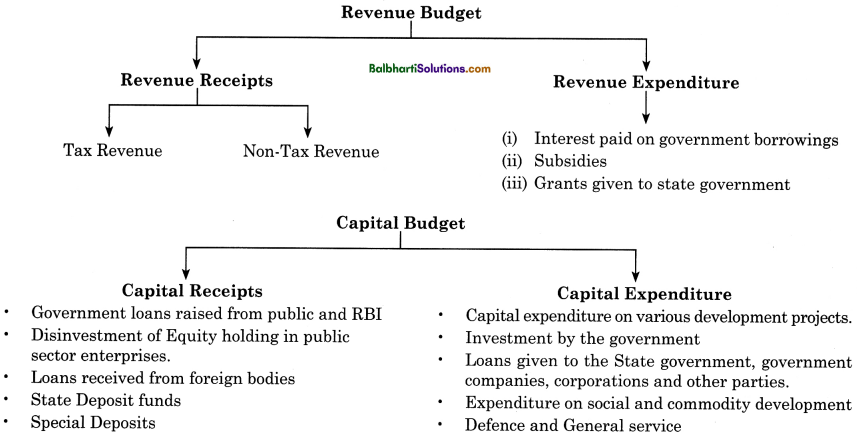

Government Budget:

It is an important instrument of financial administration to regulate all financial affairs of the state.

Budget is the annual financial statement showing expected receipts and proposed expenditure of the government in a financial year, i.e., from 1st April to 31st March.

![]()

Types of Budget:

→ Balanced Budget: When estimated revenue and expenditure of the government are equal, it is said to be balanced budget. Government Receipts = Government Expenditure.

→ Surplus Budget: When estimated government receipts are more than government expenditure, it is said to be surplus budget. Government Receipts > Government Expenditure.

→ Deficit Budget: When government receipts are less than government expenditure, it is said to be deficit budget. Government Receipts < Government Expenditure.