By going through these Maharashtra State Board Organisation of Commerce and Management 12th Notes Chapter 4 Business Services students can recall all the concepts quickly.

Maharashtra State Board Organisation of Commerce and Management 12th Notes Chapter 4 Business Services

→ Shares: ‘Share’ is a share/part in the share capital of a company. It is an interest of a person in the share capital of a company which is measured by the sum of money.

→ Debentures: A document containing an acknowledgment of indebtedness issued by a company under its common seal. It is a most common form of long-term loan borrowed by a company from the general public by issuing certificates called debenture certificates or simply called debentures.

→ Foreign exchange: The currency of a country other than one’s own; the exchanging of the currency of one country for that of another.

→ Hundies: Negotiable (transferable) instrument (document) like the bill of exchange or promissory note. It can be drafted in any one of the Indian languages.

![]()

→ Promissory Note: A written promise to pay money; a document stating that a person promises to pay another a specified sum of money at a certain date.

→ Bill of exchange: A document in writing which consists of acknowledgement of debts and promise to pay such debts after a specific period of time.

→ Cash credit: Facility similar to the overdraft given to an accountholder for a comparatively larger amount and for longer period.

→ Discounting of bills of exchange: Borrowing loan from the bank for a short duration against the security of bill of exchange.

→ Dividend warrant: A dividend warrant is a written order given by the company to its banker to pay the amount mentioned in it to the shareholder whose name is specified therein.

→ Interest warrant: A draft for the payment of interest due on Government bonds, debentures and other fixed interest securities. It can be crossed like a cheque.

→ Bonds: Fixed interest securities issued by the Government or companies after borrowing funds from the public.

→ Portfolio: The entire collection of investments belonging to an investor or held by a financial organisation such as bank, mutual fund, etc.

→ Tax returns: Statement giving detailed information of taxes due and payable to the government.

→ Demand Draft or Bank Draft: A written order made by a bank to its branch or vice versa to pay on demand a specified amount of money to the payee or his order. It is a cheque drawn by one bank on its branch or head office.

→ Underwriting of shares: A new issue of shares in a company may be underwritten. In such case, the underwriter for a certain consideration (underwriting commission) agrees to take up any shares which are not applied for by the public and thus guarantees the success of the issue.

→ Demat account: Account opened by investor with Depository Participant (DP- Bank) for converting his shares in electronic form. DP keeps records of trading of shares and their holdings.

→ Gift cheque: Cheques printed in decorative form bought by paying equivalent amount and are used as presents / gifts on the occasion of weddings, birthdays, etc.

→ Standardisation: Setting up of standards; a mental process of fixing certain norms or specifications as indicators of certain quality.

![]()

→ Branding: Giving a name, symbol, mark or numeral to a manufactured product for the purpose of giving a distinct identity to that product.

→ Economic development: The process of growth in total and per capita income of developing countries, accompanied by fundamental changes in the structure of their economics. These changes usually consists of increasing importance of industrial as opposed to agricultural activity, migration of labour from rural to urban industrial areas, etc.

→ Letter of Credit: A letter from one party usually a bank to another party usually also a bank by which a third party usually a customer named in the letter is given the right to obtain the money or credit for which the writer of the letter takes responsibility. It is a method of settling debt between parties in different countries.

→ Standard of living: Level of economic welfare or level of material well-being of an individual or household. It is usually determined by the quantities of the goods and services consumed by a person.

→ Wharf: A platform built parallel to the waterfront at a harbour or navigate river for docking, loading, unloading of ships.

→ e-mail: Electronic mail is an electronic device which transmits information from one end of the world to another, through computer network.

→ Pollution: Any cause or action which affects or makes the environment impure.

→ Physical resources: Tools, machinery, vehicles, power supply, employees, etc., that an enterprise uses to carry out its activities.

→ Natural calamities: A disaster or misfortune, especially one causing distress or misery produced by nature, e.g. cyclone, storms, earthquake, famine draughts, etc.

→ Environment: The factors which affect surroundings of anything including human beings as well as organisations.

→ Internet: Worldwide network of computers which allows its user to share and exchange information. It is the largest network of the computers in the world globally allowing many computers to be connected to each other through servers, using communication system.

→ Infrastructure: The basic facilities like roads, electricity, water, etc. that are required for the smooth running of a business, factory, etc. in particular and economy in general.

→ Perils of sea: Exposure to risk or harms; danger of sea.

→ Import duty: A tax imposed by a government on goods of specified types entering the country. The object of imposing an import duty may be to raise money or to it may be to protect the markets of domestically produced goods by making imports more expensive.

Business Service And Banking –

Introduction:

Services of different types satisfy human wants are intangibles, heterogeneous, inseparable, inconsistent and perishable. They are neither manufactured non-tranported. Services cannot be stored for future use or consumption. Services of any kind are produced and consumed simultaneously.

Meaning:

Service is an act of performance that one party offers to another for certain consideration or without consideration essentially intangible and does not result in ownership of any thing, e.g. services of teacher.

Services are provided to the customers to fulfil their needs. Services are closely associated with the goods and hence it is difficult to identify and separate the services. The ownership and possession cannot be transferred on sale of services. Services come into existence only at the time they are bought and consumed. E.g. banking, insurance, transport, warehousing, telecom, etc. Business cannot run and manage without business services.

![]()

Definition-

According to Philip Kotler, “A service is an act of performance that one party can offer to another that is essentially intangible and does not result in the ownership of anything. Its production may or may not be tied to a physical product.”

Features of services:

- Intangibility: A service is intangible because it cannot touched, seen or smelt. Services can be experienced by the receiver. They lack material form and hence services cannot be demonstrated as like goods. Service providers must deliver qualify services on time to the consumers to win their confidence.

- Inseparability: One of the important features of service is that the service and the service: provider cannot be separated from each other. The presence of service provider is necessary at the time of providing the service. The production and consumption of service take place simultaneously.

- Inconsistency: Services are inconsistent and heterogeneous. Services lack perfect standardisation. The quality of service may differ person to person and from time to time although service provider remain the same.

- Perishability: Services are perishable in nature. The production and consumption of services cannot be separated and hence services cannot be stored for future consumption.

- Non-Transferability: The ownership of services cannot be transferred from service provider to the user. All consumer services are non-transferable in nature.

- Consumer participation: The service provider cannot offer or render services without the presence of consumer. Similarly customer cannot get services in the absence of service provider. Hence, participation of consumer and presence of service provider is equally important.

Business Services-

Business cannot be run and operated in isolation. Services of different types facilitate the business to grow and develop rapidly. Business services are necessary for smooth functioning of all business activities.

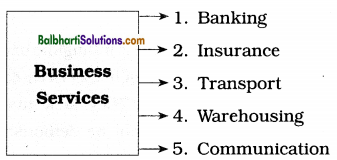

Types of business services:

The different types of business services are shown In the following chart:

Banking-

Meaning:

The word ‘Bank’ is derived from the French word ‘Banco’ which implies ‘bench’. In olden days, moneylenders used to display coins and different currencies on the benches or tables for the purpose of lending or exchanging.

Accordingly, bank refer to the financial organisation which deals with money and offers certain financial services such as accepting deposits and lending money to the consumers as per their financial requirements.

According to the Indian Banking Regulation Act, 1949 banking company means, “any company which transacts the business of banking in India.” and further defines the term ‘banking’ as “accepting for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise.”

![]()

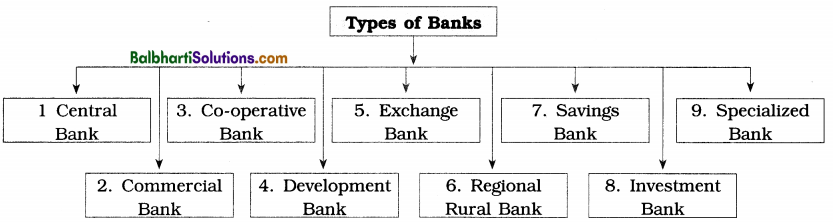

Types of Banks:

(1) Central Bank: The central bank in a country is the apex institution at the top of all the banking institutions operating in the country. Every country has its own central bank. In India, the Reserve Bank of India (RBI) is a central bank which was established in 1945 under a separate statute called Reserve Bank of India Act, 1944. It performs certain functions such as issuing currency notes, framing monetary policy, acting as bankers to the Government and banker’s bank to all the banks in the country.

(2) Commercial bank: It plays key role in economic and social development of a country. It performs primary functions which include accepting of deposits and leading of money and secondary functions which include agency functions and utility functions.

The commercial banks are grouped into three categories:

- Public Sector Banks: The banks in which majority of the share capital is held by the Government of India are called public sector

- Private Sector Banks: The banks in which majority of the share capital is held by private individuals are called Private Sector Banks e.g. HDFC Bank, ICICI Bank, etc.

- Foreign Banks: The banks which are registered outside India but operate through their branches in India are called Foreign banks, e,.g. Standard Chartered Bank, American Express Bank, etc.

(3) Co-operative Banks: Co-operative banks are formed and organised under the Indian Co¬operative Societies Acts and regulated under Banking Regulation Act. They are very popular in semi-urban and rural areas. They are primarily meant for catering to the financial needs of economically backward people, farmers and small scale units.

There are three types of co-operative banks at different levels:

(a) Primary Credit Societies: The primary credit societies are formed and established at village level. These credit societies collect funds in the form of accepting deposits from members and common people. They also get funds from the District and State Co-operative Banks for the purpose of lending.

(b) District Central Co-operative Bank: The District Central Co-operative Banks are established and operate at district levels. These banks collect funds in the form of deposits from people at district level and also get funds from the State Co¬operative Banks for lending purposes.

(c) State Co-operative Banks: The State Co-operative Banks work at state level. These banks supply the funds to the District Centred Co-operative Banks and Primary Credit Societies as and when required and monitor the functions of both.

(4) Industrial Development Banks: The banks which provide medium and long term finance for the purpose of expansion and modernisation of business are called Development

Banks, e.g. Industrial Finance Corporation of India (IFCI). Functions of these banks are underwriting of shares issued by public limited companies, providing medium and long loans and purchase debentures and bonds.

(5) Exchange Banks: These banks and large number of commercial banks undertake foreign exchange transactions e.g. Barclays bank, HSBC are exchange banks. They perform the different functions such as financing foreign trade transactions, issue letter of credit, discount foreign bills of exchange, remits dividend, interest, profits, etc.

(6) Regional Rural Banks (RRBs): These banks were established in 1975. 50%, 35% and 15% of the capital of these banks are provided by the Central Government, Sponsored banks and State Government respectively. These banks collect deposits from rural and semi-urban areas, provide loans and advances to the small and marginal farmers, agricultural workers and rural artisans.

(7) Savings Bank: A saving bank is one which has the main object of inculcating the habit of saving especially among rural community. The postal saving bank, commercial banks and co¬operative banks, act as saving banks.

(8) Investment Bank: Investment banks offer financial and advisory assistance to the business firms and government organisations. These banks provide advice on investments, helps in mergers and acquisitions by undertaking research. These banks do not directly deal with common public.

(9) Specialised Banks: These banks fulfil the requirements and provide possible support for establishing business in specified areas, The different types of specialised banks are:

- Export and Import Bank (EXIM): These banks provide the financial assistance and support to set up business for export and import of goods and services. Thus, these banks also help in promoting international trade of India.

- Small Industries Development Bank of India (SIDBI): This bank was established on 2nd April 1990 under the Act of Indian Parliament.

It acts as the main financial institution for financing, promoting and developing the Micro, Small and Medium Enterprises (MSMEs) and acts as co-ordinator of the institutions engaged in similar activities.

(c) National Bank for Agricultural and Rural Development (NABARD): This bank provides short term and long term credit to the people engaged in agricultural and allied activities through Regional Rural banks. It is also concerned with the functions of policy planning and operations relating to agricultural credit and credit for other activities in rural areas. It does not deal with common people.

![]()

New Models of Banking:

(i) Small Finance Banks: Small finance banks are the type of banks suitable for specific groups of the society which is not served (helped) by the other banks. These banks provide basic banking services of acceptance of deposits and lending money. These banks specially provide ! financial assistance to the small business units, small and marginal farmers, micro and small industries and unorganised sector entities. Existing Non-Banking Financial Companies (NBFC), Micro Finance Institutions (MFI), Local Area Banks (LAB) can apply to become small finance banks, These Banks are set up as public limited companies under the Companies Act 1956 and are governed by the provisions of Reserve Bank of India Act, 1934 and Banking Regulation Act 1949. Their two main objectives are: (i) to make provision of savings for unserved and underserved sections of the population and (ii) to supply credit to small business units, small and marginal farmers, micro and small industries and unorganised sector. Jana Small Finance Bank, Equitas Small Finance Bank, etc. are the examples of Small Finance Banks.

(ii) Payment Bank: Payment bank is a new model of banking started by the Reserve Bank of India. Its main objective is to provide financial services to small businesses and low income group people. It carries out functions such as, mobile banking, ATM cards, net banking, etc. These banks are not allowed to lend money and render services of credit cards. It can accept demand deposits up to ₹ 1 lakh. Paytm (Payment bank), Airtel Payment Bank, Indian Post Payment Bank, etc. are its examples.

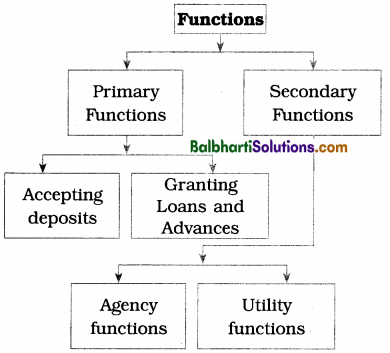

Functions of Commercial Bank:

(A) Primary Functions: The primary functions of commercial banks are also known as core banking functions. They are:

(1) Accepting deposits: The commercial banks accept deposits from public and business organisations under two heads viz. Time Deposits and Demand Deposits.

(i) Time Deposits: The deposits which are repaid to the customers after the expiry of decided time period are called time deposits. They are further classified as:

(a) Fixed Deposit: It is a type of deposit account where lumpsum amount is kept for certain specified period of time bearing fixed rate of interest. Withdrawal of amount is not permitted before maturity period. The depositor is given Fixed Deposit Receipt (FDR). He can borrow money against FDR from the bank.

(b) Recurring Deposit: It is a type of deposit account where depositor is required to deposit certain fixed amount every month for specific period of time. On the maturity, the deposit holder gets the entire amount deposited plus interest accumulated on it. Rate of interest is usually higher depending on the length of time. The depositor is given pass book by the bank to know the position of the RD account.

(ii) Demand Deposit: It is a type of deposit account in which deposited amount is repaid to the depositors as and when they demand. Money can be withdrawn as per the wish of the customers through withdrawal slip, cheques, ATM Card, online transfer, etc. There are two types of account in this.

(a) Savings Account: A bank account designed for the personal savings is called savings account. This account is suitable for those people who have fixed and regular income like salary. Although there is no restriction on the depositing money but frequent withdrawals are not permitted by the bank. Interest on balance amount is credited in this account after every 3 months, six months or 1 year period. The accountholder get pass book facility, balance on SMS, account statements, etc. to know financial position.

In this account some banks provide the facility of flexi deposit which combines the advantages of saving account and fixed deposit account. In this option, the excess funds over particular limit get transferred automatically to fixed deposit account and in case there is shortage of fund in the account or to honour any cheque payment, funds from fixed deposit get transferred to savings account.

![]()

(b) Current Account: The bank account most convenient to traders and commercial organisations is the current account. It places no restrictions on the number of times money is deposited or withdrawn from such account. Generally no interest is paid on the balance in this account. Under this type of deposit, accountholders are entitled to get overdraft facility from the bank.

(2) Granting Loans and advances:

(i) Loans: The banks grant loans and advances to industry and common people at higher rate of interest for different period.

- Short Term loans are given by the banks for a period up to 1 year. It is taken by the borrower to meet the need of working capital.

- Medium term loans are given by the banks for a period of 1 year to 5 years to meet the need of working capital and fixed capital.

- Long term loans for a period of 5 years or more to meet the requirement of long term capital.

(ii) Advances: Banks give advances to fulfil the different financial requirements of the businessman. The types of advances are as follows:

(a) Cash Credit: Under this arrangement, the bank opens a separate account (as in the case of loan) and credits a certain amount to this account. This facility is given to both current accountholder as well as savings accountholders. Interest rate charged on this account is higher.

(b) Overdraft: Overdraft is a kind of temporary loan on which the bank charges interest on the actual amount overdrawn. This facility is given only to current accountholders to meet the need of working capital. The period of overdraft varies from 15 to 60 days. All entries are shown ih current account.

(c) Discounting of Bills: A customer holding a bill of exchange can discount it at a bank. The bank pays the amount of the bills after deducting certain amount towards discount. On maturity, the bank collects the proceeds of the bill from its drawee.

(B) Secondary Functions: The secondary functions are grouped into two categories. They are explained below:

(a) Agency Functions: The commercial bank acts as an agent of his clients and performs the following agency functions:

- Periodic collections and payments: As per the standing instructions of the customers, bank collects salary, dividends, interests, cheques, drafts, etc. and makes various payments such as taxes, bills, premiums, rent, etc. For these services bank charges certain service charges quarterly or annually.

- Portfolio management: Most of the commercial banks undertake the functions of buying and selling of securities such as shares, bonds, debentures etc. on behalf of the clients, This is called portfolio management. On account of this facility, more customers are attracted towards commercial banks.

- Fund transfer: The commercial banks provide services of fund transfer from one branch to another branch and also to the branch of another bank.

- Dematerialisation: The banks offer dematerialisation facility to their clients and hold ; their securities in electronic form. As per the instructions, banks undertake transfer of securities like purchase or sale.

- Forex transactions: Forex stands for foreign exchange. The bank purchases foreign exchange from its clients and pay them in Indian currencies. The bank also sells foreign exchange to its clients when they need to settle foreign transactions.

![]()

(b) Utility Functions:

- Issue of drafts and cheques: The bank issues cheques book to its accountholders only and issues drafts to both accountholders as well as to non-accountholders for making payments to third parties. Bank charges commission for issue of bank drafts.

- Locker facility: The bank provides safe deposit vaults (lockers) to the customers on rental basis for keeping their valuables like gold, ornaments, jewels, securities, valuable documents, etc. in safe custody.

- Project report: As per the request of the client, bank prepares project report and feasible studies on their behalf to enable them to obtain funds from the market and clearance from government authorities.

- Gift cheques: The bank issues gift cheques i and gold coins to both accountholders as well as to non-accountholders, for the purpose of gifting on different occasions such as wedding, birthday, anniversaries, etc.

- Underwriting services: The banks acts as underwriter to buy shares and other securities issues by the newly established company if their shares or securities are not fully subscribed.

- Gold related services: Now banks have also started providing gold services to its clients. They buy and sell gold and gold ornaments from customers on large scale. They also provide advisory services on the investment of gold funds, gold EFF, etc.

E-banking service-

E-Banking implies electronic banking i.e. virtual banking or online banking. The following services are provided under e-banking:

(i) Automated Teller Machine (ATM): With the help of ATM card, we can deposit or withdraw cash from ATM machine. It provides 24 hours service, privacy and convenience to the bank customers. ATM can also be used for other banking transactions, like balance inquiry, request of cheque book, etc.

(ii) Credit cards: It is a payment card which allows the cardholder to pay for different transactions. Issuing bank grants credit to the cardholder and later on recover the dues from the user. Credit card gives convenience to users as they need not carry cash with them.

(iii) Debit cards: Nowadays, most of the banks issue debit cards to accountholders as soon as account is opened. By using this card, the cardholders can make purchases and avail of services at different places through payment from bank. The amount is deducted from or debited to the account of the debit cardholders immediately.

(iv) Real Time Gross Settlement (RTGS): it is a fund transfer system where transfer of funds takes place from one bank to another on a ‘Real time’ i.e. not subject to any waiting period and ‘Gross basis’ i.e. on one to one basis without bunching any other transaction. Minimum ₹ 2 Lakh can be remitted through RTGs but there is no upper limit for such remittances. This amount differs from bank to bank.

(v) National Electronic Funds Transfer (NEFT): This nationwide system facilitates individuals, firms and companies to transfer funds electronically from any branch of bank to any individual, firm and company having account with any other branch of bank in the country. The clients is required to give details like NEFT code of branch, account number of transferee. However, unlike RTGS, the transactions are bundled together in NEFT.

(vi) Net banking and Mobile banking: With | the help of laptop, computer and other gadgets,

the client can operate his bank account for banking transactions. Mobile banking means using banking services with the help of mobile phone. The client has to register with the bank for the use of this facility. The bank gives unique code for doing transactions. Through mobile client can request for balances, transfer of funds, stop payment, issue of cheque book, etc.

(vii) IMPS facility: IMPS is an abbreviation of Immediate payment services. By using this facility, the client can instantly transfer funds to any other bank account.