Web Designing (HTML – 5) 11th Information Technology Practicals Skill Set 2 Solutions Maharashtra Board

Balbharati Maharashtra State Board Class 11 Information Technology Solutions Practicals Skill Set 2 Web Designing (HTML – 5) Textbook Exercise Questions and Answers.

Class 11 Information Technology Practicals Skill Set 2 Exercise Solutions

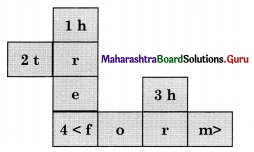

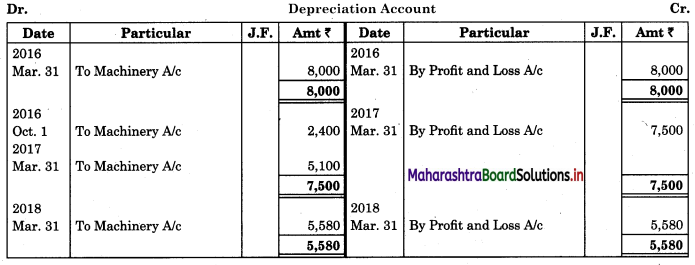

SOP 1: Write a program using HTML with the following specifications.

- The background colour should be green.

- The text colour should be red.

- The heading should be as large in size as ‘My First Web Page’.

- Display a horizontal line after the heading.

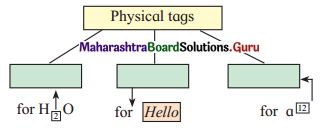

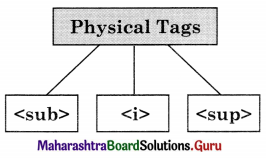

- Display your name in Bold, address in Italics, and standard as 11th.

Answer:

<!DOCTYPE html>

<html>

<head>

<title>sop1</title>

</head>

<body bgcolor=green text= red>

<h1> My First Web Page </h1>

<hr>

<b> Reliable Publications</b>

<br>

<i> Chira bazar,Charni road,Mumbai</i>

<br>

Standard 11th.

</body>

</html>

![]()

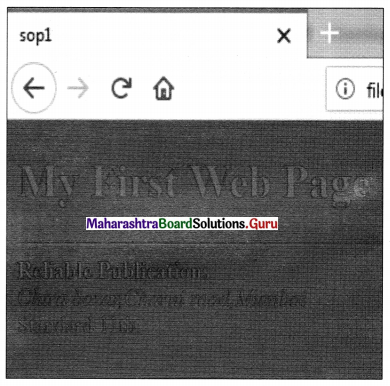

SOP 2: Create a web page with, following specifications.

- Image of any scientist with an alternate text as his name.

- Create a paragraph related to the information of that scientist.

- Create a table of his/her inventions.

Answer:

<!DOCTYPE html>

<html>

<head>

<title>sop2</title>

</head>

<body>

<img src=”Albert Einstein.jpg” alt=”Albert Einstein”>

<br>

<p>

Albert Einstein was a German-born theoretical physicist who developed the theory of relativity,<br> one of the two pillars of modern physics.His work is also known for its influence on the philosophy of science.

</p>

<table border=5 bordercolor=pink>

<tr>

<th> Sr no.</th>

<th> Invention </th>

<th> Year</th>

</tr>

<tr>

<td>1</td>

<td>Quantum Theory of Light </td>

<td>1905</td>

</tr>

<tr>

<td>2</td>

<td>Theory of Relativity</td>

<td>1907</td>

</tr>

</table>

</body>

</html>

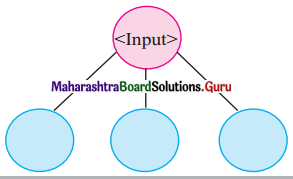

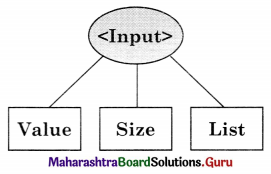

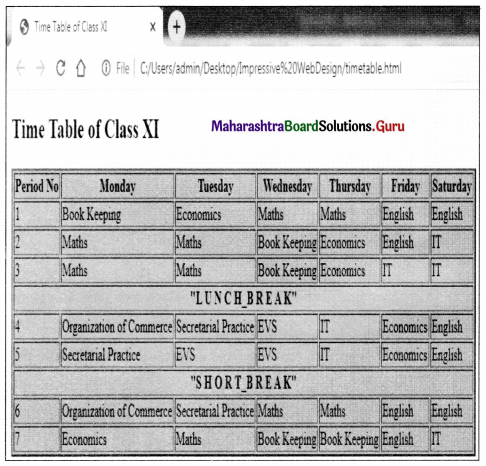

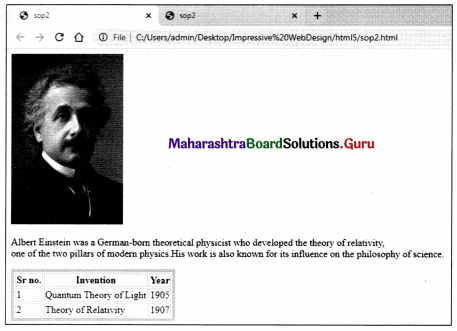

SOP 3: Create a webpage with the following specifications.

- Display heading ‘Application Form’ in the highest heading with center alignment.

- Accept name, standard 11th or 12th with only one selection choice.

- Submit the form.

Answer:

<! DOCTYPE html>

<html>

<head> <title> sop3</title>

</head>

<body>

<h1 align=center> Application Form </h1>

<form>

Enter Name:<input type=text name=t1>

<br><br>

Standard:<br>

<input type=”radio” name=r1>11th<br>

<input type=”radio” name=r1>12th<br>

<br><br>

<input type=”submit” value=”Submit”>

</form>

</body>

</html>

![]()

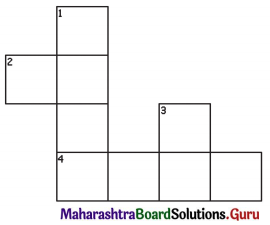

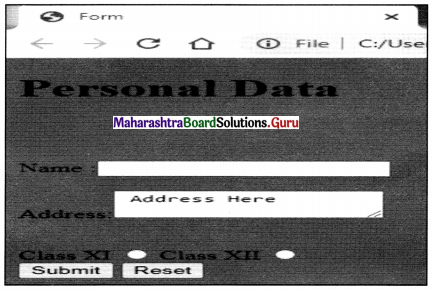

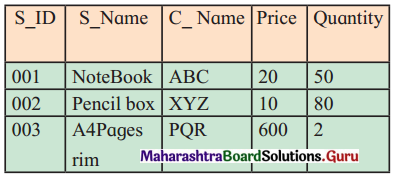

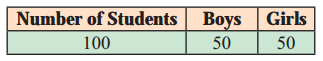

SOP 4: Write a program using HTML with the following specification.

A webpage with details about a class with a total number of students-100, (Boys – 50), Girls – 50 in tabular form.

e.g.

Link this page to another page as follows.

Demo.html

Answer:

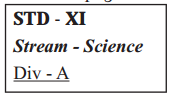

<!DOCTYPE html>

<html>

<head>

<title>New Page 1</title>

</head>

<body>

<center>

<table border=”1” width=”69%” >

<tr bgcolor=pink>

<td>Number of Students</td>

<td>Boy</td>

<td>Girls</td>

</tr>

<tr bgcolor=”lightgreen”>

<td>100</td>

<td>50</td>

<td>50</td>

</tr>

</table>

</body>

</html>

Demo

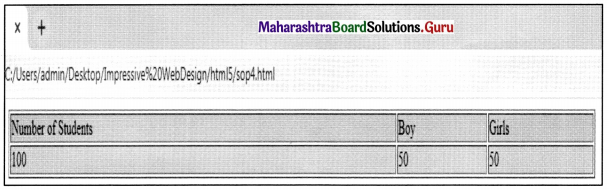

<!DOCTYPE html>

<html>

<head>

<title>the heading</title>

</head>

<BODY>

<header>

<center>

<table border=”1” align=center>

<tr align=center>

<td><a href=”sop4.html”>STD – XI</a>

<br>Stream – Science<br>

Div – A<br></td>

</tr>

</table>

</body>

</html>

Class 11 Information Technology Textbook Solutions

- Basics of Information Technology Class 11 Information Technology

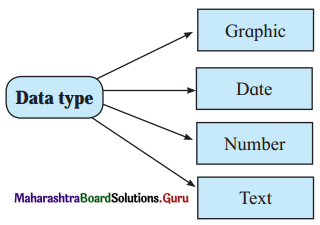

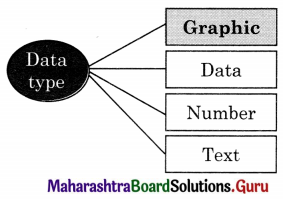

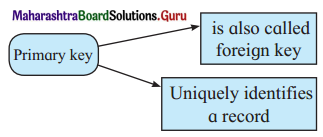

- Introduction to DBMS Class 11 Information Technology

- Impressive Web Designing Class 11 Information Technology

- Cyber Law Class 11 Information Technology

- Daily Computing (Libre Office) Class 11 Information Technology

- Web Designing (HTML – 5) Class 11 Information Technology

- Client Side Scripting (JavaScript) Class 11 Information Technology

- Accounting Package (GNUKhata) Class 11 Information Technology

- Digital Content Creation (GIMP, Inkscape) Class 11 Information Technology

- DBMS (PostgreSQL) Class 11 Information Technology