By going through these Maharashtra State Board Secretarial Practice 12th Commerce Notes Chapter 10 Dividend and Interest students can recall all the concepts quickly.

Maharashtra State Board Class 12 Secretarial Practice Notes Chapter 10 Dividend and Interest

The term dividend is derived from the Latin word ‘Dividendum’ which means ‘that which is to be divided’.

- Dividend is the part of the profit declared by the company and is distributed among the shareholders.

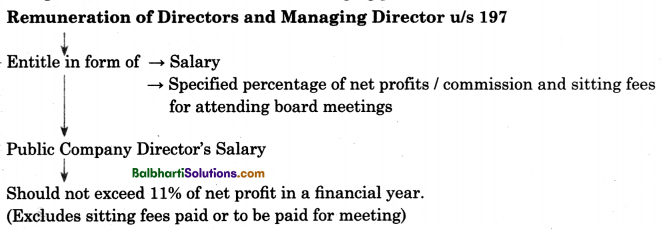

- Company has to follow different legal provisions on dividend as follows:

![]()

(i) Legal Provisions on sources of Dividend.

– Dividend is paid out of:

- Current Profits

- Profits of previous year

- Capital Profits

- Free reserves

(ii) Legal Provisions on declaration of Dividend.

(iii) Legal Provisions for payment of Dividend.

- Dividend should be paid in cash, cheque or warrant and not in kind.

- Dividend should be paid within 30 days from the date of its declaration.

- Dividend is paid only to the registered shareholders of the company.

→ Unpaid and Unclaimed Dividend

- Dividend declared by the company but not paid or claimed by the shareholder within 30 days of its declaration is termed as unpaid or unclaimed dividend.

- Unpaid/ Unclaimed dividend should be transferred to ‘Unpaid Dividend Account’ maintained in schedule bank

![]()

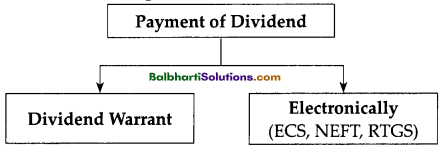

Modes of Payment of Dividend-

Dividend can be paid in cash not in kind.

Different ways in which dividend can be paid by company are as follows:

- Dividend Warrant

Cheque is sent to the shareholder for the payment of dividend. - Dividend Mandate

Dividend is credited directly into shareholder’s bank account. - Electronic Mode

It is mandatory for the listed companies to use electronic mode of payment i.e.- ECS (Electronic Clearing System)

- NEFT (National Electronic Fund Transfer)

Interim Dividend-

- Dividend declare between two Annual General Meetings is called Interim Dividend.

- It is declared by Board of Directors.

- It cannot be paid out of any reserves.

- Resolution is to be passed for declaring Interim Dividend.

Interest-

- Interest is the price paid for borrowing and lending money.

- The rate of interest is expressed as annual percentage of Principal.

- The rate of interest is fixed and pre-determined.