By going through these Maharashtra State Board Class 11 Sociology Notes Chapter 8 Social Change students can recall all the concepts quickly.

Maharashtra State Board Class 11 Sociology Notes Chapter 8 Social Change

→ All human societies and their cultures are dynamic and undergo continuous change.

→ Change is an integral part of human society. It may be cyclical.

→ The nature of change and the direction of change varies from one society to another, but change is inevitable.

→ Changes might be slow or rapid; the consequences of change may be constructive/positive or destructive/negative.

![]()

→ Changes proceed from one stage to another in a single direction known as linear change or changes can take place in several directions known as multi-linear change.

→ The view of looking at society from the point of view of structures and functions is called structural functionalism.

→ The term social change refers to changes that take place in the structure and functioning of social Institution.

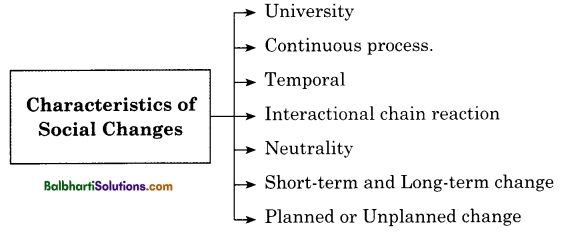

Characteristics of Social Changes:

- University

- Continuous process.

- Temporal

- Interactional chain reaction

- Neutrality

- Short-term and Long-term change

- Planned or Unplanned change

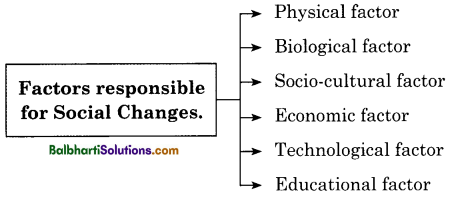

Factors responsible for Social Changes:

- Social change is a result of the interaction of multiple factors.

- No single factor is responsible for the change in society.

![]()

Factors responsible for Social Changes:

- Physical factor

- Biological factor

- Socio-cultural factor

- Economic factor

- Technological factor

- Educational factor