Balbharati Maharashtra State Board 11th Commerce Maths Solution Book Pdf Chapter 9 Commercial Mathematics Ex 9.6 Questions and Answers.

Maharashtra State Board 11th Commerce Maths Solutions Chapter 9 Commercial Mathematics Ex 9.6

Question 1.

M/s Janaseva sweet mart sold sweets of ₹ 3,86,000. What CGST and SGST he will pay if the rate of GST is 5%?

Solution:

Given that M/s Janaseva sweet mart sold sweets of ₹ 3,86,000

∴ Bill amount = ₹ 3,86,000

GST payable at the rate 5%

∴ CGST and SGST applicable is 2.5% each

∴ CGST on the bill = \(\frac{2.5}{100}\) × 3,86,000 = ₹ 9650

and SGST on the bill = \(\frac{2.5}{100}\) × 3,86,000 = ₹ 9650

Question 2.

Janhavi Gas Agency purchased some gas cylinders for ₹ 5,00,000 and sold them to the customers for ₹ 5,90,000. Find the amount of GST payable and the amount of ITC. 5% GST is applicable.

Solution:

Given that, Janhavi Gas Agency purchased some gas cylinders for ₹ 5,00,000 and GST applicable is 5%.

∴ Input tax (ITC) = 5% of 5,00,000

= \(\frac{5}{100}\) × 5,00,000

= ₹ 25,000

Janhavi Gas Agency sold the gas cylinders for ₹ 5,90,000

∴ Output tax for Janhavi Gas Agency = 5% of 5,90,000

= \(\frac{5}{100}\) × 5,90,000

= ₹ 29,500

GST payable = Output tax – Input tax (ITC)

= 29,500 – 25,000

= ₹ 4500

∴ GST payable for Janhavi Gas Agency is ₹ 4,500 and ITC is ₹ 25,000.

![]()

Question 3.

A company dealing in mobile phones purchased mobile phones worth ₹ 5,00,000 and sold the same to customers at ₹ 6,00,000. Find the amount of ITC and amount of GST if the rate of GST is 12%.

Solution:

Given that the rate of GST applicable is 12%.

The company purchased mobile phones worth ₹ 5,00,000.

∴ Input tax (ITC) = 12% of 5,00,000

= \(\frac{12}{100}\) × 5,00,000

= ₹ 60,000

The company dealing in mobile phones sold the same to customers at ₹ 6,00,000.

∴ Output tax of the company = 12% of 6,00,000

= \(\frac{12}{100}\) × 6,00,000

= ₹ 72,000

GST payable for the company = Output tax – Input tax (ITC)

= 72,000 – 60,000

= ₹ 12,000

∴ The ITC for the company is ₹ 60,000 and GST payable is ₹ 12,000.

Question 4.

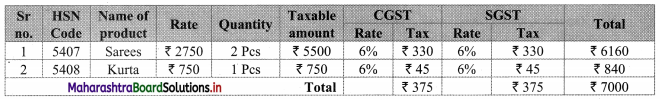

Prepare business to customers (B2C) tax invoice using given information. Write the name of supplier, address, state, Date, Invoice Number, GSTIN etc. as per your choice

Supplier: ___________

Address: ___________

State: ___________

Date: ___________

Invoice No: ___________

GSTIN: ___________

Particular: Rate of Sarees – ₹ 2750

Rate of GST 5% HSN 5407 – 2 pcs

Rate of Kurta – ₹ 750

Rate of GST 12% HSN 5408

Solution:

Supplier: M/s Swaglife Fashions

Address: 143, Shivaji Rasta, Mumbai 400001

Mobile No. 9263692111

Email: abc@gmail.com

State: Maharashtra

Date: 31/08/19

Invoice No: GST/110

GSTIN: 27ABCDE1234HIZS

∴ Rate of 1 saree = ₹ 2750

∴ Rate of 2 sarees = 2 x 2750 = ₹ 5500

∴ GST on sarees = 12% of 5500

= \(\frac{12}{100}\) × 5500

= ₹ 660

∴ CGST = SGST = ₹ 330

∴ Rate of 1 Kurta = ₹ 750

∴ GST on Kurta = 12% of 750

= \(\frac{12}{100}\) × 750

= ₹ 90

∴ CGST = SGST = ₹ 45

![]()

Question 5.

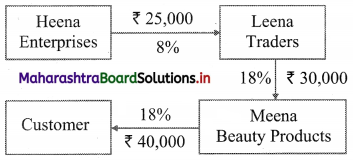

Heena Enterprise sold cosmetics worth ₹ 25,000 to Leena traders, a retailer. Leena Traders sold it further to Meena Beauty Products for ₹ 30,000. Meena Beauty Product sold it further to the customers for ₹ 40,000. The rate of GST is 18%. Find

(i) GST Payable by each party

(ii) CGST and SGST

Solution:

The trading chain,

∴ Output tax for Heena Enterprises = 18% of 25,000

= \(\frac{18}{100}\) × 25,000

= ₹ 4,500

∴ GST payable by Heena Enterprises

Now output tax for Leena traders = 18% of 30,000

= \(\frac{18}{100}\) × 30,000

= ₹ 5,400

∴ GST payable by Leena traders = Output tax – Input tax

= 5,400 – 4,500

= ₹ 900

∴ Output tax for Meena beauty products = 18% of 40,000

= \(\frac{18}{100}\) × 40,000

= ₹ 7,200

∴ GST payable by Meena beauty products = Output tax – Input tax

= 7,200 – 5,400

= ₹ 1,800

(ii) Now, CGST = SGST = \(\frac{\text { GST }}{2}\) = 9%

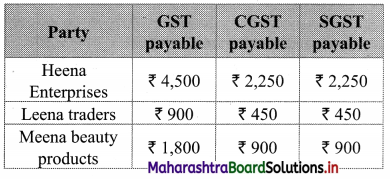

∴ Statement of GST payable at each stage can be tabulated as:

Question 6.

‘Chitra furnishings’ purchased tapestry (curtain cloth) for ₹ 28,00,000 and sold for ₹ 44,80,000. Rate of GST is 5%. Find

(i) Input Tax

(ii) Output Tax

(iii) ITC

(iv) CGST and SGST

Solution:

Given, that ‘Chitra furnishings’ purchased tapestry (curtain cloth) for ₹ 28,00,000 and rate of GST is 5%

(i) Input tax = 5% of 28,00,000

= \(\frac{5}{100}\) × 28,00,000

= ₹ 1,40,000

The tapestry was sold at ₹ 44,80,000

(ii) Output tax = 5% of 44,80,000

= \(\frac{5}{100}\) × 44,80,000

= ₹ 2,24,000

(iii) Now ITC = Input tax = ₹ 1,40,000

GST payable = Output tax – ITC

= 2,24,000 – 1,40,000

= ₹ 84,000

(iv) CGST = SGST = \(\frac{\text { GST Payable }}{2}\)

= \(\frac{84,000}{2}\)

= ₹ 42,000

∴ CGST = SGST = ₹ 42,000

![]()

Question 7.

Two friends ‘Aditi’ and ‘Vaishali’ went to a restaurant. They ordered 2 Masala Dosa costing ₹ 90 each 2 coffee costing ₹ 60 each and 1 sandwich costing ₹ 80. GST is charged at 5%. Find the Total amount of the bill including GST.

Solution:

Aditi and Vaishali ordered for 2 Masala Dosas, 2 Coffees and 1 Sandwich

∴ Total price of their order = 2 × 90 + 2 × 60 + 80 = ₹ 380

GST is charged at 5%

∴ GST on the total order = 5% × 380

= \(\frac{5}{100}\) × 380

= ₹ 19

∴ Total bill amount including GST = 380 + 19 = ₹ 399