Balbharati Maharashtra State Board 11th Commerce Maths Solution Book Pdf Chapter 9 Commercial Mathematics Miscellaneous Exercise 9 Questions and Answers.

Maharashtra State Board 11th Commerce Maths Solutions Chapter 9 Commercial Mathematics Miscellaneous Exercise 9

Question 1.

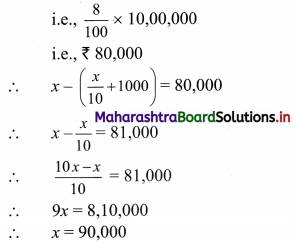

A man buys a house for ₹ 10 lakh and rents it. He puts 10% of the annual rent aside for repairs, pays ₹ 1,000 as annual taxes, and realizes 8% on his investment thereafter. Find the annual rent of the house.

Solution:

Let ₹ ‘x’ be the annual rent of the house.

The man keeps 10% of the annual rent aside for repairs.

i.e., \(\frac{10}{100}\) × x or ₹ \(\frac{x}{10}\) aside tor repairs.

In addition, he pays ₹ 1000 as annual taxes.

After incurring these expenses he is left with an amount which is 8% of his investment for the house.

∴ The annual rent of the house is ₹ 90,000.

Question 2.

Rose got 30% of the maximum marks in an examination and failed by 10 marks. However, Lily who appeared for the same examination got 40% of the total marks and got 15 marks more than the passing marks. What were the passing marks in the examination?

Solution:

Let maximum marks be x

Rose scored 30% of maximum marks

i.e. Rose scored \(\frac{30}{100}\)x

Rose failed by 10 marks

∴ passing marks = \(\frac{30}{100}\)x + 10 …..(i)

Lily scored 40% of maximum marks

i.e. Lily scored \(\frac{40}{100}\)x

Lily scored 15 marks more than passing marks

∴ passing marks = \(\frac{40}{100}\)x – 15 ……(ii)

equating (i) and (ii),

\(\frac{30x}{100}\) + 10 = \(\frac{40x}{100}\) – 15

∴ 10 + 15 = \(\frac{40 x-30 x}{100}\)

∴ 10x = (25)(100)

∴ x = 250

From (i), passing marks = \(\frac{30}{100}\)(250) + 10

= 75 + 10

= 85

∴ Passing marks for the examination were 85.

![]()

Question 3.

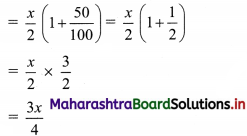

Ankita’s Salary was reduced by 50%. Again the reduced salary was increased by 50%. Find loss in terms of percentage.

Solution:

Let Ankita’s initial salary be ₹ ‘x’.

Her salary was reduced by 50%.

∴ Ankita’s salary after reduction = x(1 – \(\frac{50}{100}\))

= x(1 – \(\frac{1}{2}\))

= \(\frac{x}{2}\)

Ankita’s reduced salary was then increased by 50%

∴ Ankita’s final salary after the increase

∴ Loss in Ankita’s salary after the decrease and increase = x – \(\frac{3 x}{4}\) = \(\frac{x}{4}\)

∴ Ankita lost 25% of her salary.

Question 4.

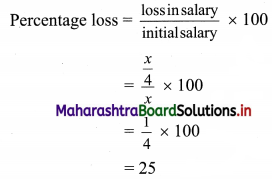

By selling 300 lunch boxes, a shopkeeper gains the selling price of 100 lunch boxes. Find his gain percent.

Solution:

Let ₹ x be the selling price (S.P.) of one lunch box.

∴ S.P. of 300 lunch boxes = 300x

and S.P. of 100 lunch boxes = 100x

Gain = 100x ……[given]

C.P. of 300 lunch boxes = S.P. – Gain

= 300x – 100x

= 200x

∴ The shopkeeper’s gain percentage is 50%.

Question 5.

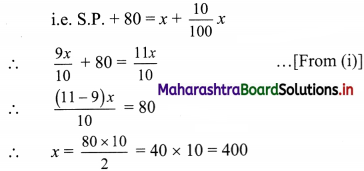

A salesman sold an article at a loss of 10%. If the selling price has been increased by ₹ 80, there would have been a gain of 10%. What was the cost of the article?

Solution:

Let ₹ x be the cost price of the article.

S.P. of the article = x – \(\frac{10}{100}\)x = \(\frac{9x}{100}\) …….(i)

Given that, S.P. increased by ₹ 80 would have given 10% gain

∴ The cost price of the article is ₹ 400

Question 6.

Find the single discount equivalent to a series discount of 10%, 20%, and 15%.

Solution:

Let the marked price be ₹ 100

After 1st discount the price = 100(1 – \(\frac{10}{100}\)) = 90

After 2nd discount the price = 90(1 – \(\frac{20}{100}\)) = 72

After 3rd discount the price = 72(1 – \(\frac{15}{100}\)) = 61.2

∴ The selling price after 3 discounts is ₹ 61.2.

∴ Single equivalent discount = marked price – selling price

= 100 – 61.2

= ₹ 38.8

∴ The single equivalent discount is ₹ 38.8 on ₹ 100.

i.e. The single equivalent discount is 38.8%.

![]()

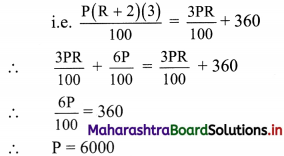

Question 7.

Reshma put an amount at simple interest at a certain rate for 3 years. Had it been put at 2% higher rate, she would have received ₹ 360 more. Find the sum.

Solution:

Let P and R represent the principal amount and rate of interest p.a. respectively.

Given duration = T = 3 years

Simple interest = \(\frac{\mathrm{PRT}}{100}=\frac{3 \mathrm{PR}}{100}\)

Given that, had the amount been kept at 2% more, then the gain would have been ₹ 360 more.

∴ The sum of money is ₹ 6,000.

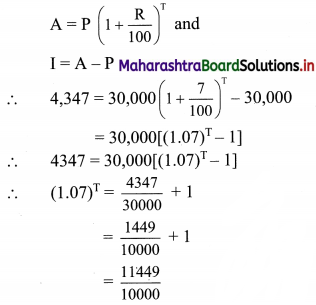

Question 8.

The compound interest on ₹ 30000 at 7% p.a. is ₹ 4347. What is the period in years?

Solution:

Given that,

Principal (P) = ₹ 30,000

Rate of interest (R) = 7% p.a.

Compound interest = ₹ 4,347

Amount after compound interest

= \(\left(\frac{107}{100}\right)^{2}\)

= (1.07)2

∴ T = 2

∴ Amount is invested for 2 years.

Question 9.

The value of the machine depreciates at the rate of 15% p.a. It was purchased 2 years ago. Its present value is ₹ 7,225. What was the purchase price of the machine?

Solution:

Given,

Rate of depreciation = r = 15%

Number of years = n = 2 years

Present value of machine = P.V. = ₹ 7,225

The purchase price (V) of the machine can be found using

∴ The purchase price of the machine was ₹ 10,000/-.

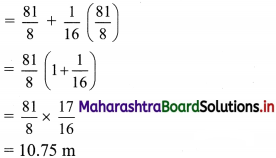

Question 10.

A tree increases annually by \(\frac{1}{8}\) of its height. By how much will it increase after 2\(\frac{1}{2}\) years. If its length today is 8 m?

Solution:

The height of the tree today is 8m.

The height of the tree increases by \(\frac{1}{8}\)th of its height every year.

At the end of 1st year, height of the tree will be = 8 + \(\frac{1}{8}\) × 8 = 9 m

And, at the end of the 2nd year, height of the tree will be = 9 + \(\frac{1}{8}\) × 9

= 9(1 + \(\frac{1}{8}\))

= 9 × \(\frac{9}{8}\)

= \(\frac{81}{8}\)

After six more months, the height of the tree will be

∴ Increase in the height of the tree after 2\(\frac{1}{2}\) years = 10.75 – 8 = 2.75 m.

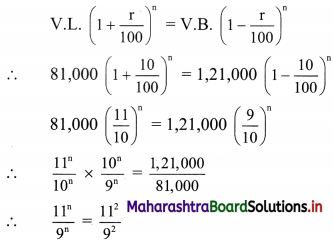

Question 11.

A building worth ₹ 1,21,000 is constructed on land worth ₹ 81,000. After how many years will the value of both be the same if land appreciates at 10% p.a and buildings depreciate at 10% p.a.

Solution:

Given,

Value of the building = V.B. = ₹ 1,21,000

Value of land = V.L. = ₹ 81,000/-

Rate of appreciation of land = rate of depreciation of building = r = 10%.

For the value of building and land to be the same.

∴ n = 2 years.

∴ After two years value of the building and land will be the same.

![]()

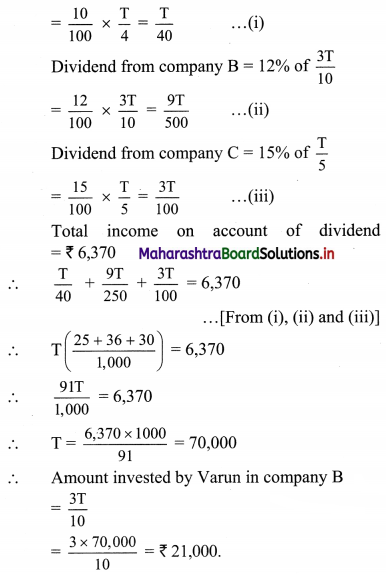

Question 12.

Varun invested 25%, 30%, and 20% of his savings in buying shares of three different companies, ‘A’, ‘B’, and ‘C’ which declared dividends, 10%, 12%, and 15% respectively. If his total income on account of dividends is ₹ 6,370/-, find the amount he invested in buying shares of company ‘B’.

Solution:

Let ‘T’ be Varan’s total savings.

∴ Investment of Varan in:

Company A = 25% of T = \(\frac{25}{100}\) × T = \(\frac{T}{4}\),

Company B = 30% of T = \(\frac{30}{100}\) × T = \(\frac{3T}{10}\),

Company C = 20% of T = \(\frac{20}{100}\) × T = \(\frac{T}{5}\)

Company A, B and C declared dividends 10%, 12% and 15% respectively.

∴ Dividend from company A = 10% of \(\frac{T}{4}\)

∴ Varan invested ₹ 21,000 in company B.

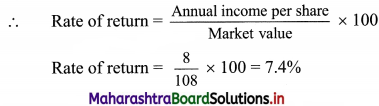

Question 13.

Find the annual dividend received from ₹ 25,000, 8% stock at ₹ 108.

Solution:

Amount invested = ₹ 25,000

Dividend = 8%

Assuming face value F.V. as ₹ 100

Annual income per share = \(\frac{\text { Dividend }}{100} \times \text { Face value }\)

= \(\frac{8}{100}\) × 100

= ₹ 8

Market value of the share M.V. = ₹ 108

Annual dividend on amount invested = Rate of return × amount invested

= \(\frac{7.4}{100}\) × 25,000

= ₹ 1850

∴ Annual dividend of ₹ 1,850 is received from 8% stock at ₹ 108.

Alternate approach

Assuming ₹ 25,000 as the total face value of all the shares.

Since the dividend is 8%,

Annual dividend = \(\frac{8}{100}\) × 25,000 = ₹ 2,000

Question 14.

A, B, and C enter into a partnership. A invests 3 times as much as B invests and B invests two-thirds of what ‘C’ invests. At the end of the year, the profit earned is ₹ 8,800. What is the share of ‘B’?

Solution:

Let ‘a’, ‘b’ and ‘c’ be the amounts invested by A, B and C respectively.

Given that, A invests 3 times as much as B and B invests two third of what ‘C’ invests.

∴ a = 3b and b = \(\frac{2}{3}\)c

∴ \(\frac{a}{b}=\frac{3}{1}\) and \(\frac{b}{c}=\frac{2}{3}\)

or \(\frac{a}{b}=\frac{6}{2}\) and \(\frac{b}{c}=\frac{2}{3}\)

∴ a : b = 6 : 2 and b : c = 2 : 3

∴ a : b : c = 6 : 2 : 3

Given that profit earned = ₹ 8800

∴ Share of ‘B’ in profit = \(\frac{2}{11}\) × 8800 = ₹ 1600

∴ B’share in profit is ₹ 1600.

![]()

Question 15.

The ratio of investment of two partners Santa and Banta is 11 : 12 and the ratio of their profits is 2 : 3. If Santa invested the money for 8 months, then for how much time did Banta his money?

Solution:

Let ‘x’ be the time in months for which Banta invested his money

Santa and Banta invested their money in the ratio 11 : 12.

Santa invested his money for 8 months and the ratio of their profits is 2 : 3.

∴ 11 × 8 : 12 × x = 2 : 3

∴ \(\frac{88}{12 x}=\frac{2}{3}\)

∴ x = \(\frac{88 \times 3}{2 \times 12}\)

∴ x = 11

∴ Banta invested his money for 11 months.

Question 16.

Akash, Sameer, and Sid took a house on rent for one year for ₹ 16,236. They stayed together for 4 months and then Sid left the house. After 5 more months, Sameer also left the house. How much rent should each pay?

Solution:

Let ‘R’ be the rent per month to be paid to the landlord.

Given that, Sid left the house after 4 months

∴ Rent paid by Sid = \(\frac{R}{3}\) × 4 = \(\frac{4R}{3}\)

Sameer left the house after another 5 months,

∴ Rent paid by Sameer = \(\frac{R}{2}\) × 5 + \(\frac{R}{3}\) × 4

= R(\(\frac{5}{2}+\frac{4}{3}\))

= \(\frac{23R}{6}\)

Akash stayed in the house for the entire year.

∴ Rent paid by Akash = 3R + \(\frac{R}{2}\) × 5 + \(\frac{R}{3}\) × 4

= R(3 + \(\frac{5}{2}+\frac{4}{3}\))

= \(\frac{41R}{6}\)

∴ The rent paid by the three of them, over that period of one year must be in the proportion.

\(\frac{41 \mathrm{R}}{6}: \frac{23 \mathrm{R}}{6}: \frac{4 \mathrm{R}}{3}\)

i.e. in the proportion

41 : 23 : 8 …..(multiplying throughout by \(\frac{6}{R}\))

Let x be the constant of proportionality.

Rent to be paid by Akash = ₹ 41x

Rent to be paid by Sameer = ₹ 23x

and rent to be paid by Sid = ₹ 8x

The total rent for the house was ₹ 16236.

∴ 41x + 23x + 8x = ₹ 16236

∴ 72x = 16236

∴ x = 225.5

∴ Akash should pay 41x = 41 × 225.5 = ₹ 9245.5

Sameer should pay 23x = 23 × 225.5 = ₹ 5186.5

and Sid should pay 8x = 8 × 225.5 = ₹ 1804

![]()

Question 17.

Ashwin Auto Automobiles sold 10 motorcycles. Total sales amount was ₹ 6,80,000. 18% GST is applicable. Calculate how much CGST and SGST the firm has to pay.

Solution:

Given, total sales amount for Ashwin Automobiles was ₹ 6,80,000.

18% GST is applicable.

∴ GST payable = 18% of 6,80,000

= \(\frac{18}{100}\) × 6,80,000

= ₹ 1,22,400

Now CGST = SGST = 9%

= \(\frac{\text { GST payable }}{2}\)

= \(\frac{1,22,400}{2}\)

= ₹ 61,200

∴ CGST = SGST = ₹ 61,200

Question 18.

‘Sweet 16’ A ready made garments shop for Women’s garments, purchased stock for ₹ 4,00,000 and sold that stock for ₹ 5,50,000 (12% GST is applicable) Find,

(i) Input Tax Credit

(ii) CGST and SGST paid by the firm.

Solution:

Given that, stock purchased by ‘Sweet 16’ was worth ₹ 4,00,000

GST applicable is 12%.

∴ Input tax = 12% of 4,00,000

= \(\frac{12}{100}\) × 4,00,000

= ₹ 48,000

∴ Input tax Credit (ITC) = ₹ 48,000

The garment stock was sold for ₹ 5,50,000

Output tax = 12% of 5,50,000

= \(\frac{12}{100}\) × 5,50,000

= ₹ 66,000

∴ GST payable = output tax – ITC

= 66,000 – 48,000

= ₹ 18,000

∴ CGST = SGST = \(\frac{\text { GST payable }}{2}\) = ₹ 9,000