Final Accounts of a Proprietary Concern 11th BK Commerce Chapter 9 Solutions Maharashtra Board

Balbharti Maharashtra State Board Bookkeeping and Accountancy 11th Solutions Chapter 9 Final Accounts of a Proprietary Concern Textbook Exercise Questions and Answers.

Class 11 Commerce BK Chapter 9 Exercise Solutions

1. Answer in One Sentence.

Question 1.

What is Trading Account?

Answer:

An account in which direct expenses are compared with direct incomes to find out gross profit or gross loss for a given period is known as Trading Account.

Question 2.

What do you mean by Profit and Loss Account?

Answer:

An account in which indirect expenses are compared with indirect incomes to find out net profit or net loss for a given period is known as the Profit and Loss Account.

![]()

Question 3.

Why Balance Sheet is prepared?

Answer:

The balance sheet is prepared to ascertain the financial position of the business on a specific date usually at the end of the accounting year.

Question 4.

State the meaning of Final Accounts.

Answer:

Final Accounts are the group of Trading Account, Profit and loss account and Balance sheet prepared to know the results of business for a given period.

Question 5.

What is Net Profit?

Answer:

When the total credit side of Profit and Loss A/c is greater than the total of debit side, it indicates credit balance which is known as net profit.

Question 6.

What do you mean by Gross Profit?

Answer:

When the total credit side of Trading A/c is greater than the total of debit side, it indicates credit balance, which is called gross profit.

Question 7.

State the meaning of Accrued Income?

Answer:

Income that is due and accumulated but not yet actually received during the current accounting year is called accrued income.

Question 8.

State the meaning of Outstanding Expenses?

Answer:

The expenses which are incurred in the current year, but not paid partly or fully during the current accounting year are termed as outstanding expenses.

![]()

Question 9.

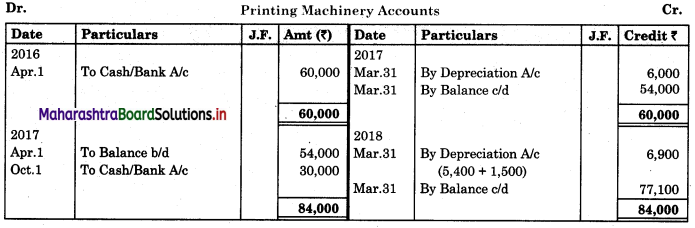

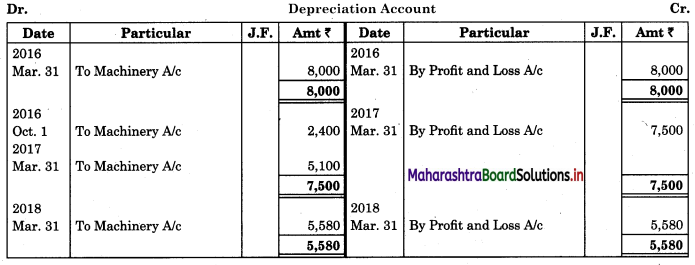

What is Depreciation?

Answer:

Depreciation means a continuous reduction in the value of property or asset due to wear and tear, accident, fall in the market price, the passage of time, etc.

Question 10.

What do you mean by Prepaid Expenses?

Answer:

The expense which is paid in advance before they are due for payment is called prepaid expenses.

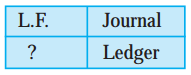

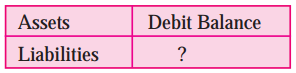

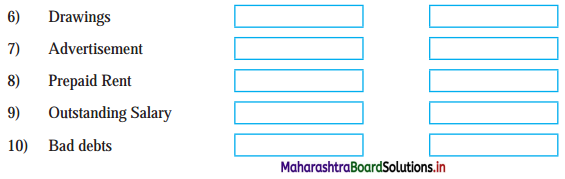

2. Give a word, term, or phrase which can substitute each of the following statements:

Question 1.

Expenses are paid before it is due.

Answer:

Prepaid Expenses

Question 2.

Income due but not yet received.

Answer:

Accrued Income

Question 3.

Carriage paid on the sale of goods.

Answer:

Carriage Outwards

Question 4.

Statement of Assets and liabilities.

Answer:

Balance Sheet

Question 5.

Account prepared to know Net Profit or Net loss.

Answer:

Profit and Loss A/c

![]()

Question 6.

Value of goods remaining unsold at the end of the year.

Answer:

Closing Stock

Question 7.

The provision was made to compensate the loss on account of likely debts.

Answer:

Provision for Bad and Doubtful Debts

Question 8.

The accounts are prepared at the end of the accounting year to know the profit or loss and financial position of the business.

Answer:

Final Accounts

Question 9.

An amount spent on promoting the sale of goods.

Answer:

Selling Expenses

Question 10.

Additional information is provided below the Trial Balance.

Answer:

Adjustments

3. Select the most appropriate alternatives given below and rewrite the sentence:

Question 1.

_____________ is excess of assets over liabilities.

(a) Goodwill

(b) Capital

(c) Investments

(d) Drawings

Answer:

(b) Capital

Question 2.

Discount earned is transferred to credit side of _____________ account.

(a) Current

(b) Profit and Loss

(c) Trading

(d) Capital

Answer:

(b) Profit and Loss

![]()

Question 3.

_____________ is a statement which shows the financial position of business on a specific date.

(a) Trading Account

(b) Trial Balance

(c) Profit and Loss A/c

(d) Balance Sheet

Answer:

(d) Balance Sheet

Question 4.

Outstanding expenses are shown on the _____________ side of Balance sheet.

(a) Assets

(b) Liability

(c) Both

(d) None of these

Answer:

(b) Liability

Question 5.

Interest on Drawing is credited to _____________ Account.

(a) Trading

(b) Profit and Loss

(c) Capital

(d) All

Answer:

(b) Profit and Loss

Question 6.

Debit balance of Trading Account means _____________

(a) Gross Loss

(b) Net Loss

(c) Net Profit

(d) Gross Profit

Answer:

(a) Gross Loss

Question 7.

Carriage Inward is debited to _____________ Account.

(a) Trading

(b) Profit and Loss

(c) Capital

(d) Bank

Answer:

(a) Trading

Question 8.

Excess of credit over to debit in Profit and Loss A/c indicates _____________

(a) Net Profit

(b) Gross Profit

(c) Gross Loss

(d) Net Loss

Answer:

(a) Net Profit

![]()

Question 9.

Closing stock is always valued at cost or market price which is _____________

(a) more

(b) less

(c) zero

(d) equal

Answer:

(b) less

Question 10.

When specific date is not given, in that case interest on drawings is charged for _____________ month.

(a) Four

(b) Six

(c) Eight

(d) Nine

Answer:

(b) Six

4. State True or False with reasons:

Question 1.

In every adjustment at least there are three effects.

Answer:

This statement is False.

There are at least two effects in every adjustment of final accounts.

Question 2.

Every item of Trial Balance has only one effect.

Answer:

This statement is True.

Every transaction is recorded through journal or subsidiary books with the principle of the double-entry book-keeping system. Journal and subsidiary books are posted to the ledger account and trial balance is prepared from the balances of the ledger so there are already two effects passed. So every item of Trial Balance has only one effect.

Question 3.

Income due but not received is a liability.

Answer:

This statement is False.

Income due but not received is an Asset and not a liability.

Question 4.

Goodwill is not a fictitious asset.

Answer:

This statement is True.

Goodwill is the reputation or name and fame of a business organization in the market. It is the money value of a business reputation earned by a business. It is an intangible asset.

Fictitious assets are created by accounting entry in the books of accounts it doesn’t have any realizable value.

E.g.: Share issue expenses.

![]()

Question 5.

The credit balance of the Profit & Loss account shows a net profit.

Answer:

This statement is True.

The credit side of profit and loss A/c represents incomes when the credit side is greater than the debit side (expenses) it shows the Net Profit of the year.

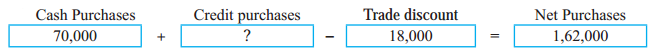

5. Fill in the blanks:

Question 1.

Gross Profit is transferred to _____________ account.

Answer:

Profit and Loss A/c

Question 2.

Debit Balance of Trading Account indicates _____________

Answer:

Gross Loss

Question 3.

Income Receivable appears on _____________ side of Balance Sheet.

Answer:

Asset

Question 4.

Interest on Bank Loan is debited to _____________ A/c.

Answer:

Profit and Loss A/c

Question 5.

Profit and Loss account is prepared to find out _____________ results of the business.

Answer:

Net Working

Question 6.

All indirect/operating expenses are transferred to _____________ account.

Answer:

Profit and Loss A/c

Question 7.

Interest of proprietor’s drawing is credited to _____________ account.

Answer:

Profit and Loss A/c

![]()

Question 8.

An excess of debit over credit in the Profit & Loss A/c represents the _____________

Answer:

Net Loss

Question 9.

All direct expenses are transferred to _____________ account.

Answer:

Trading A/c

Question 10.

Balance Sheet is _____________ of assets & liabilities.

Answer:

Statement

6. Find the odd one:

Question 1.

Rent, Salary, Insurance, Plant, and Machinery.

Answer:

Plant and Machinery

Question 2.

Purchases, Closing stock, Debtors, Factory Rent.

Answer:

Question 3.

Capital, Bills Payable, Debtors, Outstanding wages.

Answer:

Debtors

Question 4.

Advertisement, Travelling Expenses, Factory Rent, Insurance.

Answer:

Factory Rent

Question 5.

Cash in Hand, Debtors, Outstanding Income, Reserve for Doubtful Debts.

Answer:

Reserve for Doubtful Debts

7. Do you agree or disagree with the following statements:

Question 1.

Reserve for bad debts is created by debiting Profit and Loss Account.

Answer:

Agree

Question 2.

A balance Sheet is a statement as well as an account.

Answer:

Disagree

Question 3.

Indirect Expenses are debited to Trading Account.

Answer:

Disagree

![]()

Question 4.

Bank Overdraft is treated as an Internal Liability.

Answer:

Disagree

Question 5.

Capital is excess of Liabilities over Assets.

Answer:

Disagree

8. Correct and Rewrite the following statements:

Question 1.

The balancing figure of the Trading Account is Net Profit or Net Loss.

Answer:

The balancing figure of the Trading Account is Gross Profit or Gross Loss.

Question 2.

All direct expenses are debited to the Profit and Loss Account.

Answer:

All direct expenses are debited to Trading Account.

Question 3.

When the credit side of the Profit and Loss Account is greater than the debit side, it is called Net Loss.

Answer:

When the credit side of the Profit and Loss account is greater than the debit side, it is called Net Profit.

Question 4.

Capital A/c……………..Dr.

To Profit and Loss Account

(Being Net Profit transferred to Capital A/c)

Answer:

Profit and Loss Account…………….Dr.

To Capital A/c

(Being Net Profit transferred to Capital A/c)

Question 5.

Trading A/c……………Dr.

To Sales A/c

(Being Sales transferred to Trading A/c)

Answer:

Sales A/c…………Dr

To Trading A/c

(Being sales transferred to Trading A/c)

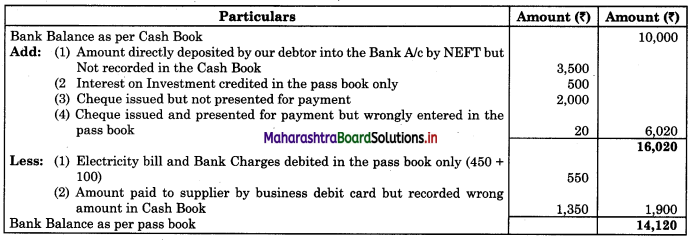

9. Calculate the following.

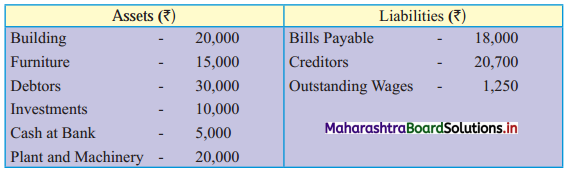

Question 1.

Calculate the Capital

Solution:

Capital = Assets – Liabilities

= ₹ 1,00,000 – ₹ 39,950

= ₹ 60,050

Question 2.

The machinery of ₹ 35,500 is purchased on 1st July 2018 and on the same day ₹ 4,500 are spent on the installation of the Machinery. The proprietor has decided to Depreciate Machinery at the rate of 7% p.a. Calculate the amount of depreciation, assuming that accounting year is ending on 31st March every year.

Solution:

Cost of Machinery = Purchase Price + Installation Charges

= 35,500 + 4,500

= ₹ 40,000

Depreciation for 9 months = 40,000 × \(\frac{7}{100} \times \frac{9}{12}\) = ₹ 2,100

![]()

Question 3.

Mr. Pramod borrowed a Loan from the State Bank of India ₹ 3,50,000 on 1st Oct. 2018 at the rate of interest of 12% p.a. Calculate the Interest on a bank loan for the year 2018-19, assuming that the financial year-end on 31st March every year.

Solution:

Interest on Bank loan for 6 months = 3,50,000 × \(\frac{12}{100} \times \frac{6}{12}\) = ₹ 21,000

Question 4.

Annual Insurance Premium ₹ 8,000 is paid on 1st Dec 2018. Calculate the amount of Insurance Premium for the accounting year ending on 31st March 2019.

Solution:

Annual Insurance Premium for 12 months = ₹ 8,000

Less: Prepaid for 8 months = ₹ 5,333

Insurance for 4 months (01.12.18 to 31.03.19) = ₹ 2,667

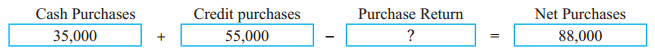

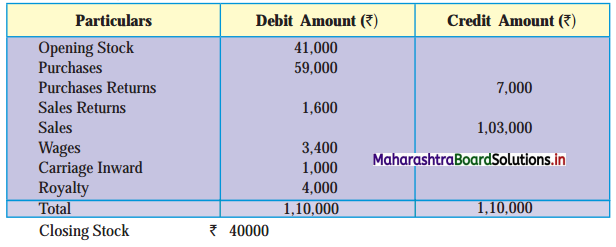

Question 5.

Calculate the Gross Profit/Gross Loss

Purchases A/c ₹ 15,500, Sales A/c ₹ 30,000, Carriage Inward ₹ 1,200, Opening Stock ₹ 5,000, Purchases Returns ₹ 500, Closing Stock ₹ 18,000

Solution:

Cost of Goods Sold = Opening Stock + Purchases – Purchases Returns + Carriage Inward – Closing Stock

= 5,000 + 15,500 – 500 + 1,200 – 18,000

= ₹ 3,200

Gross Profit = Sales – Cost of goods sold

= 30,000 – 3,200

= ₹ 26,800

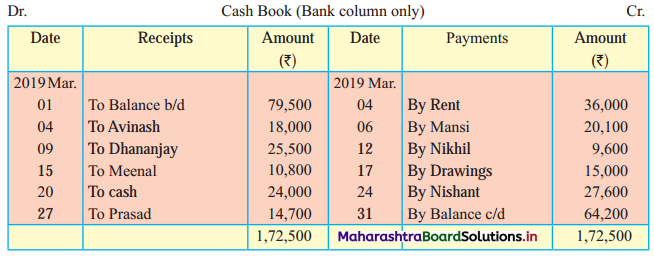

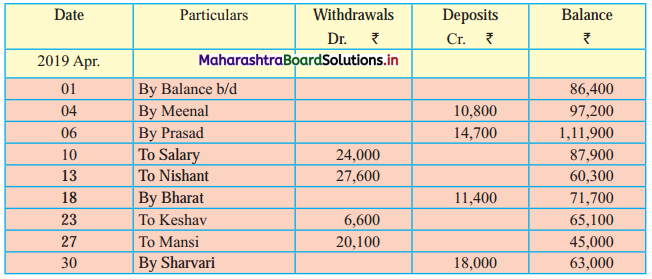

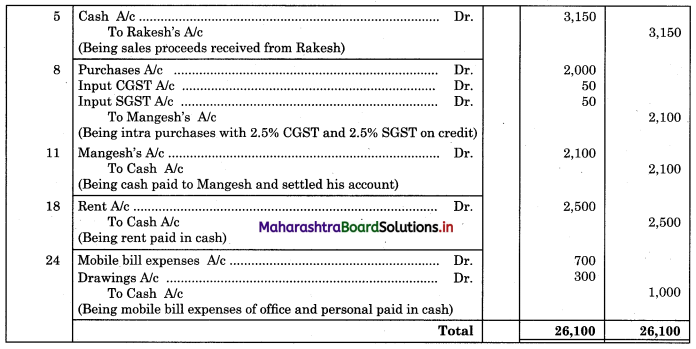

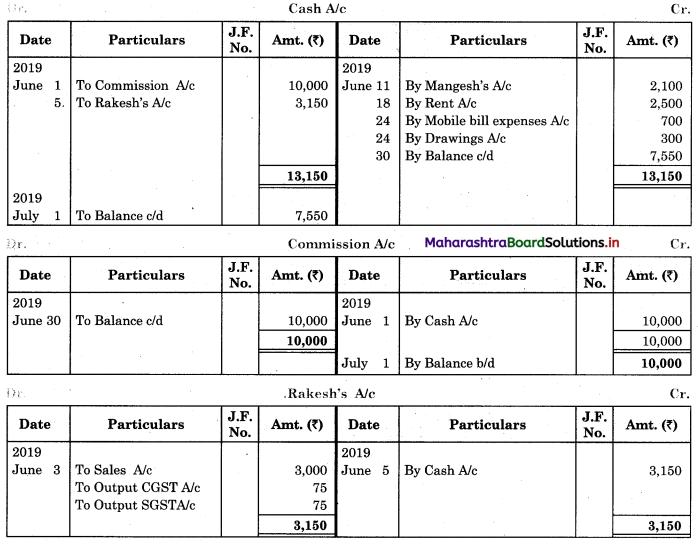

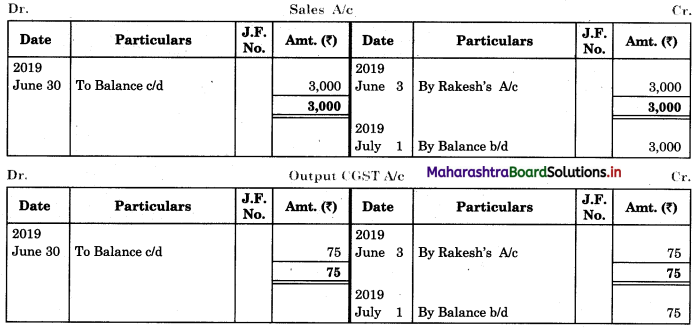

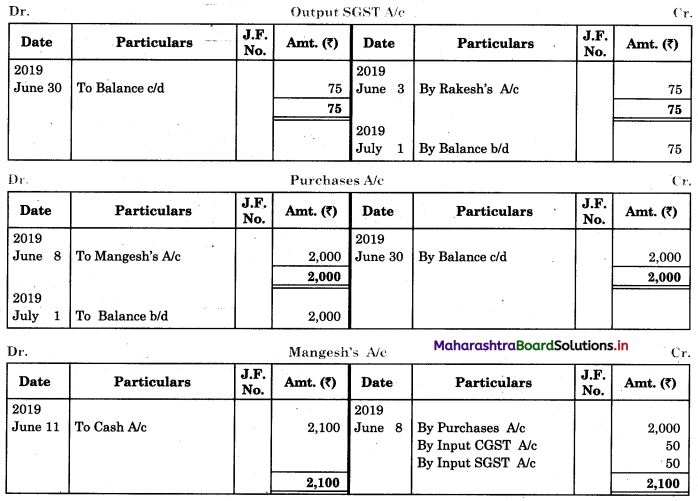

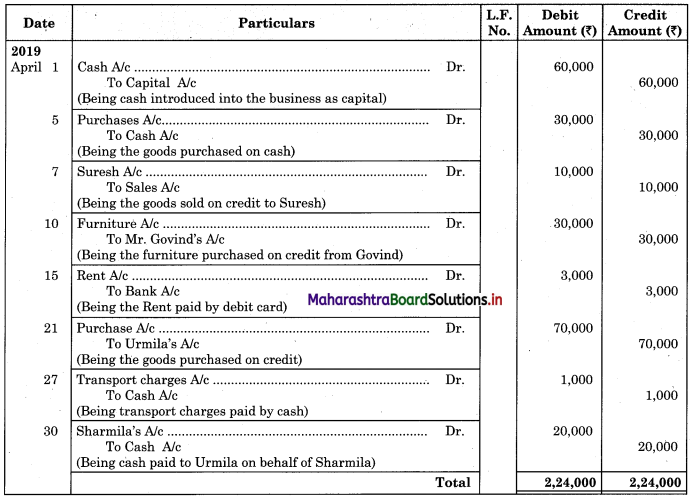

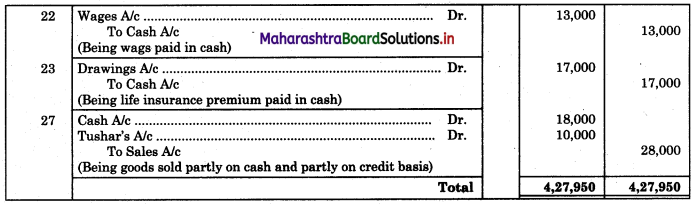

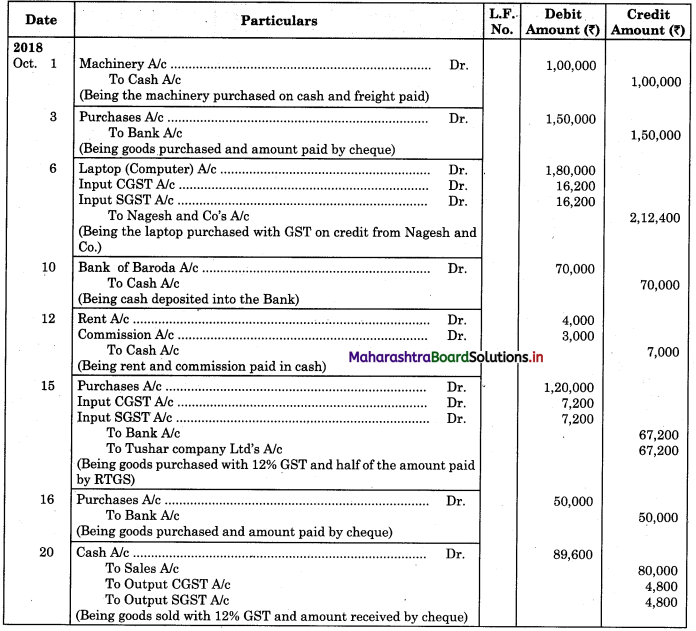

Practical Problems

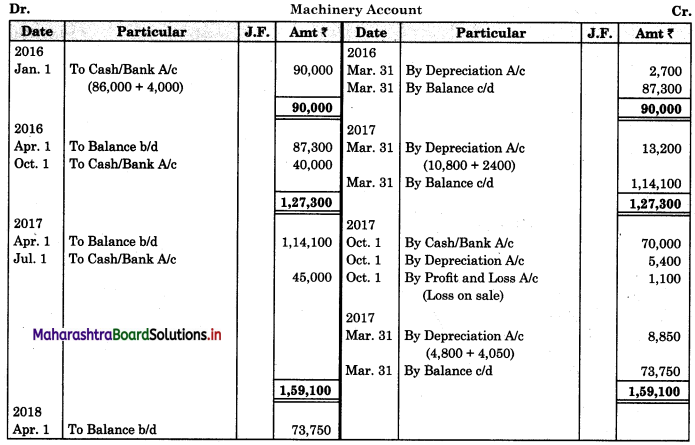

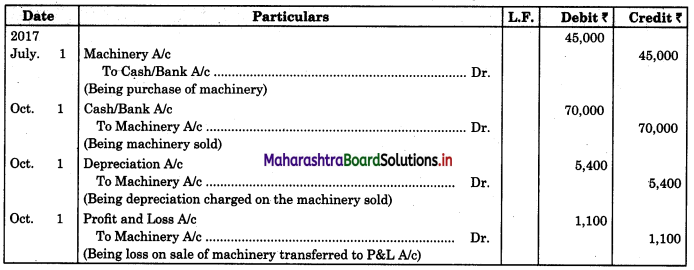

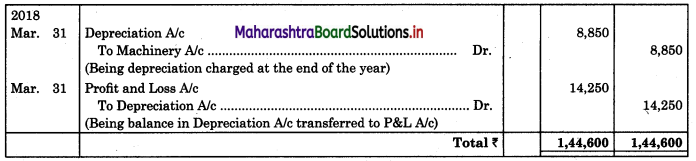

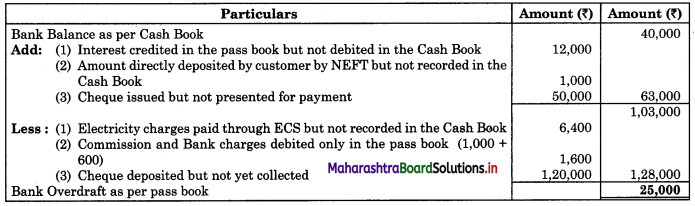

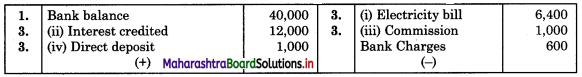

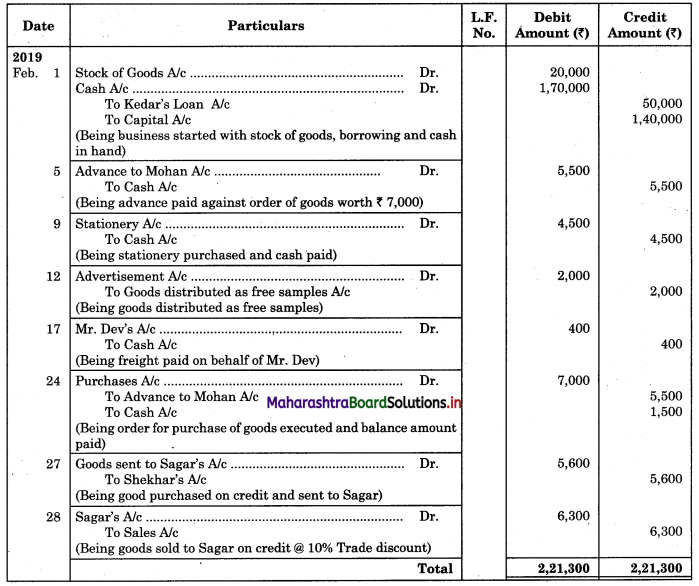

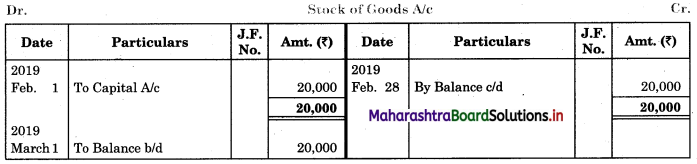

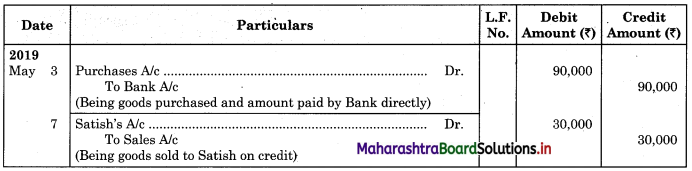

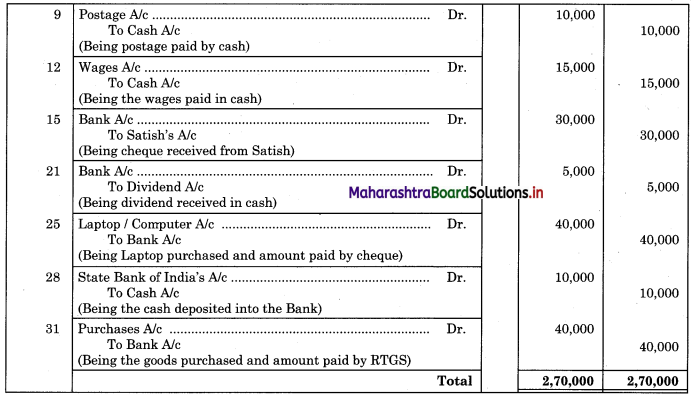

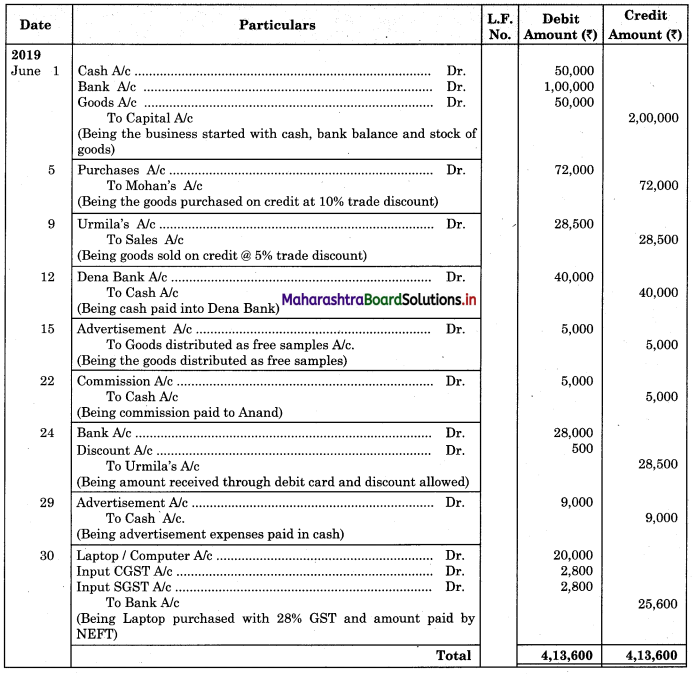

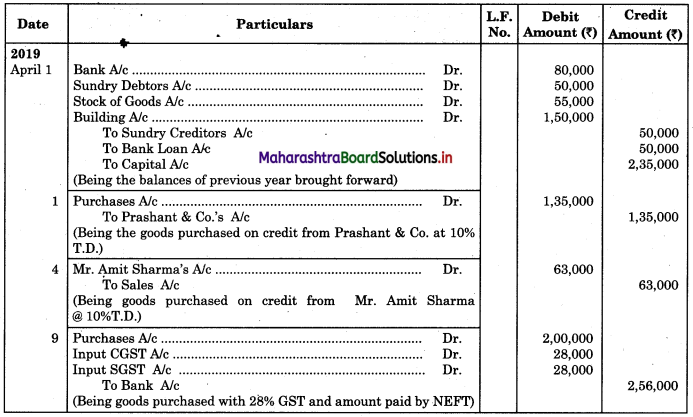

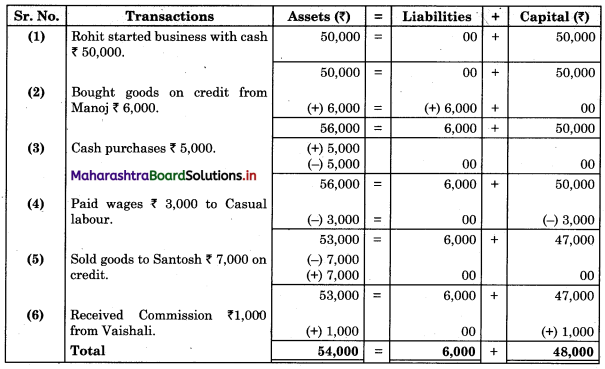

Question 1.

From the following Balances of Jayashri Traders, you are required to prepare Trading Account for the year ended 31/03/2019.

Solution:

In the books of Jayashri Traders

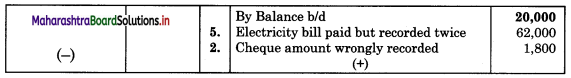

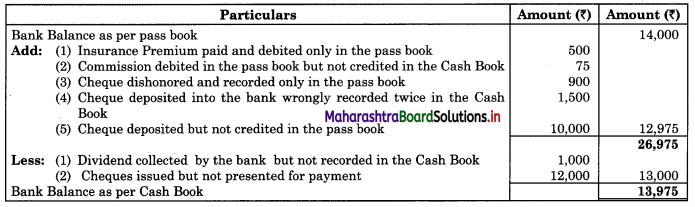

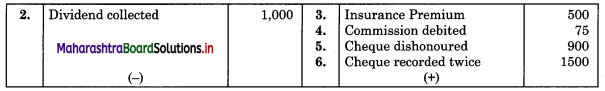

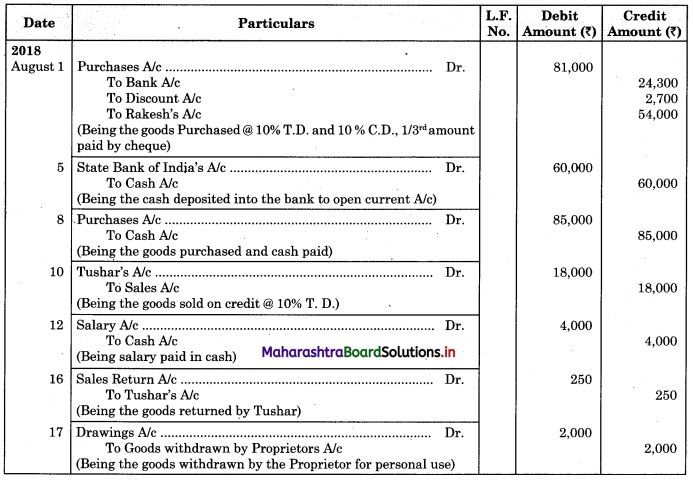

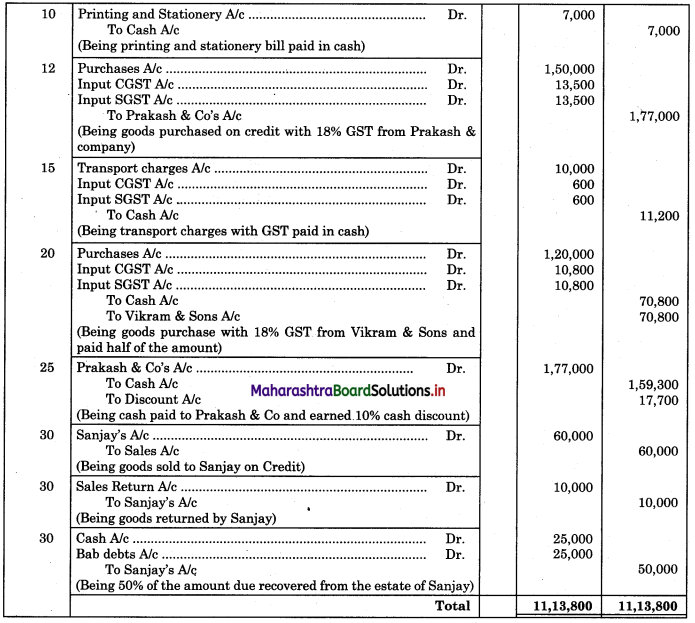

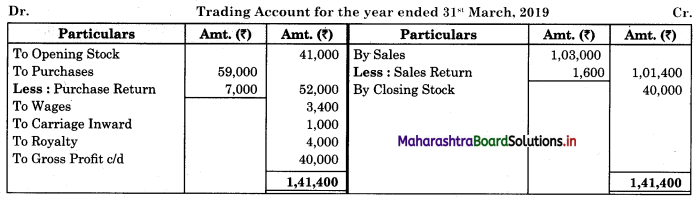

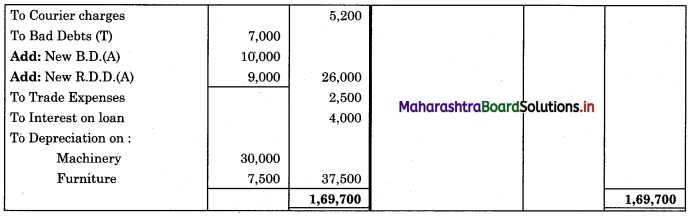

Question 2.

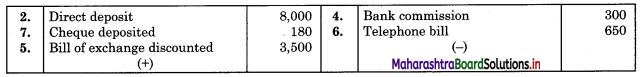

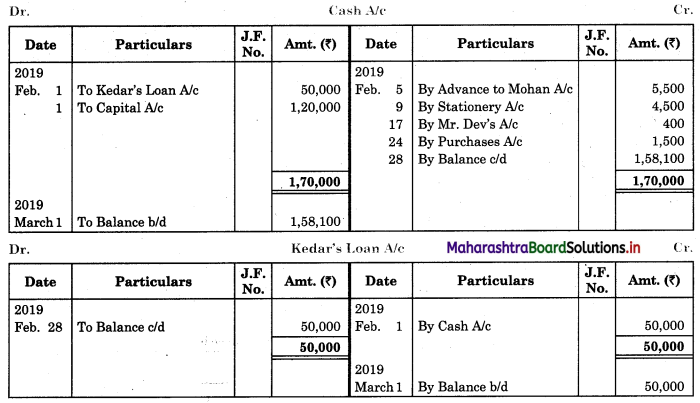

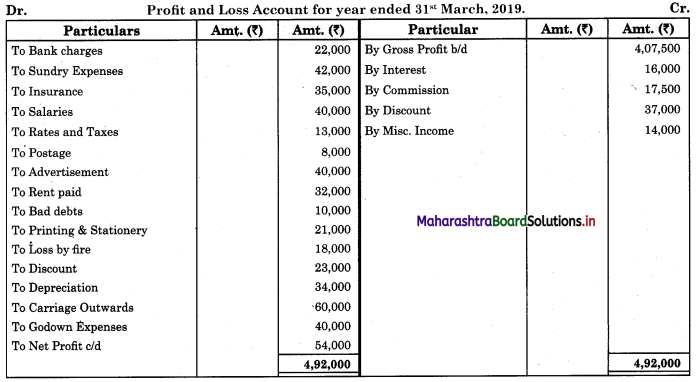

Prepare Profit and Loss Account of Sanjay Brothers for the year ended 31st March 2018 from the following balances.

1. Bank charges ₹ 22,000

2. Interest (Cr.) ₹ 16,000

3. Sundry expenses ₹ 42,000

4. Insurance ₹ 35,000

5. Salaries ₹ 40,000

6. Rates and Taxes ₹ 13,000

7. Postage ₹ 8,000

8. Advertisement ₹ 40,000

9. Rent paid ₹ 32,000

10. Bad debts ₹ 10,000

11. Commission (Cr) ₹ 17,500

12. Printing & Stationery ₹ 21,000

13. Loss by fire ₹ 18,000

14. Discount (Dr) ₹ 23,000

15. Discount (Cr) ₹ 37,000

16. Misc. Income ₹ 14,000

17. Depreciation ₹ 34,000

18. Carriage Outwards ₹ 60,000

19. Godown Expenses ₹ 40,000

Note: Gross Profit ₹ 4,07,500

Solution:

In the books of the Sanjay Brothers.

![]()

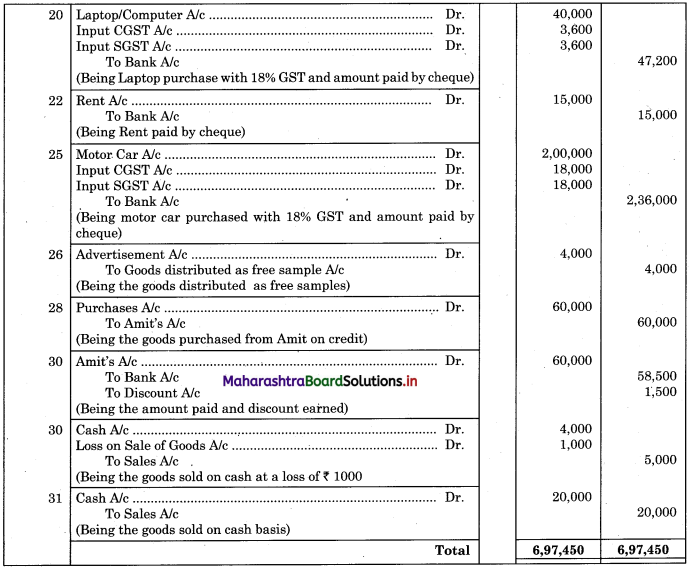

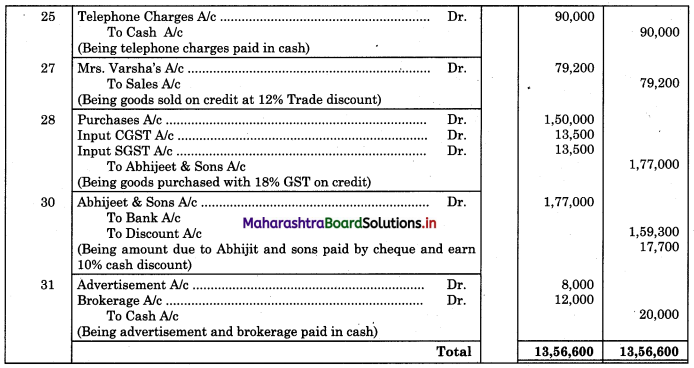

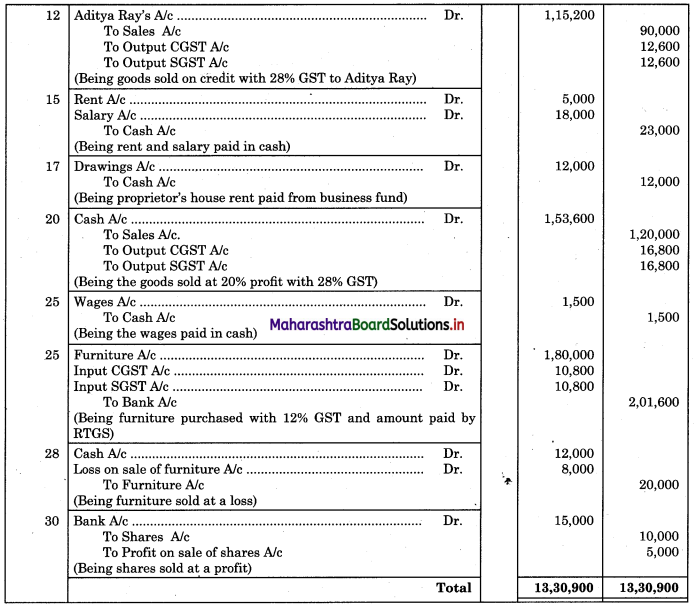

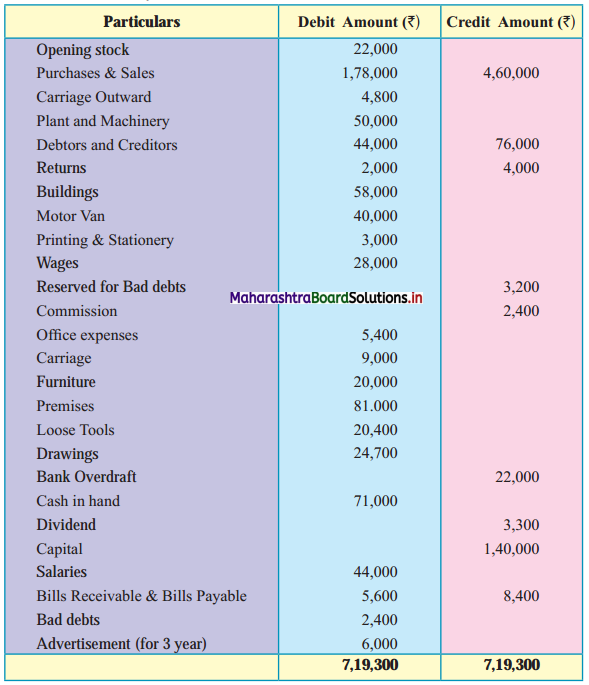

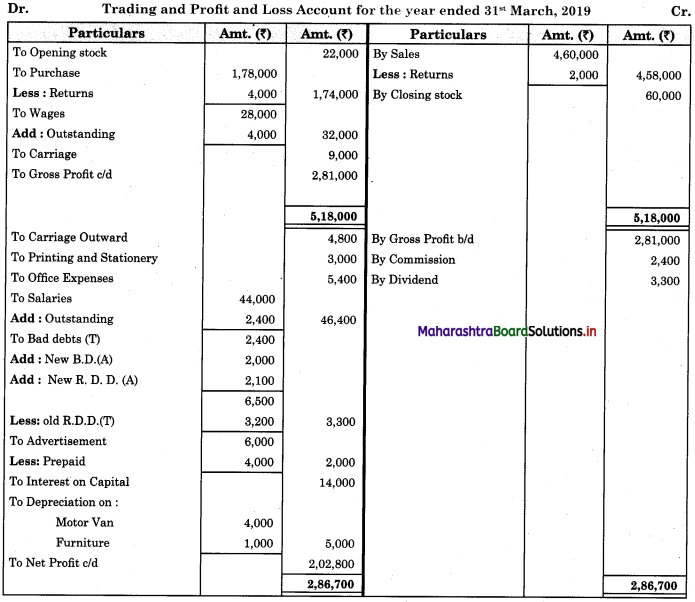

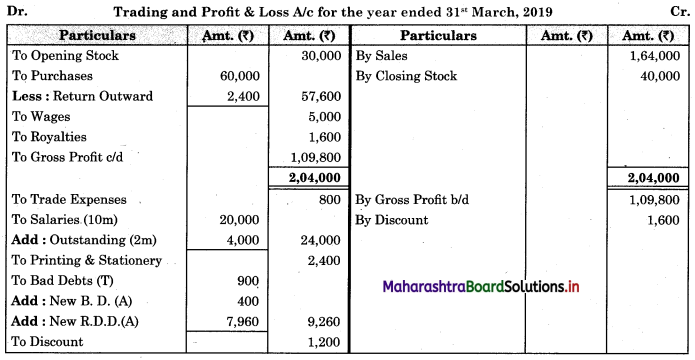

Question 3.

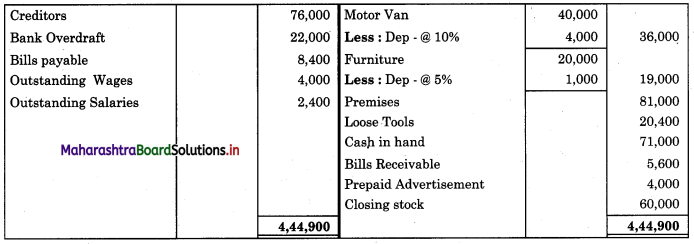

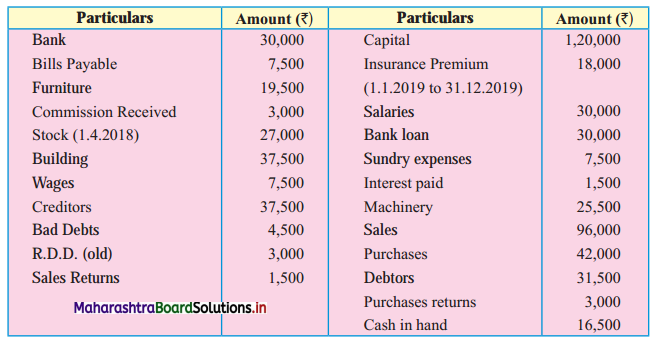

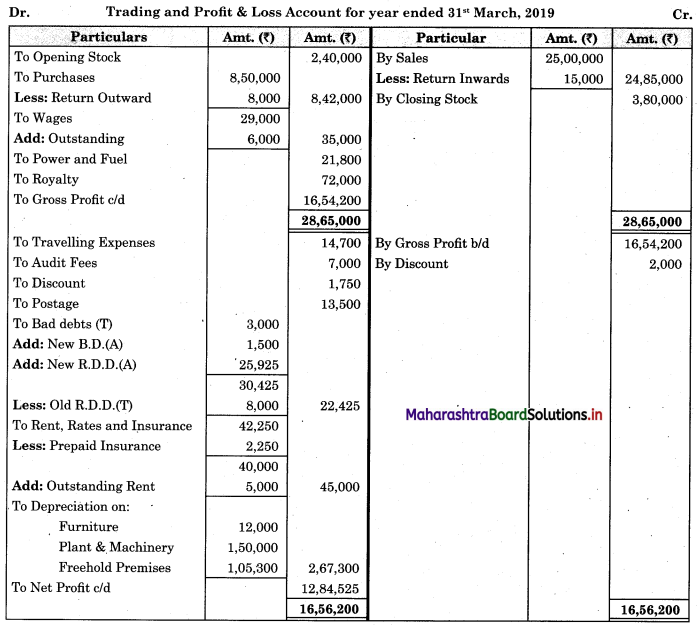

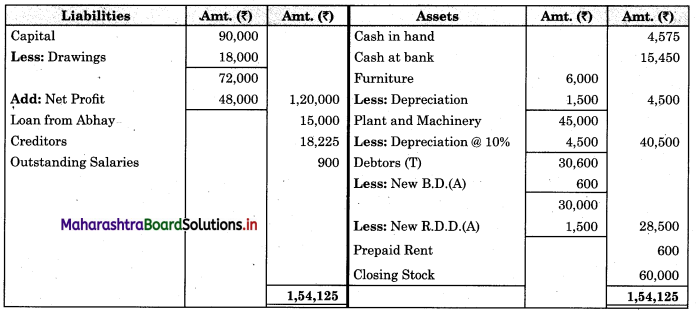

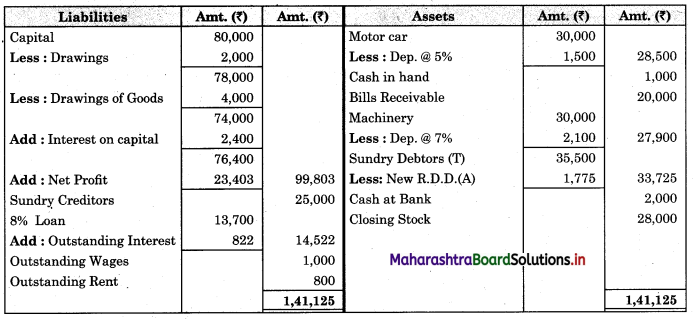

From the following Trial Balance of Sanjiv & Sons. Prepare Trading Account and Profit & Loss Account for the year ending on 31st March 2019 and a Balance Sheet as on that date.

Additional information:

1. Closing stock on 31st March 2019, was at cost ₹ 60,000 and Market Price ₹ 70,000.

2. Outstanding expenses: Wages ₹ 4,000, Salary ₹ 2,400

3. Provide depreciation at 10% on Motor Van and 5% on Furniture.

4. Write off ₹ 2,000 for bad debts and create R.D.D. at 5% on debtors.

5. Provide 10% p.a. interest on capital.

Solution:

In the books of Sanjiv & Sons

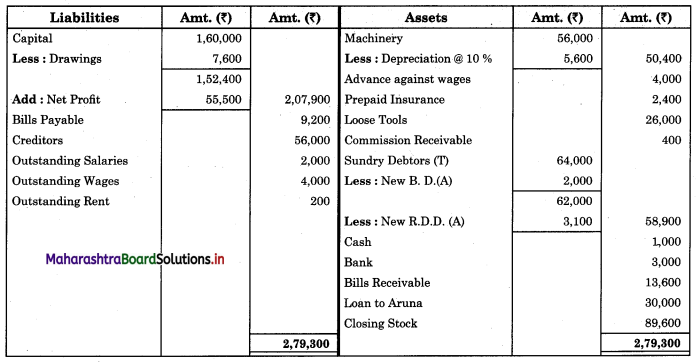

Balance Sheet as of 31st March, 2019

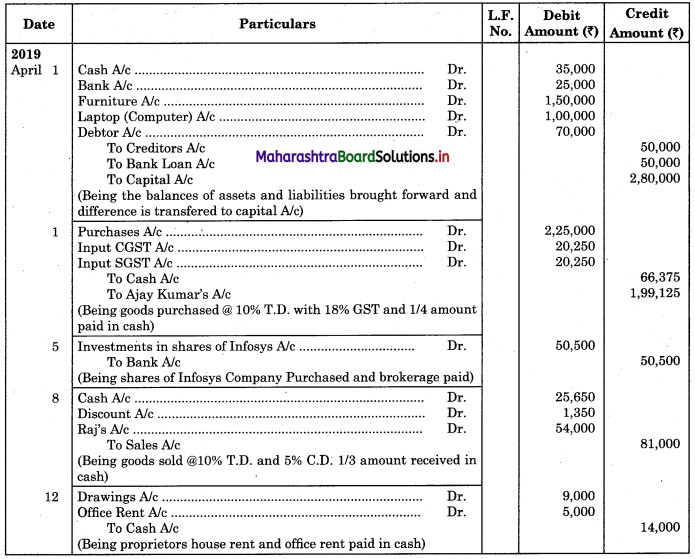

Question 4.

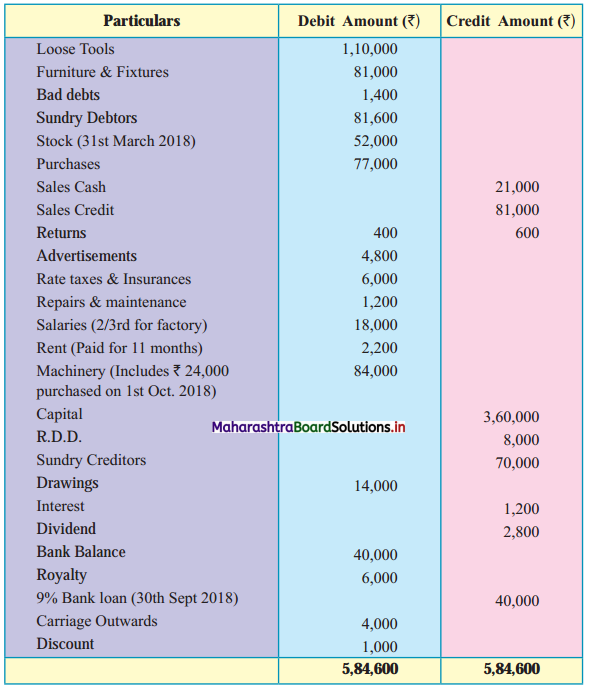

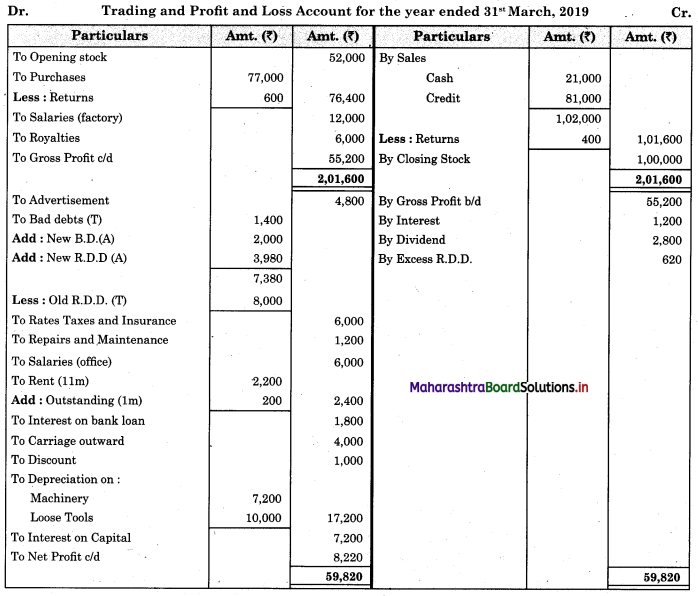

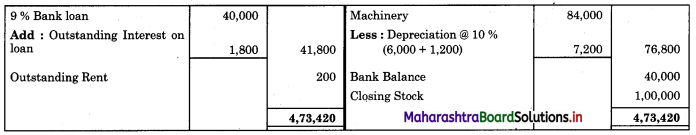

From the following Trial Balance of Nandini & Co. as of 31st March 2019. Prepare Final Accounts after considering the adjustments given below.

Adjustments:

1. Closing stock valued at ₹ 1,00,000.

2. Write off ₹ 2,000 as bad debts and create a provision for doubtful debts @ 5% on Sundry Debtor.

3. Depreciate Machinery by 10% p.a. and Loose Tools is valued at ₹ 1,00,000.

4. Charge Interest on Capital @ 2% p.a.

Solution:

In the books of Nandini & Co.

Balance Sheet as of 31st March 2019

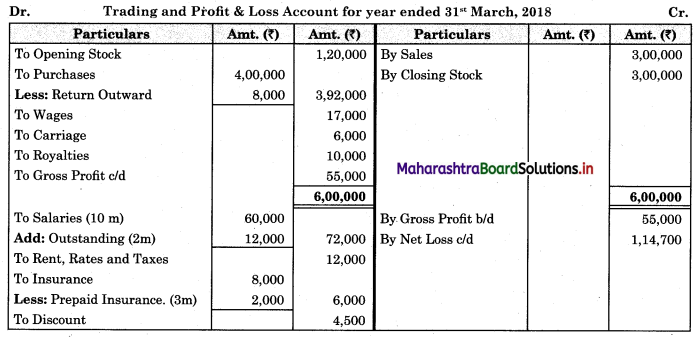

Question 5.

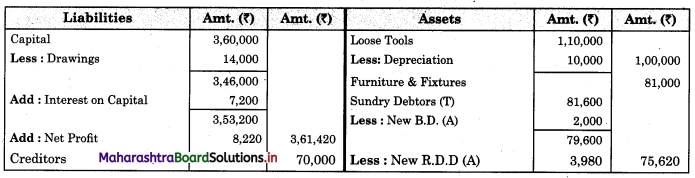

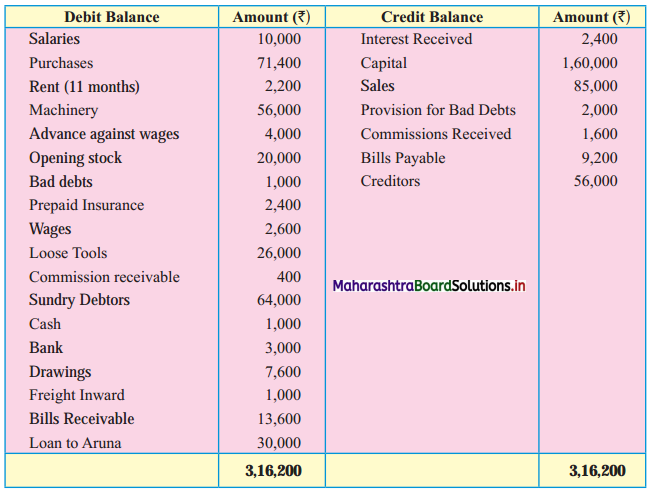

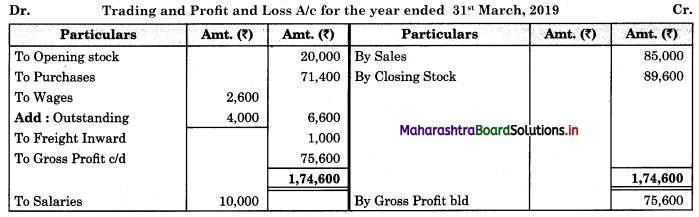

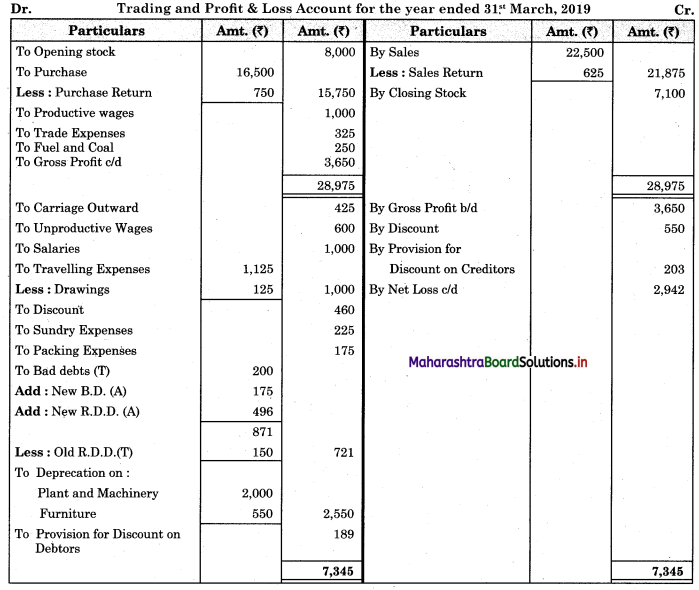

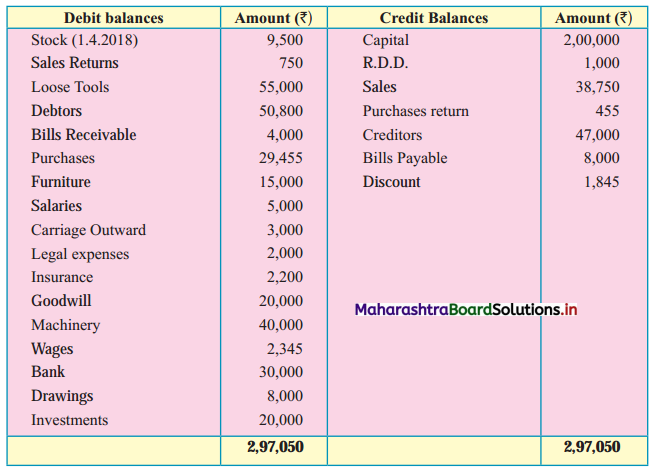

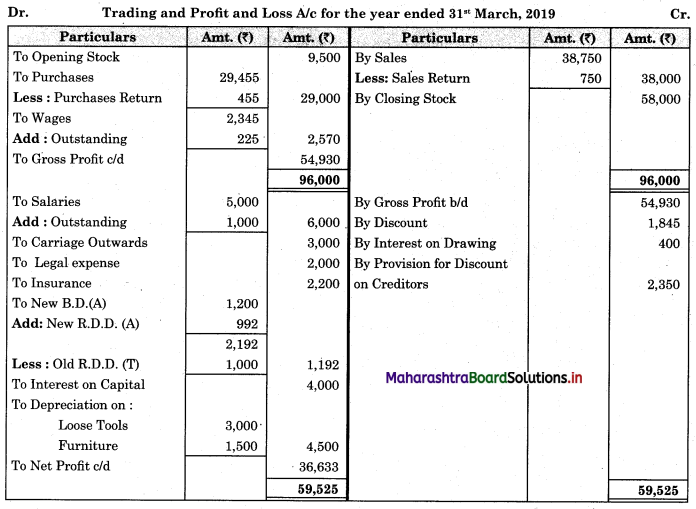

Prepare Final accounts of Abdul Traders for the year ending 31st March 2019 with the help of the following Trial Balance and Adjustments.

Trial Balance as of 31st March 2019.

Adjustments:

1. Closing stock valued at ₹ 89,600

2. Outstanding expenses Salaries ₹ 2,000, Wages ₹ 4,000

3. Charge depreciation on Machinery @ 10%

4. Bad debts are written off ₹ 2,000 and create a provision for bad and doubtful debts 5% on Sundry Debtors.

Solution:

In the books of Abdul Traders.

Balance Sheet as of 31st March 2019

![]()

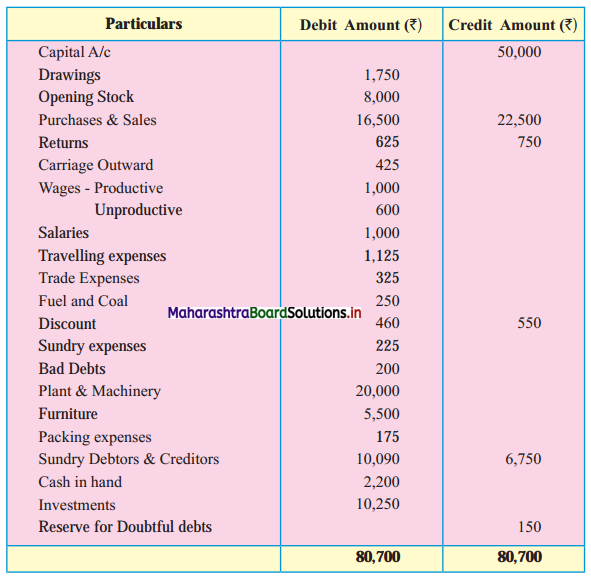

Question 6.

Following is the Trial Balance of Geeta Enterprises. You are required to prepare a Trading and Profit & Loss Account for the year ended 31st March 2019 and the Balance Sheet as of that date after taking into account the additional information provided to you.

Trial Balance as of 31st March, 2019

Additional information:

1. Closing stock of goods on 31st March 2019 valued at ₹ 7,100 at cost price and ₹ 7,500/- as market price.

2. Travelling expenses include ₹ 125 spent on personal traveling.

3. ₹ 175 is to be written off as bad debts which were due from Mr. Ashok, a debtor, and 5% R.D.D. is to be maintained on debtors.

4. Reserve for discount on debtors as well as on creditors is to be maintained at 2% and 3% respectively.

5. Provide 10% depreciation on Plant & Machinery and Furniture.

Solution:

In the books of Geeta Enterprises.

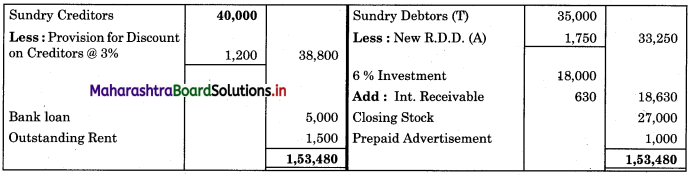

Balance Sheet as of 31st March 2019

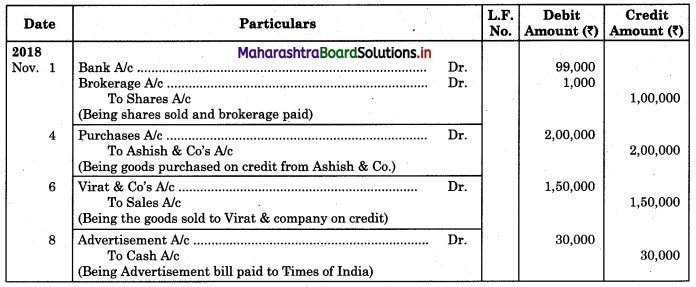

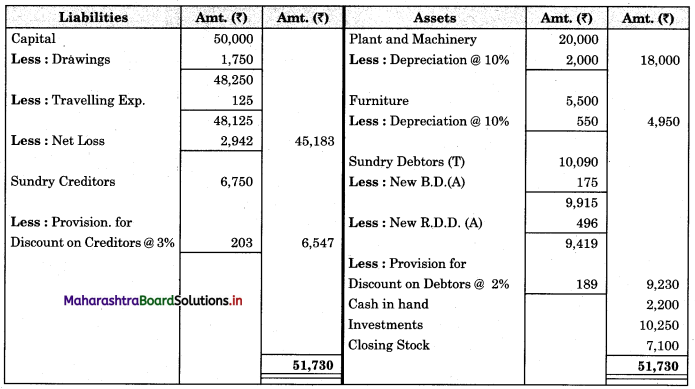

Question 7.

Following are the closing ledger balances of Deepak & Co. Prepare Trading Account and Profit & Loss Account for the year ended 31st March 2019 and Balance sheet as of that date.

Ledger Balances of Mr. Deepak and Co. as of 31st March, 2019

Adjustments:

1. Closing stock was valued at ₹ 60,000

2. An amount of ₹ 3,000 is still to be received on account of commission.

3. Provision for discount on debtors and Provision for discount on Creditors are to be created 2% and 3% respectively.

4. Amount of Furniture is to reduce by ₹ 4,500 and Building by 10%.

5. Outstanding expenses Salaries ₹ 4,500 and Wages ₹ 1,500.

Solution:

In the books of Deepak & Co.

Balance Sheet as of 31st March 2019

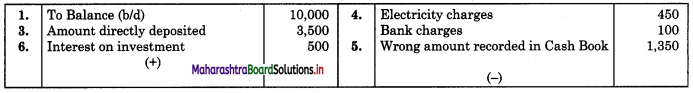

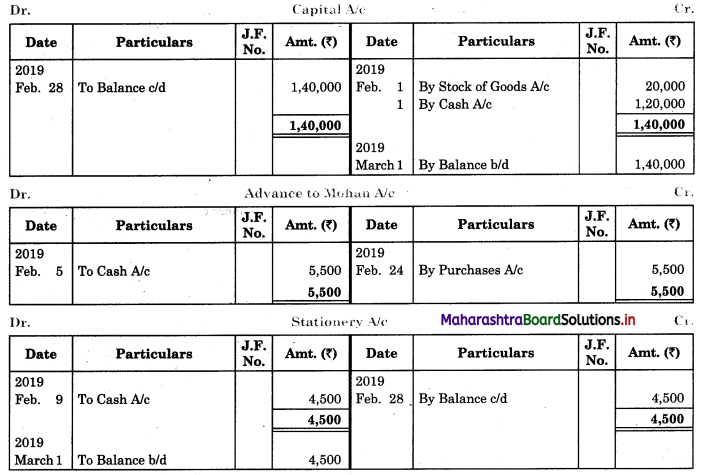

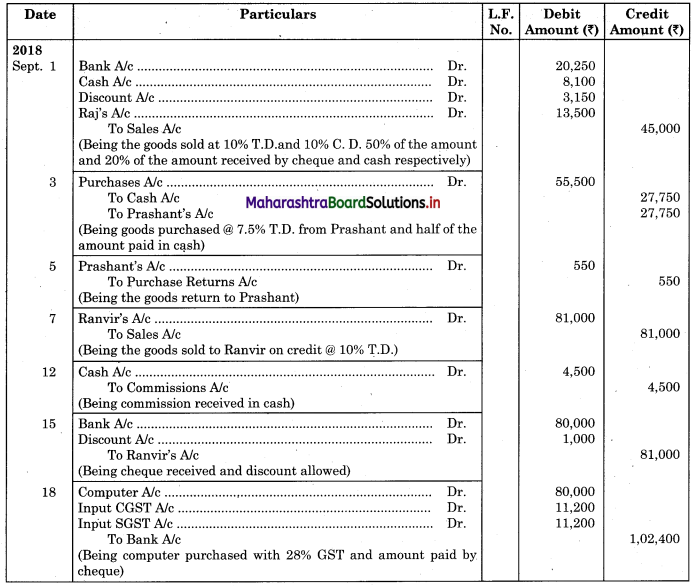

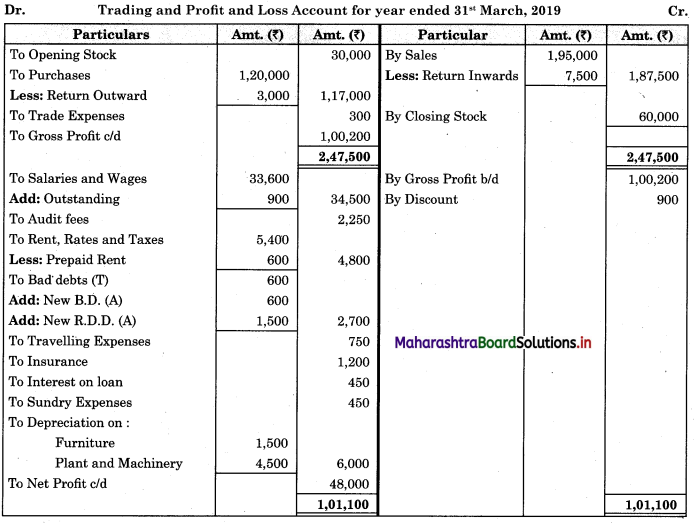

Question 8.

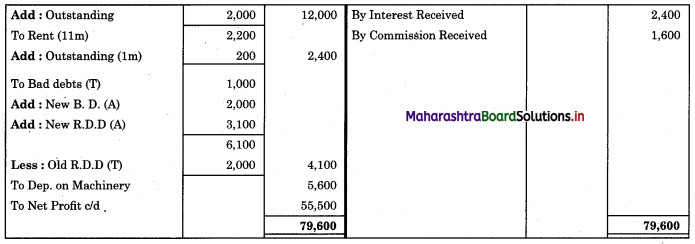

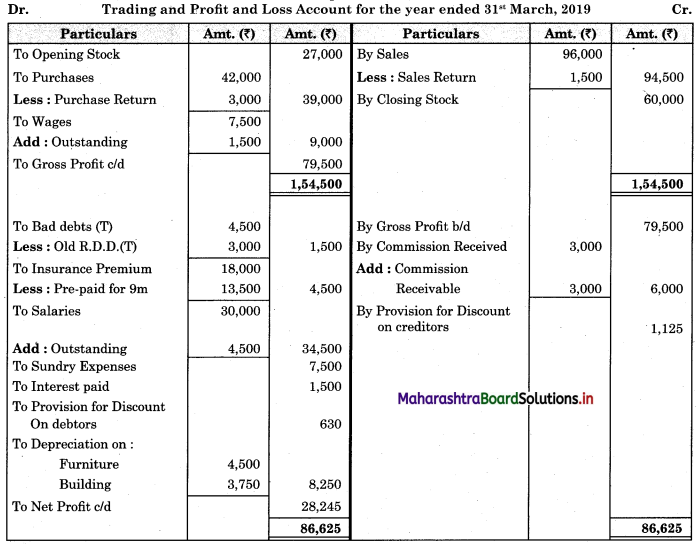

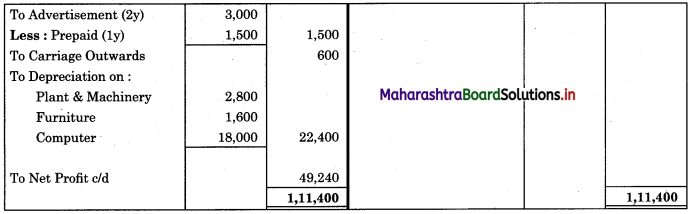

Following is the Trial Balance extracted from the books of Raju Traders. You are required to prepare Trading A/c, Profit & Loss A/c for the year ending on 31st March 2019 and Balance Sheet as of that date after Considering the additional information given below.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing stock is valued at ₹ 40,000 at Cost Price and ₹ 44,000 as Market Price.

2. Provide Depreciation on Plant & Machinery, Furniture, Computers @ 5%, 10%, 15% respectively.

3. Salaries are paid for 10 months only.

4. Further Bad debts amounted to ₹ 400 and provide 10% R.D.D. on Sundry Debtors.

5. Advertisement is paid for 2 years.

Solution:

In the books of Raju Traders.

Balance Sheet as of 31st March 2019

![]()

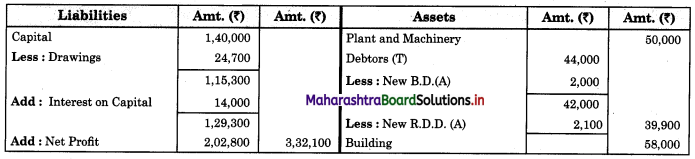

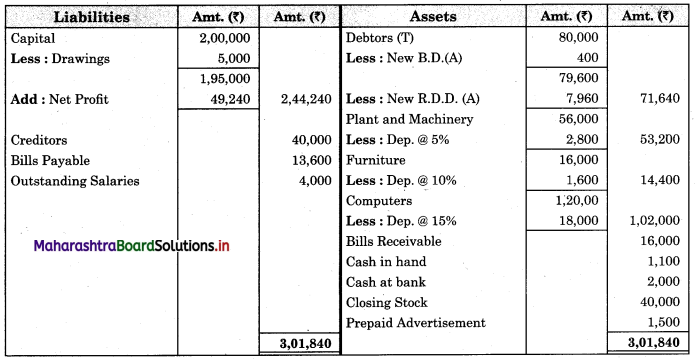

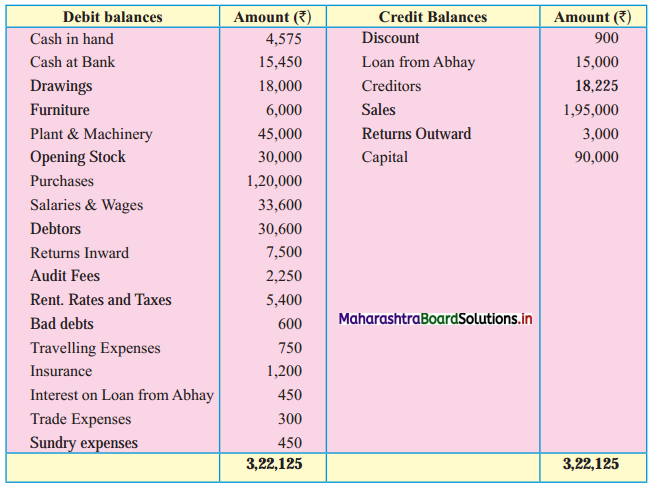

Question 9.

From the following Trial Balance of Shradha Enterprises, you are required to prepare Final Accounts for the year ending on 31st March 2019.

Trial Balance as of 31st March 2019

Adjustments:

1. Insurance is prepaid to the extent of ₹ 2,250

2. Closing stock is valued at ₹ 3,80,000 Cost price and ₹ 4,00,000 as Market price.

3. Outstanding Expenses are Wages ₹ 6,000 and Rent ₹ 5,000

4. Write off further had debts ₹ 1,500 and provide 5% Reserve for doubtful debts.

5. Depreciation on Furniture and Plant & Machinery at 10% p.a. and on Freehold Premises at 15% p.a.

Solution:

In the books of Shradha Enterprises

Balance Sheet as of 31st March 2019

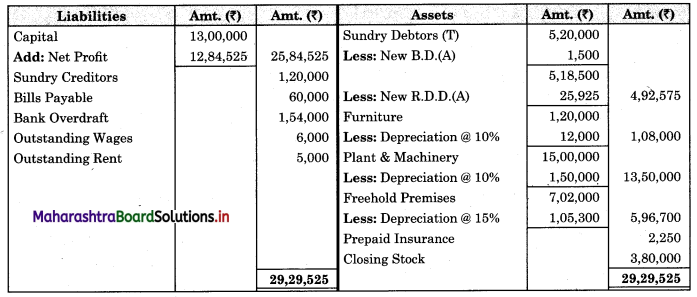

Question 10.

From the following Trial Balance of Ayub & Co. as of 31st March 2019, you are required to prepare Trading Account, Profit and Loss Account for the year ending 31st March 2019, and Balance Sheet as of that date after making necessary adjustments.

Trial Balance as of 31st March 2019

Adjustments:

1. Stock on hand on 31st March 2019 valued at ₹ 60,000

2. Rent amounting to ₹ 600 Prepaid.

3. Bad Debts ₹ 600 and create a Provision for Doubtful Debts 5%

4. Depreciation on Plant & Machinery by 10% and Furniture is valued at ₹ 4,500

5. Outstanding Salaries ₹ 900

Solution:

In the books of Ayub and Co.

Balance Sheet as of 31st March 2019

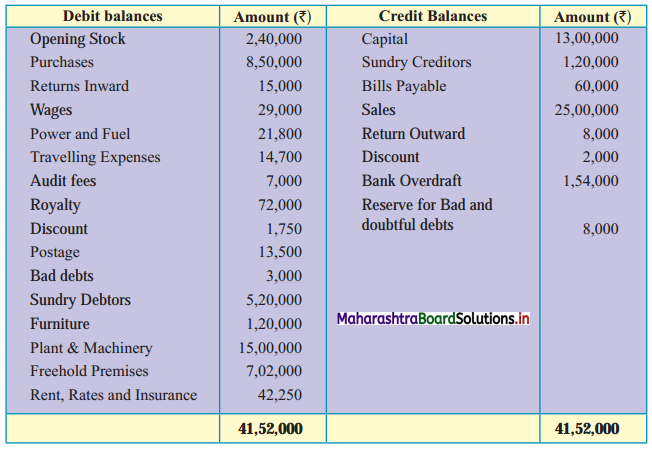

Question 11.

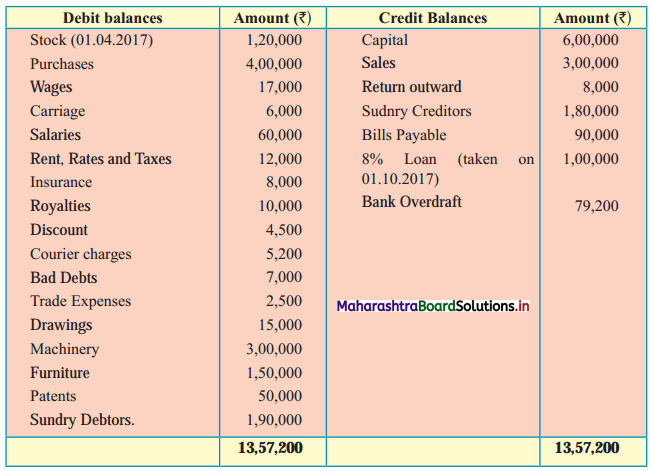

From the following Trial Balance of Rajnish & Sons and the additional information given below prepare Trading & Profit and Loss Account for the year ending on 31st March 2018 and Balance Sheet as on that date.

Trial Balance as of 31st March 2018

Adjustments:

1. Closing Stock valued at ₹ 3,00,000 cost price and ₹ 3,20,000 at Market price.

2. Salaries were paid for 10 months only.

3. Insurance is paid for one year ending on 30.06.2018

4. One of the debtors Mr. Amit became insolvent, from whom ₹ 10,000 was not received.

5. 5% R.D.D. is to be maintained on Debtors.

6. Depreciate Machinery & Furniture @ 10% and 5% respectively.

Solution:

In the books of Rajnish & Sons

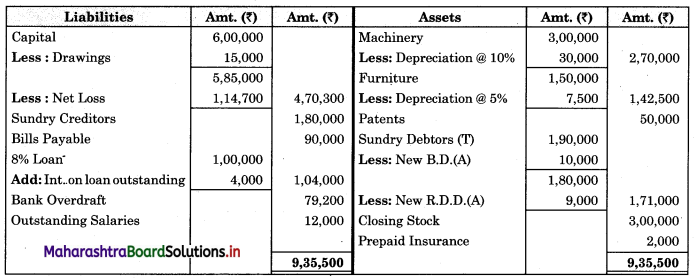

Balance Sheet as of 31st March 2018

![]()

Question 12.

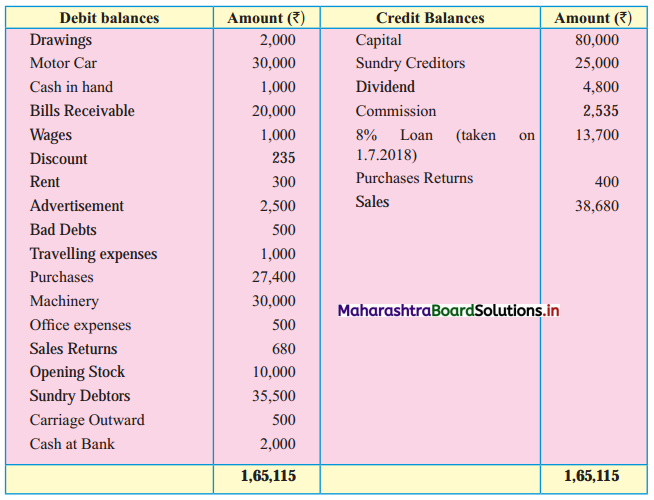

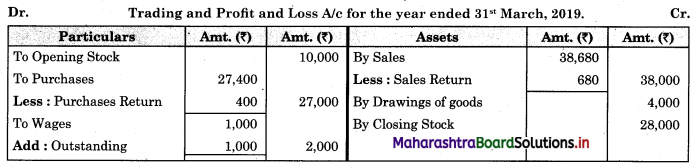

From the following Trial Balance of John & Sons, you are required to prepare Trading Account, Profit and Loss Account for the year ending 31st March 2019 and Balance Sheet as of that date.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing Stock ₹ 27,000

2. Charge Depreciation on Machinery and Motor car @ 10% and 5% respectively.

3. Create R.D.D. 5% on Sundry Debtors

4. Interest on Drawings @ 5% p.a.

5. Create Discount on Sundry Creditors 3%

6. Advertisement ₹ 1,000 is prepaid.

7. Outstanding Rent ₹ 1,500

Solution:

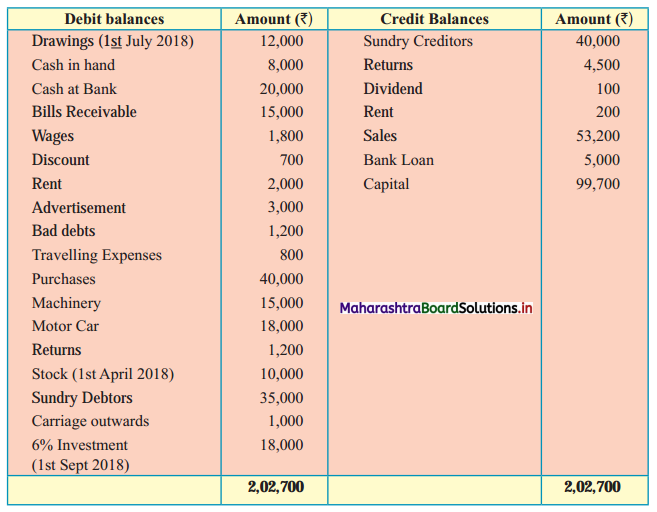

In the books of John and Sons

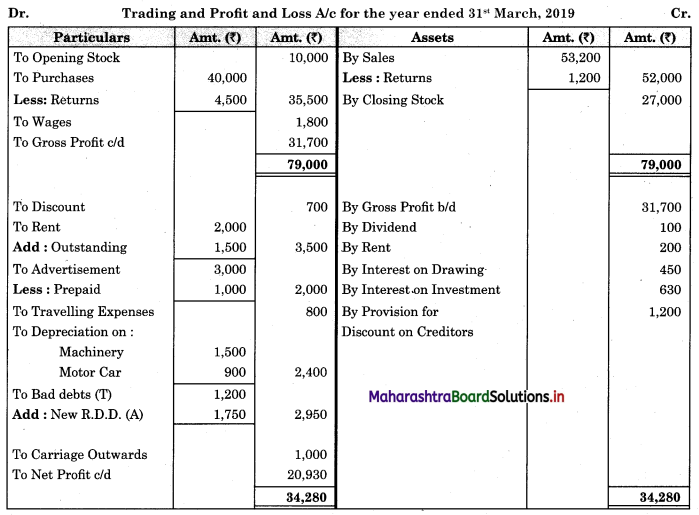

Balance Sheet as of 31st March 2019

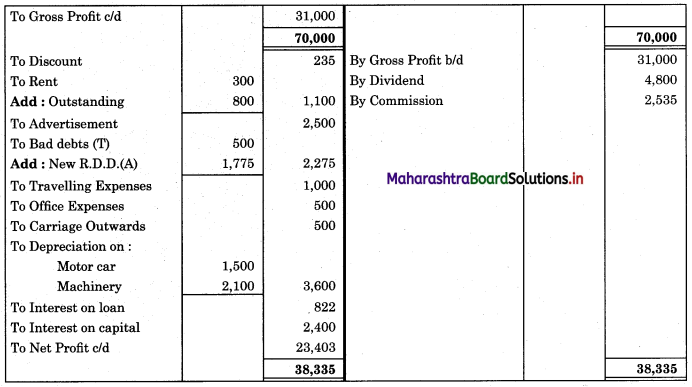

Question 13.

From the following Trial Balance of Pushkraj, you are required to prepare Trading Account and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as of that date.

Trial Balance as of 31st March 2019

Adjustments:

1. Stock on 31st March 2019 was valued at ₹ 28,000

2. Create a Provision for doubtful debts on Sundry Debtors @ 5%

3. Depreciate Motor car by 5% p.a. and Machinery by 7% p.a.

4. Outstanding expenses Rent ₹ 800 & Wages ₹ 1,000

5. Charge interest on Capital @ 3% p.a.

6. Goods of ₹ 4,000 withdrawn by the proprietor for personal use.

Solution:

In the books of Pushkraj

Balance Sheet as of 31st March 2019

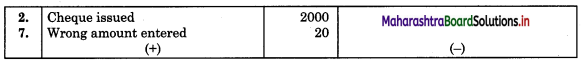

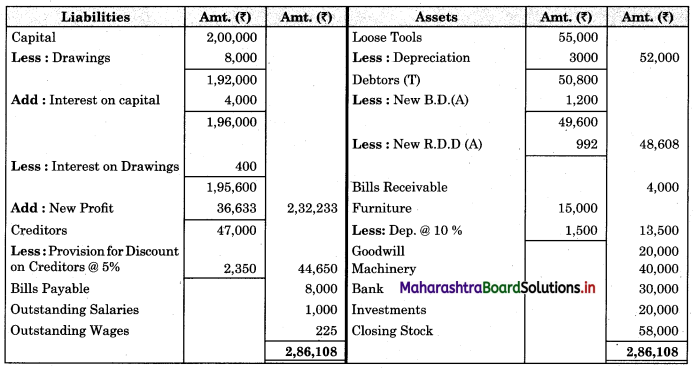

Question 14.

From the following Trial Balance of Jyoti, Trading Co. Prepare the Trading Account and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as of that date.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing stock valued at ₹ 58,000 Cost Price while the Market price is ₹ 60,000

2. Write off ₹ 1,200 as Bad debts and create provision for doubtful debts 2% on Sundry Debtors and also create provision for discount on Creditors 5%.

3. Loose Tools is valued at ₹ 52,000 and depreciate Furniture by 10% p.a.

4. Outstanding expenses Salary ₹ 1,000 and Wages ₹ 225

5. Charge interest on Capital 2% and on Drawings 10%.

Solution:

In the books of Jyoti Trading Co.

Balance Sheet as of 31st March 2019

![]()

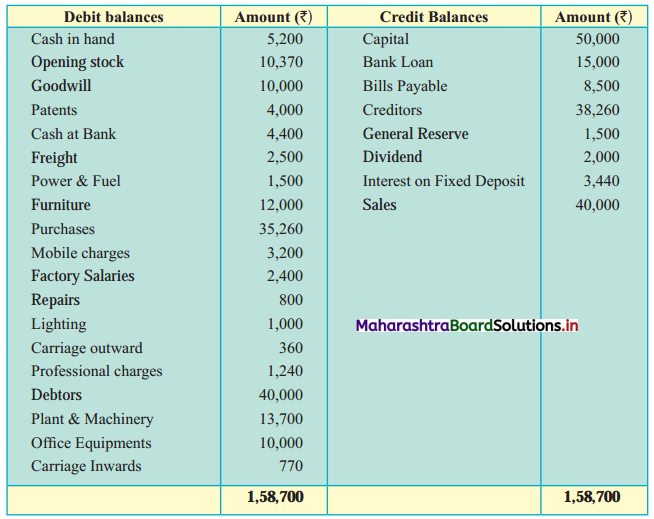

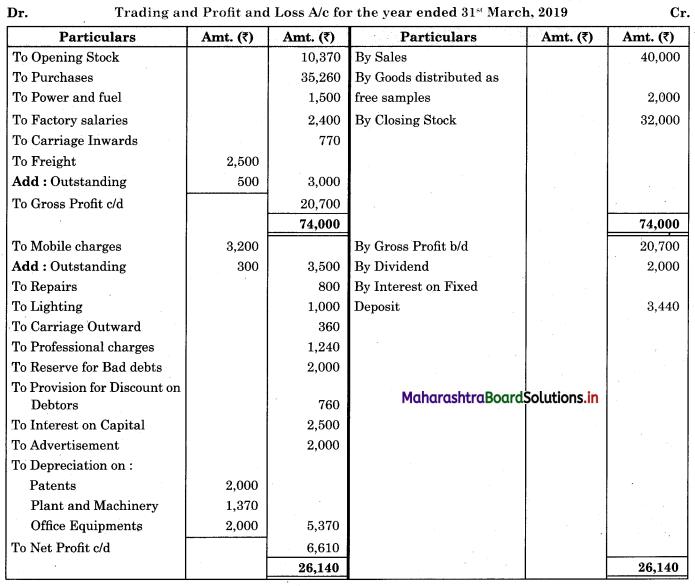

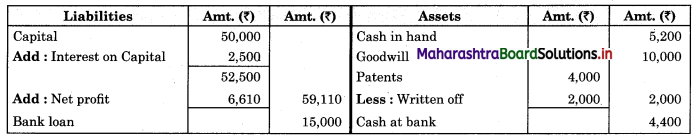

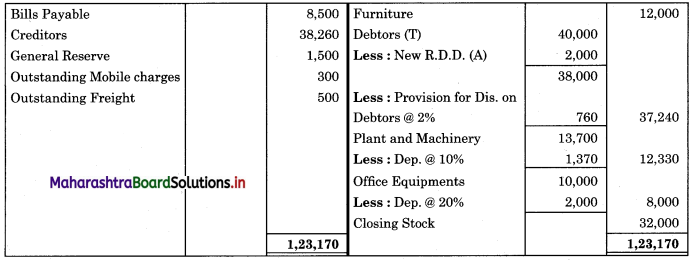

Question 15.

From the following Trial Balance of Manish Enterprise, Prepare the Trading Account and Profit and Loss Account for the year ended 31st March 2019 and Balance sheet as of that date.

Trial Balance as of 31st March 2019

Adjustments:

1. Closing Stock was ₹ 32,000.

2. Write off 50% of patents, depreciate Plant & Machinery by 10% p.a and Office Equipment by 20%.

3. Reserve for bad debts is to be created 5% and discount on Debtors 2%.

4. Outstanding expenses Mobile charges ₹ 300 and Freight ₹ 500

5. Charge Interest on Capital @ 5%.

6. Goods of ₹ 2,000 distributed on free samples.

Solution:

In the books of Manish Enterprise

Balance Sheet as of 31st March 2019

Class 11 Commerce Book Keeping & Accountancy Textbook Solutions

- Introduction to Book Keeping and Accountancy Class 11 Commerce BK

- Meaning and Fundamentals of Double Entry Book-Keeping Class 11 Commerce BK

- Journal Class 11 Commerce BK

- Ledger Class 11 Commerce BK

- Subsidiary Books Class 11 Commerce BK

- Bank Reconciliation Statement Class 11 Commerce BK

- Depreciation Class 11 Commerce BK

- Rectification of Errors Class 11 Commerce BK

- Final Accounts of a Proprietary Concern Class 11 Commerce BK

- Single Entry System Class 11 Commerce BK