By going through these Maharashtra State Board Class 12 Geography Notes Chapter 7 Region and Regional Development students can recall all the concepts quickly.

Maharashtra State Board Class 12 Geography Notes Chapter 7 Region and Regional Development

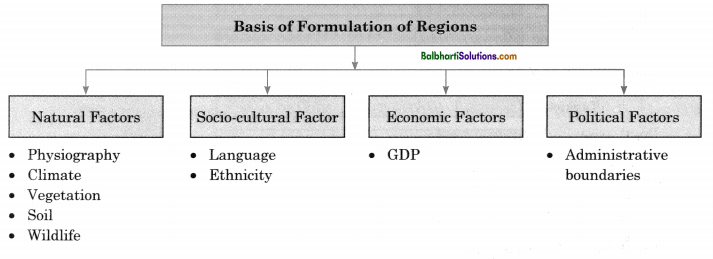

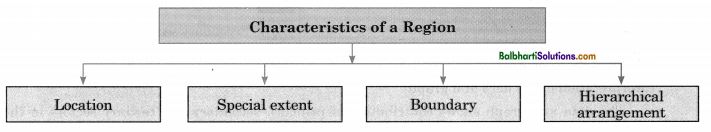

→ Natural (physical) or man-made (administrative boundaries, political or linguistic) feature of a small or large area of land having common features help us to identify them separately.

→ Demarcated boundary separates one region from the other. The geographical area that distinguishes itself from another area is called a region.

→ The classification of regions is based on common characteristics and is homogeneous in nature, which constitutes of a region.

→ A region is a basic unit in any geographical studies and helps us to differentiate one area from another.

![]()

Types of regions

→ Formal regions and functional regions are the two types of regions.

→ A formal region is an area inhabited by people who have one or more characteristics in common.

→ On the basis of characteristics, a formal region is divided into a physical region or political region.

→ A functional region is an area organized to function socially and economically as a single unit.

→ Functional region involves more than one type of physical or political regions.

Factors affecting regional development

→ Development is a relative term. Therefore, while considering regional development the physical, economic, social, environmental aspects of a region are taken into consideration.

Physical factors and regional development

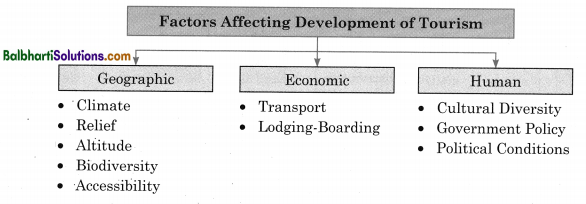

→ Regional development is affected by physical factors like climate and relief of the region.

→ Areas where land is less fertile, water is scarce and diseases flourish will be less developed.

→ A region with a large number of resources, but climate is not suitable, or lack of population to exploit resources, the region will not develop.

![]()

Population and regional development

- Population and regional development are closely interrelated. The parameters of development are measured keeping in mind the population of a region.

- The important factors of development are the quantity and quality of population as well as the efficiency of resources used by the population in a region.

Land use and regional development

→ There is a difference in the percentage of land use in developed and underdeveloped regions.

→ Demand for land use changes according to the society’s needs as well as the changes in the socio-economic conditions.

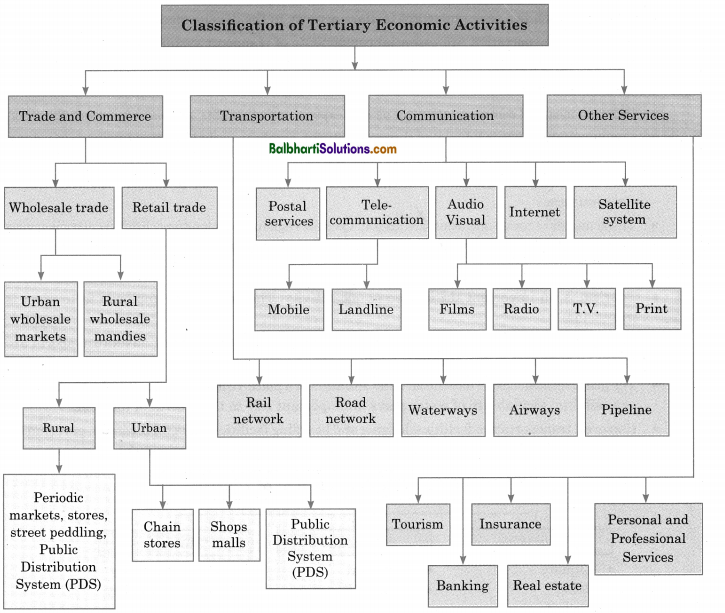

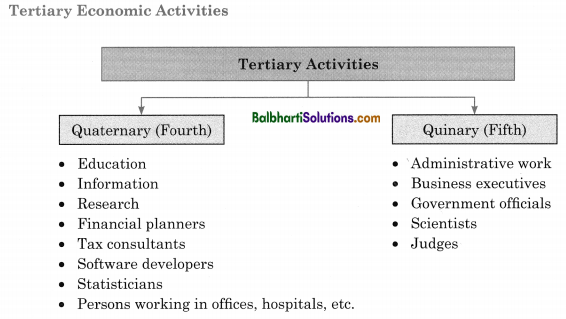

Primary, secondary and tertiary economic activities and regional development

→ Primary, secondary and tertiary economic activities carried out in any region, give an idea about the regional development in that region.

→ Regions are developed if they contribute more in the tertiary sector and depend less on primary activities.

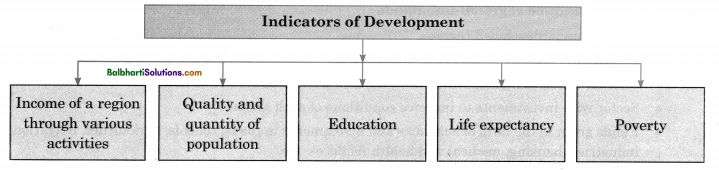

→ The Human Development Index (HDI) is used to access various aspects of development in a region.

![]()

Regional imbalance:

→ The balanced regional development policy is considered on economic, social and political grounds.

→ The policy is adopted to reduce inequalities between different regions of a country and also increasing the standard of living to a higher level at a uniform rate.

Causes of regional imbalance in India:

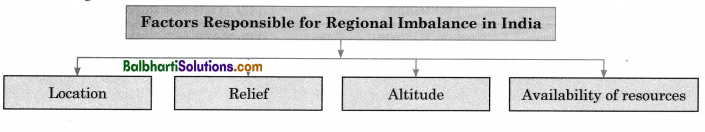

→ There is regional imbalance in India since the level of development is not similar in all sub-regions.

Policies to reduce regional imbalance

→ Identify underdeveloped regions.

→ Identify the reasons behind non-development.

→ Allocate funds to regions which need them in particular sectors or fields.

→ Sector-wise investments to improve conditions of such areas.

→ Funds are given in the form of subsidies and investments in roads, schools, agriculture, irrigation, industries, housing, medical and health facilities, etc.

→ Special care for regions that have been identified as deserts, drought-prone, hilly, and areas dominated by tribal population.

→ Decentralisation of industries to reduce the regional imbalance.