By going through these Maharashtra State Board Book Keeping & Accountancy Notes 12th Chapter 10 Computer in Accounting students can recall all the concepts quickly.

Maharashtra State Board 12th Accounts Notes Chapter 10 Computer in Accounting

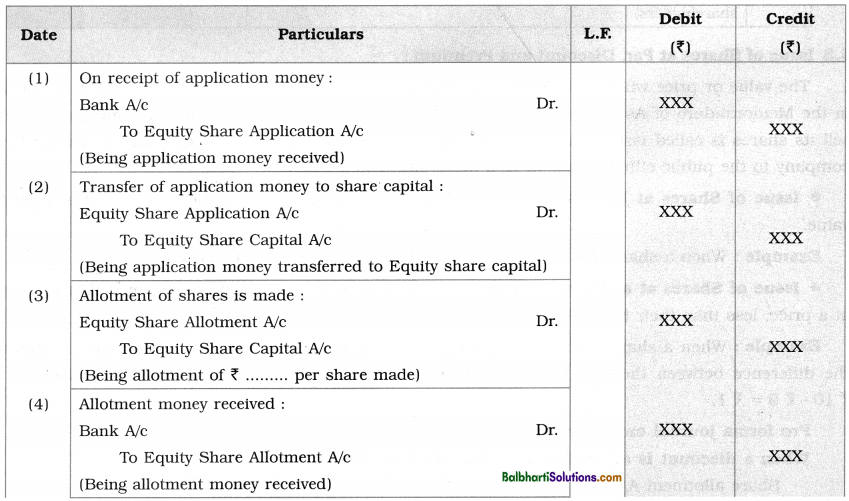

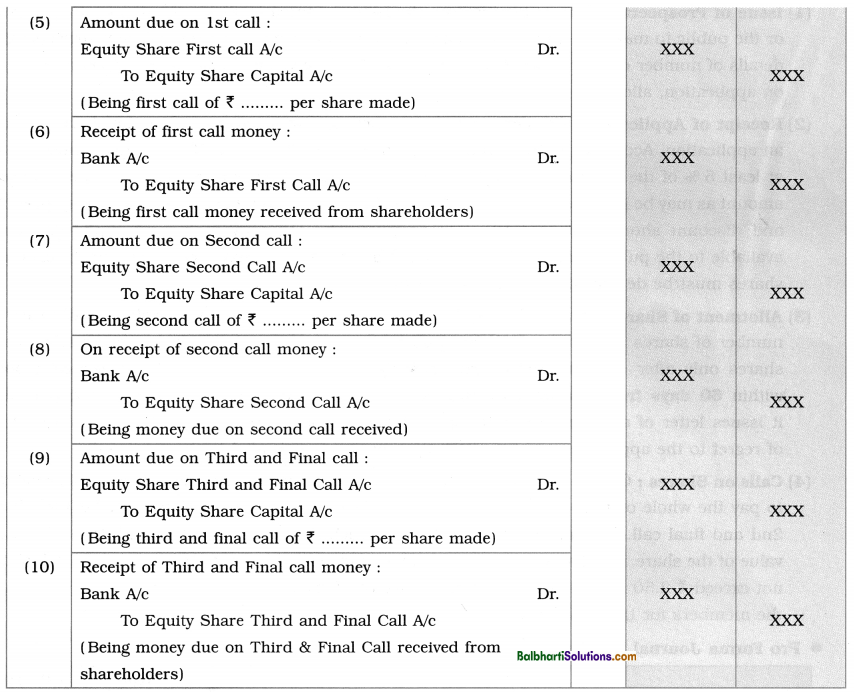

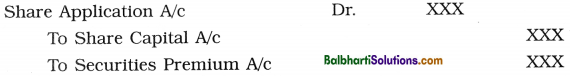

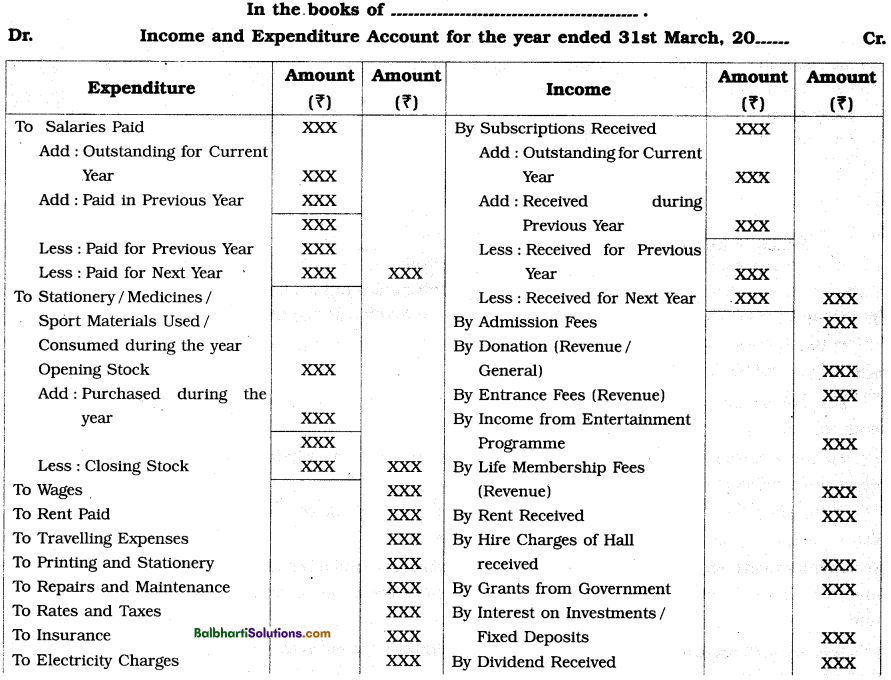

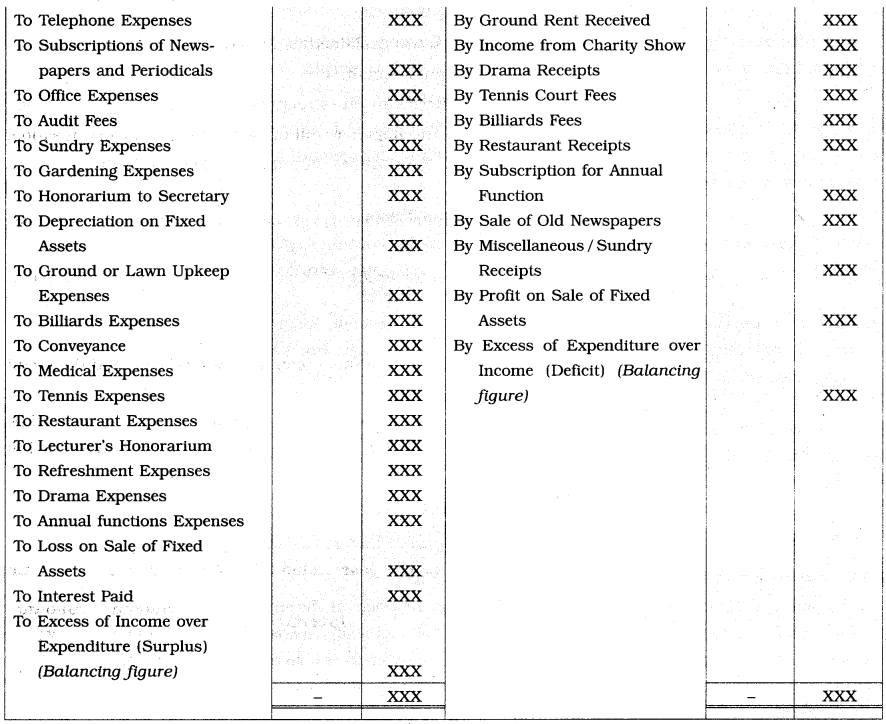

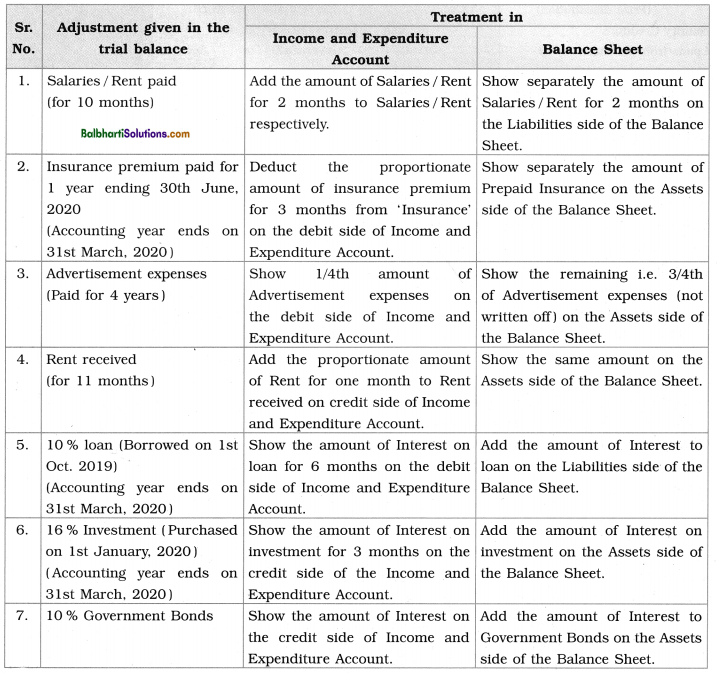

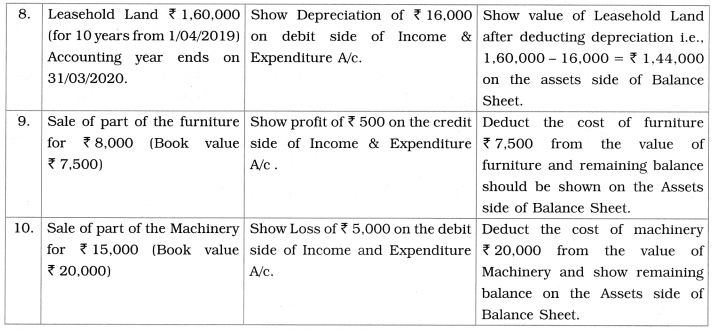

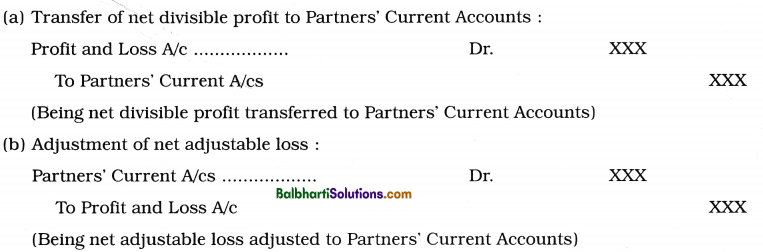

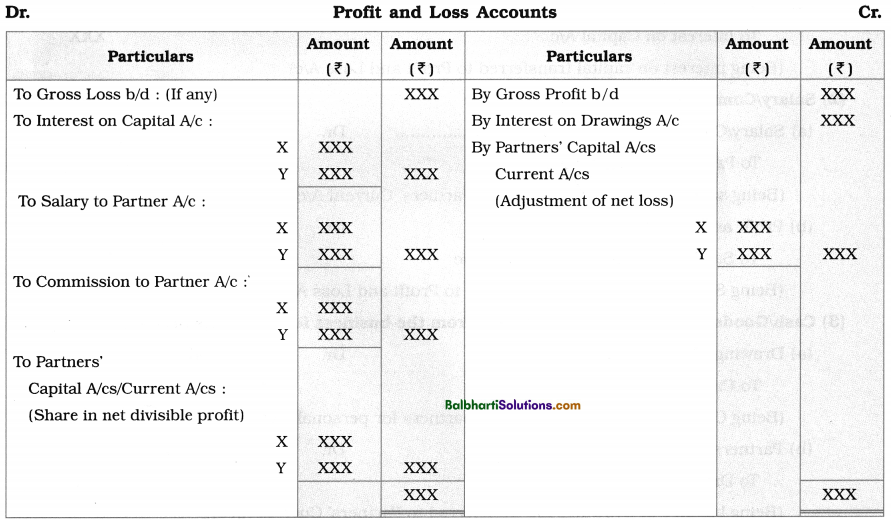

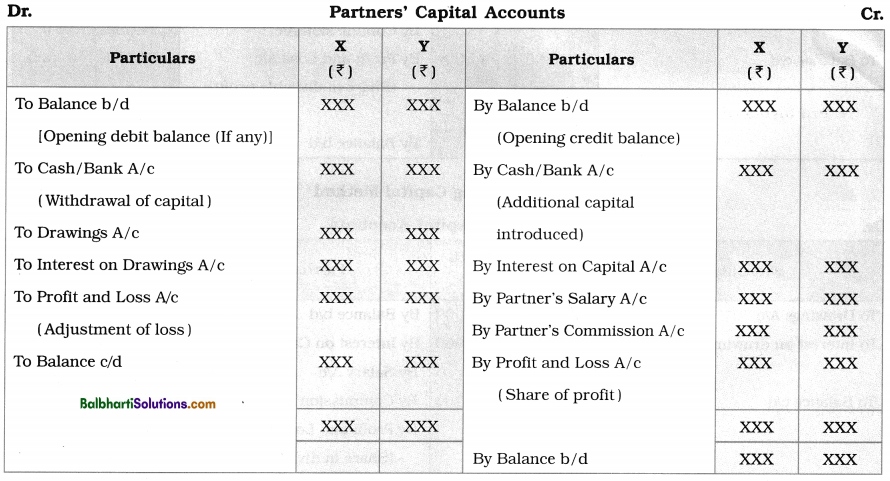

Introduction, Concept of Computerized Accounting System (CAS)-

In modern age, computer is becoming inseparable automation instrument for business as well as individual. Nowadays knowledge and operation of computer are considered as an essential thing. If a person does not know the use of computer, its usefulness is questionable. Today most of the entities – including small traders – prepare their accounts using computers. Because of computers, business entities can store, use and analyse the raw data as and when required. In modern days, it is difficult to find out a field in which computer is not used, which shows its importance.

Applications of computers for accounting has grown phenomenally, when accounts are maintained using computers raw data based on vouchers and other documents are entered into computer. Computer process such raw data. This process includes recording, storing, analysing and retrieving information. Computers can store information, analyse them and such information can be retrieved when required. However, they respond according to set of instructions given to it and such instructions are known as Programme or Software. Based on such software only, computer processes raw data and generates meaningful information or reports as and when required.

![]()

Computerized accounting system are connected through computer, network server or remote accessed device with internet. Every company or firm prepares their reports as per Generally Accepted Accounting Principles (GAPP).

Features of Computerized Accounting System-

(1) Integrated date & Information : Computerized Accounting System is developed and designed for all business activities like purchase, sales, finance, inventory, payroll and manufacturing which is user friendly, automated and integrated for such process. Dueto computerized accounting system, businessman keep their accounting records accurate, up-to-date and get information within no time. When Computerized Accounting is mixed with Management Information System (MIS) with multi-lingual and Data organization capabilities to support the company then all the business operations will be easy and cost effective.

(2) Accuracy and Speed As per the need of business, Computerized Accouting has various templates and software due to which fast and accurate data entry and transactions operations are possible which generates various information and reports quickly and automatically.

(3) Quick Decision Making : Based on information and reports generated by Computerized Accounting System, the company or firm can plan its activities, can take quick decision and can access complete and critical information of the company.

(4) Modern and Integrated : Computerized Accouting System perform functions at much higher speed than the speed of human beings which saves time and other resources. If accounts are prepared with the help of computer. Trial balance and Final accounts can be derived at any point of time within fraction of seconds.

(5) Immediate Availability of Books of Accounts : Due to Computerized Accounting System, books and registers tike Cash book, Purchase register, Sales register, Bank book, Account of Receivables and Payables are readily available at any point of time.

(6) Security: By keeping security control at various stage, data and information in Computerized

Accouting System can be kept confidential and more secured. This kind of the security is not possible in the traditional accounting system.

(7) Transparency: For the business, greater transparency is possible in the day to day business operations due to Computerized Accounting System.

(8) Grouping of Accounts : In the Computerized Accouting System grouping of Accounts is easily possible. As per the business requirements, groups like Assets, Liabilities, Income, Expenditure, etc. and their subgroups can be derived as per convenience of user.

![]()

Importance of Computerized Accounting System-

Following are the points of importance of Computerized Accounting System for the various types of business organizations, firms, companies, etc.

- Automation: Compared to manual accounting calculations, all the calculations are automatically

done by the accounting software with minimum time and without mistakes. - Multi-user Facilities : Computerized Accounting System with multi-user facility enables business ‘

houses to access accounting information online or offline, inside or outside the office, .

simultaneously. – - Accuracy: Computers performs functions with high degree of accuracy. If hardware, software and ^

humanware are proper, the Computerised Accouting System can assure of accurate outcome. - Speed : Computerized Accounting software perform functions at much higher speed than the speed of human beings. If accounts are prepared with the help of computer, final accounts can be prepared in much lesser time and as per user requirements.

- Reduction in cost: Reduction in cost due to Computerized Accounting System is possible as less persons in less time can complete the work with more speed and more accuracy.

- Systematic and up-to-date records: Compterized Accounting System ensures systematic and up-to-date financial records of the business organization.

- Huge Storage Capacity: Manual accounting requires seperate books and registers to be maintained

every year while in Computerized Accounting System records of many years can be stored in system / computer. - Compact: The voluminous financial information can be stored in a compact way by the means of hard disk or external storage device which requires very little Space.

- Transferability / Sharing Information : Business organization can share the financial information to interested parties through pen drive or through internet.

Components of Computerized Accounting System-

(a) Hardware : Hardware comprises of electronic equipments that includes computers, hard disks, monitors, printers and the network that connects with them. Most modern accouting system require a network, the system of electronic linkages which allows many computers to the main computer or server which stores the program and data, with right communication of hardware and software, one can perform all the work on site.

(b) Software : Software is a set of instructions and programme that can direct and perform desired task as required by users. Accounting software accepts, edits and stores transactions and data and generates reports as per the requirement.

(c) Personel: Personel / Humanware is the people who dealt with computer and software and play an imortant role in effective implementation of Computerized Accounting System.

Management of a Computerized Accounting System requires careful planning of data and access to the data. Security is sought by setting passwords, codes, etc. at different stage which gives them more safety of data.

Creation of Accounting Documents-

In accounting software generally the following components are used :

- Creation of Accounting Documents : With the help of computer software, different accounting documents like cash memos, vouchers, receipts, invoices, etc. can be created / prepared.

- Recording of Transactions: Day to day business transactions can be recorded through computerized accounting software which reduces the paper work.

- Preparation of Trial balance and Financial Statements: Based on the recorded business transactions, data is transferred into ledger through software and vouchers are also prepared. From these data, Final accounts are prepared automatically.

Transactions with missing data or other critical information are not accepted by the system.

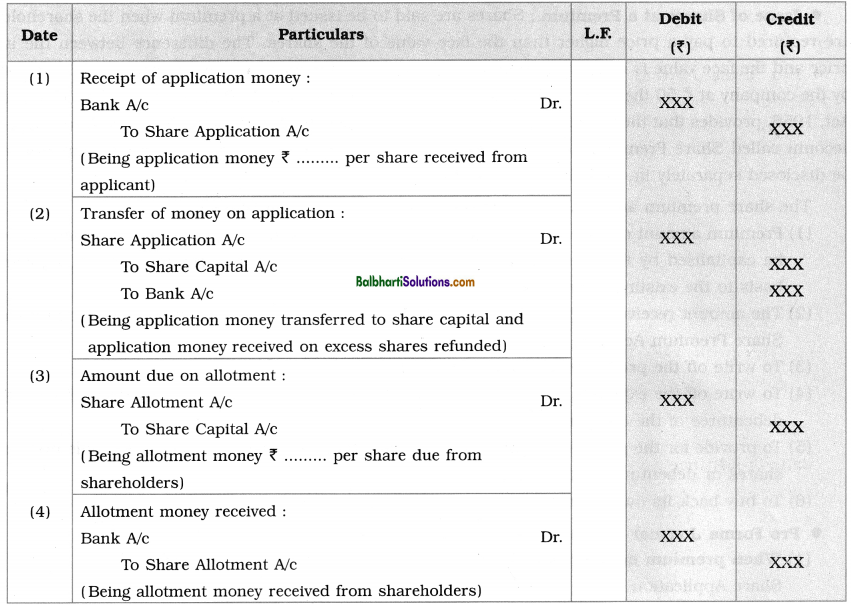

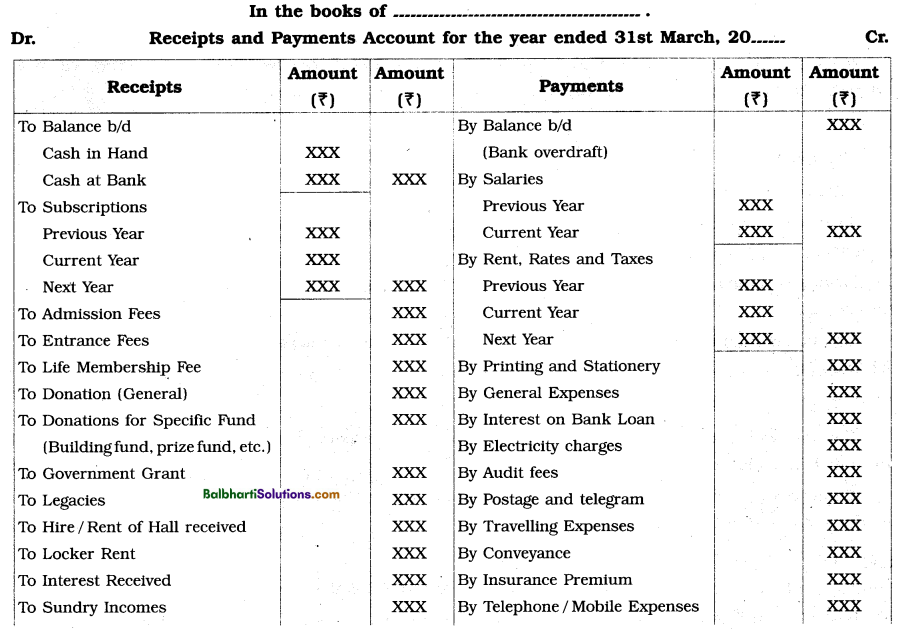

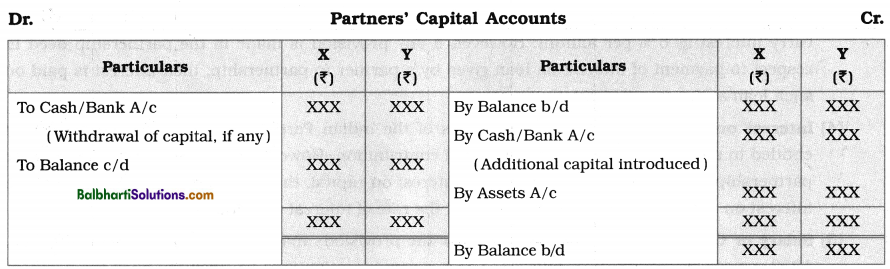

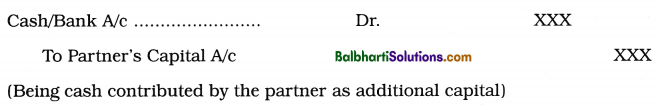

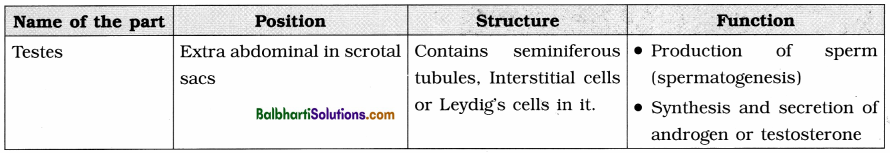

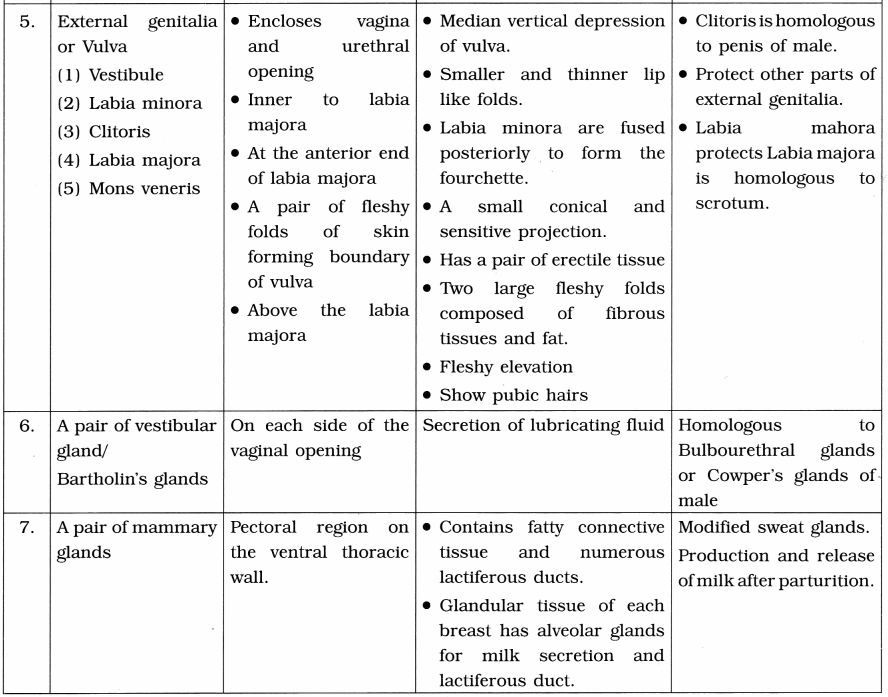

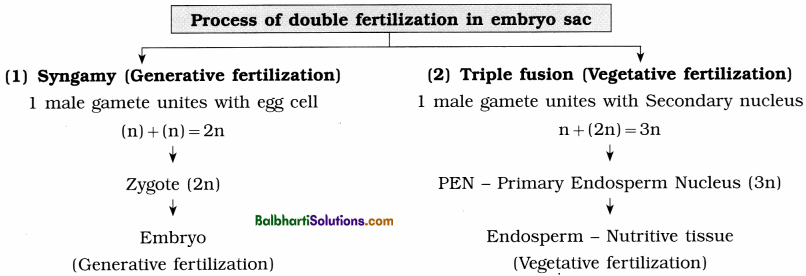

Comparision between Manual Accounting Process and Computerized Accounting Process.

| Basis of Difference | Manual Accounting | Computerized Accounting |

| (1) Meaning | Manual accounting is the system in which each business transactions are recorded in books of accounts like journal and ledger. | Computer accounting is the system in which transactions are recorded by using computers and accouting software for digital record. |

| (2) Calculation and total | In this system, all calculations are done manually.

Here, balance of each accounts are to be found out by making total of debit and credit side |

In this system, all calculations are done by computer system.

Here, balance of each accounts are calculated / found automatically. |

| (3) Ledger Accounts | From the journal, recorded transactions have to be posted in different ledger accounts manually, so chances of mistake is always there. | Here, once a voucher is entered, it will automatically posted in the different ledger accounts without any mistake. |

| (4) Trial Balance | After posting, trial balance is to be prepared by taking balance of each ledger accounts. | Trial balance is automatically prepared using accounting software. |

| (5) Record of Adjustment Entries | Adjustment journal entries and its posting in the ledger accounts will be done manually one by one. | Adjustment entries are to be passed in the system, and posting in the ledger accounts will be done automatically. |

| (6) Financial Statements | Financial Statements are prepared manually by transferring trial balance figures carefully. | With the help of accounting software, such financial statements are automatically prepared after recording adjustment entries. |

| (7) Closing the books | After close of every year; in the beginning of year, opening balances are required to be carried forward in new books of accounts. | There is no need for recording opening balances as the balances are automatically carried forward to next year. |

![]()

Sourcing of Accounting Software-

Before acquiring accounting software, expertise of people responsible in business for accounting work is to be considered, as people are responsible for accounting and not the computers.

The choice of the accounting software would depend upon the suitability to the organisation or firm, in terms of accounting and financial needs. From this perspective available accounting packages are classified into the following categories :

(a) Ready to use

(b) Customized

(c) Tailored

(d) Free and Open Source

(a) Ready to use: Ready to use software is suitable and developed for the need of organization or firm whose volume of accounting transactions are less. Ready to use software is cost effective and relatively easier to learn. Such software have many features and low level of secrecy. This kind of the software may not have linkage benefits.

(b) Customized : As per the need of the special requirements of customer, when accounting software is developed, it is known as Customized software, which is suitable for large and medium size businesses. Customization includes modification and addition to the software contents, provision for the specified number of users and other authentication, etc. The cost of training and installation and maintenance of customized software is relatively high. Customized software can be linked to the other infromation system with proper level of secrecy.

(c) Tailored : When software are designed and developed according to the need of a customer with multi-users facility and geographically scattered locations, it is known as Tailored software. This kind of the software form an important part of organizational Management Information System (MIS). The Secrecy and authenticity checks are most important things in such software. This software needs specialized training to the users and they offer high flexibility in terms of number of users.

(d) Free and Open Source ; When small business or firm wants to use accounting software but do not have enough budget, then they try to get it from open source software available on the internet, which can be downloaded and installed from the websites.

Legal / Licensed vs Pirated Accounting Software-

As Per the business needs, one should select legal and open source accounting software from the available packages and applications in the market.

Legal Software : Full functional and safe software, can be updated as per statutory changes.

Pirated Software: Cracked software, nearly full functional, but illegal to use and risky from the data safety point of view, i.e. data can be corrupted.

Demo Software : Used for demo purpose with all major features but with a very few restrictions.

Voucher Types in Tally

| Voucher Types | Its Uses |

| F4 (Contra) | This voucher is used to deposit cash into the bank. Withdrawal of cash from the bank Transfer of fund i.e. cash from one Account to another. It is also used to transfer fund from one bank to another Bank. |

| F5 (Payment) | All types of payments i.e. payment by cash and payment by cheque are recorded through this voucher. Credit items of a payment voucher shall be either Cash or Bank Account only. There can be two modes : Single Entry Mode or Double Entry Mode. |

| F6 (Receipt) | There can be only two types of receipts, viz. Cash receipts and Bank receipts. Both these receipts has to be entered here. Debit item of Receipt Voucher will always be either Bank or Cash. TWo modes of voucher are : Single Entry Mode or Double Entry Mode. |

| F7 (Journal) | F7 (Journal) voucher is used for non-cash transactions, e.g., depreciation, provisions, transfer entries, purchase of fixed assets on credit etc. Journal voucher never to be used for credit sales or credit purchases. |

| F8 (Sales) | This voucher i.e. F8 (Sales) voucher is used for cash sales as well as credit sales. There are two modes viz. “As Invoice” or “As Voucher”. Write Party’s A/c Name when ledger to be debited and write Cash in case of Cash Sales. |

| F9 (Purchase) | This voucher type is used for Credit Purchases as well as Cash Purchases. There are two modes viz. “As Invoice” or “As Voucher”. Party’s A/c name is written when ledger to be credited. |