By going through these Maharashtra State Board 12th Science Chemistry Notes Chapter 15 Introduction to Polymer Chemistry students can recall all the concepts quickly.

Maharashtra State Board 12th Chemistry Notes Chapter 15 Introduction to Polymer Chemistry

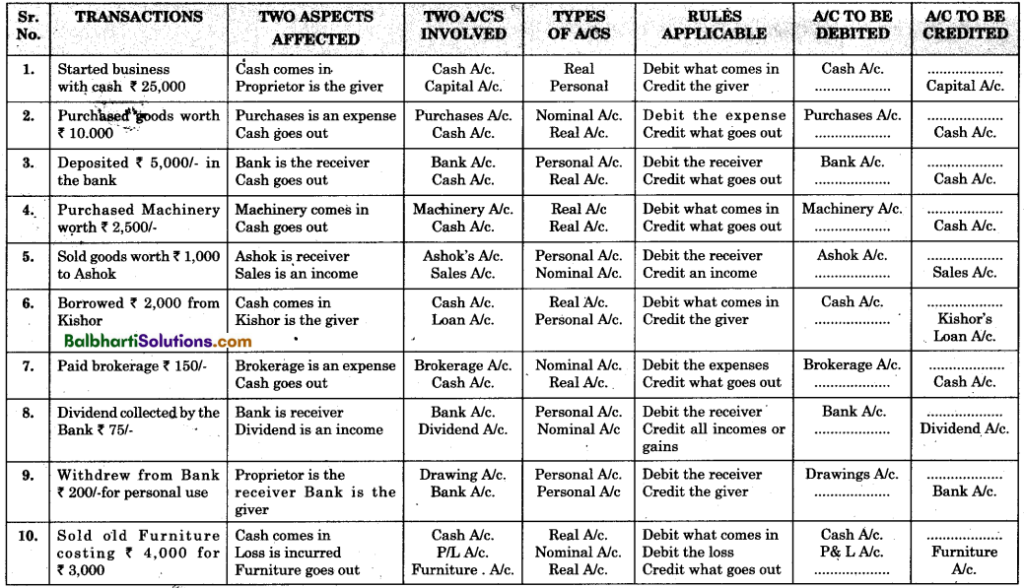

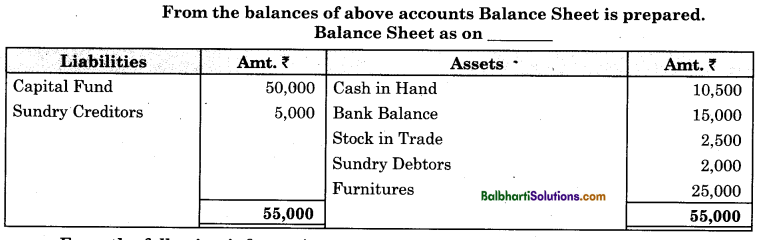

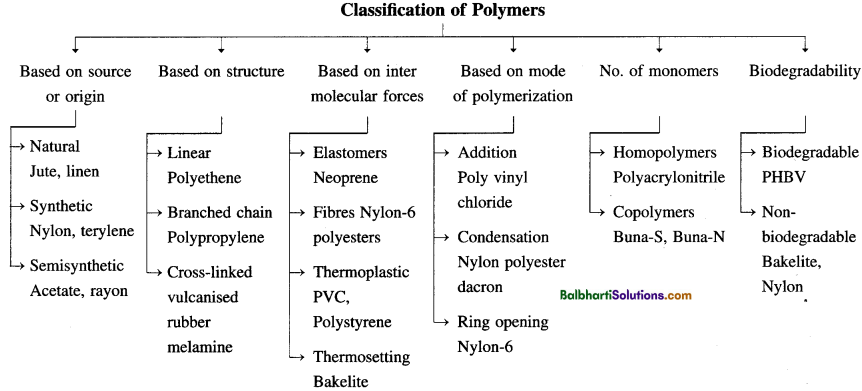

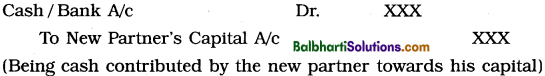

Classification of Polymers-

- Based on source or origin

- Based on structure

- Based on intermolecular forces

- Based on the mode of polymerization

- No. of monomers

- Biodegradability

Based on source or origin:

- Natural Jute, linen

- Synthetic Nylon, terylene

- Semisynthetic Acetate, rayon

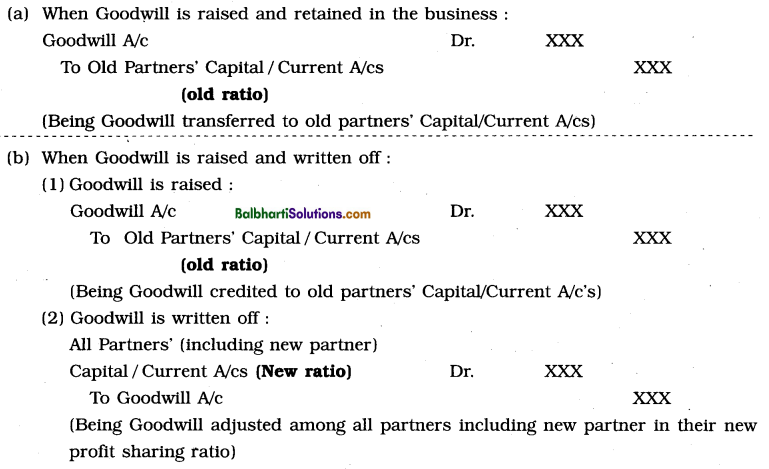

Based on structure:

- Linear Polyethene

- Branched-chain Polypropylene

- Cross-linked vulcanized rubber melamine

![]()

Based on intermolecular forces:

- Elastomers Neoprene

- Fibres Nylon-6 polyesters

- Thermoplastic PVC, Polystyrene

- Thermosetting Bakelite

Based on mode of polymerization:

- Addition Polyvinyl chloride

- Condensation Nylon polyester dacron

- Ring-opening Nylon-6

No. of monomers:

- Homopolymers Polyacrylonitrile

- Copolymers Buna-S, Buna-N

Biodegradability:

- Biodegradable PHBV

- Non- biodegradable Bakelite, Nylon

Natural rubber: It is a linear polymer of isoprene (2-methyl-1, 3-butadiene), Cis isomer, exhibits elastic property.

Vulcanization of rubber: The effect of vulcanization enhances the properties like stiffness elasticity, toughness etc. of natural rubber

Natural rubber +1-3% sulphur → Rubber is very soft

Natural rubber + 20-30% sulphur → Rubber is hard.

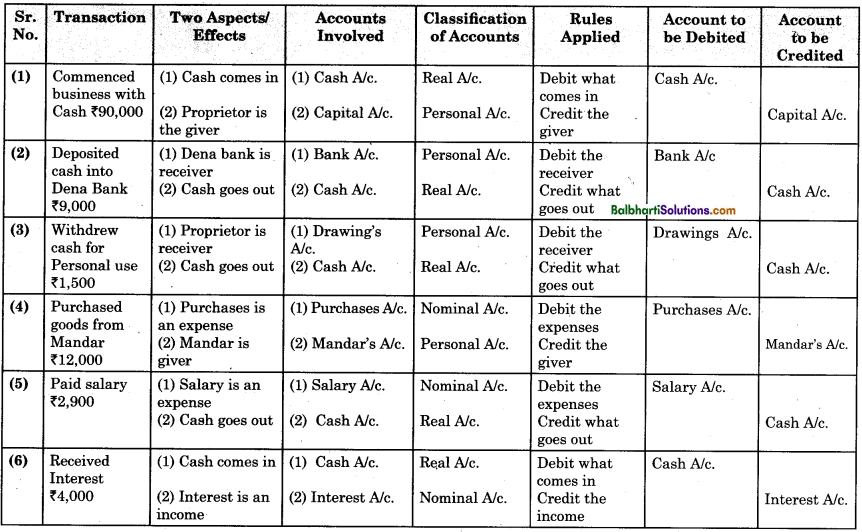

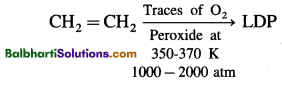

Polyethene:

(1) LDP (Low-density polyethylene)

(2) HDP (High density polyethylene)

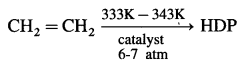

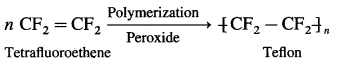

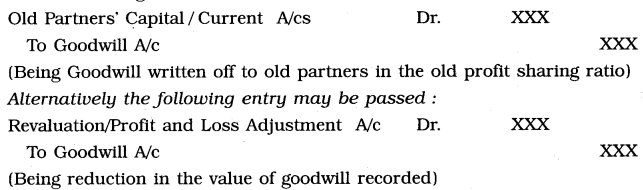

(3) Teflon :

![]()

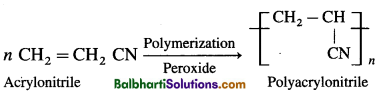

(4) Polyacrylonitrile :

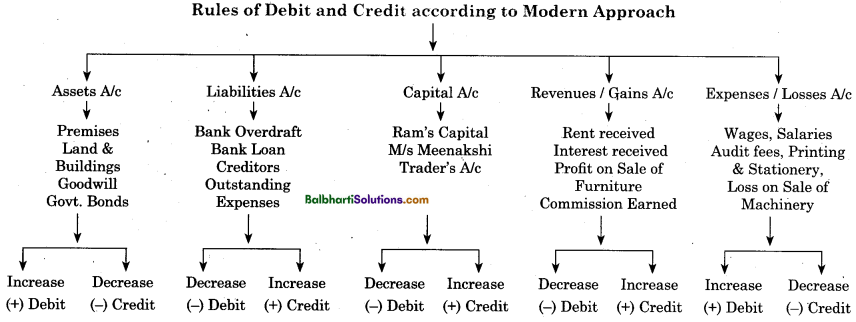

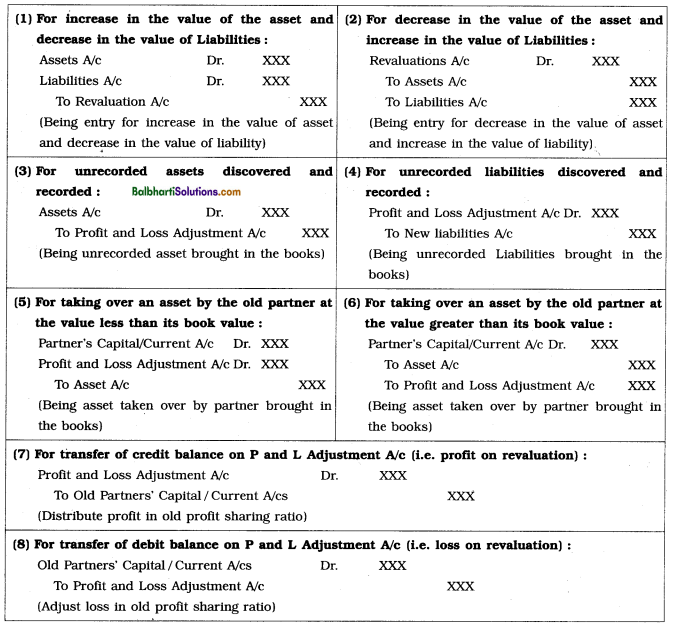

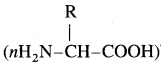

(5) Condensation polymerization. (Polyamide, polyester fibres)

![]()

Example : Nylon-6, Nylon-66, Terylene.

(6) Preparation of bakelite :

Formaldehyde + Phenol → Novolac → Bakelite

Other polymers of formaldehyde

- with urea (NH2CONH2) → Moulded plastic

- with melamine: formaldehyde + melamine → monomer

formaldehyde melamine polymer

formaldehyde melamine polymer

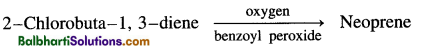

(7) Preparation of synthetic rubber :

- Buna-S (SBR) Styrene-butadiene rubber

Styrene + 1, 3-butadiene → Buna-S - Neoprene rubber

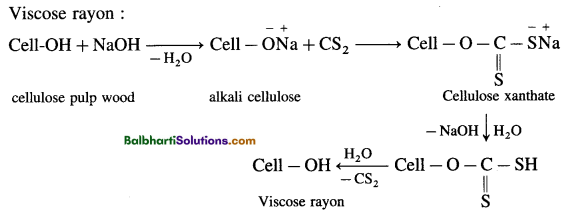

(8) Semisynthetic fiber:

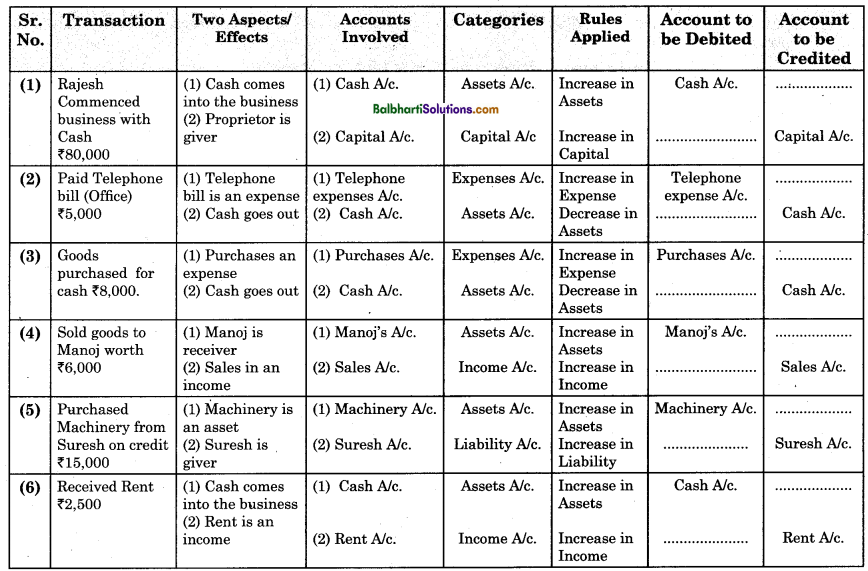

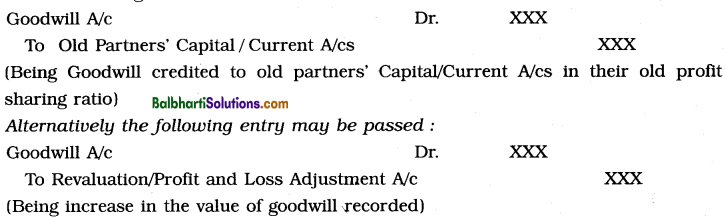

(9) Biodegradable polymers :

PHBV (polyhydroxy butyrate-CO-β hydroxy valerate)

3-Hydroxy butanoic acid + 3 Hydroxy pentanoic acid ![]() PHBV (ester linkage)

PHBV (ester linkage)

Nylon-2-nylon-6

Glycine + amino caproic acid → Nylon -2-nylon-6

![]()

(10) Commercially important polymers :

- Perspex/acrylic glass

- Buna N

- PVC

- Polyacryl amide

- Urea-formaldehyde resin

- Glyptal

- Polycarbonate

- Thermocol.

.

.