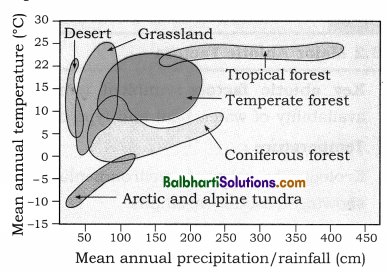

By going through these Maharashtra State Board 12th Science Biology Notes Chapter 12 Biotechnology students can recall all the concepts quickly.

Maharashtra State Board 12th Biology Notes Chapter 12 Biotechnology

Biotechnology-

1. Biotechnology is defined as ‘the development and utilization of biological forms, products or processes for obtaining maximum benefits to man and other forms of life.

2. The term biotechnology was first used by Karl Ereky in 1919 to describe a process for the large-scale production of pigs.

3. According to OECD (Organization for Economic Cooperation and Development, 1981) -‘Biotechnology is the application of scientific and engineering principles to the processing of materials by biological agents to provide goods and service to the human welfare’.

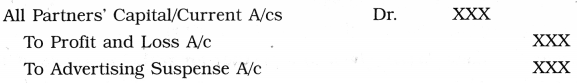

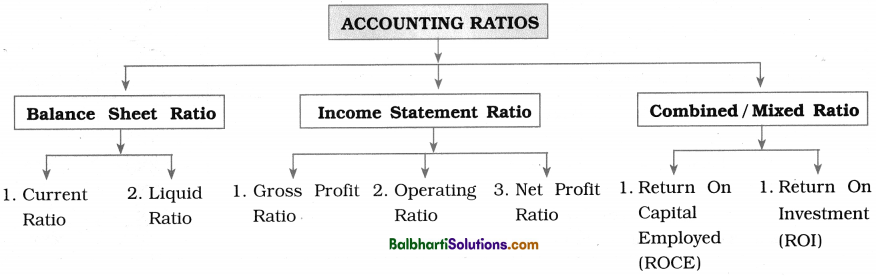

4. Two phases of the development of biotechnology in terms of its growth :

- Traditional or old biotechnology: Based on fermentation technology using microorganisms as in the preparation of curd, ghee, soma, vinegar, yogurt, cheese making, winemaking, etc.

- Modern or new biotechnology: Based on –

- The use of rDNA technology, polymerase chain reaction (PCR), microarrays, cell culture, cell fusion, and bioprocessing to develop specific products.

- Ownership of technology and its socio-political impact.

![]()

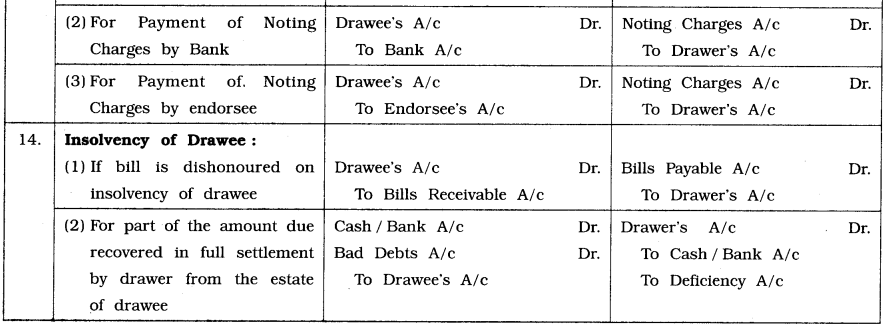

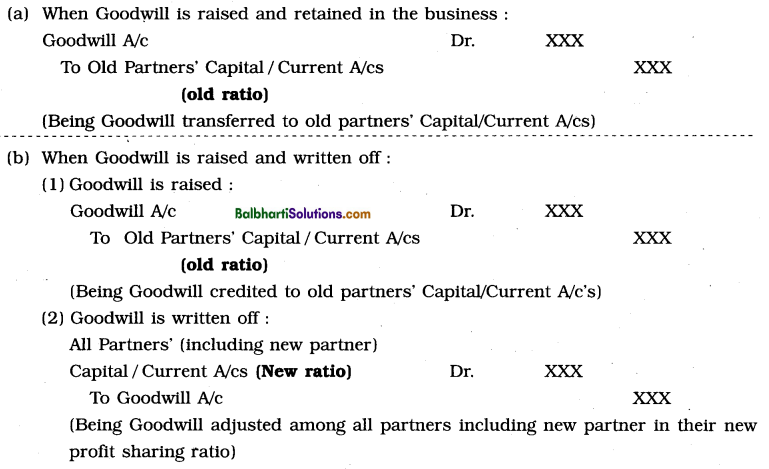

Principles and Processes of Biotechnology-

1. Two core techniques of modem biotechnology :

(1) Genetic engineering :

(a) Manipulation of genetic material towards the desired end and in a directed and predetermined way, using in vitro process.

(b) Definition of genetic engineering (By Smith): ‘The formation of a new combination of heritable material by the insertion of nucleic acid molecule produced by whatever means outside the cells, into any virus, bacterial plasmid or another vector system so as to allow their incorporation into a host organism in which they do not occur naturally but in which they are capable of continued propagation.

(c) Genetic engineering is also called recombinant DNA technology or gene cloning, as it involves alterations in DNA.

(2) Chemical engineering: Maintaining a sterile environment for manufacturing of useful products like vaccines, antibodies, enzymes, organic acids, vitamins, therapeutics, etc.

2. Different techniques and instruments (devices) for gene cloning/r-DNA technology :

(1) The techniques used in rDNA technology, on the basis of molecular weight: Gel

permeation, osmotic pressure, ion-exchange chromatography, spectroscopy, mass spectrometry, electrophoresis, etc.

(2) Electrophoresis :

- It is used for the separation of charged molecules like DNA, RNA, and proteins, by application of an electric field.

- Different types of electrophoresis: Agarose gel electrophoresis, PAGE, SDA PAGE.

(3) Polymerase chain reaction (PCR) :

- It was discovered by Kary Mullis in 1985.

- Uses of PCR : In vitro gene cloning or gene multiplication to produce a billion copies of the desired segment of DNA or RNA, with high accuracy and specificity, in few hours.

- Requirements of PCR : Thermal cycler, DNA containing the desired segment to be amplified, deoxyribonuclueoside triphosphates (dNTPs), excess of two primer molecules, heat stable DNA polymerase and appropriate quantities of Mg<sup>++</sup> ions.

- Three essential steps : Denaturation, annealing of primer and extension of primer.

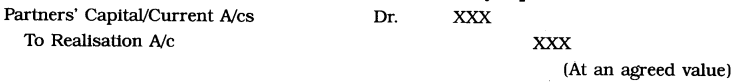

3. Biological tools for gene cloning/r-DNA technology :

(1) Enzymes :

- Lysozymes, Nucleases (exonucleases, endonucleases, restriction endonucleases), DNA ligases, DNA polymerases, alkaline phosphatases, reverse transcriptases, etc.

- Nucleases : They cut the phosphodiester bonds of polynucleotide chains.

- Types of nucleases :

- Exonucleases : They cut nucleotides from the ends of DNA strands.

- Endonucleases : They cut DNA from within.

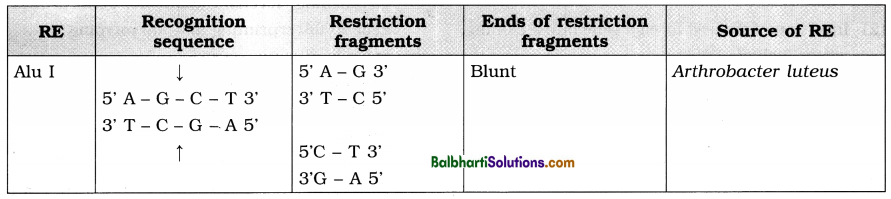

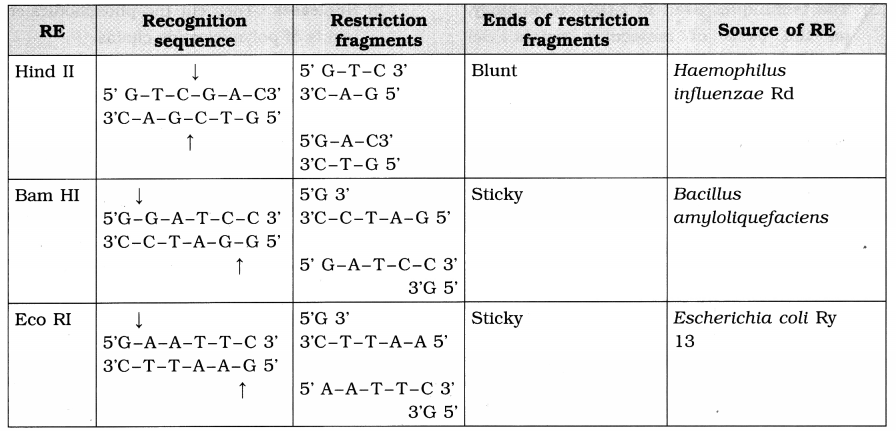

Restriction endonucleases or restriction enzymes :

- They are the molecular scissors which recognize and cut the phosphodiester back bone of DNA on both strands, at highly specific sequences.

- The 4 to 8 nucleotide long sites recognized by them are called recognition sequences or recognition sites.

- Types of restriction enzyme :

- Type I : They fuction simultaneously as endonuclease and methylase e.g. EcoKI.

- Type II : They have separate cleaving and methylation activities e.g. EcoRI, Bgll. They cut DNA at specific sites within the palindrome.

- Type III : They cut DNA at specific non-palindromic sequences e.g. Hpal, MboII.

- Restriction cutting may result in DNA fragments with blunt ends or cohesive or sticky ends or staggered ends (having short, single stranded projections).

Table : Source and recognition sequences of various restriction enzymes :

(2) Cloning vectors (vehicle DNA) :

- Vectors are DNA molecules that carry a foreign DNA segment and replicate inside the host cell.

- Examples of vectors : Plasmids (e.g. Ti plasmid of Agrobacterium tumejaciens, pBR 322, pUC), bacteriophages (e.g. M13, lambda virus), cosmid, phagemids, BAC (bacterial artificial chromosome), YAC (yeast artificial chromosome), transposons, baculoviruses and MACs (mammalian artificial chromosomes).

(3) Competent host: e.g. bacteria like Bacillus Haemophilus, Helicobacter pyroli and E. coli.

![]()

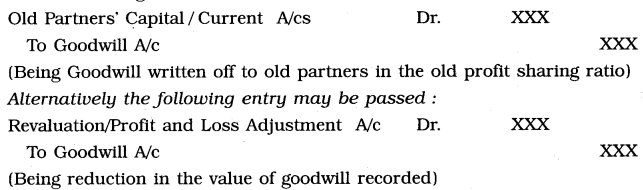

Methodology for r-DNA technology-

1. The steps involved in gene cloning :

- Isolation of DNA (gene) from the donor organism.

- Insertion of desired foreign gene into a cloning vector (vehicle DNA).

- Transfer of r-DNA into suitable competent host or cloning organism.

- Selection of the transformed host cell.

- Multiplication of transformed host cell.

- Expression of the gene to obtain desired product.

2. Gene library :

(1) Gene library is a collection of different DNA sequences from an organism where each sequence has been cloned into a vector for ease of purification, storage and analysis.

(2) Types of gene library :

- Genomic library : It is a collection Of clones that represent the complete genome of an organism.

- c-DNA library : It is a collection of clones containing cDNAs inserted into suitable vectors like phages or

Applications of Biotechnology-

1. Healthcare Biotechnology :

(1) It involves unique, targeted and personalized therapeutic and diagnostic solutions for organ transplant, stem cell technology, genetic counselling, forensic medicine, gene probes, genetic fingerprinting and karyotyping.

(2) Human insulin production using r-DNA technology.

(3) Vaccine production :

- Recombinant vaccines, naked DNA vaccines, viral vector vaccines and plant- derived vaccines are found to be most effective against various diseases.

- Modern diagnostic test kits include rickettsial, bacterial and viral vaccines along with radio-labelled biological therapeutics for imaging and analysis.

- Oral Vaccines.

| Proteins produced by r-DNA technology | Disorders |

| Factor VIII | Haemophilia A |

| Factor IX | Haemophilia B |

| Erythropoeitin | Anaemia |

| Tissue plasminogen activator (TPA), Urokinase | Blood clots |

| Platelet derived growth factor | Atherosclerosis |

| Hepatitis B vaccine | Hepatitis B |

| Interleukin-1 -receptor | Asthma |

| a Antitrypsin | Emphysema |

| Interferons, Tumour necrosis factor, interleukins, macrophage activating factor | Cancer |

| Insulin | Diabetes |

| Relaxin | Parturition |

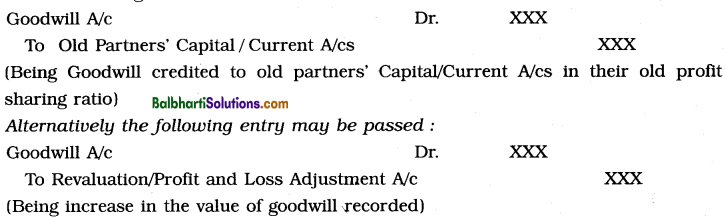

2. Agriculture :

(1) Application of biotechnology in agriculture : Genetically modified organisms, Bt Cotton, pest resistant plants, improvement in the agricultural productivity.

(2) Applications of tissue culture :

- Micropropagation i.e. large-scale propagation of plants in very short durations.

- Storage of germplasm and maintaining clone of plants which produce recalcitrant seeds or highly variable seeds. Recalcitrant seeds are those whose survival and viability gets affected because of dehydration and freezing.

3. Gene therapy :

(1) Gene therapy is the treatment of genetic disorders by replacing, Elitering , or supplementing a gene that is absent or abnormal Eind whose absence or abnormality is responsible for the disease.

(2) Genes can be delivered by three ways, viz. Ex vivo delivery, in vivo delivery and use of virosomes (Liposome + inactivated HIV) and bionic chips.

(3) Forms of gene therapy :

- Germ line gene therapy and

- Somatic cell gene therapy.

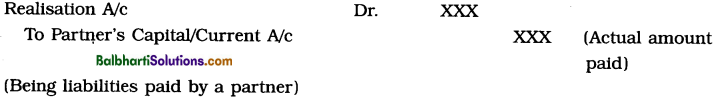

4. Genetically Modified Organisms (GMOs) :

(1) Genetically modified orgEinisms are those whose genetic material has been artificially manipulated in a laboratory through genetic engineering to create combinations of plant, animal, baetericil and virals genes that do not occur in nature or through traditional crossbreeding methods.

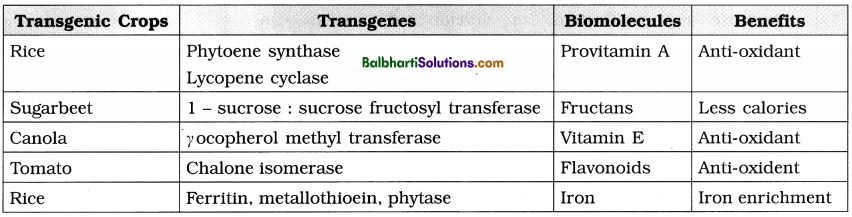

(2) Transgenic Plants : Transgenic plants have been developed for :

- Insect pest resistance : e.g. Bt cotton and Transgenic tobacco.

- Biofortification : Improvement in quantity and quality of vitamin, proteins, oil and iron.

- Tolerance to abiotic stresse and herbicides.

- Resistance to various diseases.

- Improvement in post-harvest characteristics : e.g. Flavr savr tomatoes.

(3) Plants are potential factories or bioreactors for :

- Biochemicals (starch, sugar, lipids and proteins) and biopharmaceuticals (hormones, antibodies, vaccines, drugs or enzymes) isolated from transgenic plants.

- Fine chemicals, perfumes and adhesive compounds.

- Industrial lubricants.

- Biodegradable plastic.

- ‘Renewable’ energy crops to replace fossil fuels.

- ‘Superglue’

- Edible vaccines

(4) Transgenic animals : Transgenic animals are the animals in which there has been a deliberate modification of the genome and such animlas are used in various fields such as medical research, toxicology, molecular biology and in pharmaceutical industry.

- Transgenic mice : Used in cancer research.

- Transgenic fish : Developed for increased cold tolerance and improved growth.

Transgenic farm animals :

(i) The main objectives for developing transgenic animals are to improve quality and quantity of milk, meat and wool, to increase egg production, to develop disease resistant animals, production of low-cost pharmaceuticals and biologicals.

(ii) Transgenic farm animals include transgenic cattle (developed for food production and human therapeutic production), transgenic sheep (developed for production of better quality and quantity of wool and meat. They are also used as bioreactors), transgenic pigs (developed for improved meat production, as bioreactors and they are useful in human transplants – xenotransplantation) and transgenic chicken (developed for having traits like lower levels of fat and cholesterol, high protein containing eggs, in vivo resistance to viral and coccidial diseases, better feed efficiency and better meat quality).

![]()

Bioethics-

Ethics deals with the matters related to socially acceptable moral duty, conduct and judgement. It helps to regulate the behaviour of community by certain set of standards.

1. Bioethics helps to study moral vision, decision and policies of human behaviour in relation to biological phenomena or events.

2. It deals with wide range of reactions on new developments like :

- r-DNA technology, cloning, transgenics and gene therapy.

- In vitro fertilization, sperm bank, prenatal genetic selection and eugenics.

- Euthanasia, death, maintaining those who are in comatose state.

- Use of animals causes great sufferings to them.

- Violation of integration of species caused due to transgenosis.

- Transfer of human genes into animals and vice versa.

- Indiscriminate use of biotechnology poses risk to the environment, health and biodiversity.

3. Bioethical concerns related to GMO :

- The effects on non-target organisms,

- Insect resistance crops,

- Gene flow

- The loss of diversity as well as the issue on

- Modification process disrupting the natural process of biological entities.

4. Ethics in biotechnology also includes the general subject of what should and should not be done in using recombinant DNA techniques.

Effects of Biotechnology on the Environment-

1. Herbicide Use and Resistance :

- Unintended hybrid strains of weeds and other plants can develop resistance to these herbicides through cross-pollination, thus negating the potential benefit of the herbicide.

- E.g. Crops of Round Up-ready soybeans have already been implemented into agricultural practices, possibly conferring Round Up resistance to neighbouring plants.

2. Effects on Untargeted Species :

- Bt corn has adverse effects on untargeted species like Monarch butterfly.

- GM plants can also have unintentional effects on neutral or even beneficial species.

Effects of Biotechnology on Human Health-

- Allergies : e.g. Transgenic soyBean containing a gene from the Brazil nut to increase the production of methionine, has caused allergic reactions in those with known nut allergies (Biotech SoyBeans).

- Long-Term Effects : GMO technology is a recent development and its long-term effects on health cannot be anticipated now.

- New Proteins : Proteins which were never ingested before, can have potential effects which are not yet known.

- Food Additives : The use of GMOs may create antibiotic and vaccine-resistant strains of diseases.

- The Indian Government has set up the Genetic Engineering Approval Committee (GEAC) to make decisions regarding the validity of research involving GMOs and addresses the safety of GMOs introduced for public use.

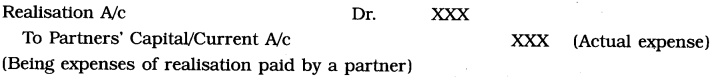

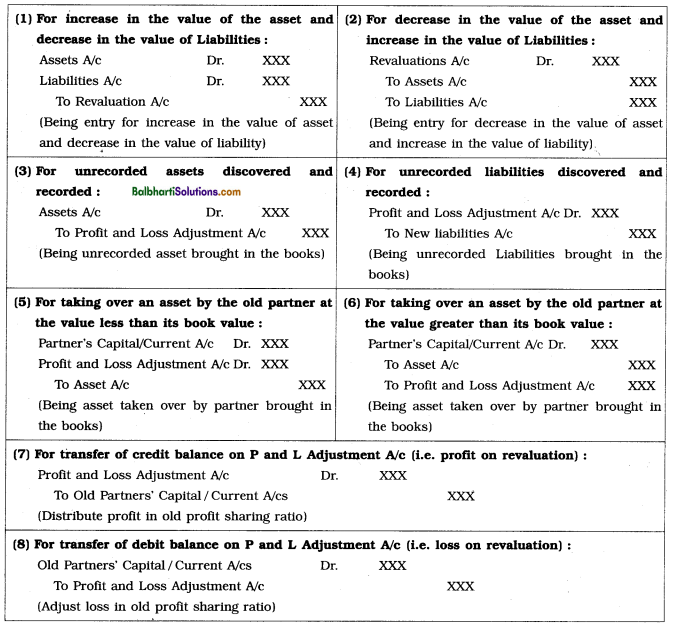

Biopatent and Biopiracy-

Patent is a special right granted to the inventor by the government.

A patent consists of three parts – grant (agreement with the inventor), specification (subject matter of invention) and claims (scope of invention to be protected).

1. Biopatent :

- Biopatent is a biological patent awarded for strains of microorganisms, cell lines, genetically modified strains, DNA sequences, biotechnological processes, product processes, product and product applications.

- Biopatent allows the patent holder to exclude others from making, using, selling or importing protected invention for a limited period of time.

- First biopatent : Genetically engineered bacterium ‘Pseudomonas’ used for clearing oils spills.

![]()

2. Biopiracy:

(1) Biopiracy is defined as ‘theft of various natural products and then selling them by getting patent without giving any benefits or compensation back to the host country’.

(2) It is unauthorized misappropriation of any biological resource and indigenous knowledge.

(3) Examples of Biopiracy :

- Patenting of Neem (Azadirachta indica)

- Patenting of Basmati

- Patenting of Haldi (Turmeric)

.

.