By going through these Maharashtra State Board Secretarial Practice 12th Commerce Notes Chapter 9 Depository System students can recall all the concepts quickly.

Maharashtra State Board Class 12 Secretarial Practice Notes Chapter 9 Depository System

Introduction:

→ Joint-stock companies raise finance by issuing shares and debentures.

→ Securities can be held in two modes:

- Physical or Paper Form

- Electronic/ Digital/Dematerialized Form

→ A new system called “depository system” has been established to

- Field securities of an investor in an electronic form

- Eliminate the risk of forgery and mutilation

→ Depository system exists in all developed countries.

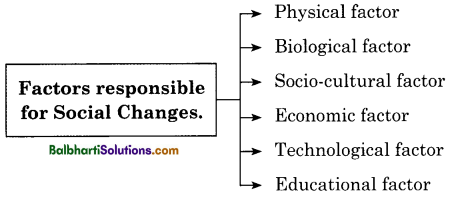

![]()

Terms and Constituents related to Depository System-

→ Depository System which was introduced in India by passing The Depository Act 1996.

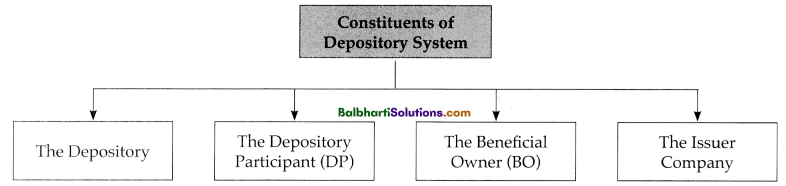

→ Constituents of Dlepository System :

- The Depository

- The Depository Participant(DP)

- The Beneficial Owner (BO)

- The Issuer Company

→ Depository contacts the customer through depository participant.

→ Depository participant is the representative of the depository.

→ An investor is known as beneficial owner.

→ Companies which issue any kind of security are known as ‘Issuer’ in the depository system.

→ Issuer Company must register with the Depository.

→ Dematerialization is the process in which share certificates are converted into electronic form.

→ Rematerialization is the process by which shares in electronic form are reconverted into physical form.

→ ISIN is a unique code that is used to identify securities.

Functioning of Depository System:

→ The investor has to open a demat account when he wants to dematerialize the share.

→ The investor intending to dematerialize his securities send a duly filled in and signed. Demat Request Form in triplicate along with scrip certificate to Depository Participant.

![]()

→ Depositories existing in India:

- NSDL – National Security Depository Limited -1996

- CDSL – Central Depository Services Limited – 1999