Std 5 English Lesson No 29 A Lark Question Answer Maharashtra Board

Balbharti Maharashtra State Board Class 5 English Solutions Chapter 29 A Lark Notes, Textbook Exercise Important Questions and Answers.

5th Std English Poem A Lark Question Answer

English Balbharati Std 5 Digest Chapter 29 A Lark Textbook Questions and Answers

1. Guess the meaning of:

Question 1.

Guess the meaning of:

- weary

- dreary

- on the wing

Answer:

- weary – very tired

- dreary – dull and gloomy

- on the wing – flying

![]()

2. Answer the following questions.

Question 1.

Write what the lark does.

Answer:

The lark soars high in the sky.

Question 2.

Write what the goldfish does.

Answer:

The goldfish dives deep in the sea.

![]()

Question 3.

What does the poet want to know from the lark?

Answer:

The poet wants to know from the lark if it is not tired of soaring high to the empty sky and if it doesn’t find the experience dull and boring. He further asks the lark if it doesn’t long to be a silent goldfish in the sea.

Question 4.

What does the poet want to know from the goldfish?

Answer:

The poet wants to know from the Goldfish whether it is not sad when it feels the cold waves moving slowly and quietly over it. He further enquires if the Goldfish sometimes long to be like a lark bird flying in the sky.

3. Recite the poem.

Question 1.

Recite the poem.

Answer:

Do it yourself.

![]()

4. Do you long to be something else? Write about your longing.

Question 1.

Do you long to be something else? Write about your longing.

Answer:

Yes, I long to be a bird! If I were a bird….. the high flight and exploring the beauty of this wonderful world would be such a great feeling. Humming sweet songs, building, nests so beautiful atop the tree, living in the green forests, Wouldn’t that be wonderful?

English Balbharati Std 5 Answers Chapter 29 A Lark Additional Important Questions and Answers

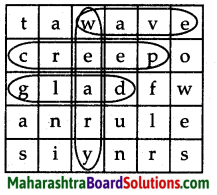

Spot the words

Question 1.

- very tired

- a moving strip of water

- move slowly and quietly

- pleased and joyful

Answer:

- weary

- wave

- creep

- glad

![]()

Language Study :

Question 1.

Complete the list of describing words from the extract:

- empty

- silent

- cold

- sad

Answer:

- sky

- goldfish

- waves

- clouds

Match the rhyming words :

Question 1.

| 1. high | a. dreary |

| 2. weary | b. creep |

| 3. be | c. sky |

| 4. deep | d. wing |

| 5. sing | e. sea |

Answer:

| 1. high | c. sky |

| 2. weary | a. dreary |

| 3. be | e. sea |

| 4. deep | b. creep |

| 5. sing | d. wing |

![]()

Reading Skills :

Read the following extract and answer the question given below:

Question 1.

Choose the correct alternative and complete the following. Don’t you sometimes long to be a in the sea.

i. a silent mermaid

ii. a silent goldfish

Answer:

a silent goldfish

Question 2.

Goldfish, goldfish ………….. are you never sad.

i. dancing is glee

ii. diving deep

Answer:

i. diving deep

![]()

Question 3.

What does the poem deal with?

Answer:

The poem deals with one’s longing to be someone or something else.

Question 4.

Which are the two characters the poet has addressed in the poem?

Answer:

The poet has addressed the lark bird and the goldfish in the poem.

Question 5.

Explain the line:

‘Don’t you sometimes long to be

A silent goldfish in the sea

Answer:

The poet wants to know whether the lark is not weary and tired of the life it leads and whether it doesn’t long to be like a goldfish in the sea.

![]()

A Lark Summary in English

Summary :

‘A Lark’ written by Lawrance Alma Tadema is a poem which throws light on how we are not happy in the situation we are in, and long to be someone or something beyond what we are. There are times when we intensely wish to be something we are not. As the proverb goes The grass is always greener on the other side’. The poet has beautifully illustrated this through this poem where he asks both the Lark bird and Goldfish if they were really happy and not weary of the life they lead. Addressing the lark bird flying high in the sky, the poet asks the lark if he is not tired when he reaches the empty sky amidst the gloomy cloud.

The poet wants to know from the lark if there are times when he longs to be a silent gold fish in the sea The poet asks the goldfish diving deep in the sea that when the cold waves slowly and quietly creep over it, is it really enjoyable? The poet enquires whether he doesn’t long to sing and lead the life like a lark bird soaring high in the sky. A simple poem with beautiful illustrations i.e. examples, the poet has conveyed a simple truth of life.

![]()

Meanings :

lark (n) – A small brown singing bird

soaring (u) – Fly or rise high into the air

weary (u) – Very tired

dreary (adj.) – dull and gloomy

diving (u) – plunge head first into water with arms raised over one’s head.

creep (v) – move slowly and quietly

English Balbharati Std 5 Answers Unit 4

- The Man in the Moon Class 5 English Solutions

- Water in the Well Class 5 English Solutions

- The Legend of Marathon Class 5 English Solutions

- All about Money Class 5 English Solutions

- A Lark Class 5 English Solutions

- Be a Netizen Class 5 English Solutions

- Give your Mind a Workout! Class 5 English Solutions

- Helen Keller Class 5 English Solutions

- Rangoli Class 5 English Solutions