By going through these Maharashtra State Board Organisation of Commerce and Management 11th Notes Chapter 7 Business Environment students can recall all the concepts quickly.

Maharashtra State Board Organisation of Commerce and Management 11th Notes Chapter 7 Business Environment

Business Environment-

Definition:

Boyard O Wheeler

The total of all things external to firm and industries which affect their organization and operations is called as Business Environment”.

Barry M. Richman and Melvyan Copan

“Environment factors of constraints are largely if not totally external and beyond the control of individual enterprises and their arrangement”.

William F. Glueck

“Business Environment is the process by which strategists monitor the economic, governmental, market, supplier, technological, geographic and social settings to determine opportunities and threat to the firms.

![]()

Importance of Business Environment

- Flexible and Dynamic

- Opportunities and Threats

- Competition

- Utilization of Resources

- Strength and Weakness

- Knowledge

- Image Building

- Adaptability to Socio – Economic – Changes.

Dimention of Business Environment-

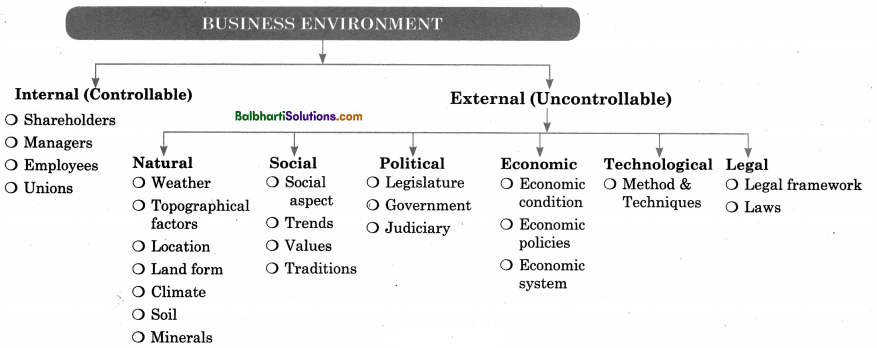

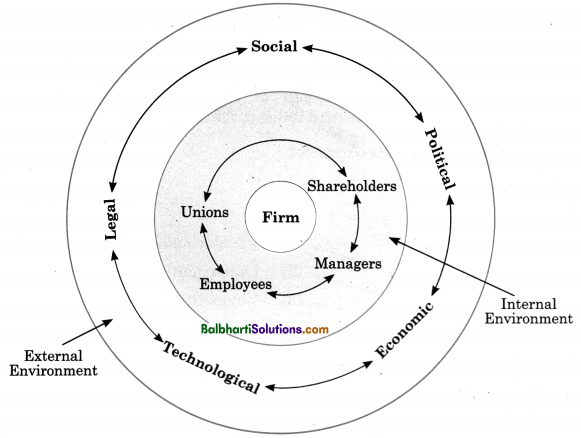

Business Environment:

- Internal (Controllable)

- External (Uncontrollable)

1. Internal (Controllable):

- Shareholders

- Managers

- Employees

- Unions

2. External (Uncontrollable)

Natural:

- Weather

- Topographical factors

- Location

- Land form

- Climate

- Soil

- Minerals

Social:

- Social aspect

- Trends

- Values

- Traditions

Political:

- Legislature

- Government

- Judiciary

Economic:

- Economic condition

- Economic policies

- Economic system

Technological:

Method & Techniques

Legal:

- Legal framework

- Laws

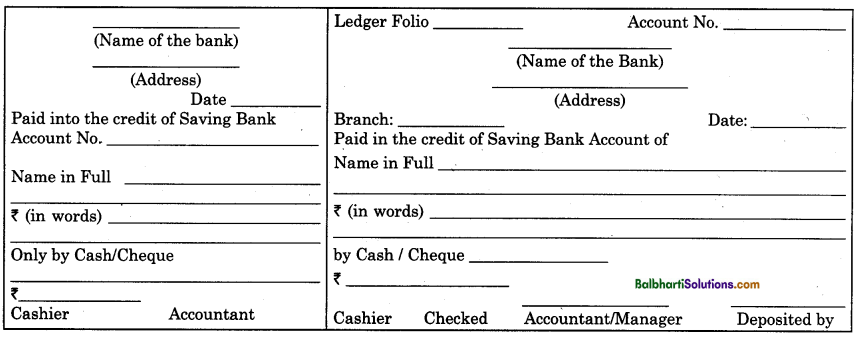

![]()

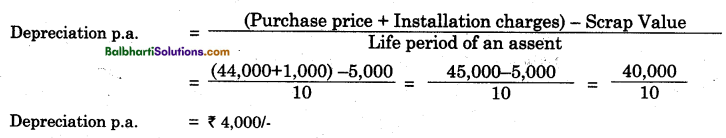

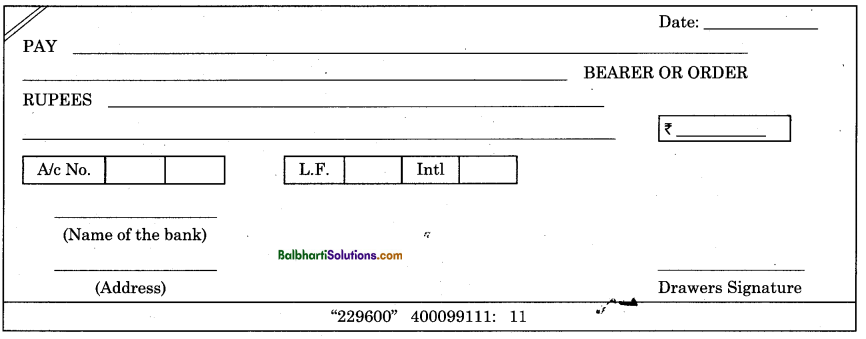

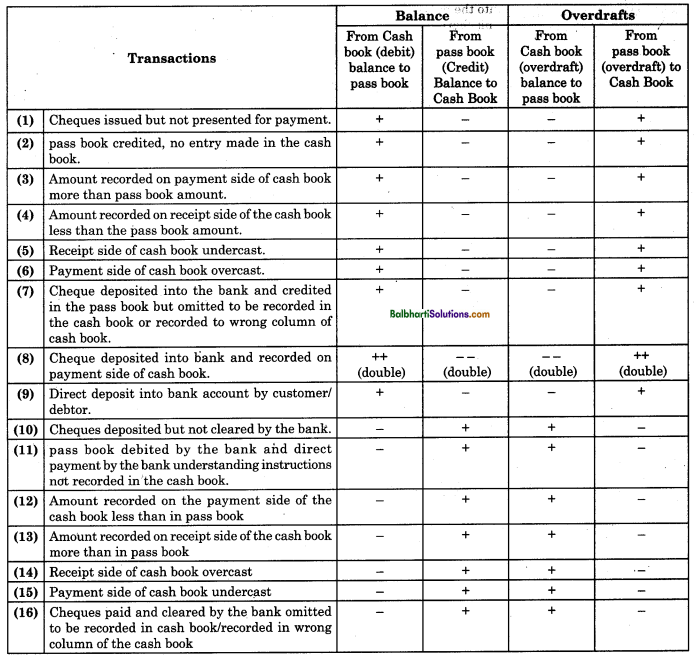

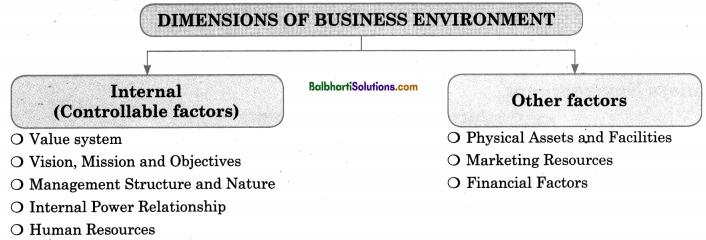

Dimension of Business Environment-

- Internal (Controllable)

- Other factors

Internal (Controllable):

- Value system

- Vision, Mission and Objectives

- Management Structure and Nature

- Internal Power Relationship

- Human Resources

Other factors:

- Physical Assets and Facilities

- Marketing Resources

- Financial Factors

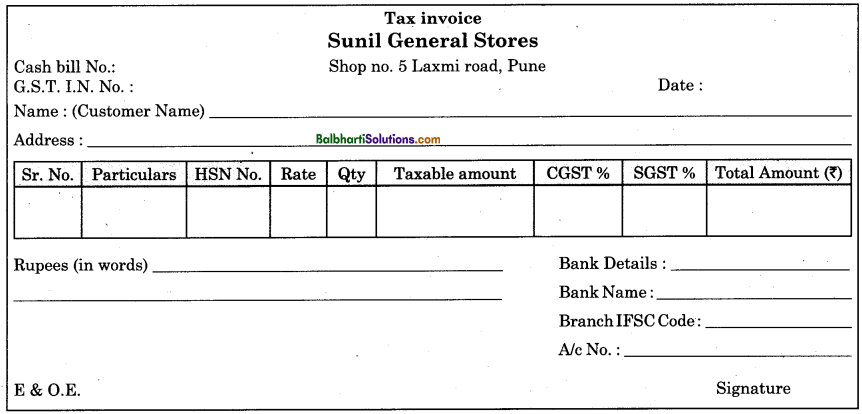

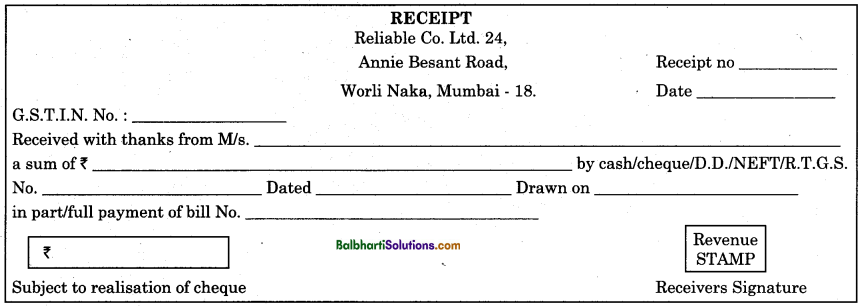

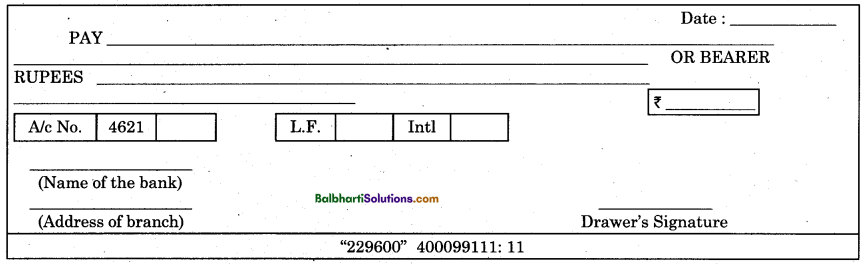

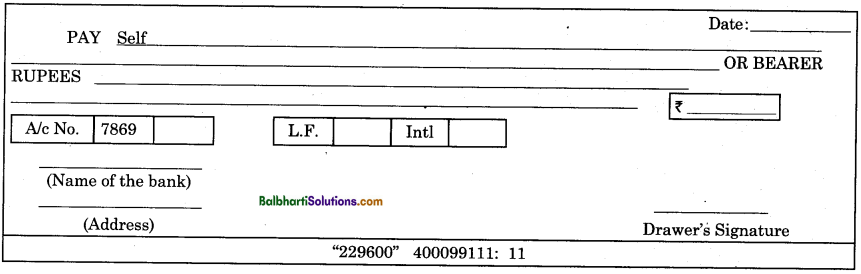

Financial Factors-

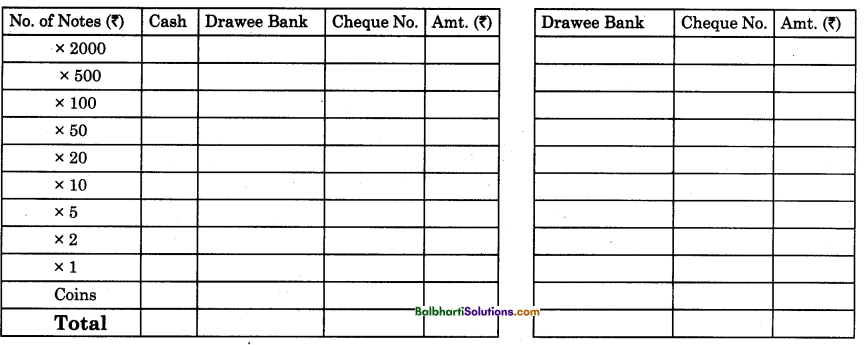

![]()

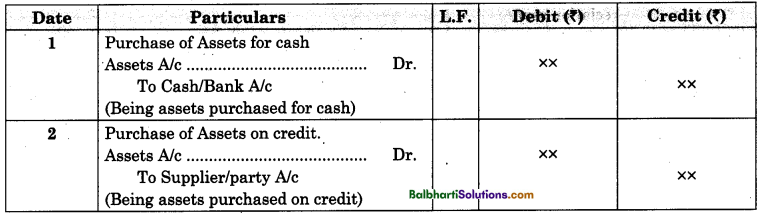

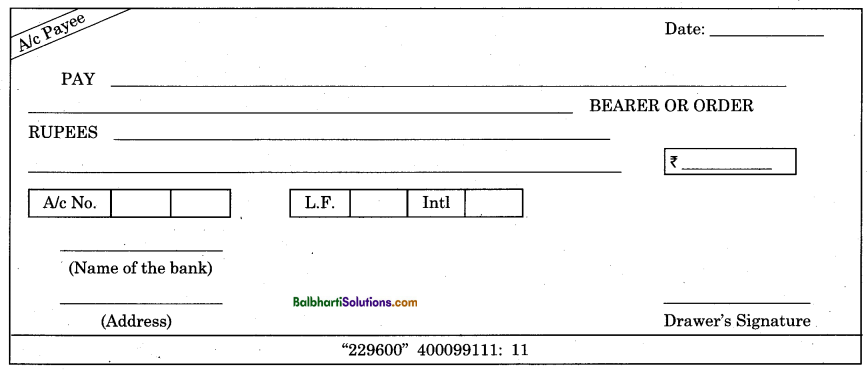

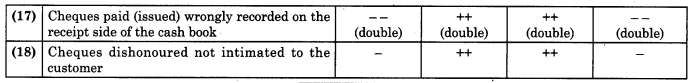

Dimension in Business Environment

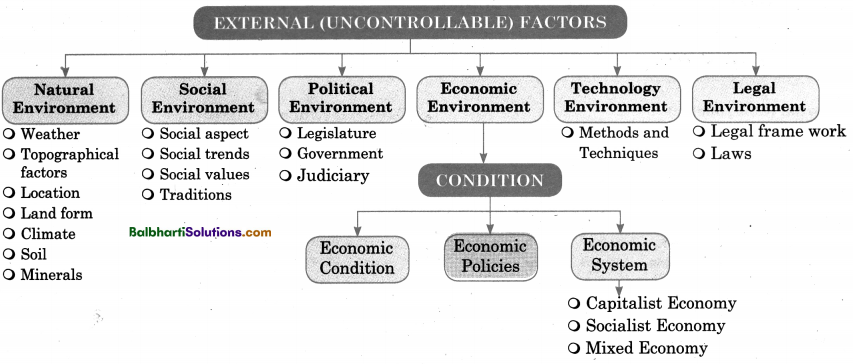

External (Uncontrollable) Factors:

Natural Environment:

- Weather

- Topographical factors

- Location

- Land form

- Climate

- Soil

- Minerals

Social Environment:

- Social aspect

- Social trends

- Social values

- Traditions

Political Environment:

- Legislature

- Government

- Judiciary

Economic Environment:

Condition:

1. Economic Condition

2. Economic Policies

3. Economic System:

- Capitalist Economy

- Socialist Economy

- Mixed Economy

Technology Environment:

Methods and Techniques

Legal Environment

- Legal frame work

- Laws

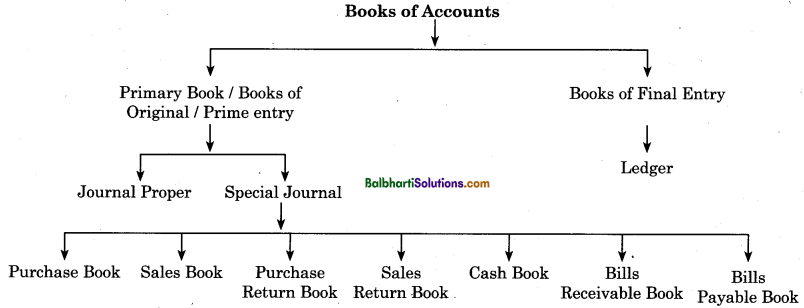

![]()

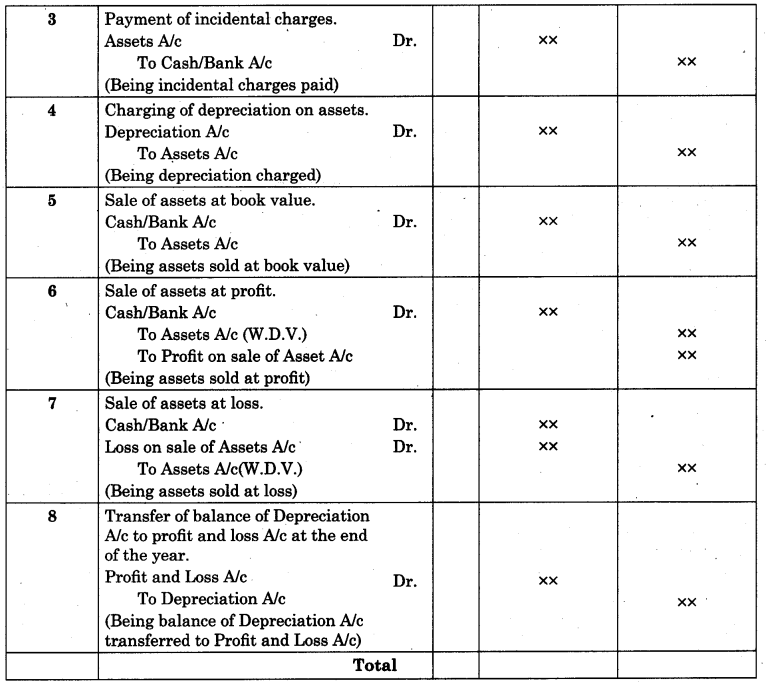

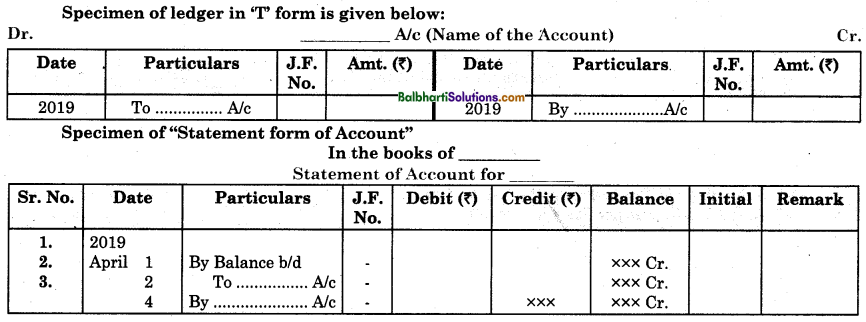

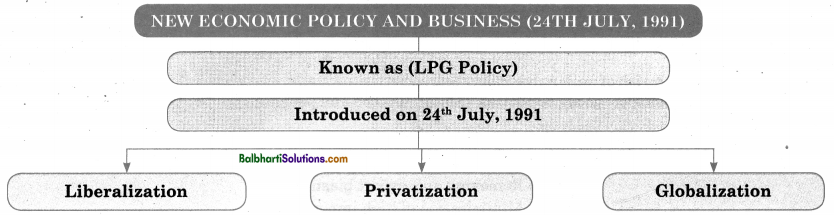

New Economic Policy and Business

- New Economic Policy And Business (24TH JULY, 1991)

- Known as (LPG Policy)

- Introduced on 24th July, 1991

- Liberalization

- Privatization

- Globalization

Liberalization-

Meaning: The process of eliminating unnecessary controls and restrictions for smooth functioning of business.

Indian Economic Liberalization Includes:

- Abolishing Industrial Licensing System

- Reduction in physical restrictions on import and import duties

- Reformation of financial system

- Reduction in taxation

- Reduction in control of foreign exchange

- Changing approach towards industrial sickness

- Freedom to decide the scale of business activities

- Attracting foreign investment

- Freedom in fixing prices of goods and services

- Opening of telecommunication sectors

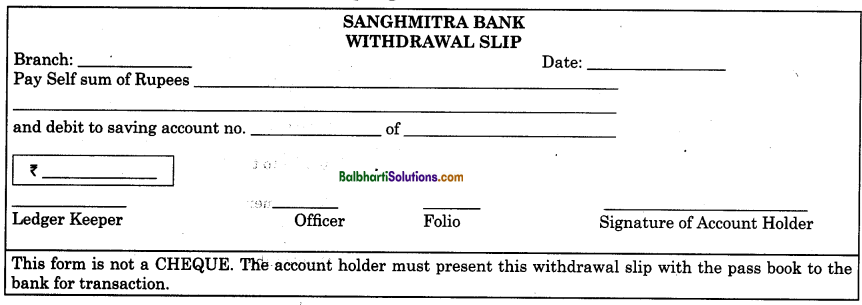

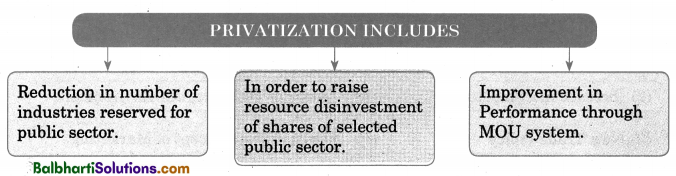

Privatization-

Meaning : To reduce the involvement of state or public sectors by involving of private sector in economic activities.

Need for Privatization :

- More efficiency

- Less Political interference

- Reduction in labour problem

- Ensuring accountability

- Capital Market discipline

Privatization Includes-

- Reduction in number of industries reserved for public sector.

- In order to raise resource disinvestment of shares of selected public sector.

- Improvement in Performance through MOU system.

![]()

Globalisation-

Meaning : Integration of national economy and societies through cross country flows of information, ideas, technologies, goods securities, capital, finance and people.

Includes-

- Removing anti export biasness

- Minimization of high import tariffs

- Lesser reliance on quantitative restrictions on imports

Features of globalization-

- Buying and selling from/to any country

- Freedom to set business anywhere in the world

- Lesser distance between local and international market

- Exchange of new ideas and technology around the world

- Direct foreign participation

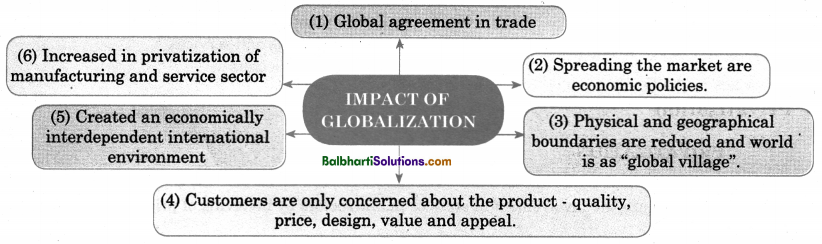

Impact of Globalisation-

- Global agreement in trade

- Spreading the economic policies

- Physical and geographical% boundaries are reduced and world is as “global village”.

- Customers are only concerned about the product – quality, price, design, value and appeal.

- Created an economically interdependent international environment

- Increased in privatization of manufacturing and service sector

Impact of New Economic policy on Business-

- Budgetary Support

- Increase in Competition

- New Trade Policy

- Demanding Customers

- New For Development

- Change in Technological Environment

- Change in the Concept of Marketing

Word Meaning:

isolated – unreachable; relevant – appropriate / related; negotiates – work out; thrives – prosper / grow; survive – to stay on; disturbances – distraction / trouble; spell – amount to; threats – dangers; appraise – to judge; orientations – direction of something; demographic – related to structure of population; trends

– movement; strategies – planning; constraints – restrictions; beyond – extreme; overcoming – deal with; sensitivity – reactivity; analyze – to examine; formulate – to prepare; frontiers – limits; intimacy – relationship; controllable – influence; domain – area / sector; structure – formation; logistic – activity of transporting; preservation – to protect; non-replenishable – cannot be renewed; to cope with – to deal with; reciprocal – give and take; ethics – principles; expectancy – hope; heritage – tradition; mobility – ability to move; ideology

– ideas; survival – to exist/to live; monetary – in terms of money; dramatic – considerable; alert – aware; persist – to continue; amendments – changes; eliminating – to remove; accountability – responsibility; disinvestment – reduction in investment; interdependent – depend on each other; implication – indications; reliance – to be dependent; diminishing – reducing; tremendous – huge; discontinuation – not to continue; varying – differ; nurtured – to raise; restructuring – to rearrange; fundamentally – basics; reliable – to good; integration – combination.